Automotive Aluminum Alloy Market | Acumen Research and Consulting

Automotive Aluminum Alloy Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

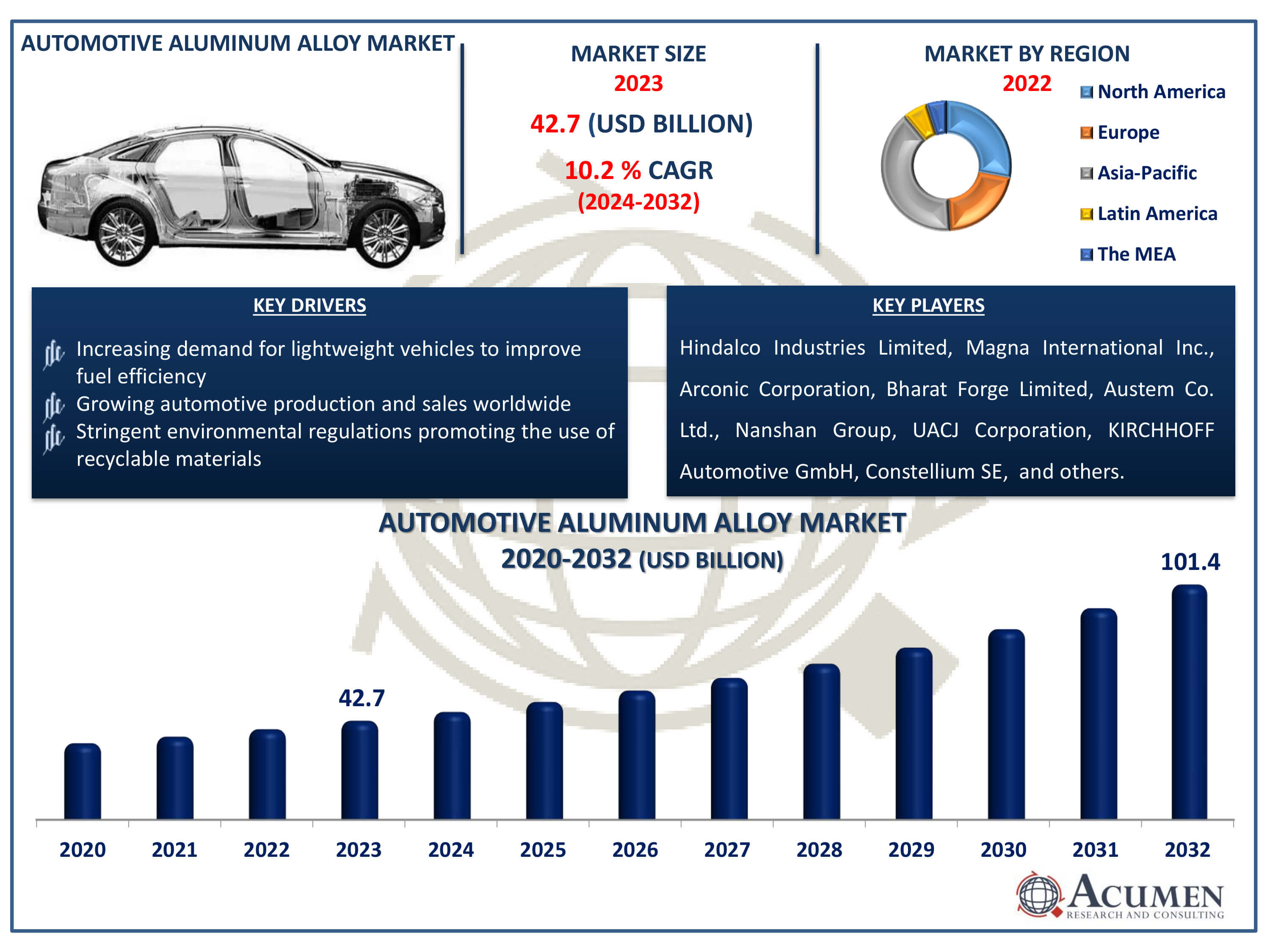

The Automotive Aluminum Alloy Market Size accounted for USD 42.7 Billion in 2023 and is estimated to achieve a market size of USD 101.4 Billion by 2032 growing at a CAGR of 10.2% from 2024 to 2032.

Automotive Aluminum Alloy Market Highlights

- Global automotive aluminum alloy market revenue is poised to garner USD 101.4 billion by 2032 with a CAGR of 10.2% from 2024 to 2032

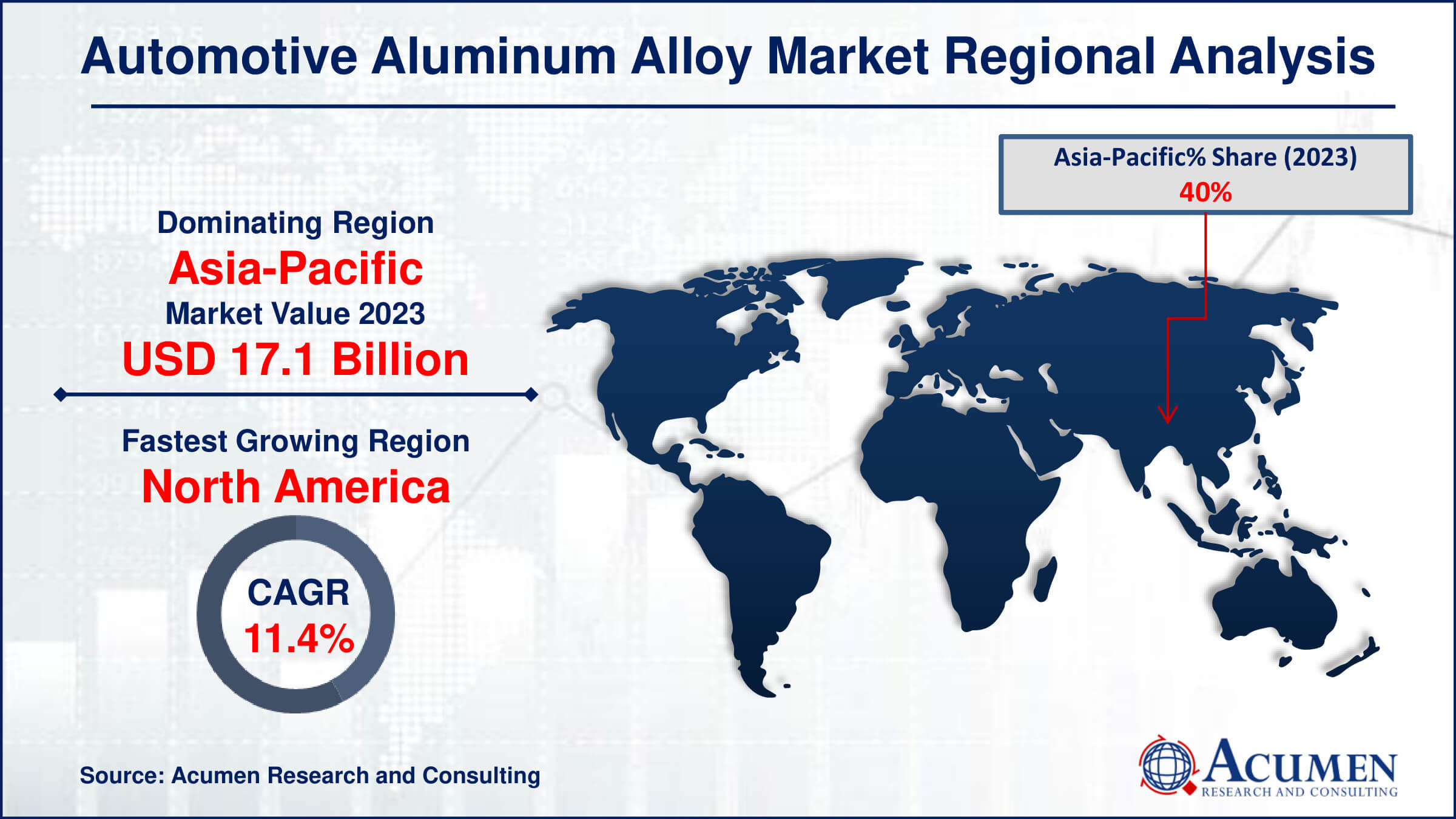

- Asia-Pacific automotive aluminum alloy market value occupied around USD 17.1 billion in 2023

- North America automotive aluminum alloy market growth will record a CAGR of more than 11.4% from 2024 to 2032

- Among type, the body parts sub-segment generated significant of the market share in 2023

- Based on vehicle type, the passenger vehicles sub-segment generated notable market share in 2023

- Increasing adoption of high-strength aluminum alloys to reduce vehicle weight and improve fuel efficiency is the automotive aluminum alloy market trend that fuels the industry demand

Aluminum is extensively utilized in manufacturing various frames and components for automotive vehicles. Sourced from bauxite, aluminum is a preferred material across numerous sectors. Although pure aluminum lacks high tensile strength, the addition of alloying elements significantly enhances its strength. Due to its versatility, aluminum is commonly used in producing automotive parts suitable for cold climates. Additionally, aluminum's cost-effectiveness compared to other available alternatives makes it an ideal material choice.

Global Automotive Aluminum Alloy Market Dynamics

Market Drivers

- Growing automotive production and sales worldwide

- Increasing demand for lightweight vehicles to improve fuel efficiency

- Stringent environmental regulations promoting the use of recyclable materials

Market Restraints

- High cost of aluminum compared to traditional steel

- Limited availability of raw materials and fluctuating prices

- Technical challenges in manufacturing and repairing aluminum components

Market Opportunities

- Advancements in alloy technology enhancing performance and durability

- Expansion in electric vehicle production requiring lightweight materials

- Increasing focus on vehicle safety boosting the adoption of high-strength aluminum alloys

Automotive Aluminum Alloy Market Report Coverage

| Market | Automotive Aluminum Alloy Market |

| Automotive Aluminum Alloy Market Size 2022 | USD 42.7 Billion |

| Automotive Aluminum Alloy Market Forecast 2032 | USD 101.4 Billion |

| Automotive Aluminum Alloy Market CAGR During 2023 - 2032 | 20.1% |

| Automotive Aluminum Alloy Market Analysis Period | 2020 - 2032 |

| Automotive Aluminum Alloy Market Base Year |

2022 |

| Automotive Aluminum Alloy Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Vehicle Type, By Heat Sensitivity Type, By Application Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Hindalco Industries Limited, Magna International Inc., Arconic Corporation, Bharat Forge Limited, Austem Co. Ltd., Nanshan Group, UACJ Corporation, KIRCHHOFF Automotive GmbH, Constellium SE, Norsk Hydro ASA, Flex-N-Gate LLC, and Gordon Auto Body Parts Co. Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automotive Aluminum Alloy Market Insights

The rising demand for lightweight vehicles to enhance fuel efficiency is significantly boosting the automotive aluminum alloy market. For instance, according to Department of Energy, by integrating lightweight components and employing high-efficiency engines made possible by advanced materials, a transformation of one quarter of the U.S. fleet could result in savings of over 5 billion gallons of fuel each year by 2030. Aluminum alloys, known for their strength and light weight, help reduce vehicle weight, leading to better fuel economy and lower emissions. Automakers are increasingly incorporating these materials to meet stringent environmental regulations and consumer expectations for fuel-efficient cars. This shift not only supports sustainability goals but also drives innovation in vehicle design and manufacturing. Consequently, the automotive aluminum alloy market is experiencing robust growth and expanding applications across the industry.

The automotive aluminum alloy market faces growth challenges due to the limited availability of raw materials, which restricts production capacity and increases dependency on supply chains. Fluctuating prices of these raw materials further exacerbate the situation, creating cost unpredictability for manufacturers. This volatility can lead to increased production costs and reduced profit margins, making it difficult for companies to plan long-term investments. Additionally, the competition for these materials from other industries intensifies the scarcity and price instability. Consequently, these factors collectively impede the consistent growth and expansion of the automotive aluminum alloy market.

Advancements in alloy technology are significantly enhancing the performance and durability of automotive aluminum alloys, driving market growth. For instance, Constellium showcased its newest advancements in aluminum automotive structures at CES 2024 in Las Vegas, USA. These innovations lead to lighter, stronger, and more corrosion-resistant materials, which improve vehicle efficiency and longevity. Enhanced properties of modern aluminum alloys facilitate better fuel economy and reduced emissions, aligning with environmental regulations and consumer demands. The continuous development in this field opens up new applications and design possibilities for manufacturers. Consequently, the automotive industry is increasingly adopting advanced aluminum alloys to meet stringent performance standards and sustainability goals.

Automotive Aluminum Alloy Market Segmentation

The worldwide market for automotive aluminum alloy is split based on type, vehicle type, heat sensitivity type, end-use industry, and geography.

Automotive Aluminum Alloy (OE) Market By Type

- Engine Component

- Wheels

- Driveline

- Heat Exchangers

- Body Parts

- Others

According to the automotive aluminum alloy industry analysis, body parts are expected to dominate the market, due to their critical roles in automotive and aerospace industries. For instance, components such as engine blocks, chassis frames, and wheels demand materials that offer excellent strength-to-weight ratios and resistance to corrosion, qualities in which aluminum alloys particularly excel. These alloys also offer versatility in design and manufacturing, making them ideal for achieving lightweight structures without compromising durability. As industries continue to prioritize fuel efficiency and performance, demand for aluminum alloys in essential body parts is expected to grow significantly.

Automotive Aluminum Alloy (OE) Market By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Light Commercial Vehicle (LCV)

- Heavy Commercial Vehicle (HCV)

- Electric Vehicles

According to the automotive aluminum alloy industry analysis, passenger vehicles are poised to dominate the market due to their increasing production and demand for lightweight materials. For instance, according to China Association of Automobile Manufacturers, in June 2023, the production of passenger cars reached 2.219 million units, marking a 10.4% increase compared to the previous month. Similarly, sales amounted to 2.268 million units, showing a month-on-month rise of 10.6%.Aluminum alloys offer crucial advantages like improved fuel efficiency, reduced emissions, and enhanced performance, aligning with global trends towards sustainability and regulatory requirements. Moreover, advancements in alloy formulations and manufacturing processes are further driving their adoption in passenger vehicles, reinforcing their pivotal role in shaping the future of automotive design and technology.

Automotive Aluminum Alloy (OE) Market By Heat Sensitivity Type

- Heat-Treatable (Al-Mg-Si)

- Non Heat-Treatable (Al-Mg-Mn)

According to the automotive aluminum alloy industry forecast, heat-treatable (Al-Mg-Si) expected to dominates market, due to their superior mechanical properties and lightweight nature. These alloys offer excellent strength-to-weight ratios, corrosion resistance, and formability, crucial for manufacturing automotive components that meet stringent performance and efficiency standards. Their ability to be heat-treated allows for modified strength levels, enhancing structural integrity while reducing overall vehicle weight, thereby contributing to fuel efficiency and sustainability goals in the automotive industry.

Automotive Aluminum Alloy (OE) Market Application

- Powertrain

- Structure & Exterior

- Others

According to the automotive aluminum alloy industry forecast, aluminum alloys are increasingly used in powertrain components such as engine blocks, cylinder heads, and transmission cases. The demand for lightweight materials to improve fuel efficiency and reduce emissions has driven the adoption of aluminum alloys in these critical components. Additionally, structure & exterior: aluminum alloys are widely used in the structure and exterior components of vehicles to reduce weight while maintaining strength and durability. This includes body panels, chassis components, and crash management systems.

Automotive Aluminum Alloy Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive Aluminum Alloy Market Regional Analysis

For several reasons, the Asia-Pacific region leads the global automotive aluminum alloy market, driven by significant growth in the automotive industry, particularly in China, Japan, and India. The region's dominance is fueled by increasing demand for lightweight vehicles to improve fuel efficiency and reduce emissions. Additionally, strong investments in infrastructure and manufacturing capabilities enhance aluminum production and utilization. Technological advancements and favorable government policies supporting automotive innovations also contribute to this leadership. As a result, the Asia-Pacific market continues to expand, catering to both domestic and international automotive needs.

North America is poised to dominate the automotive aluminum alloy market due to several key factors. The region's stringent emissions regulations are pushing automakers towards lightweight materials like aluminum to improve fuel efficiency and reduce carbon emissions. Additionally, regions robust automotive manufacturing infrastructure and strong emphasis on innovation are driving the adoption of advanced aluminum alloys for vehicle production. For instance, in August 2023, Arconic Corporation was acquired by Apollo Funds, with economic participation from a third-party entity known as Irenic Capital Management. Moreover, increasing consumer demand for electric vehicles further amplifies the need for lightweight materials, positioning North America at the forefront of this market segment.

Automotive Aluminum Alloy Market Players

Some of the top automotive aluminum alloy companies offered in our report include Hindalco Industries Limited, Magna International Inc., Arconic Corporation, Bharat Forge Limited, Austem Co. Ltd., Nanshan Group, UACJ Corporation, KIRCHHOFF Automotive GmbH, Constellium SE, Norsk Hydro ASA, Flex-N-Gate LLC, and Gordon Auto Body Parts Co. Ltd.

Frequently Asked Questions

How big is the automotive aluminum alloy market?

The automotive aluminum alloy market size was valued at USD 42.7 billion in 2023.

What is the CAGR of the global automotive aluminum alloy market from 2024 to 2032?

The CAGR of automotive aluminum alloy is 10.2% during the analysis period of 2024 to 2032.

Which are the key players in the automotive aluminum alloy market?

The key players operating in the global market are including Hindalco Industries Limited, Magna International Inc., Arconic Corporation, Bharat Forge Limited, Austem Co. Ltd., Nanshan Group, UACJ Corporation, KIRCHHOFF Automotive GmbH, Constellium SE, Norsk Hydro ASA, Flex-N-Gate LLC, and Gordon Auto Body Parts Co. Ltd.

Which region dominated the global automotive aluminum alloy market share?

Asia-Pacific held the dominating position in automotive aluminum alloy industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of automotive aluminum alloy during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global automotive aluminum alloy industry?

The current trends and dynamics in the automotive aluminum alloy industry include increasing demand for lightweight vehicles to improve fuel efficiency, growing automotive production and sales worldwide, and stringent environmental regulations promoting the use of recyclable materials.

Which type held the maximum share in 2023?

The body parts held the maximum share of the automotive aluminum alloy industry.