Commercial Seeds Market | Acumen Research and Consulting

Commercial Seeds Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

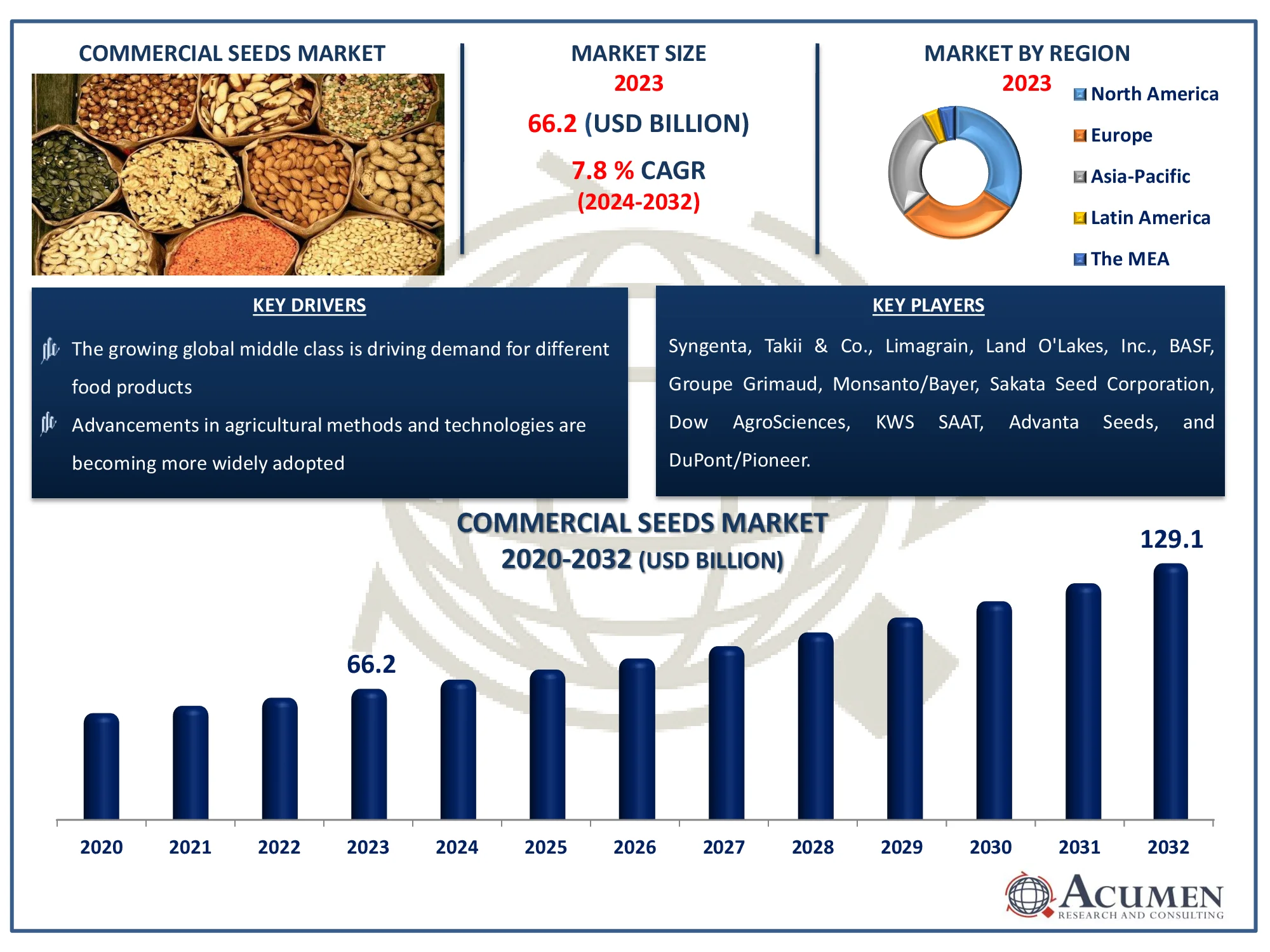

The Commercial Seeds Market Size accounted for USD 66.2 Billion in 2023 and is estimated to achieve a market size of USD 129.1 Billion by 2032 growing at a CAGR of 7.8% from 2024 to 2032.

Commercial Seeds Market Highlights

- Global commercial seeds market revenue is poised to garner USD 129.1 billion by 2032 with a CAGR of 7.8% from 2024 to 2032

- North America commercial seeds market value occupied around USD 22.5 billion in 2023

- Asia-Pacific commercial seeds market growth will record a CAGR of more than 8.5% from 2024 to 2032

- Among product, the maize (Corn) sub-segment generated USD 26.5 billion revenue in 2023

- Based on genetically modified seeds product, the maize sub-segment generated 46% commercial seeds market share in 2023

- Emerging markets in developing countries have enormous development potential is a popular commercial seeds market trend that fuels the industry demand

Commercial seeds are specialized plant seeds that farmers utilize to cultivate their crops. These aren't just any seeds; scientists and breeders worked hard to create seeds that are both tough and nutritious. Imagine these as super seeds! They can grow more food, resist bugs and diseases, and even tolerate harsh weather. Farmers rely on commercial seeds to produce healthier crops. These seeds act as the foundation for everything we eat. Commercial seeds help feed the world with everything from wheat for bread to tomatoes for salads.

There are various varieties of commercial seeds, some of which have been genetically manipulated to improve them even more. While this technology has greatly benefited farmers, it has also raised concerns among some. However, one thing is certain: commercial seeds are a crucial element of modern farming and will remain so for many years.

Global Commercial Seeds Market Dynamics

Market Drivers

- The rising global population is driving up food demand

- Advancements in agricultural methods and technologies are becoming more widely adopted

- Increased emphasis on crop output and quality improvement

- The growing global middle class is driving demand for different food products

Market Restraints

- Seed development is restricted by stringent government controls and permits

- Concerns about genetically modified organisms (GMOs) are impeding market growth

- High Cost of R&D for Seed Innovation

Market Opportunities

- Growing demand for organic and non-GMO seeds

- Drought and pest-resistant seed types are increasingly being developed

- Increased need for precision agriculture and data-driven seed solutions

Commercial Seeds Market Report Coverage

| Market | Commercial Seeds Market |

| Commercial Seeds Market Size 2022 |

USD 66.2 Billion |

| Commercial Seeds Market Forecast 2032 | USD 129.1 Billion |

| Commercial Seeds Market CAGR During 2023 - 2032 | 7.8% |

| Commercial Seeds Market Analysis Period | 2020 - 2032 |

| Commercial Seeds Market Base Year |

2022 |

| Commercial Seeds Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Genetically Modified Seeds Product, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Syngenta, Takii & Co., Limagrain, Land O'Lakes, Inc., BASF, Groupe Grimaud, Monsanto/Bayer, Sakata Seed Corporation, Dow AgroSciences, KWS SAAT, Advanta Seeds, and DuPont/Pioneer. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Commercial Seeds Market Insights

The expanding need for food is attributable to rising worldwide populace is a huge factor driving the market. Also, the high return and cost-viability offered by Genetically Modified (GM) seeds are anticipated to impel the product demand. Decreasing zone of arable land inferable from urbanization, desertification, and by and large decay of soil quality. Subsequently, there is a huge need to expand the yield of the harvests that are developed in the accessible land. Also, there are districts that confront huge difficulties in rural creation attributable to progressively restricted access to water assets. These elements are relied upon to help selection of exceptionally effective GM seeds.

Soybean was evaluated to represent a notable revenue offer of the commercial seed market by virtue of huge utilization of soybean as oil and creature feed. In the class of hereditarily changed seeds, cotton is evaluated to enlist the quickest CAGR because of high return furnished by Bt cotton combined with low usage of bug sprays required in its production. The commercial seed showcase is merged with best players representing huge market share of the overall industry. These players incorporate Monsanto, Syngenta, DowDuPont, Vilmorin, and Cie. Acquisitions and dispatch of new offices are the key techniques received by these organizations. For example, Syngenta finished the procurement of Nidera seeds to increase upper hand and to expand market share of the market.

Commercial Seeds Market Segmentation

The worldwide market for commercial seeds is split based on product, genetically modified seeds product, and geography.

Commercial Seeds Market By Products

- Maize (Corn)

- Soybean

- Vegetable

- Cereals

- Cotton

- Rice

- Canola (Rapeseed)

- Others

According to commercial seeds industry analysis, maize, sometimes known as corn, reigns supreme in the commercial seed industry. It is a versatile crop with a wide range of applications, including human food, animal feed, and biofuel. A variety of variables contribute to its domination. For starters, its high production potential makes it an economically viable option for farmers. Second, corn is an important element in many processed meals, livestock feed, and ethanol manufacturing, which drives steady demand. Furthermore, constant advances in seed technology, such as hybrid types and genetically modified alternatives, have increased corn production and broadened its application possibilities. These factors contribute to maize's dominance in the commercial seeds market.

Commercial Seeds Market By Genetically Modified Seeds Products

- Soybean

- Maize (Corn)

- Cotton

- Canola (Rapeseed)

- Others

Genetically modified (GM) maize is the most profitable area during the commercial seed market forecast period. This dominance is due to a number of variables. For starters, maize is a staple crop in many parts of the world, and genetically modified varieties provide higher yields and better resistance to pests and diseases, which is crucial for meeting global food and animal feed demands. Furthermore, GM maize is designed to withstand herbicides, making it easier for farmers to manage weeds and reduce crop losses, resulting in increased output.

The broad adoption of genetically modified maize in nations such as the United States, Brazil, and Argentina has also helped it maintain its market leadership. These countries have large agricultural operations and are major maize exporters. Genetically modified maize is popular among farmers because of its economic benefits, such as decreased chemical input costs and higher profit margins. As a result, GM maize continues to generate the most income in the commercial seeds market, highlighting its significance in modern agriculture.

Commercial Seeds Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

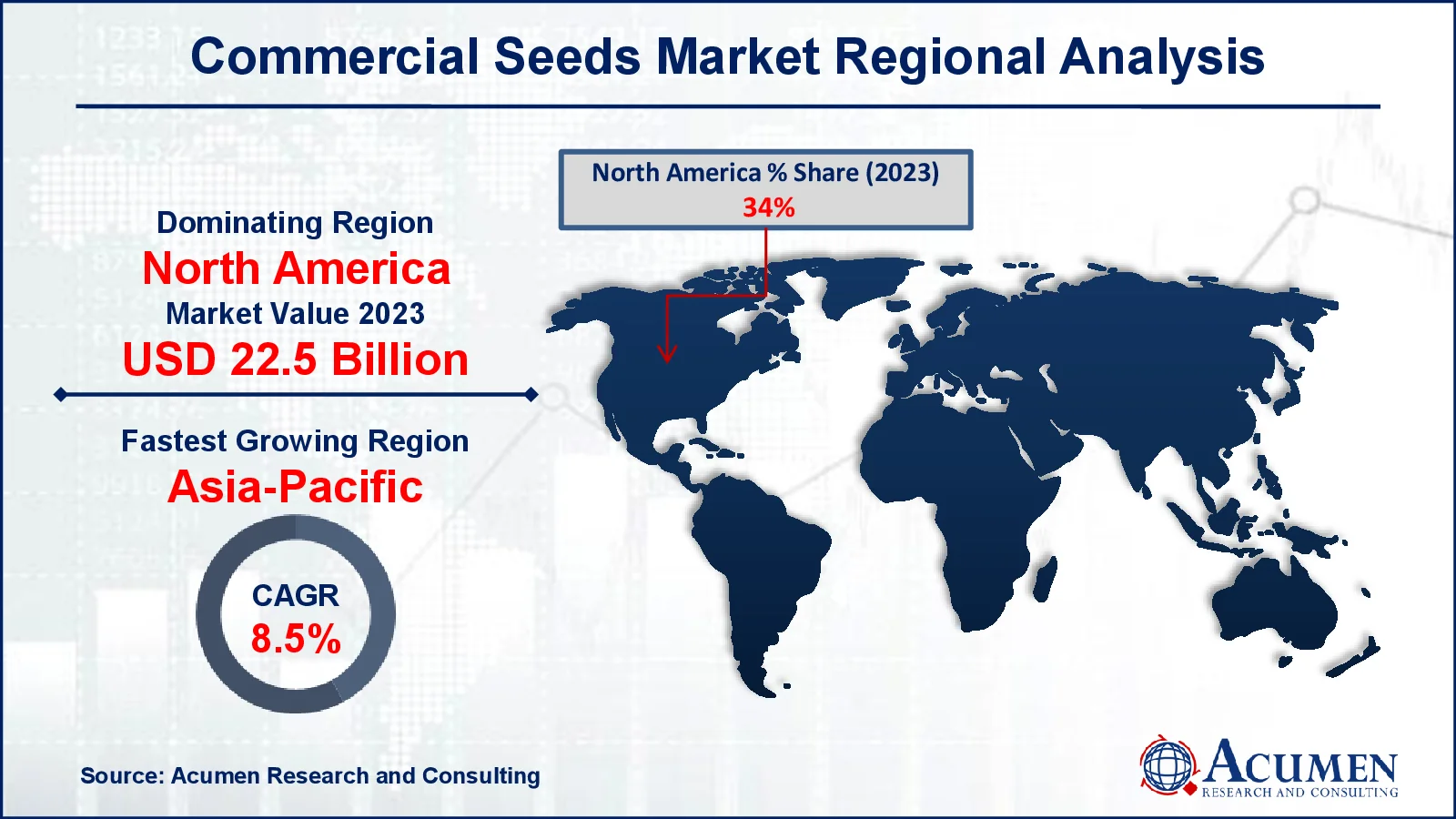

Commercial Seeds Market Regional Analysis

In terms of commercial seeds market analysis, North America is the undisputed leader in the industry. For decades, the United States and Canada have been at the forefront of agricultural technology. With huge farmlands, excellent research facilities, and a long history of agricultural innovation, this region provides a perfect setting for seed development and production. They've been pioneers in generating novel seed kinds, particularly those genetically modified to withstand pests, illnesses, and harsh weather. This, paired with a robust economy and favorable government regulations, has transformed North America into the world's seed industry powerhouse.

While North America has traditionally dominated the commercial seeds market, the Asia-Pacific region is rapidly catching up. Countries with big populations and growing economies, such as China and India, are experiencing an increase in food demand. This has resulted in a significant increase in agricultural activity, creating a vast market for commercial seeds. Furthermore, these countries are spending extensively in modern farming techniques and adopting new technologies to boost food productivity. Though they are catching up, the region's rapid growth makes them a force to be reckoned with in the international seed market.

Commercial Seeds Market Players

Some of the top commercial seeds companies offered in our report includes Syngenta, Takii & Co., Limagrain, Land O'Lakes, Inc., BASF, Groupe Grimaud, Monsanto/Bayer, Sakata Seed Corporation, Dow AgroSciences, KWS SAAT, Advanta Seeds, and DuPont/Pioneer.

Frequently Asked Questions

How big is the commercial seeds market?

The commercial seeds market size was valued at USD 66.2 billion in 2023.

What is the CAGR of the global commercial seeds market from 2024 to 2032?

The CAGR of Commercial Seeds is 7.8% during the analysis period of 2024 to 2032.

Which are the key players in the commercial seeds market?

The key players operating in the global market are including Syngenta, Takii & Co., Limagrain, Land O'Lakes, Inc., BASF, Groupe Grimaud, Monsanto/Bayer, Sakata Seed Corporation, Dow AgroSciences, KWS SAAT, Advanta Seeds, and DuPont/Pioneer.

Which region dominated the global commercial seeds market share?

North America held the dominating position in commercial seeds industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of commercial seeds during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global commercial seeds industry?

The current trends and dynamics in the commercial seeds industry include rising global population is driving up food demand, advancements in agricultural methods and technologies are becoming more widely adopted, increased emphasis on crop output and quality improvement, and the growing global middle class is driving demand for different food products.

Which genetically modified seeds product held the maximum share in 2023?

The maize genetically modified seeds product held the maximum share of the commercial seeds industry.