Herbal Supplements Market | Acumen Research and Consulting

Herbal Supplements Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

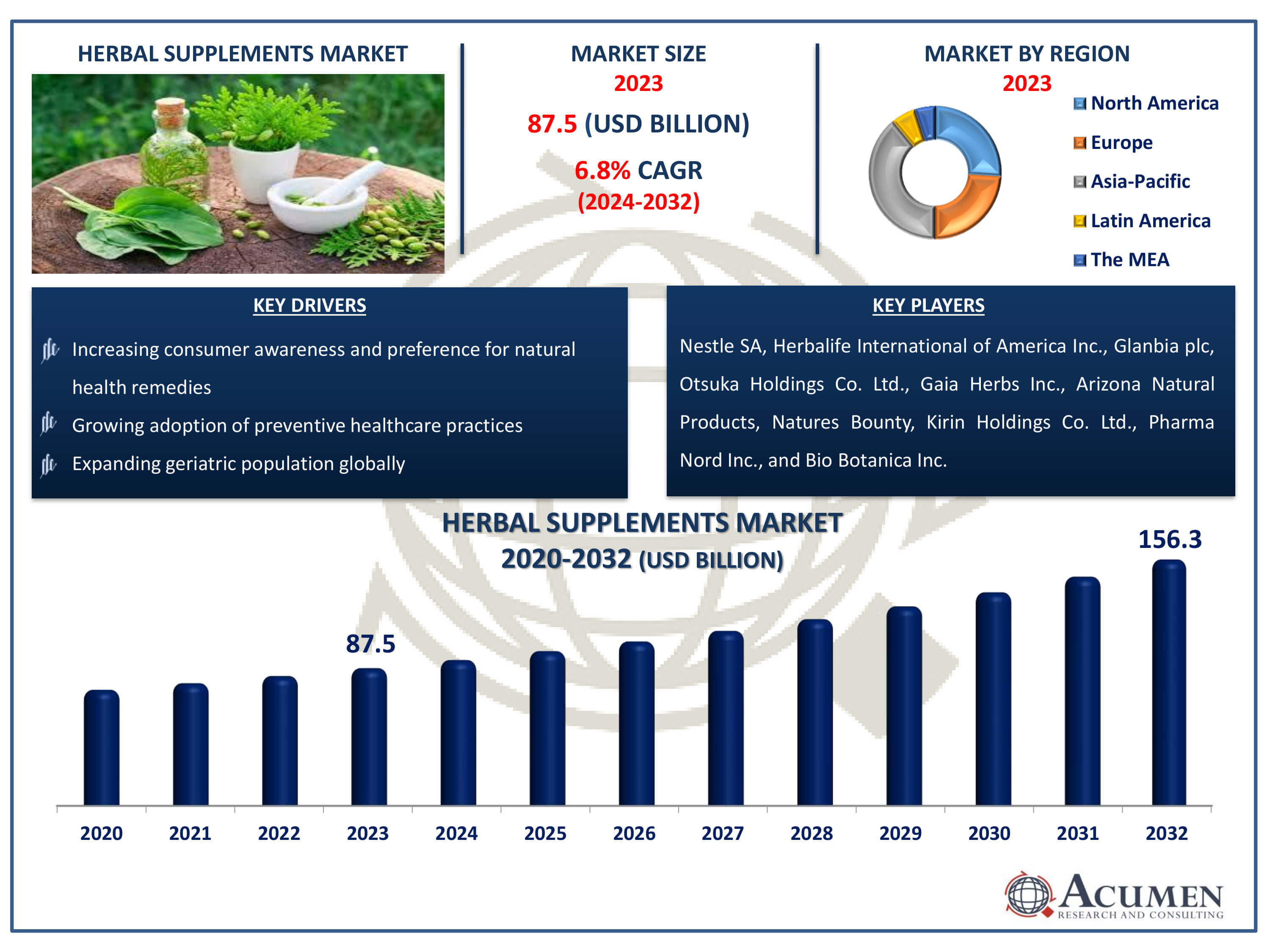

The Herbal Supplements Market Size accounted for USD 87.5 Billion in 2023 and is estimated to achieve a market size of USD 156.3 Billion by 2032 growing at a CAGR of 6.8% from 2024 to 2032.

Herbal Supplements Market Highlights

- Global herbal supplements market revenue is poised to garner USD 156.3 billion by 2032 with a CAGR of 6.8% from 2024 to 2032

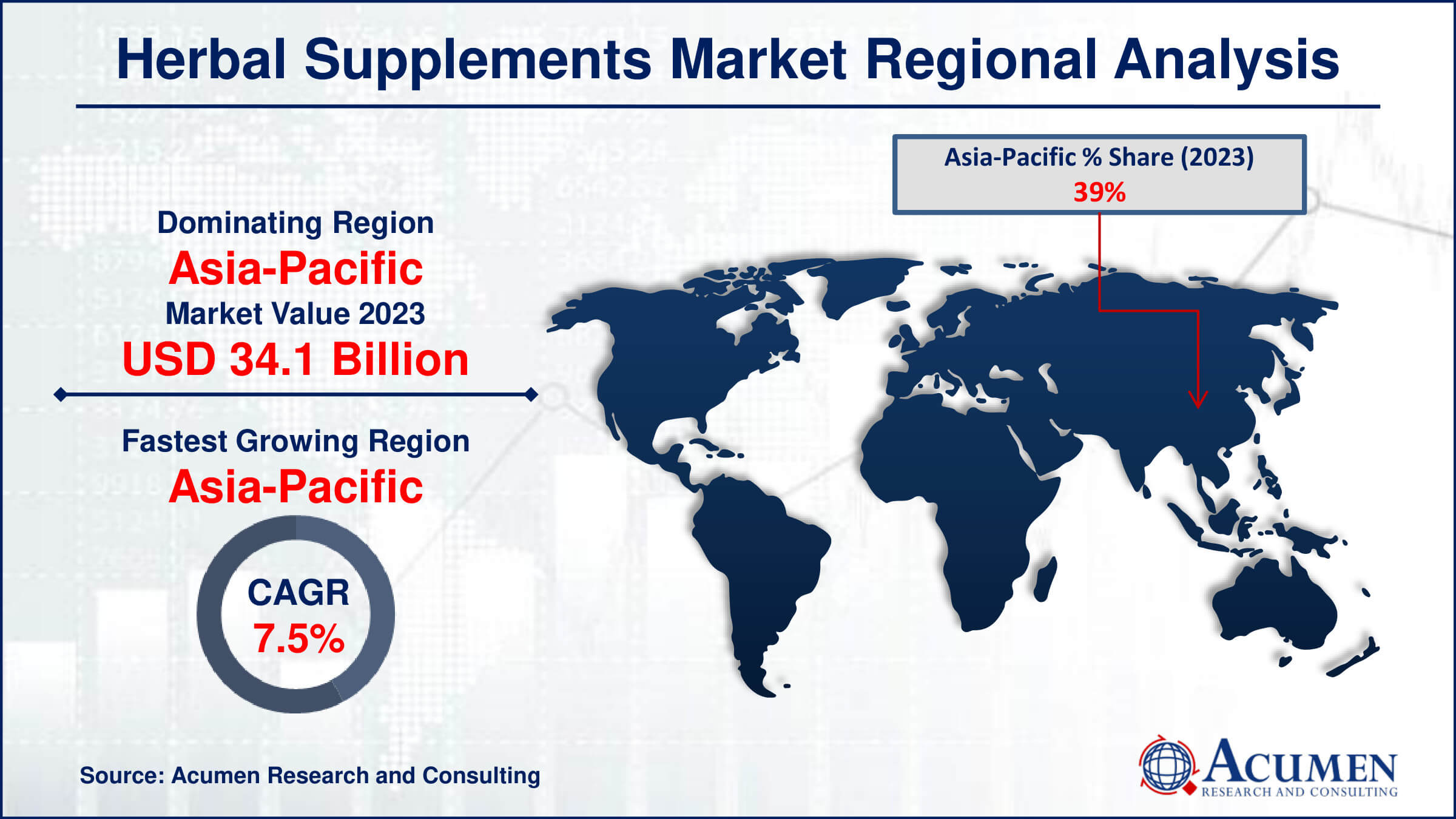

- Asia-Pacific herbal supplements market value occupied around USD 34.1 billion in 2023

- Asia-Pacific herbal supplements market growth will record a CAGR of more than 7.5% from 2024 to 2032

- Among product, the echinacea sub-segment generated more than USD 30.6 billion revenue in 2023

- Based on formulation, the capsules sub-segment generated around 30% market share in 2023

- Demand surge for immune-boosting supplements post-pandemic is a popular herbal supplements market trend that fuels the industry demand

Herbal supplements are dietary supplements made from plants or plant extracts that are used to promote health and well-being. They come in various forms, including capsules, tablets, powders, and extracts. Herbal supplements are sought after for their potential medicinal benefits, which are often derived from their active compounds such as vitamins, minerals, antioxidants, and phytochemicals. These supplements are commonly used to support specific health goals, such as boosting immune function, improving digestion, enhancing mental clarity, or managing stress. While they are perceived as natural alternatives to conventional medicine, it's crucial to note that their efficacy and safety can vary widely depending on factors like dosage, formulation, and individual health conditions. As such, consulting with a healthcare provider before starting any herbal supplement regimen is recommended to ensure safety and efficacy.

Global Herbal Supplements Market Dynamics

Market Drivers

- Increasing consumer awareness and preference for natural health remedies

- Growing adoption of preventive healthcare practices

- Expanding geriatric population globally

- Rising prevalence of lifestyle diseases

Market Restraints

- Lack of stringent regulatory oversight and standardization

- Potential herb-drug interactions and safety concerns

- Limited scientific evidence supporting efficacy claims

Market Opportunities

- Expansion in emerging markets with rising disposable incomes

- Innovations in product formulations and delivery methods

- Growing acceptance of herbal supplements in mainstream healthcare

Herbal Supplements Market Report Coverage

| Market | Herbal Supplements Market |

| Herbal Supplements Market Size 2022 | USD 87.5 Billion |

| Herbal Supplements Market Forecast 2032 | USD 156.3 Billion |

| Herbal Supplements Market CAGR During 2023 - 2032 | 6.8% |

| Herbal Supplements Market Analysis Period | 2020 - 2032 |

| Herbal Supplements Market Base Year |

2022 |

| Herbal Supplements Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Consumer, By Formulation, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Nestle SA, Herbalife International of America Inc., Glanbia plc, Otsuka Holdings Co. Ltd., Gaia Herbs Inc., Arizona Natural Products, Natures Bounty, Kirin Holdings Co. Ltd., Pharma Nord Inc., and Bio Botanica Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Herbal Supplements Market Insights

The herbal supplements market is poised for significant growth driven by several key factors. Firstly, the rising geriatric population worldwide and increasing awareness of preventive healthcare practices are pivotal drivers. As people age, there is a heightened focus on maintaining health and well-being, leading to greater consumption of herbal supplements known for their perceived natural benefits and potential health-promoting properties. Moreover, the increase in healthcare spending globally contributes to market expansion. Consumers are increasingly investing in preventive healthcare measures, including herbal supplements, to support overall health and potentially reduce healthcare costs in the long term.

Accessibility plays a crucial role in market growth, facilitated by various strategies such as bundled offerings and direct selling adopted by businesses. These approaches make herbal supplements readily available to consumers, thereby boosting market penetration and consumption. Awareness about the benefits of herbal supplements is also on the rise, further driving product demand. Consumers are becoming more educated about the nutritional and health benefits offered by herbal products, prompting increased adoption across different consumer segments. For instance, targeted advertising campaigns aimed at children emphasize the nutritional benefits of supplements for healthy growth, contributing to market expansion among younger demographics.

Additionally, there is growing acceptance of natural therapies and products, including herbal supplements, within mainstream healthcare. This trend reflects a broader cultural shift towards holistic health approaches and natural remedies, bolstering the herbal supplements market globally. Overall, these factors combine to create a favorable environment for market growth, with manufacturers focusing on strategic product placement and expanding their consumer base across diverse demographics. As demand continues to rise and regulatory frameworks evolve to ensure product safety and efficacy, the herbal supplements market is expected to thrive in the coming years.

Herbal Supplements Market Segmentation

The worldwide herbal supplements market is split based on product, consumer, formulation, and geography.

Herbal Supplements Market By Product

- Moringa

- Echinacea

- Flaxseeds

- Turmeric

- Ginger

- Ginseng

According to herbal supplements industry analysis, among the listed products in the market, echinacea emerges as the largest segment. Echinacea, derived from the coneflower plant, is widely recognized for its potential immune-boosting properties. It is commonly used to prevent or reduce the severity of colds and flu symptoms, as well as to support overall immune system health.

The popularity of Echinacea stems from its long history in traditional medicine and its integration into modern healthcare practices. Consumers seek Echinacea supplements for its purported ability to enhance immune response and shorten the duration of illnesses. This demand is bolstered by increasing consumer awareness of natural health remedies and a preference for products perceived to be safer alternatives to pharmaceutical options. Manufacturers often market Echinacea supplements in various forms, including capsules, tablets, and extracts, catering to different consumer preferences. As research continues to explore its efficacy and benefits, Echinacea maintains a prominent position in the herbal supplements market globally.

Herbal Supplements Market By Consumer

- Pregnant Women

- Adult

- Pediatric

- Geriatric

The adult segment dominates the herbal supplements market due to several key factors distinct to this demographic. Adults often seek herbal supplements as part of their proactive approach to maintaining overall health and wellness. Unlike other age groups, adults are typically more proactive in managing their health, often incorporating supplements into their daily routines to support various aspects of well-being, such as immune function, energy levels, and cognitive health. Moreover, the adult population tends to have greater purchasing power and disposable income, allowing them to invest in preventive healthcare measures like herbal supplements. This demographic is also more likely to research and understand the potential benefits and risks associated with different herbal products, making informed choices based on their specific health needs and preferences.

Herbal Supplements Market By Formulation

- Tablets

- Capsules

- Liquid

- Powder and granules

- Soft gels

- Others

Capsules emerge as the largest segment during the herbal supplements industry forecast period, driven by several distinct advantages appealing to consumers. Capsules are favored for their convenience and ease of use, offering a straightforward way to consume herbal supplements without the taste or texture issues sometimes associated with other forms like powders or liquids. This makes capsules particularly popular among consumers who prefer a quick and mess-free option for integrating supplements into their daily routines. Furthermore, capsules are often perceived as more stable and easier to transport compared to liquid formulations, ensuring longer shelf life and convenience for storage. Their popularity is also bolstered by manufacturers who innovate with various capsule sizes and formulations to enhance absorption and bioavailability of herbal ingredients.

Herbal Supplements Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Herbal Supplements Market Regional Analysis

In 2023, the Asia-Pacific region captured the largest revenue share, a trend projected to continue over the herbal supplements market forecast period. This dominance is driven by the region's strong belief in Ayurvedic medicine and its focus on natural remedies for treating illnesses. Other growth drivers for herbal supplements in Asia-Pacific include an increasing patient population and improvements in herbal supplement facilities.

In terms of herbal supplements market analysis, APAC is anticipated to emerge as the fastest-growing region due to its large population suffering from chronic diseases such as cardiovascular diseases, diabetes, cancer, coronary thrombosis, among others. Countries like South Korea, China, India, and other nations in Asia-Pacific presents significant growth opportunities for key companies, fueled by enhanced healthcare infrastructure, rising disposable incomes, increasing healthcare awareness, growing demand for better healthcare solutions, and the burgeoning medical tourism market. Europe is also projected to be a rapidly developing market for herbal supplements, driven by high incidences of chronic diseases and a large target population base.

Herbal Supplements Market Players

Some of the top herbal supplements companies offered in our report include Nestle SA, Herbalife International of America Inc., Glanbia plc, Otsuka Holdings Co. Ltd., Gaia Herbs Inc., Arizona Natural Products, Natures Bounty, Kirin Holdings Co. Ltd., Pharma Nord Inc., and Bio Botanica Inc.

Frequently Asked Questions

How big is the herbal supplements market?

The herbal supplements market size was valued at USD 87.5 billion in 2023.

What is the CAGR of the global herbal supplements market from 2024 to 2032?

The CAGR of herbal supplements is 6.8% during the analysis period of 2024 to 2032.

Which are the key players in the herbal supplements market?

The key players operating in the global market are including Nestle SA, Herbalife International of America Inc., Glanbia plc, Otsuka Holdings Co. Ltd., Gaia Herbs Inc., Arizona Natural Products, Natures Bounty, Kirin Holdings Co. Ltd., Pharma Nord Inc., and Bio Botanica Inc.

Which region dominated the global herbal supplements market share?

Asia-Pacific held the dominating position in herbal supplements industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of herbal supplements during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global herbal supplements industry?

The current trends and dynamics in the herbal supplements industry include increasing consumer awareness and preference for natural health remedies, growing adoption of preventive healthcare practices, expanding geriatric population globally, and rising prevalence of lifestyle diseases.

Which consumer held the maximum share in 2023?

The adult consumer held the maximum share of the herbal supplements industry.