Commercial Aircraft Airframe Materials Market | Acumen Research and Consulting

Commercial Aircraft Airframe Materials Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

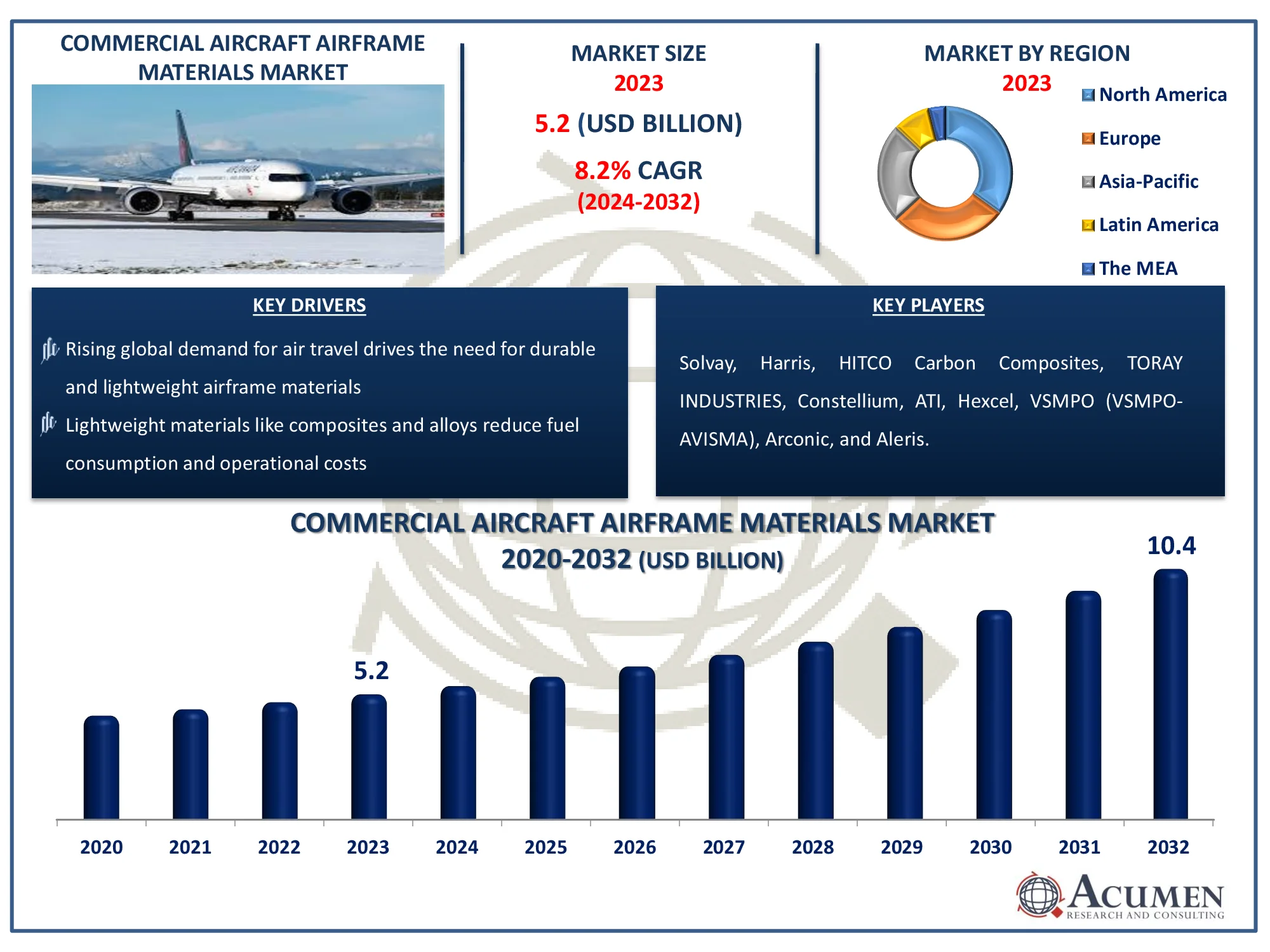

The Global Commercial Aircraft Airframe Materials Market Size accounted for USD 5.2 Billion in 2023 and is estimated to achieve a market size of USD 10.4 Billion by 2032 growing at a CAGR of 8.2% from 2024 to 2032.

Commercial Aircraft Airframe Materials Market Highlights

- Global commercial aircraft airframe materials market revenue is poised to garner USD 10.4 billion by 2032 with a CAGR of 8.2% from 2024 to 2032

- North America commercial aircraft airframe materials market value occupied around USD 1.8 billion in 2023

- Asia-Pacific commercial aircraft airframe materials market growth will record a CAGR of more than 9.1% from 2024 to 2032

- Among type, the narrow-body aircraft sub-segment generated noteworthy revenue in 2023

- Based on material, the aluminum alloys sub-segment generated 60% commercial aircraft airframe materials market share in 2023

- Upgrading existing fleets with modern materials is a popular commercial aircraft airframe materials market trend that fuels the industry demand

Airframe is the machine-driven structure of an aircraft, which comprises landing gear, empennage, wings and fuselage. Airframe design consists of materials technology, manufacturing approaches and aerodynamics to strike a balance between performance, reliability and cost. The airframe must be able to endure aerodynamic forces and stresses progressive due to the weightiness of the payload, fuel and crew. There was a significant enhancement in the airframe materials market throughout the 1930s as the fabric and wood used previously in aircraft were substituted by high-strength and lightweight materials such as titanium, magnesium, aluminum alloys, and some stainless steel.

Global Commercial Aircraft Airframe Materials Market Dynamics

Market Drivers

- Rising global demand for air travel drives the need for durable and lightweight airframe materials

- Lightweight materials like composites and alloys reduce fuel consumption and operational costs

- Innovations in material science enhance the performance and lifecycle of airframe materials

- Expansion of fleets by major airlines supports material consumption

Market Restraints

- Advanced materials like carbon fiber composites involve expensive manufacturing processes

- Limited availability of certain raw materials affects timely production

- Compliance with aviation safety and environmental standards increases complexity

Market Opportunities

- Growing interest in electric vertical takeoff and landing (eVTOL) aircraft fuels demand for advanced materials

- Increasing focus on eco-friendly materials presents innovation opportunities

- Rising air travel in Asia-Pacific and Latin America drives material demand

Commercial Aircraft Airframe Materials Market Report Coverage

| Market | Commercial Aircraft Airframe Materials Market |

| Commercial Aircraft Airframe Materials Market Size 2022 |

USD 5.2 Billion |

| Commercial Aircraft Airframe Materials Market Forecast 2032 | USD 10.4 Billion |

| Commercial Aircraft Airframe Materials Market CAGR During 2023 - 2032 | 8.2% |

| Commercial Aircraft Airframe Materials Market Analysis Period | 2020 - 2032 |

| Commercial Aircraft Airframe Materials Market Base Year |

2023 |

| Commercial Aircraft Airframe Materials Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Type, By Material, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Solvay, Harris, HITCO Carbon Composites, TORAY INDUSTRIES, Constellium, ATI, Hexcel, VSMPO (VSMPO-AVISMA), Arconic, and Aleris. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Commercial Aircraft Airframe Materials Market Insights

The commercial aircraft airframe materials sector is rapidly increasing, owing primarily to changing requirements for next-generation aircraft. As aircraft regulations emphasize safety, fuel efficiency, and environmental sustainability, there is an increasing preference for complex materials such as carbon fiber composites, titanium alloys, and aluminum-lithium. These materials not only improve the structural integrity of airframes, but they also help to reduce weight, increasing fuel efficiency and lowering greenhouse gas emissions. Airlines and manufacturers are embracing these cutting-edge materials to meet demanding compliance regulations, which is fuelling the market.

However, the expansion of this industry is hampered, owing to the high maintenance and production costs associated with sophisticated airframe materials. Manufacturing procedures for lightweight composites and other specialist materials need complex techniques and significant capital expenditure, which may inhibit smaller companies in the market. Furthermore, the costs of repair and maintenance for these materials are higher than for conventional solutions, putting additional restraints.

Despite these challenges, the sector has immense potential, particularly given the growing usage of 3D printing technologies. This innovative method is revolutionizing aviation component manufacturing by reducing waste, lowering costs, and enabling complex designs. As the aerospace sector quickly uses 3D printing for airframe manufacturing, stakeholders have a lucrative opportunity to address cost concerns and improve efficiency, resulting in commercial aircraft airframe materials market development.

Commercial Aircraft Airframe Materials Market Segmentation

The worldwide market for commercial aircraft airframe materials is split based on product, material, and geography.

Commercial Aircraft Airframe Materials Market By Type

- Wide Body Aircraft

- Narrow Body Aircraft

- Regional Aircraft

According to commercial aircraft airframe materials industry analysis, the narrow-body aircraft sector is likely to dominate the market share. Short- and medium-haul flights, which account for the vast majority of global air traffic, rely on narrow-body aircraft. Airlines are increasingly using these aircraft because of their operational efficiency, cost-effectiveness, and suitability for high-demand domestic and regional routes.

The rise of low-cost carriers, particularly in emerging countries such as Asia-Pacific and Latin America, has increased demand for narrow-body aircraft. Furthermore, advances in materials such as lightweight composites and aluminum alloys improve the performance and fuel efficiency of these aircraft, making them more enticing to operators. With widespread use and growing order backlogs from leading manufacturers, the narrow-body sector is likely to maintain its market dominance.

Commercial Aircraft Airframe Materials Market By Materials

- Aluminum Alloys

- Steel Alloys

- Titanium Alloys

- Super Alloys

- Composite Materials

- Others

Aluminum alloys are the most important material category, accounting for over 60% of the commercial aircraft airframe materials market, because to their high strength-to-weight ratio, corrosion resistance, and cost-effectiveness. These characteristics make them essential for the manufacture of important structural components like as wings, fuselages, and tail assemblies. Aluminum alloys' lightweight properties considerably improve fuel efficiency, which is key in the aviation industry where operational expenses are quite important.

Furthermore, aluminum alloys are incredibly flexible, making them easy to make and repair, resulting in less maintenance time. The material's established supply network and extensive availability all contribute to its market dominance. As aircraft manufacturers prioritize sustainability and operational efficiency, aluminum alloys are expected to maintain their market dominance in the commercial aircraft airframe segment.

Commercial Aircraft Airframe Materials Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Commercial Aircraft Airframe Materials Market Regional Analysis

North America leads the commercial aircraft airframe materials market due to its established aerospace industry and growing demand for contemporary aircraft. The United States is a significant contributor, having huge aircraft manufacturers like Boeing and a robust supply network. Strong military and commercial aviation investments help to strengthen the sector even further. Furthermore, the region benefits from ongoing material advancements, such as composites and titanium, which help to meet strict performance and environmental requirements. Increased passenger traffic and a focus on fleet modernization drive up the need for innovative airframe materials. The existence of regulatory authorities such as the FAA maintains high quality and safety standards, which drives material improvements in the region.

The commercial aircraft airframe materials market in Asia-Pacific is quickly growing as air travel increases and airline fleets expand. China, India, and Southeast Asian countries are major suppliers, helped by increased disposable incomes, urbanization, and tourism. The region is also investing considerably in indigenous aircraft manufacturing capabilities, including China's COMAC. Lightweight materials such as aluminum alloys and carbon composites are being employed to meet the increasing need for fuel-efficient airplanes. Furthermore, beneficial government programs like "Make in India" and other initiatives promote regional production. As Asia-Pacific expands its aviation infrastructure, the market for airframe materials is expected to increase dramatically.

Commercial Aircraft Airframe Materials Market Players

Some of the top commercial aircraft airframe materials companies offered in our report includes Solvay, Harris, HITCO Carbon Composites, TORAY INDUSTRIES, Constellium, ATI, Hexcel, VSMPO (VSMPO-AVISMA), Arconic, and Aleris.

Frequently Asked Questions

How big is the commercial aircraft airframe materials market?

The commercial aircraft airframe materials market size was valued at USD 5.2 billion in 2023.

What is the CAGR of the global commercial aircraft airframe materials market from 2024 to 2032?

The CAGR of commercial aircraft airframe materials is 8.2% during the analysis period of 2024 to 2032.

The CAGR of commercial aircraft airframe materials is 8.2% during the analysis period of 2024 to 2032.

The key players operating in the global market are including Solvay, Harris, HITCO Carbon Composites, TORAY INDUSTRIES, Constellium, ATI, Hexcel, VSMPO (VSMPO-AVISMA), Arconic, and Aleris.

Which region dominated the global commercial aircraft airframe materials market share?

North America held the dominating position in commercial aircraft airframe materials industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest c CAGR for market of commercial aircraft airframe materials during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global commercial aircraft airframe materials industry?

The current trends and dynamics in the commercial aircraft airframe materials industry include rising global demand for air travel drives the need for durable and lightweight airframe materials, and lightweight materials like composites and alloys reduce fuel consumption and operational costs.

Which material held the maximum share in 2023?

The aluminum alloys material held the maximum share of the commercial aircraft airframe materials industry.