Agriculture Precision Market | Acumen Research and Consulting

Agriculture Precision Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Agriculture Precision Market Size accounted for USD 9.2 Billion in 2022 and is estimated to achieve a market size of USD 31.2 Billion by 2032 growing at a CAGR of 13.3% from 2023 to 2032.

Agriculture Precision Market Highlights

- Global agriculture precision market revenue is poised to garner USD 31.2 billion by 2032 with a CAGR of 13.3% from 2023 to 2032

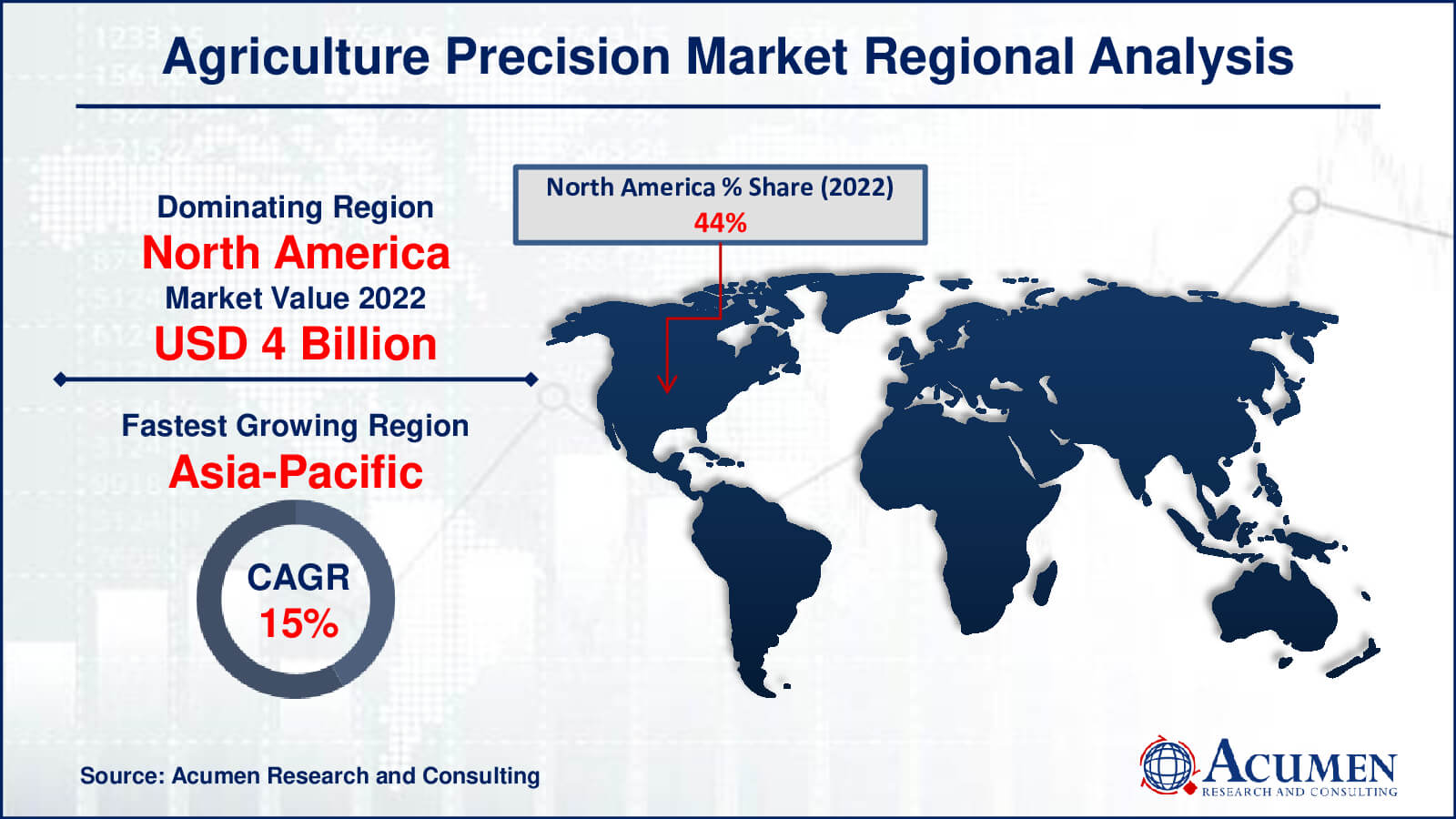

- North America agriculture precision market value occupied around USD 4 billion in 2022

- Asia-Pacific precision agriculture market growth will record a CAGR of more than 15% from 2023 to 2032

- Among component, the hardware sub-segment generated over US$ 6.2 billion revenue in 2022

- Based on application, the yield monitoring sub-segment generated around 43% share in 2022

- Development of innovative data analytics for farming optimization is a popular precision farming market trend that fuels the industry demand

Agriculture precision also known as satellite farming is a farming management system based on observing, measuring and responding to inter and intra-field changeability in crops. The purpose of precision agriculture research is to describe a decision support system (DSS) for entire farm management with the goal of enhancing returns on inputs while protecting resources. The precision farming technique largely depends on specialized equipment such as sensing devices, antennas and access points, and automation and control system. It also involves maintenance services and managed services. Additionally, it incorporates a broad range of technologies such as bio-engineering, robotics and automation, imagery and sensors, and big data.

Agriculture Precision Market Dynamics

Market Drivers

- Increasing adoption of precision farming techniques

- Advancements in technology for precision agriculture

- Growing global population and food demand

- Government initiatives promoting sustainable farming practices

Market Restraints

- High initial investment and implementation costs

- Lack of skilled labor and technical expertise

- Concerns regarding data privacy and security

Market Opportunities

- Rising demand for IoT and AI-based agriculture solutions

- Integration of precision agriculture with drone technology

- Expansion of precision farming in emerging markets

Agriculture Precision Market Report Coverage

| Market | Agriculture Precision Market |

| Agriculture Precision Market Size 2022 | USD 9.2 Billion |

| Agriculture Precision Market Forecast 2032 | USD 31.2 Billion |

| Agriculture Precision Market CAGR During 2023 - 2032 | 13.3% |

| Agriculture Precision Market Analysis Period | 2020 - 2032 |

| Agriculture Precision Market Base Year |

2022 |

| Agriculture Precision Market Forecast Data | 2023 - 2032 |

| Precision Agriculture Market Segments Covered | By Component, By Technology, By Application, And By Geography |

| Precision Agriculture Market Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Precision Agriculture Market Key Companies Profiled | Deere and Company, The Climate Corporation, Trimble Inc., AGCO Corporation, Ag Leader Technology, Raven Industries Inc., Topcon Corporation, Farmers Edge Inc., AgJunction Inc., CropMetrics LLC, AgEagle Aerial Systems Inc. (Agribotix LLC), DICKEY-john Corporation, Grownetics Inc., and Proagrica (SST Development Group Inc.). |

| Precision Agriculture Market Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Precision Agriculture Market Insights

The surge in telematics applications within agriculture is poised to significantly impact and fuel the demand for precision farming market. Telematics, utilizing GNSS-based tracking devices, plays a pivotal role in managing equipment positions, thereby elevating farm efficiency and overall productivity. By harnessing real-time data and location information, telematics facilitates precise decision-making, enabling farmers to optimize their operational processes and resource utilization.

The escalating prominence of precision agriculture is attributable to the imperative need for optimal production amidst increasingly constrained resources and the evolving weather patterns resulting from global warming. Cutting-edge technologies integrated into precision agriculture, such as real-time farm monitoring and advanced climate forecasting tools, empower farmers by providing actionable insights. These insights empower them to make informed decisions, leading to heightened efficiency and increased yield, even in challenging environmental conditions.

Despite its numerous benefits, the adoption of precision farming faces a notable impediment in the form of substantial upfront costs. This obstacle is particularly pronounced for smaller farms, where the expenses associated with acquiring and deploying advanced technologies, along with ongoing maintenance and staffing needs, present considerable hurdles. These financial constraints limit the widespread adoption of precision agriculture, curtailing its potential transformative impact on farming practices.

The integration of artificial intelligence (AI) and machine learning (ML) into precision farming signifies a promising leap forward. AI-driven systems proficiently analyze data gleaned from an array of sources including sensors and drones. The insights derived from this analysis aid farmers in strategic crop management, precision irrigation techniques, effective pest control measures, and accurate yield prediction. Additionally, these AI-powered systems offer tailored recommendations, optimizing resource allocation and minimizing waste. This amalgamation of AI/ML with precision agriculture serves as a transformative force, ushering in sustainability and a substantial uptick in agricultural production.

Precision Agriculture Market Segmentation

The worldwide precision agriculture market is split based on component, technology, application, and geography.\

Precision Agriculture Market By Components

- Hardware

- Automation & Control Systems

- Sensing Devices

- Antennas & Access Points

- Software

- Web-based

- Cloud-based

- Service

- System Integration & Consulting

- Maintenance & Support

- Managed Services

- Assisted Professional Services

By component, the global agriculture precision market is segmented into hardware, software, and service. The hardware segment led the precision argiculture market and is expected to remain dominant over the agriculture precision industry forecast period owing to the high adoption of automation and control devices, such as drones/UAVs, GPS/GNSS, irrigation controllers, guidance and steering systems, yield monitors, and sensors. The yield monitoring process has hardware such as sensors and GPS devices play a vital role in measuring various yield parameters. The process also uses GPS-based auto-guidance technology in agricultural vehicles to reduce the overlapping of equipment and tractor passes, thus saving fuel, labor, time, and soil compaction.

Precision Agriculture Market By Technology

- Guidance Technology

- GPS/GNSS-Based Guidance Technology

- GIS-based Guidance Technology

- Remote Sensing Technology

- Handheld or Ground-based Sensing

- Satellite or Aerial Sensing

- Variable-Rate Technology

- Map-based VRT

- Sensor-based VRT

Among the technology segments in the agriculture precision market, the largest is guidance technology. Guidance technology holds the foremost position due to its widespread implementation in optimizing farming processes. It encompasses GPS-based systems, auto-steering mechanisms, and precision navigation, aiding farmers in precise equipment maneuvering and reducing overlaps. This technology significantly enhances operational efficiency, minimizing resource wastage and maximizing yields. Its integration across various farming equipment and applications makes it the leading technology segment, streamlining agricultural practices and contributing extensively to improved productivity and resource utilization in modern farming methodologies.

Precision Agriculture Market By Applications

- Yield Monitoring

- Field Mapping Telematics

- Crop Scouting

- Weather Tracking & Forecasting

- Inventory Management

- Farm Labor Management

- Others

According to the precision farming market analysis, the application is segmented into yield monitoring, crop scouting, irrigation management, field mapping, weather tracking & forecasting, inventory management, farm labor management, and financial management. Yield monitoring holds the highest precision farming market share due to its versatile applications in soil monitoring, aiding in the detection of soil properties to increase yields. Yield monitors, mounted on harvesting equipment, are utilized across various crops such as corn, wheat, soybeans, sugar beets, potatoes, and cotton.

Precision Agriculture Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Precision Farming Market Regional Analysis

North America leads the agriculture precision market owing to use of mechanization and heavy dependence on technology for aiding agribusinesses. The factors that are backing the market growth in the region are estimated to be the increasing awareness about the quality of crops and the introduction of new initiatives to bring innovations to the sector. The federal government also passed the Precision Agriculture Connectivity Act to meet the connectivity needs of the precision farming in the U.S. The regulatory body established a task force, which investigates and provides policy recommendations on how to improve the broadband internet access in croplands.

The Asia-Pacific region is anticipated to be the fastest-growing market during the agriculture precision Market forecast period. The presence of countries with the largest population, rising demands for food products, and the need to enhance farm output drives the demand for precision farming/agriculture techniques in the region. Countries like China and Japan have readily embraced this technology and are adopting it strongly.

Latin America and the Middle East and Africa contribute the least market share and are expected to grow slower than the global average growth rate.

Precision Farming Market Players

Some of the top precision farming market companies covered in our report includes Deere and Company, The Climate Corporation, Trimble Inc., AGCO Corporation, Ag Leader Technology, Raven Industries Inc., Topcon Corporation, Farmers Edge Inc., AgJunction Inc., CropMetrics LLC, AgEagle Aerial Systems Inc. (Agribotix LLC), DICKEY-john Corporation, Grownetics Inc., and Proagrica (SST Development Group Inc.)

Frequently Asked Questions

How big is the agriculture precision market?

The agriculture precision market size was reported USD 9.2 Billion in 2022.

What is the CAGR of the global precision agriculture market from 2023 to 2032?

The CAGR of precision agriculture market is 13.3% during the analysis period of 2023 to 2032.

Which are the key players in the agriculture precision market?

The key players operating in the global market are including Deere and Company, The Climate Corporation, Trimble Inc., AGCO Corporation, Ag Leader Technology, Raven Industries Inc., Topcon Corporation, Farmers Edge Inc., AgJunction Inc., CropMetrics LLC, AgEagle Aerial Systems Inc. (Agribotix LLC), DICKEY-john Corporation, Grownetics Inc., and Proagrica (SST Development Group Inc.).

Which region dominated the global precision agriculture market share?

North America held the dominating position in precision agriculture industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of agriculture precision during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global agriculture precision industry?

The current trends and dynamics in the agriculture precision industry include increasing adoption of precision farming techniques, advancements in technology for precision agriculture, growing global population and food demand, and government initiatives promoting sustainable farming practices.

Which component held the maximum share in 2022?

The hardware component held the maximum share of the agriculture precision industry.