Class 7 Truck Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Class 7 Truck Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

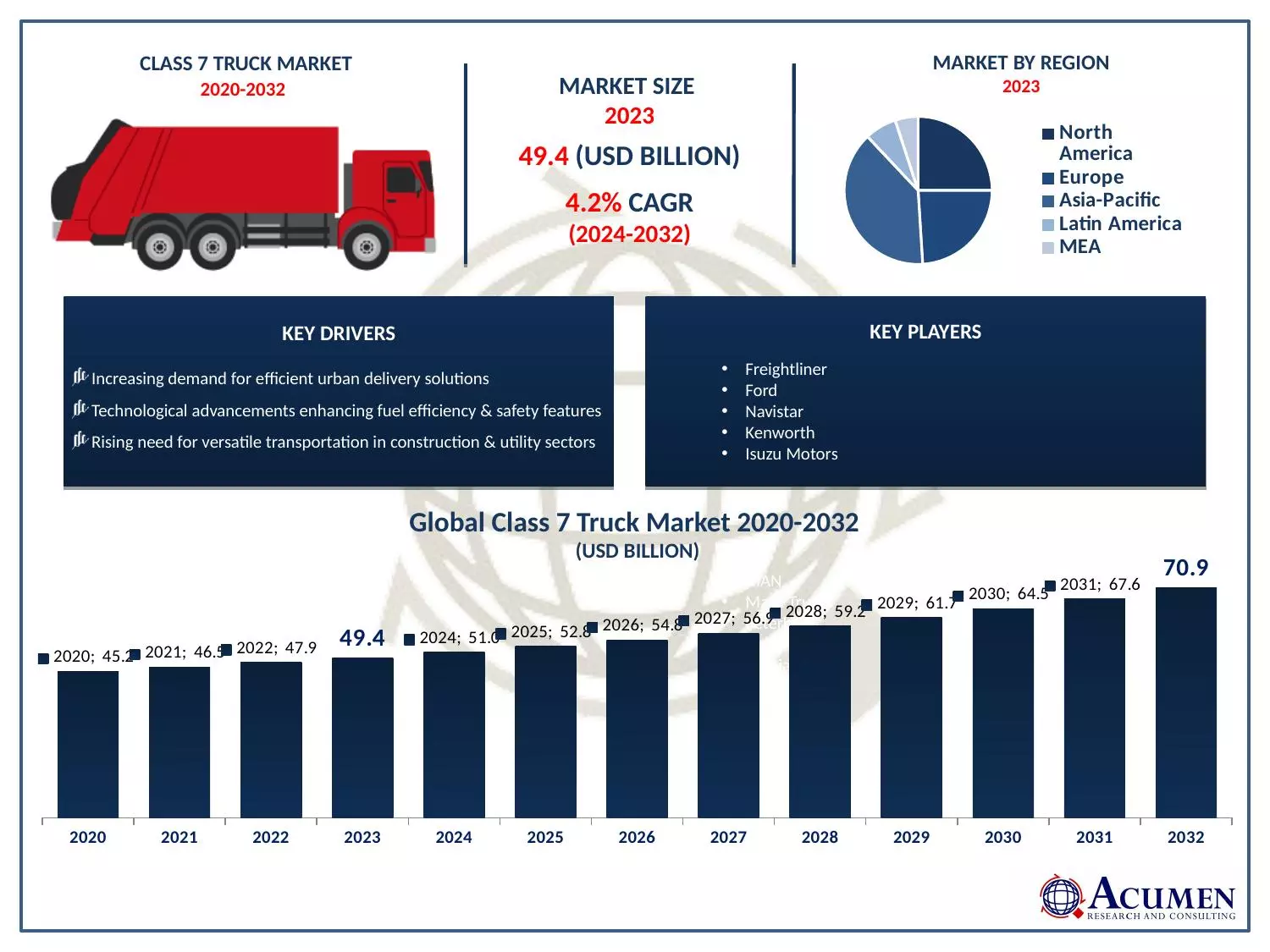

The Class 7 Truck Market Size accounted for USD 49.4 Billion in 2023 and is projected to achieve a market size of USD 70.9 Billion by 2032 growing at a CAGR of 4.2% from 2024 to 2032.

Class 7 Truck Market Key Highlights

- Global class 7 truck market revenue is expected to increase by USD 70.9 Billion by 2032, with a 4.2% CAGR from 2024 to 2032

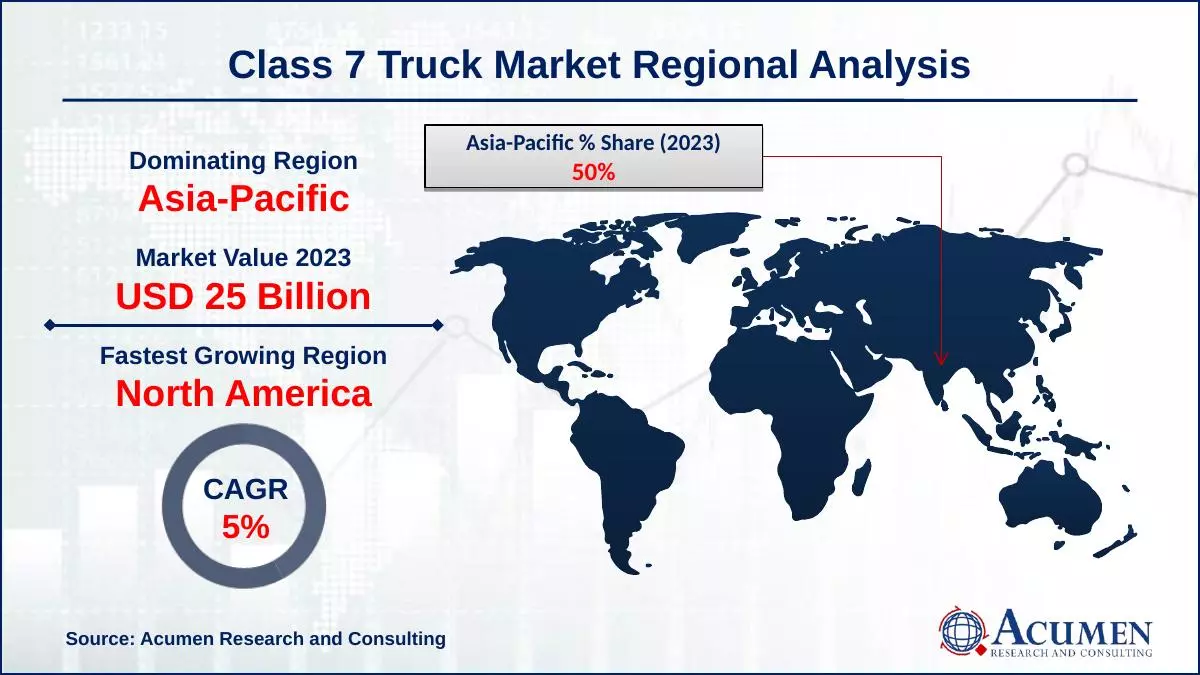

- Asia-Pacific region led with more than 50% of class 7 truck market share in 2023

- North America class 7 truck market growth will record a CAGR of more than 4.8% from 2024 to 2032

- By fuel, the diesel segment contributed over 78% of revenue share in 2023

- By application, the freight delivery segment captured more than 34% of revenue share in 2023

- Increasing demand for efficient urban delivery solutions, drives the class 7 truck market value

Class 7 trucks are medium-duty trucks with a gross vehicle weight rating (GVWR) ranging from 26,001 to 33,000 pounds. They are versatile vehicles used for various purposes, including delivery trucks, utility trucks, and small dump trucks. These trucks are popular among businesses and industries requiring transportation and delivery solutions that are more robust than those offered by smaller vehicles but don't require the heavy-duty capabilities of Class 8 trucks. Class 7 trucks typically offer a balance between power, maneuverability, and fuel efficiency, making them suitable for urban and suburban environments where space may be limited.

The market growth of Class 7 trucks has been steady in recent years, driven by several factors. Increasing demand for efficient and reliable transportation solutions, particularly in industries such as retail, construction, and logistics, has fueled the adoption of Class 7 trucks. Additionally, advancements in technology, such as improved fuel efficiency, connectivity features, and safety systems, have made these trucks more attractive to businesses looking to optimize their operations. Moreover, regulatory initiatives aimed at reducing emissions and promoting sustainability have encouraged the adoption of cleaner and more efficient vehicles, further contributing to the growth of the Class 7 truck market.

Global Class 7 Truck Market Trends

Market Drivers

- Increasing demand for efficient urban delivery solutions

- Technological advancements enhancing fuel efficiency and safety features

- Growing need for versatile transportation in construction and utility sectors

- Regulatory push towards cleaner and sustainable transportation options

- Expansion of e-commerce driving demand for reliable logistics infrastructure

Market Restraints

- Economic uncertainties affecting capital expenditure in transportation

- Challenges in infrastructure development impacting trucking efficiency

Market Opportunities

- Increasing focus on last-mile delivery solutions in urban areas

- Adoption of electric and alternative fuel technologies for sustainability

Class 7 Truck Market Report Coverage

| Market | Class 7 Truck Market |

| Class 7 Truck Market Size 2022 | USD 49.4 Billion |

| Class 7 Truck Market Forecast 2032 | USD 70.9 Billion |

| Class 7 Truck Market CAGR During 2023 - 2032 | 4.2% |

| Class 7 Truck Market Analysis Period | 2020 - 2032 |

| Class 7 Truck Market Base Year |

2022 |

| Class 7 Truck Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Fuel, By Application, By Axle, By Horsepower, By Ownership, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Freightliner, Ford, Navistar, Kenworth, Isuzu Motors, MAN, Mack Trucks, Peterbilt, Volvo Trucks, and Scania AB. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Class 7 Truck Market Dynamics

Class 7 trucks typically feature robust engines and chassis, making them suitable for various applications across industries such as transportation, construction, delivery, and utilities. In transportation, Class 7 trucks serve as reliable vehicles for hauling goods over short to medium distances. Their size and agility make them well-suited for navigating urban and suburban environments, making deliveries to retail stores, warehouses, and distribution centers. Additionally, Class 7 trucks are commonly used in the construction industry for transporting materials and equipment to job sites. Their payload capacity and rugged construction enable them to handle heavy loads while maneuvering through challenging terrain. Furthermore, Class 7 trucks find applications in utility services, such as telecommunications, energy, and municipal services. These trucks are often equipped with specialized bodies and equipment for tasks such as aerial lifting, digging, and maintenance of utility infrastructure.

The Class 7 truck market has witnessed notable growth in recent years, driven by several factors contributing to its expansion. One significant driver has been the increasing demand for efficient urban delivery solutions. With the rise of e-commerce and the need for timely deliveries in densely populated areas, Class 7 trucks have become indispensable for businesses seeking reliable transportation options for last-mile logistics. This trend is expected to continue as urbanization and online shopping continue to grow, bolstering the market for medium-duty trucks. Moreover, technological advancements have played a crucial role in fueling the growth of the Class 7 truck market. Manufacturers have been integrating advanced features such as improved fuel efficiency, enhanced connectivity, and safety systems into their vehicles, making them more attractive to businesses looking to optimize their operations.

Class 7 Truck Market Segmentation

The global class 7 truck market segmentation is based on fuel, application, axle, horsepower, ownership, and geography.

Class 7 Truck Market By Fuel

- Diesel

- Hybrid electric

- Natural gas

- Others

According to class 7 truck industry analysis, the diesel segment held the largest market share in 2023. One of the key factors driving the growth of diesel-powered Class 7 trucks is their proven reliability and robustness in heavy-duty applications. Diesel engines offer high torque and towing capacity, making them well-suited for the demanding tasks often required in industries such as construction, utilities, and logistics. Additionally, diesel fuel infrastructure is well-established, providing a convenient refueling network for fleet operators, which further strengthens the position of diesel-powered trucks in the market. Moreover, advancements in diesel engine technology have led to improvements in fuel efficiency and emissions reduction, addressing concerns related to environmental impact and operating costs. Manufacturers have invested in research and development to optimize diesel engines for better performance while meeting stringent emissions standards.

Class 7 Truck Market By Application

- Freight delivery

- Construction & mining

- Utility services

- Others

In terms of application, the freight delivery segment dominated the market in 2023. As online shopping continues to surge, the demand for efficient freight delivery solutions has intensified, creating opportunities for Class 7 trucks. These trucks are well-suited for freight delivery due to their versatility, capacity, and maneuverability, making them ideal for navigating urban environments and completing last-mile deliveries. Moreover, the growth of the freight delivery segment is further fueled by advancements in logistics technology and supply chain management. Companies are increasingly investing in advanced fleet management systems, route optimization software, and real-time tracking solutions to enhance the efficiency and reliability of their delivery operations.

Class 7 Truck Market By Axle

- 4x2

- 6x2

- 6x

According to the class 7 truck market forecast, the 6x4 segment is expected to witness significant growth in the coming years. Trucks in the 6x4 configuration are equipped with six wheels, with four of them powered, providing enhanced traction and payload capacity compared to other configurations. This makes them well-suited for demanding tasks such as heavy-duty hauling, construction, and utility work. As industries requiring robust transportation solutions continue to expand, the demand for Class 7 trucks in the 6x4 segment has surged, driving market growth. Furthermore, advancements in technology have played a significant role in fueling the growth of the 6x4 segment. Manufacturers have introduced innovations such as more efficient engines, advanced transmission systems, and integrated telematics, enhancing the performance, reliability, and fuel efficiency of 6x4 trucks.

Class 7 Truck Market By Horsepower

- Below 300HP

- 300HP - 400HP

- 400HP - 500HP

- 500HP & Above

Based on the horsepower, the 400HP - 500HP segment is expected to witness significant growth in the coming years. Trucks in this horsepower range offer a balance between power and fuel economy, making them well-suited for a wide range of applications, including regional hauling, urban delivery, and vocational tasks. As industries seek to optimize their fleet operations and improve productivity, the demand for Class 7 trucks with higher horsepower engines has surged, contributing to the growth of this segment. Moreover, advancements in engine technology have played a crucial role in fueling the growth of the 400HP to 500HP segment. Manufacturers have introduced more efficient and reliable engines that deliver increased power while meeting stringent emissions standards. These advancements have not only enhanced the performance of trucks in this segment but also improved fuel efficiency, reducing operating costs for fleet operators.

Class 7 Truck Market By Ownership

- Independent operator

- Fleet operator

In terms of ownership, the fleet operator segment has been experiencing significant growth in recent years. Fleet operators, encompassing logistics companies, transportation firms, and businesses with extensive vehicle fleets, have increasingly turned to Class 7 trucks to meet their transportation needs. These operators often require vehicles that offer a balance of performance, reliability, and efficiency to optimize their fleet operations and minimize operating costs. Class 7 trucks, with their versatility and capability to handle various tasks, have emerged as preferred choices for fleet operators seeking to streamline their logistics and delivery operations. Moreover, technological advancements have played a significant role in fueling the growth of the fleet operator segment.

Class 7 Truck Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Class 7 Truck Market Regional Analysis

The Asia-Pacific region has emerged as a dominating force in the Class 7 truck market, driven by several factors contributing to its prominence. One significant factor is the rapid industrialization and urbanization taking place across countries in the region, leading to increased demand for transportation and logistics solutions. As economies grow and infrastructural development projects expand, there is a heightened need for medium-duty trucks like Class 7 vehicles to support construction, distribution, and other industries. This surge in demand has propelled the Asia-Pacific region to the forefront of the Class 7 truck market. Moreover, the Asia-Pacific region boasts a significant manufacturing base for commercial vehicles, with several leading global manufacturers establishing production facilities in countries such as China, Japan, and South Korea. This localized manufacturing presence enables efficient production and distribution of Class 7 trucks to meet the growing demand within the region and beyond. Additionally, favorable government policies and initiatives aimed at boosting domestic manufacturing, enhancing transportation infrastructure, and promoting economic growth have further stimulated the Class 7 truck market in the Asia-Pacific region.

Class 7 Truck Market Player

Some of the top class 7 truck market companies offered in the professional report include Freightliner, Ford, Navistar, Kenworth, Isuzu Motors, MAN, Mack Trucks, Peterbilt, Volvo Trucks, and Scania AB.

Frequently Asked Questions

What was the market size of the global class 7 truck in 2023?

The market size of class 7 truck was USD 49.4 Billion in 2023.

What is the CAGR of the global class 7 truck market from 2024 to 2032?

The CAGR of class 7 truck is 4.2% during the analysis period of 2024 to 2032.

Which are the key players in the class 7 truck market?

The key players operating in the global market are including Freightliner, Ford, Navistar, Kenworth, Isuzu Motors, MAN, Mack Trucks, Peterbilt, Volvo Trucks, and Scania AB.

Which region dominated the global class 7 truck market share?

Asia-Pacific held the dominating position in class 7 truck industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of class 7 truck during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global class 7 truck industry?

The current trends and dynamics in the class 7 truck industry include increasing demand for efficient urban delivery solutions, technological advancements enhancing fuel efficiency and safety features, and growing need for versatile transportation in construction and utility sectors.

Which fuel held the maximum share in 2023?

The diesel fuel held the maximum share of the class 7 truck industry.