Cnc Machines Market | Acumen Research and Consulting

CNC Machines Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format : ![]()

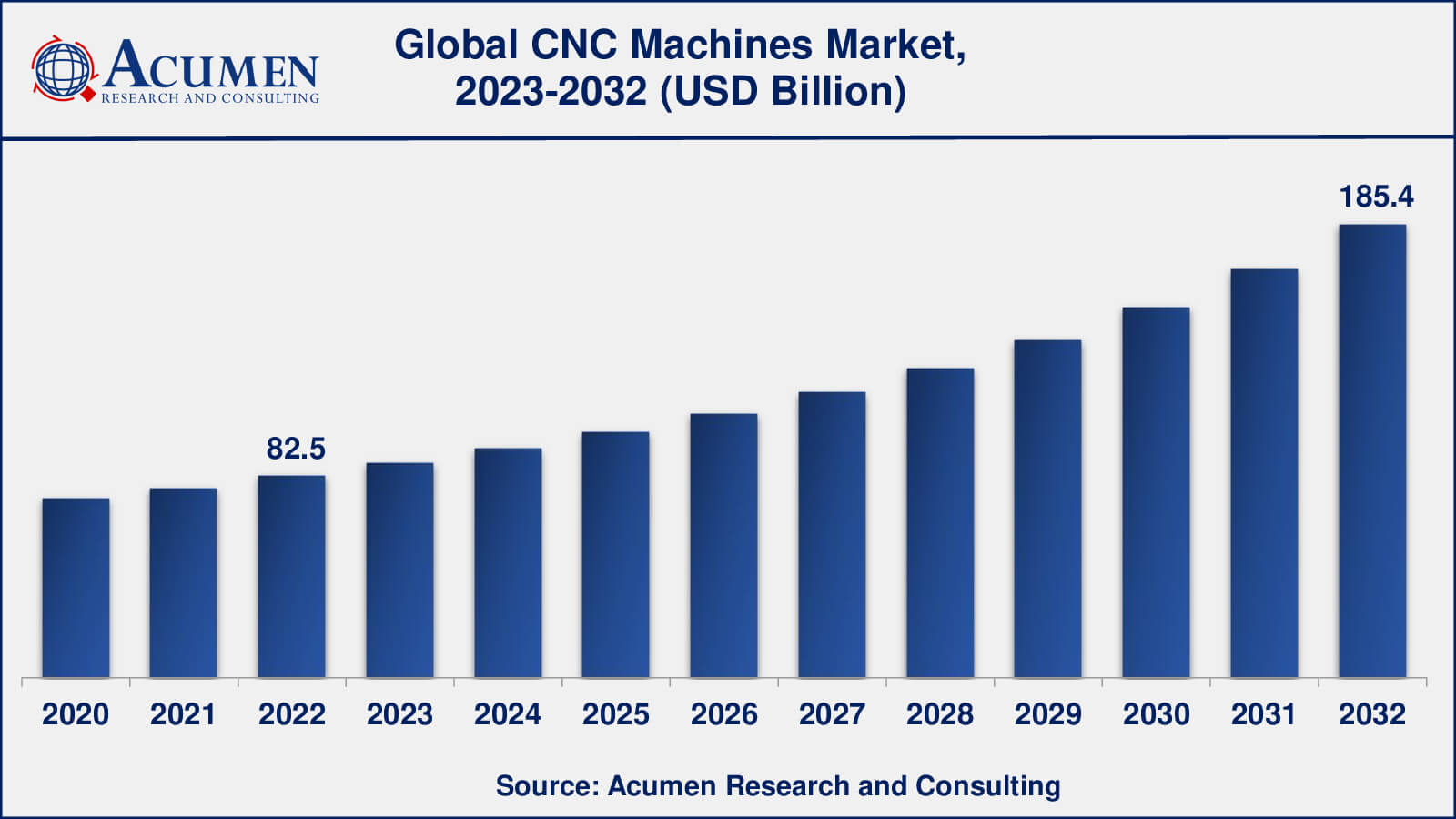

The Global Computer Numerical Control Machines Market Size accounted for USD 82.5 Billion in 2022 and is estimated to achieve a market size of USD 185.4 Billion by 2032 growing at a CAGR of 8.7% from 2023 to 2032.

Computer Numerical Control Machines Market Highlights

- Global computer numerical control machines market revenue is poised to garner USD 185.4 billion by 2032 with a CAGR of 8.7% from 2023 to 2032

- Asia-Pacific computer numerical control machines market value occupied around USD 29.7 billion in 2022

- Europe computer numerical control machines market growth will record a CAGR of more than 9% from 2023 to 2032

- Among type, the lathe machines sub-segment generated over US$ 26.4 billion revenue in 2022

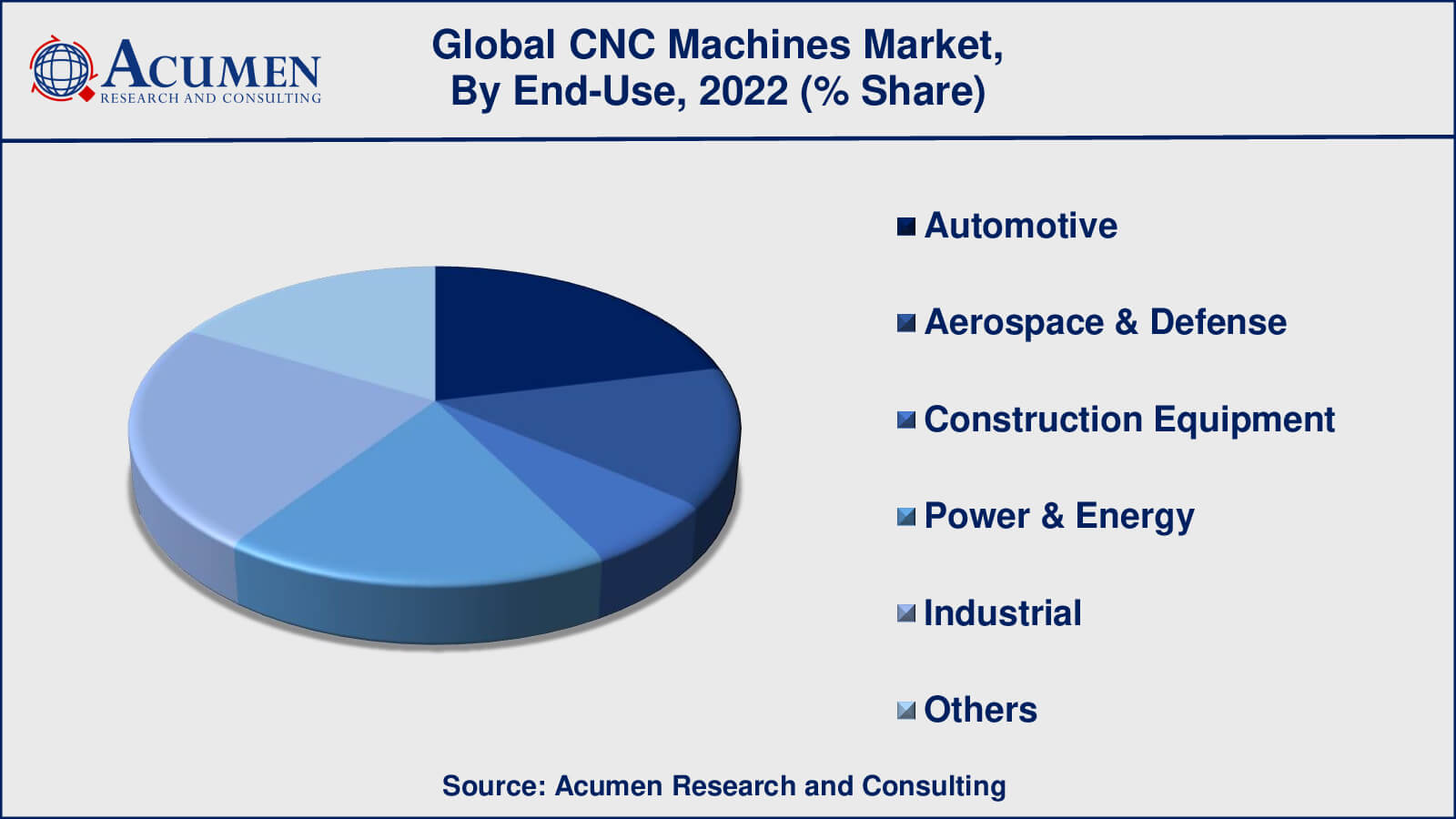

- Based on end-use, the industrial sub-segment generated around 23% share in 2022

- Rising demand for 3D printing and additive manufacturing is a popular computer numerical control machines market trend that fuels the industry demand

CNC machines are computer-controlled machines that employ computer programmes to control the movement and functioning of machine tools. These machines are frequently utilized in manufacturing processes to generate precision parts and components for industries ranging from aerospace to automotive to healthcare. CNC machines are in high demand because they outperform traditional manual machines in terms of accuracy, consistency, and efficiency. They also help manufacturers save time and money while increasing output by reducing the need for physical labor. Furthermore, CNC machines can conduct complicated tasks that would be difficult or impossible to perform on traditional manual machines. They can also easily generate customized parts and components, making them perfect for sectors requiring a high degree of customization.

The market for CNC machines is likely to expand significantly in the next years. This is owing to an increase in automation requirements as well as the implementation of Industry 4.0 and smart manufacturing. Furthermore, the expansion of the aerospace and defense industries, as well as the increasing demand for 3D printing and additive manufacturing, are likely to fuel demand for CNC machines. The development of hybrid CNC machines, which combine additive and subtractive manufacturing capabilities, is also projected to open up new potential opportunities in the CNC machines market.

Global Computer Numerical Control Machines Market Dynamics

Market Drivers

- Increasing demand for mass production in various industries

- Growing need for automation in manufacturing processes to increase efficiency and productivity

- Advancements in technology, such as the integration of IoT and AI in CNC machines

- Growing demand for customized products in industries such as automotive, aerospace, and healthcare

- Expansion of the manufacturing sector in developing countries

Market Restraints

- High initial cost of CNC machines

- Lack of skilled labor to operate and maintain CNC machines

- Complexity of CNC programming and set-up

- High maintenance and repair costs

- Difficulty in retrofitting existing machines with CNC technology

Market Opportunities

- Increasing adoption of Industry 4.0 and smart manufacturing

- Growth in the aerospace and defense industries

- Increasing demand for CNC machines in emerging markets

- Development of hybrid CNC machines that combine additive and subtractive manufacturing capabilities

Computer Numerical Control Machines (CNC) Market Report Coverage

| Market | Computer Numerical Control Machines Market |

| Computer Numerical Control Machines Market Size 2022 | USD 82.5 Billion |

| Computer Numerical Control Machines Market Forecast 2032 | USD 185.4 Billion |

| Computer Numerical Control Machines Market CAGR During 2023 - 2032 | 8.7% |

| Computer Numerical Control Machines Market Analysis Period | 2020 - 2032 |

| Computer Numerical Control Machines Market Base Year | 2022 |

| Computer Numerical Control Machines Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Yamazaki Mazak, DMG MORI Co. Ltd., Haas Automation, Inc., Hurco Companies, Inc., Okuma Corporation, Makino Milling Machine Co., Ltd., FANUC Corporation, JTEKT Corporation, Doosan Machine Tools Co., Ltd., Amada Machine Tools Co., Ltd., Chiron Werke GmbH & Co. KG, GF Machining Solutions, TRUMPF GmbH + Co. KG, INDEX-Werke GmbH & Co. KG, and Hermle AG. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Computer Numerical Control Machines Market Insights

The market for computer numerical control (CNC) machines has grown significantly in recent years and is likely to develop more in the coming years. The key drivers of this expansion are the increased demand for automation in industrial processes and the necessity for mass production in numerous industries. CNC machines have various advantages over traditional manual machines, including improved accuracy, consistency, and efficiency, which make them perfect for businesses requiring high levels of precision and customization.

Technological improvements, such as the incorporation of IoT and AI in CNC machines, are also contributing to the market's growth. These technical advances have resulted in the creation of more sophisticated and efficient CNC machines capable of performing complex operations with ease. Industry 4.0 and smart manufacturing are also projected to stimulate demand for CNC machines. Manufacturers can use Industry 4.0 to construct a completely connected and automated production process that increases efficiency, productivity, and reduces costs.

However, the market confronts a number of difficulties that may limit its expansion. The high initial cost of CNC machines, which can be a barrier to entrance for some industries, is one of the key problems. The intricacy of CNC programming and setup is also a hurdle, as operating and maintaining CNC machines requires expert labor. Furthermore, the high expenses of CNC machine maintenance and repair can be a considerable expense for producers.

Despite these obstacles, the expansion of the manufacturing sector in developing nations, as well as the adoption of Industry 4.0 and smart manufacturing, present new prospects for market growth. In the future years, the aerospace and defence industries, as well as increased need for 3D printing and additive manufacturing, are likely to fuel demand for CNC machines. The development of hybrid CNC machines, which combine additive and subtractive manufacturing capabilities, is also projected to open up new potential opportunities in the CNC machines market.

Computer Numerical Control Machines Market Segmentation

The worldwide market for computer numerical control machines is split based on type, end-use, and geography.

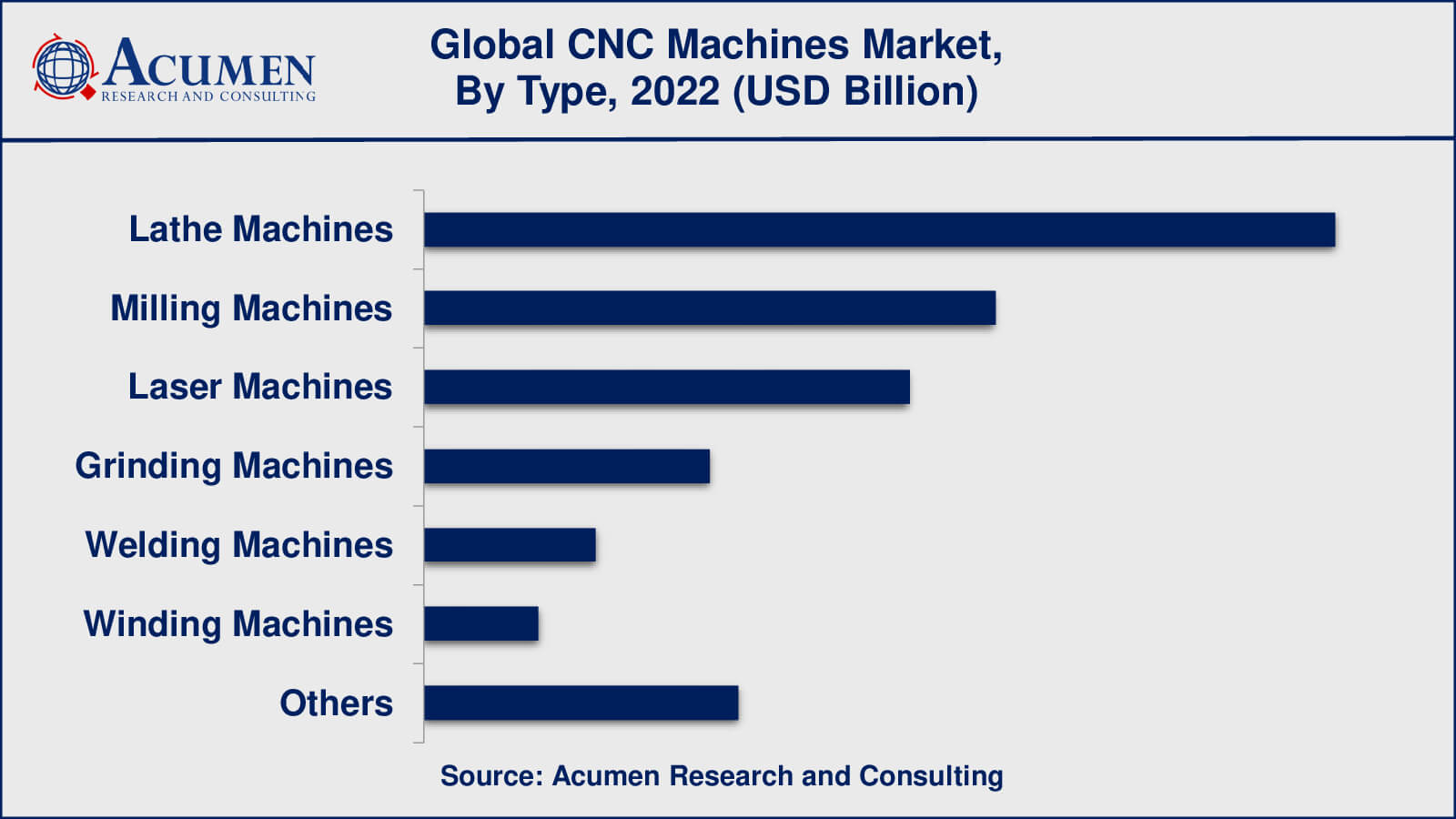

CNC Machines Types

- Grinding Machines

- Laser Machines

- Lathe Machines

- Milling Machines

- Welding Machines

- Winding Machines

- Others

According to the CNC machnes industry data, lathe machines are a major category in the industry, accounting for a sizable market share. Lathe machines are used to shape and turn materials like metal and wood. They're frequently employed in the production of shafts, valves, and other precision parts.

Milling machines are also widely utilised in a variety of industries, including automotive, aerospace, and healthcare, to name a few. These machines may conduct a variety of operations on a variety of materials, including metal, plastic, and composites, such as drilling, cutting, and shaping. Milling machines are also extremely configurable, allowing producers to build high accuracy and complex items. Laser machines are also gaining popularity in the CNC machine market due to their high precision and flexibility. These machines use lasers to cut and engrave various materials, including metal, plastic, and wood. They are widely used in industries such as electronics, automotive, and healthcare, among others.

CNC Machines End-Use

- Automotive

- Aerospace & Defense

- Construction Equipment

- Industrial

- Power & Energy

- Others

According to the CNC machine market forecast, the automotive industry will lead the CNC machine market in 2022, accounting for the biggest share. CNC machines are widely used in the automobile sector, primarily for the production of automotive parts such as engines, transmissions, and suspension components. CNC machines are used in a variety of operations to make these parts with great precision and accuracy, including milling, turning, drilling, and grinding. The usage of CNC machines in the automotive sector allows manufacturers to produce high-quality parts more quickly and efficiently.

Another key component in the CNC machine market is the aerospace and defence industry, which accounts for a large part of the market. CNC machines are utilised in the production of a wide range of aerospace and defence components, including turbine blades, aircraft parts, and missile components. These components need high precision and accuracy, which CNC machines are capable of meeting.

Computer Numerical Control Machines Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Computer Numerical Control (CNC) Machines Market Regional Analysis

According to a revenue share estimate of the CNC machines market in 2021, Asia Pacific is predicted to be the largest market, accounting for 36% of total revenue. The manufacturing sector in the region is expanding rapidly, owing to increased demand for automation and the adoption of new technologies such as Industry 4.0. Countries such as China, Japan, and India are major contributors to the region's CNC machine market, owing to the expansion of key end-use sectors such as automotive, aerospace, and defense.

With a revenue share of 23%, Europe is the third-largest and fastest-expanding market for CNC machines. The automotive and aerospace industries, which require CNC machines for the production of high-precision parts, are well-represented in the region. Germany, France, and the United Kingdom are key contributors to the region's CNC machine market.

Computer Numerical Control Machines Market Players

Some of the top computer numerical control CNC machine companies offered in our report include Yamazaki Mazak, DMG MORI Co. Ltd., Haas Automation, Inc., Hurco Companies, Inc., Okuma Corporation, Makino Milling Machine Co., Ltd., FANUC Corporation, JTEKT Corporation, Doosan Machine Tools Co., Ltd., Amada Machine Tools Co., Ltd., Chiron Werke GmbH & Co. KG, GF Machining Solutions, TRUMPF GmbH + Co. KG, INDEX-Werke GmbH & Co. KG, and Hermle AG.

In January 2022, Yamazaki Mazak introduced the Variaxis C-600, a revolutionary compact five-axis vertical machining centre. The machine is intended for high-precision machining of small to medium-sized items, and it has advanced features including simultaneous five-axis machining and Mazak's SmoothX CNC system.

In September 2021, Haas Automation has introduced the EC-400PP pallet pool horizontal machining centre, which is intended for high-volume manufacturing of complicated parts. The machine has a 400-mm pallet pool and a high-speed spindle, and it can be outfitted with up to 120 tools.

Frequently Asked Questions

What was the market size of the global CNC machines in 2022?

The market size of CNC machines was USD 82.5 Billion in 2022.

What is the CAGR of the global CNC machines market from 2023 to 2032?

The CAGR of CNC machines is 8.7% during the analysis period of 2023 to 2032.

Which are the key players in the computer numerical control CNC machines market?

The key players operating in the global market are including Yamazaki Mazak, DMG MORI Co. Ltd., Haas Automation, Inc., Hurco Companies, Inc., Okuma Corporation, Makino Milling Machine Co., Ltd., FANUC Corporation, JTEKT Corporation, Doosan Machine Tools Co., Ltd., Amada Machine Tools Co., Ltd., Chiron Werke GmbH & Co. KG, GF Machining Solutions, TRUMPF GmbH + Co. KG, INDEX-Werke GmbH & Co. KG, and Hermle AG.

Which region dominated the global CNC machines market share?

Asia-Pacific held the dominating position in CNC machines industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Europe region exhibited fastest growing CAGR for market of CNC machines during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global computer numerical control CNC machines industry?

The current trends and dynamics in the computer numerical control CNC machines industry include increasing demand for mass production in various industries, growing need for automation in manufacturing processes to increase efficiency and productivity, and advancements in technology, such as the integration of IoT and AI in CNC machines.

Which type held the maximum share in 2022?

The lathe machines type held the maximum share of the computer numerical control machines industry.