Coal Power Generation Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Coal Power Generation Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

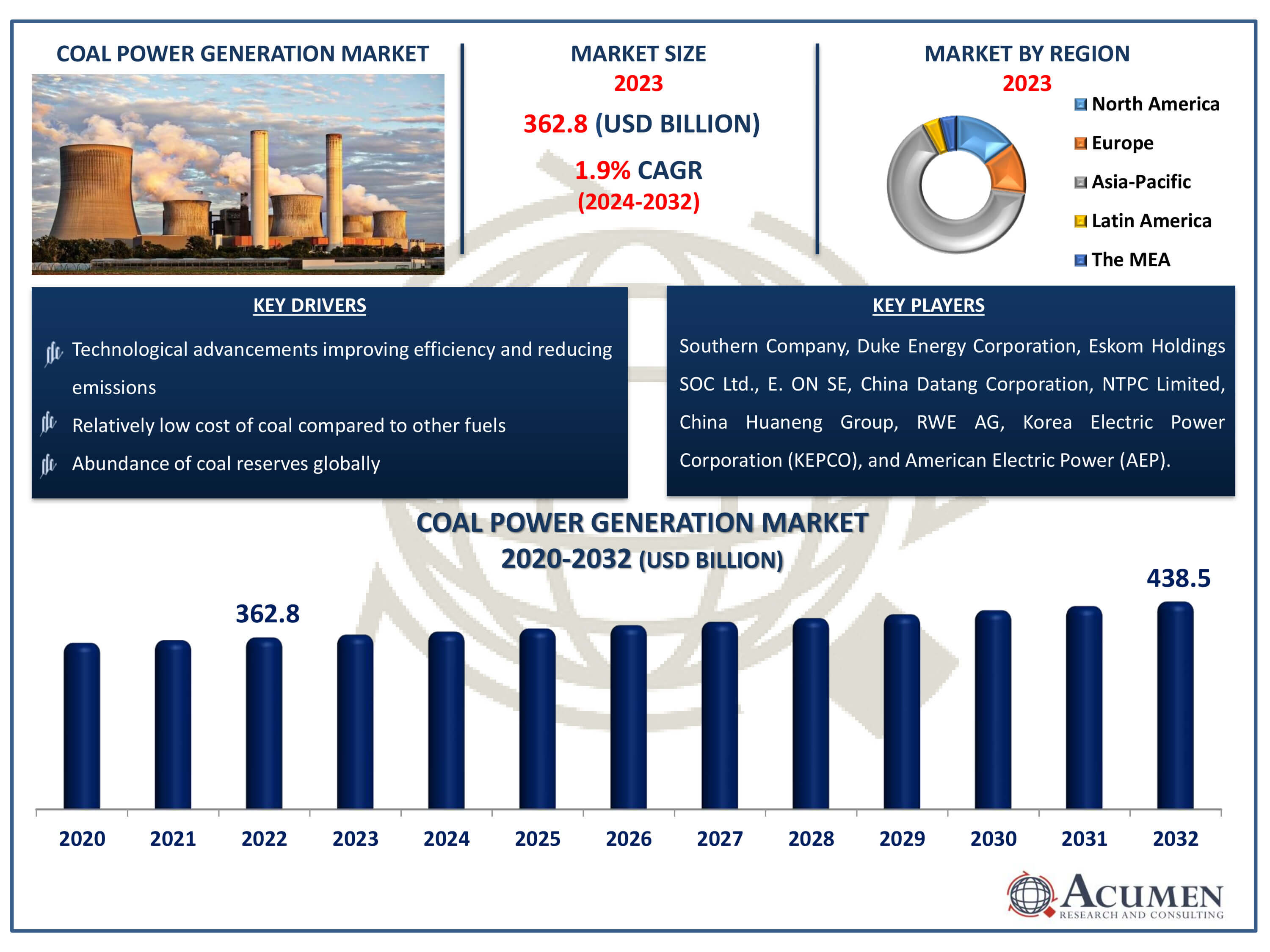

The Coal Power Generation Market Size accounted for USD 362.8 Billion in 2022 and is estimated to achieve a market size of USD 438.5 Billion by 2032 growing at a CAGR of 1.9% from 2024 to 2032.

Coal Power Generation Market Highlights

- Global coal power generation market revenue is poised to garner USD 438.5 billion by 2032 with a CAGR of 1.9% from 2024 to 2032

- Coal power generation market accounted for USD 2,090.2 GW in 2022 and is estimated to achieve a market size of USD 2,605.2 GW by 2032 anticipated to witness 2.3% CAGR

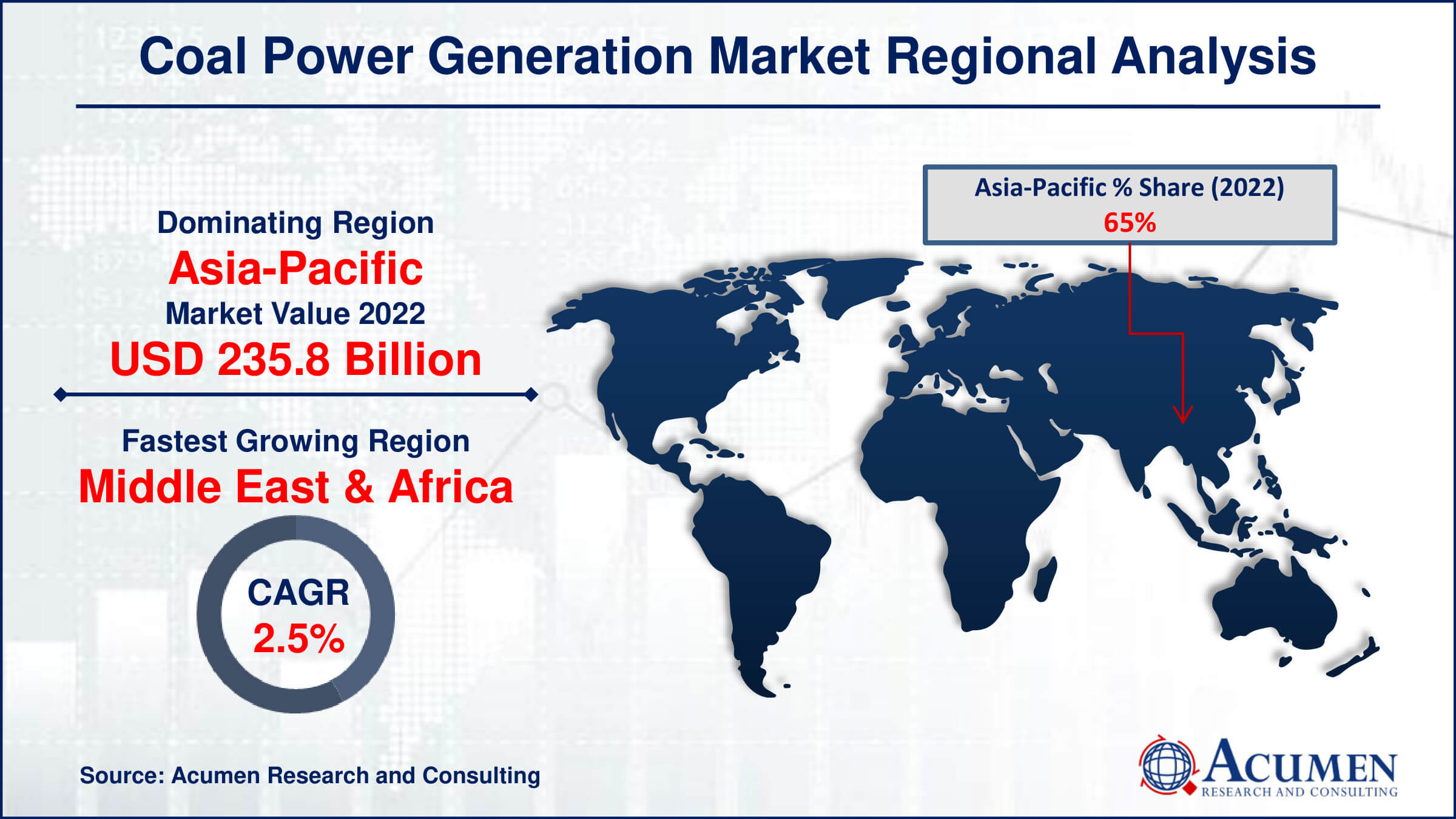

- Asia-Pacific coal power generation market value occupied around USD 235.8 billion in 2022

- MEA coal power generation market growth will record a CAGR of more than 2.5% from 2024 to 2032

- Among technology, the pulverized coal systems sub-segment generated 65% share in 2022

- Based on application, the residential sub-segment gathered utmost coal power generation market revenue in 2022

- Adoption of co-firing and biomass conversion to diversify fuel sources and reduce emissions is a popular coal power generation market trend that fuels the industry demand

Coal power generation is the process of creating energy by burning coal. Coal is burned in a boiler to generate steam, which powers a turbine attached to a generator, turning mechanical energy into electrical energy. This technology is frequently utilized worldwide because to the quantity of coal deposits and its inexpensive cost when compared to other fuels. However, coal power generation is a significant source of greenhouse gas emissions and air pollution, which contribute to environmental deterioration and public health issues. To offset these negative repercussions, efforts are being made to move to cleaner and more sustainable energy sources.

Global Coal Power Generation Market Dynamics

Market Drivers

- Abundance of coal reserves globally

- Relatively low cost of coal compared to other fuels

- Growing energy demand in emerging economies

- Technological advancements improving efficiency and reducing emissions

Market Restraints

- Environmental concerns regarding greenhouse gas emissions and air pollution

- Increasing competition from renewable energy sources

- Stringent regulatory frameworks and emissions standards

Market Opportunities

- Integration of advanced technologies for cleaner coal power generation

- Development of carbon capture and storage (CCS) solutions

- Expansion of coal power generation infrastructure in developing regions

Coal Power Generation Market Report Coverage

| Market | Coal Power Generation Market |

| Coal Power Generation Market Size 2022 | USD 362.8 Billion |

| Coal Power Generation Market Forecast 2032 |

USD 438.5 Billion |

| Coal Power Generation Market CAGR During 2024 - 2032 | 1.9% |

| Coal Power Generation Market Analysis Period | 2020 - 2032 |

| Coal Power Generation Market Base Year |

2022 |

| Coal Power Generation Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Technology, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Southern Company, Duke Energy Corporation, Eskom Holdings SOC Ltd., E. ON SE, China Datang Corporation, NTPC Limited, China Huaneng Group, RWE AG, Korea Electric Power Corporation (KEPCO), and American Electric Power (AEP) |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Coal Power Generation Market Insights

Energy demand worldwide is on the rise due to rapid industrialization and urbanization, particularly in countries experiencing robust economic growth. For decades, coal has been the primary source for energy generation, owing to its easy availability and cost-effectiveness. Government preferences for coal further drive its demand. Major energy-consuming countries include China, the US, and India, with primary energy consumption in 2020 reaching 145, 87, and 31 exajoules respectively, according to the International Energy Agency. Global energy demand is projected to increase, with fossil fuel-based energy generation expected to hold a significant share. Relaxed environmental regulations and policies promoting coal production contribute to the growth of the coal power generation market. Russia, China, the US, and India possess significant proven coal reserves, with the US holding the largest share with reserves of 249 billion tons in 2019. These countries heavily rely on coal for energy, prompting policymakers to implement projects and regulations to boost domestic coal production. For instance, Russia aims to increase coal production to 670 million tons by 2035, while India opened up coal reserves to the private sector in 2020 to reduce dependency on coal imports. These initiatives collectively drive global market growth.

Rapid urbanisation in emerging nations, along with an increase in construction projects, is pushing up power consumption. The adoption of smart home gadgets increases energy consumption. In Europe, the residential sector accounted for a major portion of energy consumption. This trend is mirrored in India, where home energy consumption has significantly increased. While there is an increase in demand, worries about CO2 emissions and environmental degradation remain, especially due to coal production and electricity generation. Efforts to convert to green energy via wind and solar projects are ongoing, indicating a move away from coal reliance. However, issues such as supply chain interruptions affecting coal imports, worsened by Covid-19 lockdowns, have hampered market development prospects. However, shifting government laws and favourable policies boost local coal production, creating opportunities for market participants.

Coal Power Generation Market Segmentation

The worldwide market for coal power generation is split based on technology, application, and geography.

Coal Power Generation Technologies

- Pulverized Coal Systems

- Cyclone Furnaces

- Others

In the industry, pulverised coal systems is the largest technology sector and expected to grow continue throughout the coal power generation market forecast period. This dominance may be due to a number of factors, including its broad acceptance and appeal. Pulverised coal systems include the grinding of coal into fine particles, which are subsequently burned in a boiler to produce steam. This steam is used to power turbines attached to generators, which produce energy. One significant feature of pulverised coal systems is their ability to transform coal into electricity with great thermal efficiency and power production. Furthermore, these systems are adaptable and can handle a wide range of coal kinds, making them appropriate for a variety of coal sources in diverse areas. Furthermore, pulverised coal systems have experienced constant technical developments, increasing dependability, operational flexibility, and environmental performance. These reasons contribute to the pulverised coal systems segment's dominance in the coal power generation market, making it the chosen option for many power plants throughout the world.

Coal Power Generation Applications

- Residential

- Commercial And Industrial

According to coal power generation industry analysis, residential appears as the leading application, owing to various major reasons driving its importance. To begin, residential energy consumption accounts for a sizable share of total energy demand, owing to global population growth and urbanisation. As more homes rely on electricity for daily activities such as lighting, cooking, heating, and powering electronic devices, the need for dependable and cost-effective energy sources such as coal grows. Furthermore, coal power generation has historically been a low-cost choice for satisfying household energy demands, especially in areas where coal deposits are abundant and alternative energy infrastructure is limited or expensive to construct. Also, coal-fired power facilities are frequently strategically positioned to effectively deliver electricity to residential areas, utilising existing transmission and distribution networks. This close proximity to end-users reduces transmission losses and assures a consistent supply of power to households. Despite rising worries about environmental pollution and greenhouse gas emissions from coal burning, the residential segment continues to rely on coal power because it is affordable and reliable, particularly in developing countries with limited access to cleaner energy sources.

Coal Power Generation Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Coal Power Generation Market Regional Analysis

In terms of coal power generation market analysis, the Asia-Pacific region dominates the industry for a variety of reasons. With vigorous industrialization, fast urbanization, and a growing population, nations such as China and India have become important coal users for power generation. The region's large coal deposits, along with rising energy demand, have cemented coal's status as the dominant source of electricity generation. Despite attempts to diversify energy sources and encourage renewable energy, coal remains an important contributor to satisfying the region's expanding energy demands, sustaining economic growth, and supporting development activities.

On the other hand, the Middle East and Africa (MEA) region is seeing the fastest growth in the coal power generation industry forecast period. Rapid urbanization, industrial growth, and infrastructural development are causing an increase in energy consumption throughout the region. Furthermore, MEA has significant coal resources and benefits from favorable government regulations that encourage investment in coal-powered plants. However, difficulties like as water shortages and environmental concerns present substantial barriers, demanding novel techniques to ensuring the region's long-term coal power generation. Despite these obstacles, the MEA area offers enormous opportunity for expansion and investment in the coal power production sector.

Coal Power Generation Market Players

Some of the top coal power generation companies offered in our report includes Southern Company, Duke Energy Corporation, Eskom Holdings SOC Ltd., E. ON SE, China Datang Corporation, NTPC Limited, China Huaneng Group, RWE AG, Korea Electric Power Corporation (KEPCO), and American Electric Power (AEP).

Frequently Asked Questions

How big is the coal power generation market?

The coal power generation market size was valued at USD 362.8 billion in 2022.

What is the CAGR of the global coal power generation market from 2024 to 2032?

The CAGR of coal power generation is 1.9% during the analysis period of 2024 to 2032.

Which are the key players in the coal power generation market?

The key players operating in the global market are including Southern Company, Duke Energy Corporation, Eskom Holdings SOC Ltd., E. ON SE, China Datang Corporation, NTPC Limited, China Huaneng Group, RWE AG, Korea Electric Power Corporation (KEPCO), and American Electric Power (AEP).

Which region dominated the global coal power generation market share?

Asia-Pacific held the dominating position in coal power generation industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

MEA region exhibited fastest growing CAGR for market of coal power generation during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global coal power generation industry?

The current trends and dynamics in the coal power generation industry include abundance of coal reserves globally, relatively low cost of coal compared to other fuels, growing energy demand in emerging economies, and technological advancements improving efficiency and reducing emissions.

Which application held the maximum share in 2022?

The residential application held the maximum share of the coal power generation industry.