Complementary And Alternative Medicine Market | Acumen Research and Consulting

Complementary and Alternative Medicine Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

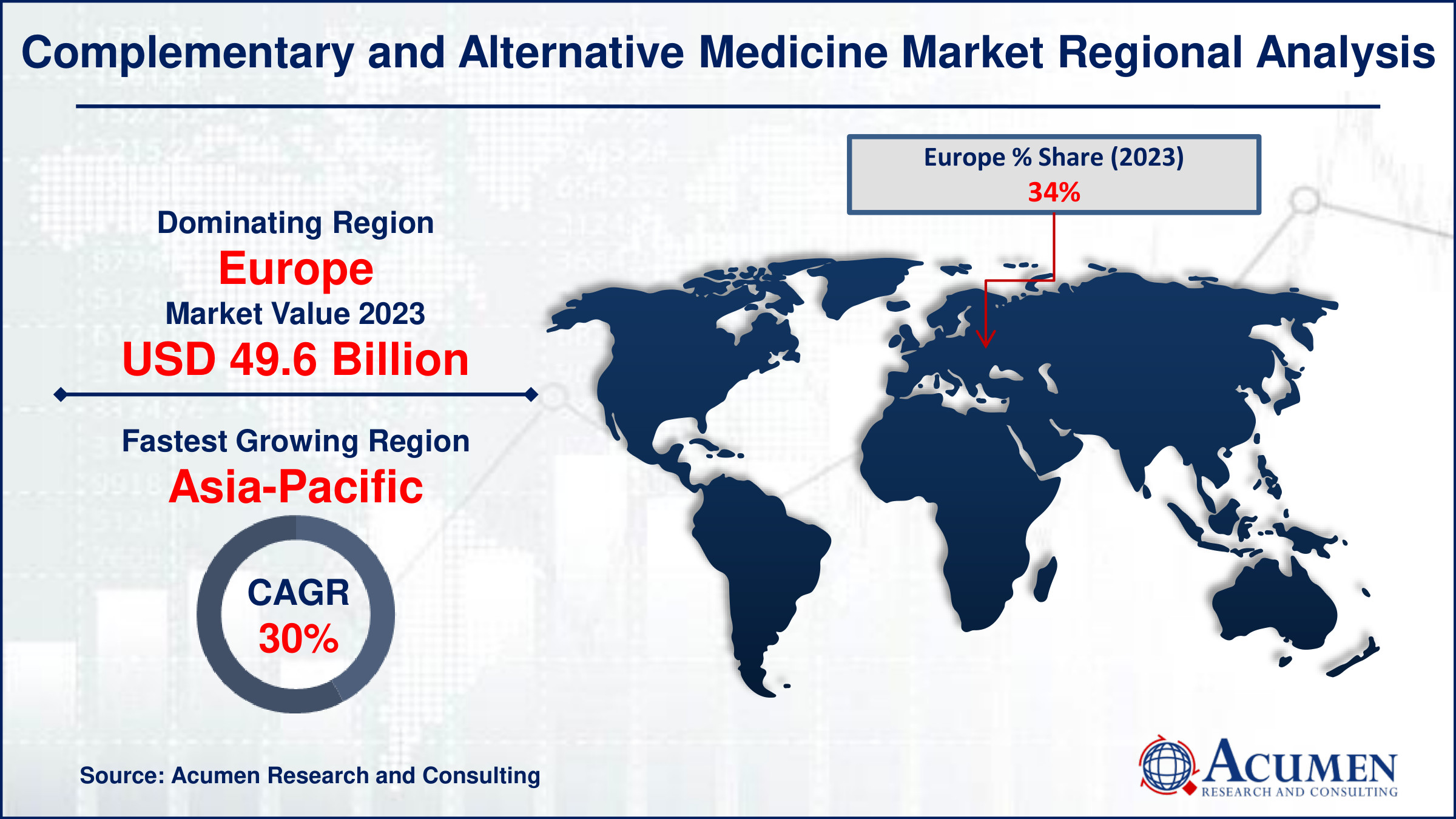

The Complementary and Alternative Medicine Market Size accounted for USD 145.8 Billion in 2023 and is estimated to achieve a market size of USD 897.2 Billion by 2032 growing at a CAGR of 22.7% from 2024 to 2032.

Complementary and Alternative Medicine Market Highlights

- Global complementary and alternative medicine market revenue is poised to garner USD 897.2 billion by 2032 with a CAGR of 22.7% from 2024 to 2032

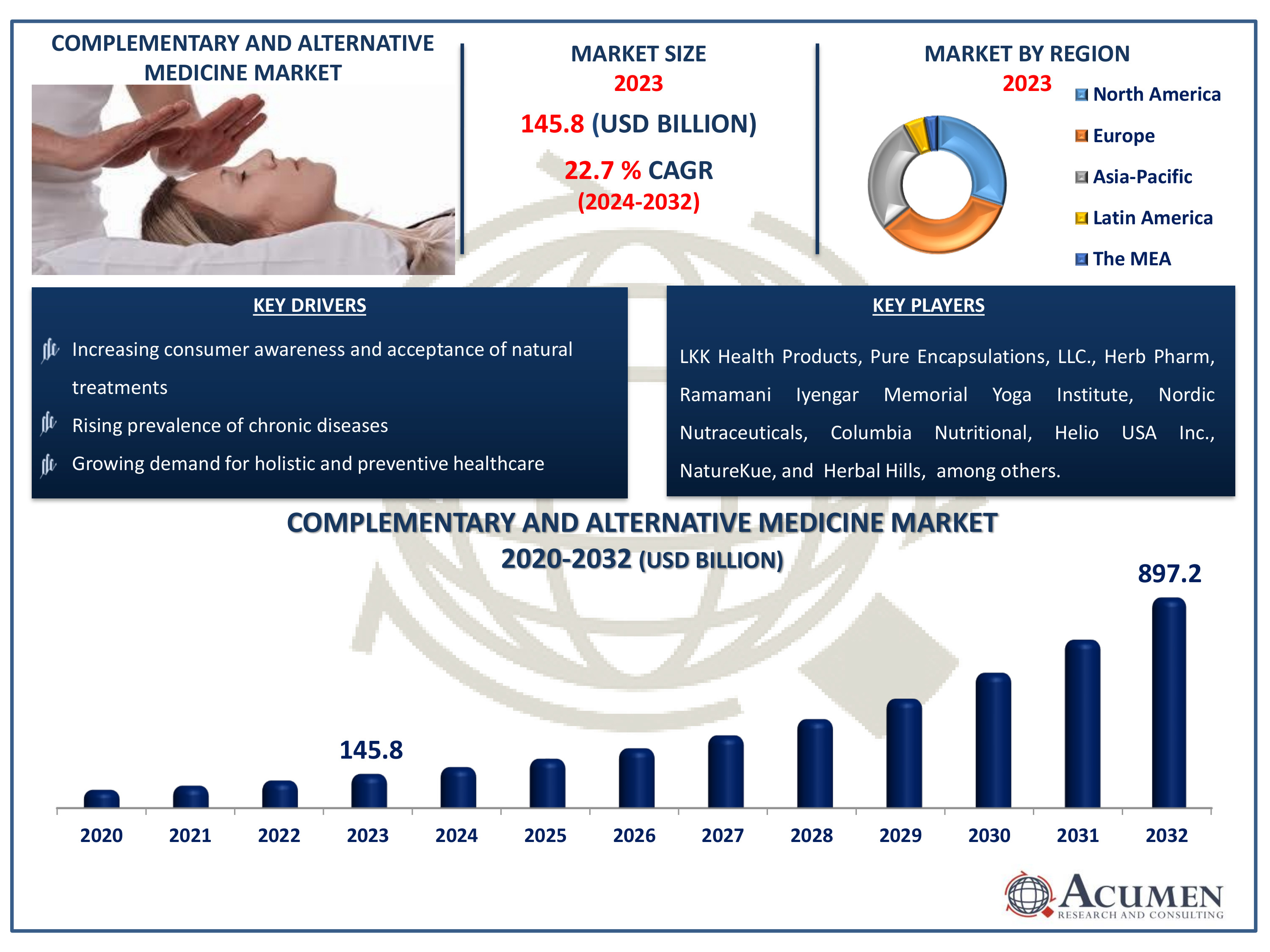

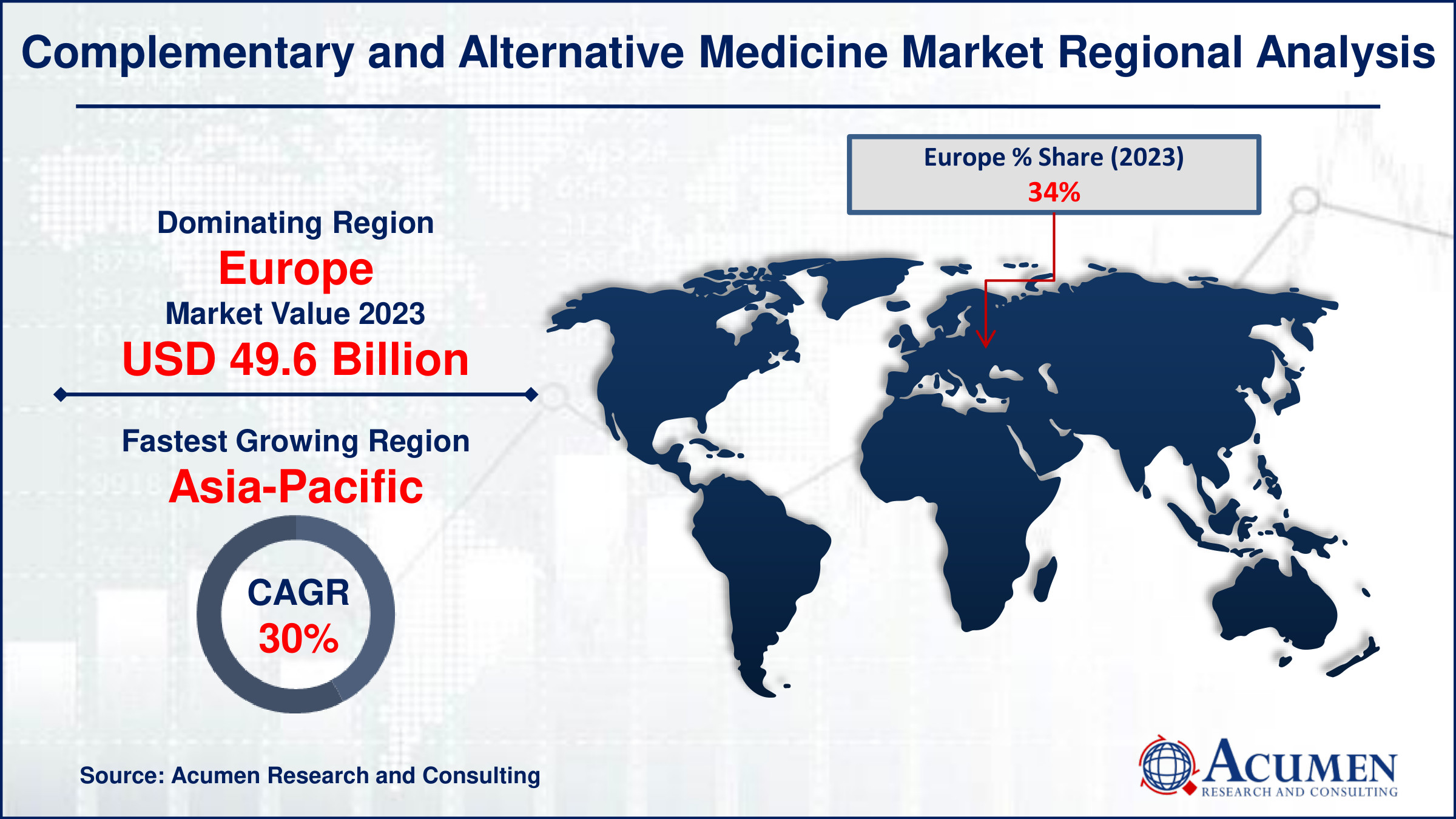

- Europe complementary and alternative medicine market value occupied around USD 49.6 billion in 2023

- Asia-Pacific complementary and alternative medicine market growth will record a CAGR of more than 30% from 2024 to 2032

- Among disease, the cancer sub-segment generated more than USD 65.6 billion revenue in 2023

- Based on type, the body therapy sub-segment generated around 58% complementary and alternative medicine market share in 2023

- Growing interest in wellness and lifestyle management is a popular complementary and alternative medicine market trend that fuels the industry demand

Complementary and alternative medicine (CAM) refers to a broad range of health care practices not typically part of conventional medical care. Complementary medicine is used alongside standard treatments to enhance their effectiveness, while alternative medicine is used in place of conventional methods. CAM includes practices such as acupuncture, chiropractic care, herbal medicine, and meditation. These approaches often emphasize holistic care, focusing on the whole person body, mind, and spirit. CAM practices are diverse and can be rooted in traditional, cultural, or philosophical beliefs. Despite their growing popularity, CAM therapies vary in terms of scientific support and regulatory oversight. Patients often use CAM to manage chronic conditions, improve quality of life, or maintain health and wellness.

Global Complementary and Alternative Medicine Market Dynamics

Market Drivers

- Increasing consumer awareness and acceptance of natural treatments

- Rising prevalence of chronic diseases

- Growing demand for holistic and preventive healthcare

- Advances in research and validation of CAM practices

Market Restraints

- Lack of standardized regulations and quality control

- Limited insurance coverage for CAM therapies

- Skepticism among conventional healthcare providers

Market Opportunities

- Integration of CAM with conventional medicine

- Expansion of CAM education and training programs

- Development of new CAM products and services

Complementary and Alternative Medicine Market Report Coverage

| Market | Complementary and Alternative Medicine Market |

| Complementary and Alternative Medicine Market Size 2022 | USD 145.8 Billion |

| Complementary and Alternative Medicine Market Forecast 2032 | USD 897.2 Billion |

| Complementary and Alternative Medicine Market CAGR During 2023 - 2032 | 22.7% |

| Complementary and Alternative Medicine Market Analysis Period | 2020 - 2032 |

| Complementary and Alternative Medicine Market Base Year |

2022 |

| Complementary and Alternative Medicine Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Disease, By Distribution Channels, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | LKK Health Products Group Limited, Pure Encapsulations, LLC., Herb Pharm, Ramamani Iyengar Memorial Yoga Institute, Nordic Nutraceuticals, Columbia Nutritional, Helio USA Inc., NatureKue, Herbal Hills, and John Schumacher Unity Woods Yoga Centre. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Complementary and Alternative Medicine Market Insights

One major driver is the increasing cost of conventional medicine, which is prompting consumers to explore more affordable alternatives. As healthcare expenses rise, patients are turning to CAM therapies that are often less expensive and more accessible. This trend is particularly evident in regions with limited access to affordable conventional healthcare services. Another driver is the growing consumer preference for holistic and preventive healthcare. People are becoming more conscious of their overall wellness and are seeking treatments that address the mind, body, and spirit. CAM practices, such as meditation, chiropractic care, and naturopathy, align with this holistic approach and are thus gaining popularity.

Additionally, the rising prevalence of chronic diseases is boosting the demand for CAM therapies. Chronic conditions like arthritis, diabetes, and cardiovascular diseases often require long-term management. Patients are increasingly using CAM to complement conventional treatments, aiming to improve their quality of life and manage symptoms more effectively.

There are several promising opportunities in the complementary and alternative medicine market. One significant opportunity is the integration of CAM with conventional medicine. Healthcare providers are beginning to recognize the benefits of combining conventional and alternative treatments to offer comprehensive patient care. This integration can enhance patient outcomes and broaden the acceptance of CAM practices. Another opportunity lies in the expansion of CAM education and training programs. As more healthcare professionals receive training in CAM therapies, the credibility and availability of these treatments will increase, further driving market growth. Moreover, the development of new CAM products and services presents a substantial opportunity. Innovations in herbal supplements, natural therapies, and wellness programs can attract a wider consumer base and meet the growing demand for alternative health solutions.

Complementary and Alternative Medicine Market Segmentation

The worldwide market for complementary and alternative medicine is split based on type, disease distribution channels, and geography.

Complementary and Alternative Medicine Market By Types

- Traditional Alternative Therapeutics

- Body Therapy

- Mind Therapy

- Sensory Therapy

- Others

According to complementary and alternative medicine industry analysis, market is segmented into various types, including traditional alternative therapeutics, body therapy, mind therapy, sensory therapy, and others. among these, the body therapy segment is the leading segment, driven by its widespread acceptance and diverse range of practices. Body therapies include chiropractic care, massage therapy, and acupuncture, which are highly sought after for their ability to alleviate pain, improve mobility, and enhance overall physical well-being. The popularity of body therapies is also bolstered by growing consumer preference for non-invasive and drug-free treatment options. Additionally, increased awareness of the benefits of physical therapies in managing chronic conditions and improving quality of life contributes to the dominance of this segment in the CAM market.

Complementary and Alternative Medicine Market By Diseases

- Cancer

- Arthritis

- Diabetes

- Cardiovascular

- Neurology

- Others

The cancer segment commands the largest share due to the increasing number of cancer patients seeking holistic and supportive care options alongside conventional treatments and this segment expected to grow continue throughout the complementary and alternative medicine market forecast period. Patients and healthcare providers are recognizing the value of CAM therapies, such as acupuncture, herbal supplements, and mind-body practices, in managing cancer-related symptoms like pain, nausea, and fatigue. These therapies can enhance the quality of life for cancer patients, reduce treatment side effects, and support overall well-being. The integration of CAM in cancer care is driven by patient demand for comprehensive treatment plans that address both physical and emotional needs, contributing to the segment's significant market share.

Complementary and Alternative Medicine Market By Distribution Channels

- Direct Sales

- Online Sales

- Distance Correspondence

In the landscape of the complementary and alternative medicine market, direct sales emerge as the dominant distribution channel, commanding the largest share. This trend is driven by a personalized approach that fosters direct interaction between practitioners and consumers. Unlike conventional retail models, direct sales in CAM facilitate one-on-one consultations where practitioners can tailor therapies and products to individual needs, enhancing customer satisfaction and trust. This direct engagement often occurs through specialized clinics, wellness centers, or practitioners private offices, where clients receive personalized attention and recommendations. This approach not only strengthens customer relationships but also allows for immediate feedback and adjustments to treatment plans, thereby promoting better outcomes. Moreover, it underscores the importance of trust and expertise in CAM practices, where direct sales channels play a pivotal role in meeting the diverse health and wellness needs of consumers seeking alternative healthcare solutions.

Complementary and Alternative Medicine Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Complementary and Alternative Medicine Market Regional Analysis

Europe leads the complementary and alternative medicine market primarily due to widespread adoption of botanicals like dietary supplements, notably in countries such as Germany and France. These nations have a long-standing cultural acceptance and regulatory framework supporting CAM practices, fostering a robust market environment. Additionally, the integration of CAM into mainstream healthcare systems and the availability of comprehensive insurance coverage further bolster its prominence in Europe.

Conversely, the Asia Pacific region is poised for substantial growth in the complementary and alternative medicine industry forecast period. Factors driving this expansion include burgeoning medical tourism, rising costs of conventional medicine, and Asia Pacific's status as a cradle of traditional medical practices like Ayurveda, Traditional Chinese Medicine (TCM), and acupuncture. These ancient healing techniques resonate globally, attracting patients seeking holistic and cost-effective healthcare alternatives.

Moreover, Asia Pacific's diverse demographic landscape and increasing disposable incomes contribute to the rising demand for CAM therapies and products. Countries such as India, China, and Japan are pivotal in this growth, leveraging their rich heritage in herbal medicines and non-pharmaceutical treatments. As regulatory frameworks evolve to accommodate CAM practices and consumer awareness grows, the region is expected to witness significant investments in CAM infrastructure and research, further propelling market expansion.

Complementary and Alternative Medicine Market Players

Some of the top complementary and alternative medicine companies offered in our report includes LKK Health Products Group Limited, Pure Encapsulations, LLC., Herb Pharm, Ramamani Iyengar Memorial Yoga Institute, Nordic Nutraceuticals, Columbia Nutritional, Helio USA Inc., NatureKue, Herbal Hills, and John Schumacher Unity Woods Yoga Centre.

Frequently Asked Questions

How big is the complementary and alternative medicine market?

The complementary and alternative medicine market size was valued at USD 145.8 billion in 2023.

What is the CAGR of the global complementary and alternative medicine market from 2024 to 2032?

The CAGR of complementary and alternative medicine is 22.7% during the analysis period of 2024 to 2032.

Which are the key players in the complementary and alternative medicine market?

The key players operating in the global market are including LKK Health Products Group Limited, Pure Encapsulations, LLC., Herb Pharm, Ramamani Iyengar Memorial Yoga Institute, Nordic Nutraceuticals, Columbia Nutritional, Helio USA Inc., NatureKue, Herbal Hills, and John Schumacher Unity Woods Yoga Centre.

Which region dominated the global complementary and alternative medicine market share?

Europe held the dominating position in complementary and alternative medicine industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of complementary and alternative medicine during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global complementary and alternative medicine industry?

The current trends and dynamics in the complementary and alternative medicine industry include increasing consumer awareness and acceptance of natural treatments, rising prevalence of chronic diseases, growing demand for holistic and preventive healthcare, and advances in research and validation of CAM practices.

Which disease held the maximum share in 2023?

The cancer disease held the maximum share of the complementary and alternative medicine industry.

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date