Commercial Satellite Imaging Market | Acumen Research and Consulting

Commercial Satellite Imaging Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

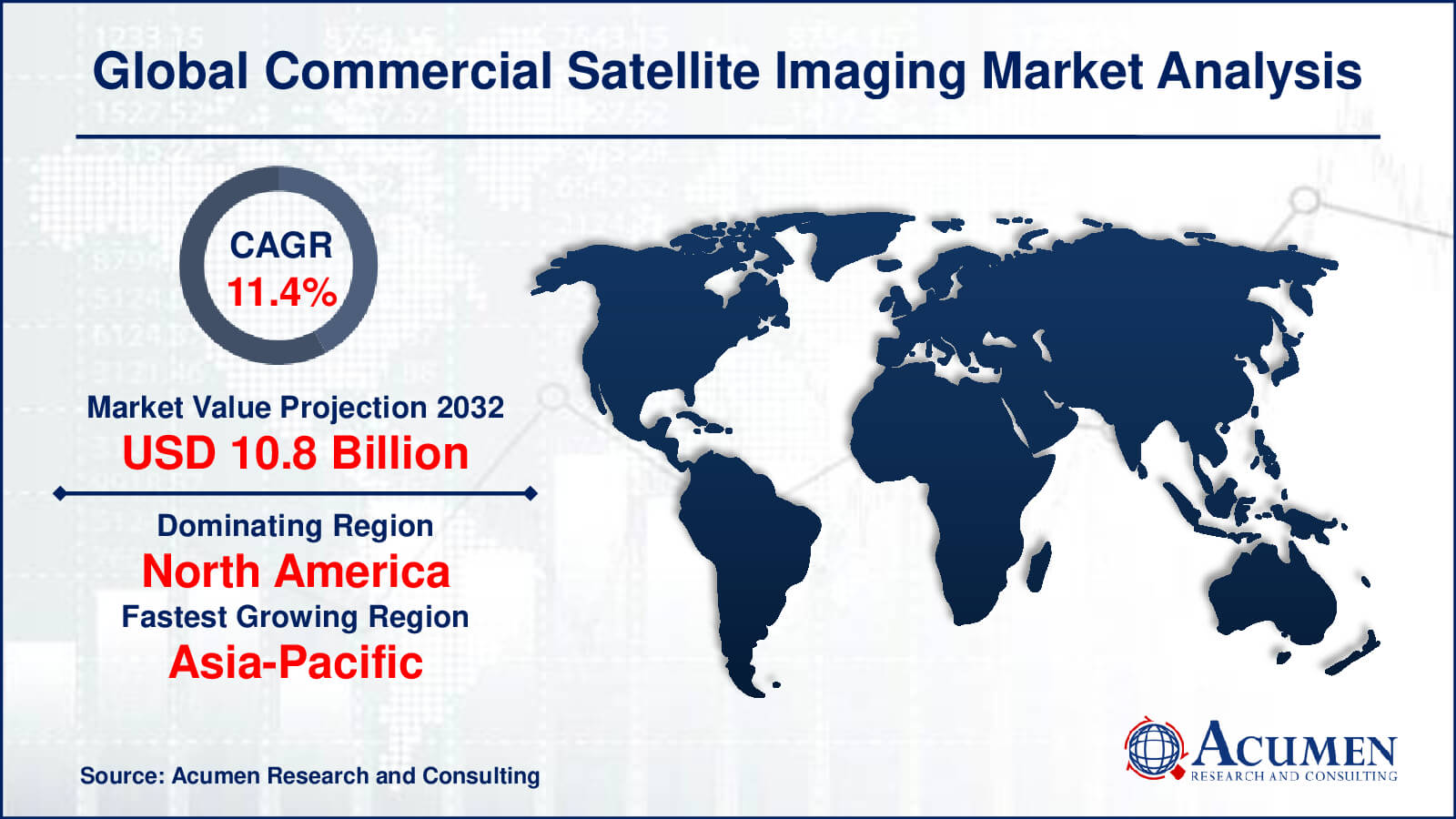

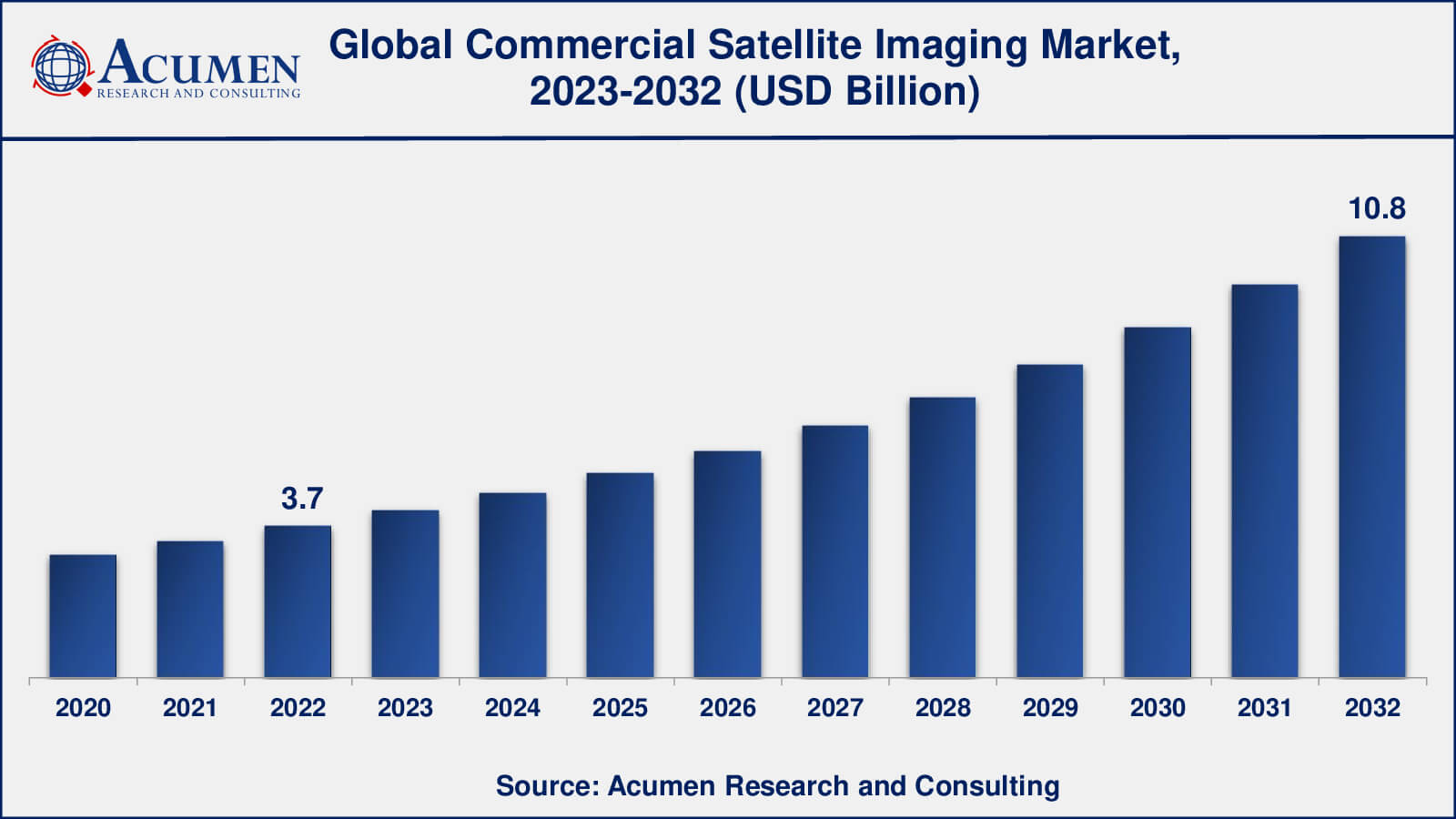

The Global Commercial Satellite Imaging Market Size accounted for USD 3.7 Billion in 2022 and is estimated to achieve a market size of USD 10.8 Billion by 2032 growing at a CAGR of 11.4% from 2023 to 2032.

Commercial Satellite Imaging Market Highlights

- Global commercial satellite imaging market revenue is poised to garner USD 10.8 billion by 2032 with a CAGR of 11.4% from 2023 to 2032

- North America commercial satellite imaging market value occupied around 2.1 billion in 2022

- Asia-Pacific commercial satellite imaging market growth will record a CAGR of more than 12% from 2023 to 2032

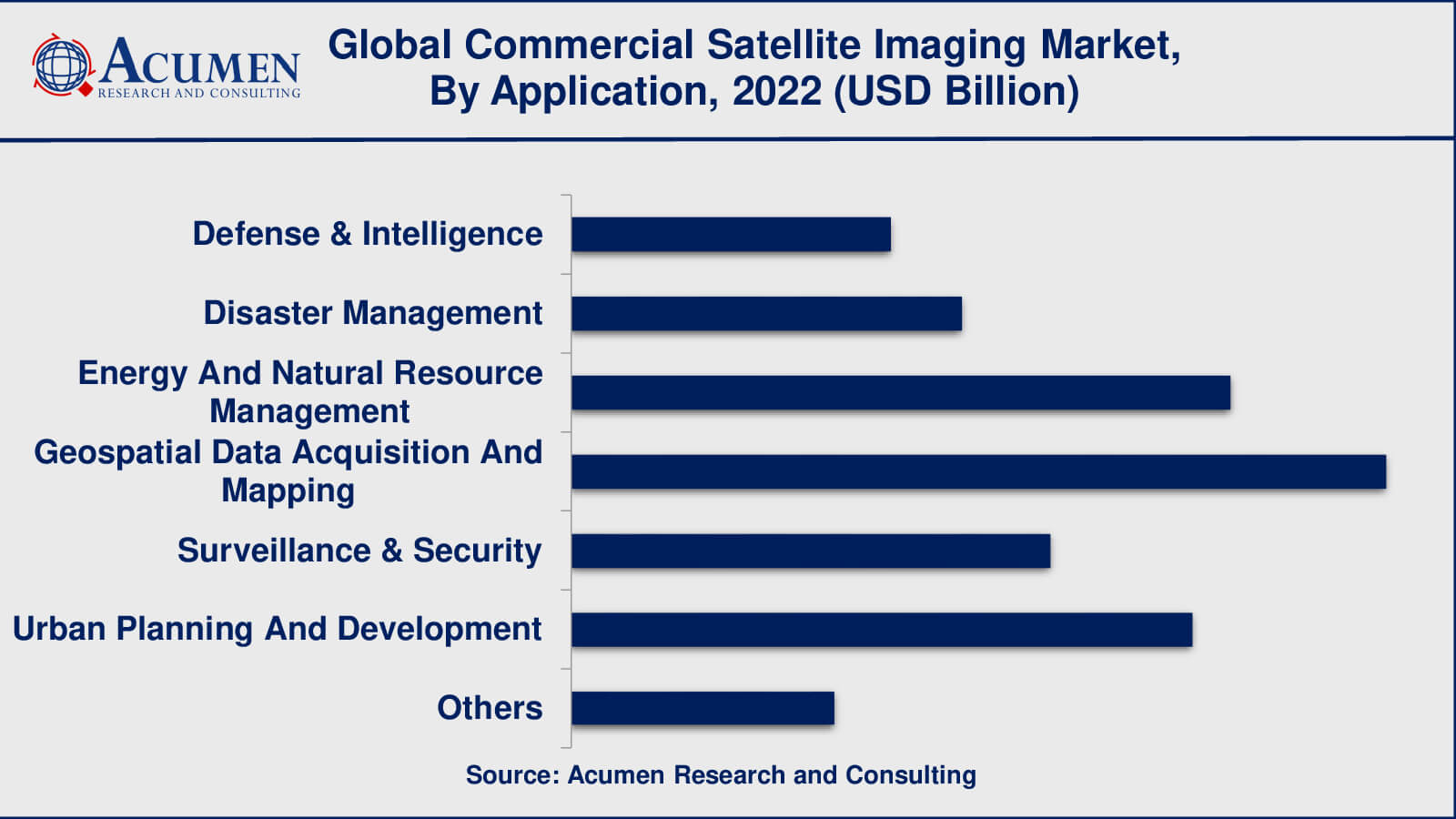

- Among application, the geospatial data acquisition and mapping sub-segment generated over US$ 855.6 million revenue in 2022

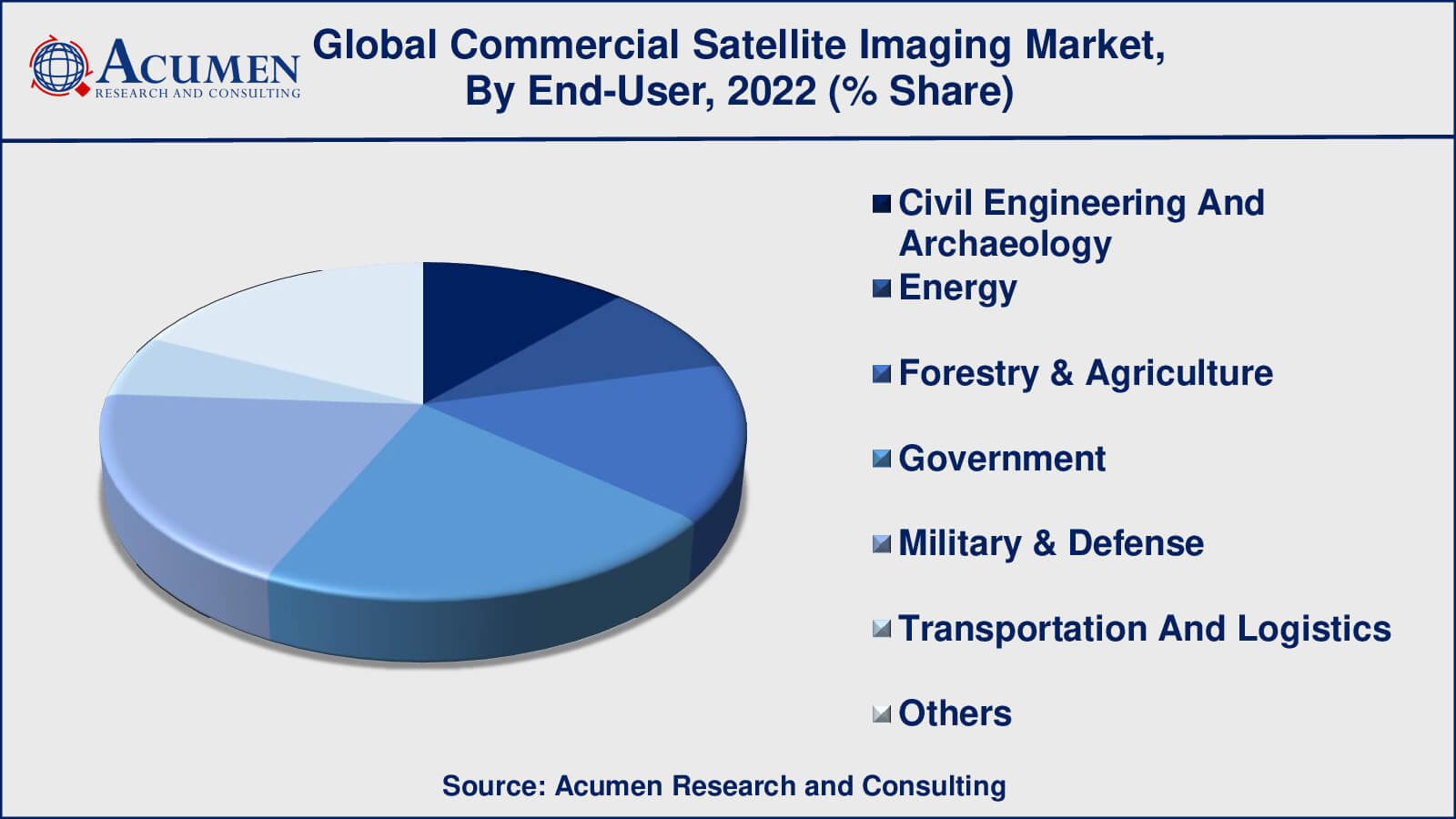

- Based on end-use, the government & sub-segment generated around 21% share in 2022

- Expansion of the commercial space industry, including the deployment of large constellations of small satellites is a popular commercial satellite imaging market trend that fuels the industry demand

Commercial satellite imaging is the use of satellite systems to acquire high-resolution pictures and data of the Earth's surface for a variety of commercial uses. It entails the launch of satellites outfitted with powerful imaging sensors that capture photos and data from orbit, offering significant insights and information. This technology has grown in popularity owing to a variety of variables.

For starters, the growing popularity of location-based services (LBS) has increased the demand for precise and up-to-date satellite images. Satellite imaging is used by businesses across industries to improve their services and make educated decisions based on geographical data. Commercial satellite imagery is widely used in mapping, navigation, and geospatial information systems.

Second, various businesses have diverse uses for satellite imagery. For example, satellite imaging is used in agriculture for crop monitoring and yield estimates. It is used by energy corporations to monitor pipelines, renewable energy projects, and power plants. Satellite imaging is widely used by defense and military organizations for surveillance, reconnaissance, and information collection.

The need for precise and up-to-date spatial data, developments in imaging technology and its wide variety of applications across numerous sectors fuel demand for commercial satellite imaging. The need for commercial satellite imaging is projected to expand further as technology advances and more firms see the usefulness of satellite photography.

Global Commercial Satellite Imaging Market Dynamics

Market Drivers

- Increasing demand for location-based services (LBS) and geospatial information systems (GIS) across various industries

- Growing need for remote sensing and monitoring applications in agriculture, forestry, and environmental management sectors

- Advancements in satellite imaging technology, including high-resolution imagery and improved data accuracy

- Rising investments in space exploration and satellite infrastructure by government and private organizations

- Expansion of the e-commerce and logistics industry for accurate and real-time mapping and navigation solutions

- Growing use of satellite imagery for urban planning, infrastructure development, and disaster management

Market Restraints

- High costs associated with satellite imaging services, including satellite deployment, data acquisition, and processing

- Regulatory challenges and restrictions related to satellite imagery acquisition and data privacy

- Limited availability of satellite bandwidth and processing capabilities for high-resolution imagery

- Challenges in capturing imagery during adverse weather conditions or in remote and inaccessible regions

- Competition from alternative mapping and imaging technologies, such as aerial photography and drones

Market Opportunities

- Increasing adoption of satellite imagery for defense and security applications

- Emerging applications in the energy sector, such as monitoring oil & gas pipelines and renewable energy installations

- Growing demand for satellite imagery in the construction industry for site selection, project monitoring, and 3D mapping

- Integration of satellite imagery with AI and ML algorithms for automated analysis and decision-making

- Potential for satellite imaging in emerging markets, where infrastructure development, resource management, and disaster preparedness are of significant importance

Commercial Satellite Imaging Market Report Coverage

| Market | Commercial Satellite Imaging Market |

| Commercial Satellite Imaging Market Size 2022 | USD 3.7 Billion |

| Commercial Satellite Imaging Market Forecast 2032 | USD 10.8 Billion |

| Commercial Satellite Imaging Market CAGR During 2023 - 2032 | 11.4% |

| Commercial Satellite Imaging Market Analysis Period | 2020 - 2032 |

| Commercial Satellite Imaging Market Base Year | 2022 |

| Commercial Satellite Imaging Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Airbus Defence and Space, BlackSky Global, DigitalGlobe (Maxar Technologies), Earth-I, E-GEOS (Telespazio), European Space Imaging, Galileo Group, Harris Geospatial Solutions, ImageSat International (ISI), MDA (MacDonald, Dettwiler and Associates), Planet Labs, and Satellogic. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Commercial Satellite Imaging Market Insights

The commercial satellite imaging industry is undergoing substantial expansion and transition as a result of a variety of factors. The growing need for location-based services (LBS) and geographic information systems (GIS) across many businesses is one of the key causes. Organizations are beginning to recognize the need of accurate and up-to-date spatial data for decision-making, planning, and resource management. Satellite imagery offers organizations with rich and high-resolution information that allows them to obtain insights and optimize their operations.

Another important driver is the increasing need for remote sensing and monitoring applications in industries such as agriculture, forestry, and environmental management. Satellite imagery enables crop health evaluation, deforestation monitoring, and environmental change tracking. This information is critical for long-term resource management, risk assessment, and environmental protection.

Satellite imaging technology advancements have also played an important role in market expansion. High-resolution imagery, increased data accuracy, and the introduction of hyperspectral and radar imaging capabilities have broadened the spectrum of satellite imagery applications. These advances allow for more accurate mapping, thorough analysis, and identification of objects and features on the Earth's surface.

Government and business sector investments in space exploration and satellite infrastructure are propelling the market ahead. Governments are recognizing the strategic and economic benefits of satellite imagery and committing monies for the development and deployment of sophisticated satellite systems. Simultaneously, commercial businesses are developing satellite constellations to provide high-quality, real-time imaging services.

The growth of the e-commerce and logistics industries is also increasing demand for commercial satellite imagery. Mapping and navigation solutions that are accurate and up to date are critical for optimizing supply chain operations, assuring efficient delivery, and increasing customer experience.

However, the commercial satellite imaging sector faces a number of obstacles and constraints. The significant expenses involved with satellite imaging services, such as satellite deployment, data collecting, and processing, might make these services inaccessible to smaller firms. Regulatory obstacles and limits connected to satellite imagery procurement and data privacy are also impeding industry expansion.

Commercial Satellite Imaging Market Segmentation

The worldwide market for commercial satellite imaging is split based on application, end-user, and geography.

Commercial Satellite Imaging Applications

- Defense & Intelligence

- Disaster Management

- Energy And Natural Resource Management

- Geospatial Data Acquisition And Mapping

- Surveillance & Security

- Urban Planning And Development

- Others

According to commercial satellite imaging industry analysis, geospatial data collecting and mapping applications have seen significant development. Satellite imagery is used to create accurate and up-to-date maps, elevation models, and land surveys. Urban planning, infrastructure construction, transportation management, and navigation systems all benefit from these applications.

Another important use for commercial satellite imaging is energy and natural resource management. Satellite photography is used to follow mining activities, monitor oil and gas pipelines, manage forest resources, and evaluate renewable energy projects. It provides vital data for effective resource utilisation, environmental impact assessment, and the development of sustainable energy.

The commercial satellite imaging business is also dominated by the defence and intelligence sectors. Defence and intelligence organisations have used satellite images extensively for surveillance, reconnaissance, and intelligence collection. Satellite imaging provides high-resolution images that allows these organisations to monitor activity, detect possible threats, and gather crucial information for national security.

Commercial Satellite Imaging End-Users

- Civil Engineering And Archaeology

- Energy

- Forestry & Agriculture

- Government

- Military & Defense

- Transportation And Logistics

- Others

As per the commerical satellite imaging market forecast, the government sector has been a leading end-user of commercial satellite imaging services. Satellite imagery is used by government agencies at all levels, including national, regional, and municipal, for a variety of purposes, including urban planning, infrastructure development, environmental monitoring, disaster management, and border surveillance.

Another significant end-user that heavily use commercial satellite imagery for surveillance, reconnaissance, and information collection is the military and defence industry. Satellite imaging is used by military forces for mission planning, threat assessment, and situational awareness.

The energy industry, which includes oil and gas firms, utilities, and renewable energy suppliers, is a major user of satellite imaging services. Monitoring energy infrastructure, such as pipelines, power plants, and renewable energy projects, is aided by satellite images. It aids in the discovery of resources, the evaluation of environmental impact, and the management of assets.

Commercial Satellite Imaging Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Commercial Satellite Imaging Market Regional Analysis

North America has long been a market leader in commercial satellite imagery. The existence of large satellite imaging firms and space agencies, as well as considerable expenditures in space technology, has helped the area maintain its market leadership. Several significant participants in the sector are based in the United States. Defense and intelligence, disaster management, and energy resource monitoring are driving the market in North America.

With numerous European nations actively participating in space exploration and satellite technology, Europe has a strong presence in the commercial satellite imaging business. The European Space Agency (ESA) is an important driver of the business in the region. European nations with well-established satellite imaging capabilities, such as France, Germany, and the United Kingdom, contribute to applications such as urban planning, agriculture, and environmental monitoring.

The commercial satellite imaging industry is expanding rapidly in the Asia-Pacific area. China, India, and Japan have made significant investments in space technology and satellite infrastructure. Applications including urban development, agriculture, disaster management, and infrastructure planning drive the market in this area. Furthermore, growing Southeast Asian nations are rapidly embracing satellite imaging technology for a variety of uses.

Commercial Satellite Imaging Market Players

Some of the top commercial satellite imaging companies offered in our report include Airbus Defence and Space, BlackSky Global, DigitalGlobe (Maxar Technologies), Earth-I, E-GEOS (Telespazio), European Space Imaging, Galileo Group, Harris Geospatial Solutions, ImageSat International (ISI), MDA (MacDonald, Dettwiler and Associates), Planet Labs, and Satellogic.

In January 2022, Satellogic established a strategic agreement with China Great Wall Industry Corporation (CGWIC) to speed the deployment of Satellogic's satellite network. The collaboration intends to increase Satellogic's capabilities and extend its commercial imaging services in the Chinese market by using CGWIC's launch services.

In August 2021, Maxar Technologies has reported the successful launch of its WorldView Legion satellite constellation. The six high-resolution imaging satellite constellations will provide enhanced picture collecting capacity and return rates, allowing clients to obtain more timely and comprehensive images.

Frequently Asked Questions

What was the market size of the global commercial satellite imaging in 2022?

The market size of commercial satellite imaging was USD 3.7 billion in 2022.

What is the CAGR of the global commercial satellite imaging market from 2023 to 2032?

The CAGR of commercial satellite imaging is 11.4% during the analysis period of 2023 to 2032.

Which are the key players in the commercial satellite imaging market?

The key players operating in the global market are including Airbus Defense and Space, BlackSky Global, DigitalGlobe (Maxar Technologies), Earth-I, E-GEOS (Telespazio), European Space Imaging, Galileo Group, Harris Geospatial Solutions, ImageSat International (ISI), MDA (MacDonald, Dettwiler and Associates), Planet Labs, and Satellogic.

Which region dominated the global commercial satellite imaging market share?

North America held the dominating position in commercial satellite imaging industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of commercial satellite imaging during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global commercial satellite imaging industry?

The current trends and dynamics in the commercial satellite imaging industry include increasing demand for location-based services (LBS) and geospatial information systems (GIS) across various industries, growing need for remote sensing and monitoring applications in agriculture, forestry, and environmental management sectors, and advancements in satellite imaging technology, including high-resolution imagery and improved data accuracy.

Which Application held the maximum share in 2022?

The geospatial data acquisition and mapping application held the maximum share of the commercial satellite imaging industry.?