Civil Engineering Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Civil Engineering Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Civil Engineering Market Size accounted for USD 8.7 Trillion in 2022 and is estimated to achieve a market size of USD 15.4 Trillion by 2032 growing at a CAGR of 5.9% from 2023 to 2032.

Civil Engineering Market Highlights

- Global civil engineering market revenue is poised to garner USD 15.4 trillion by 2032 with a CAGR of 5.9% from 2023 to 2032

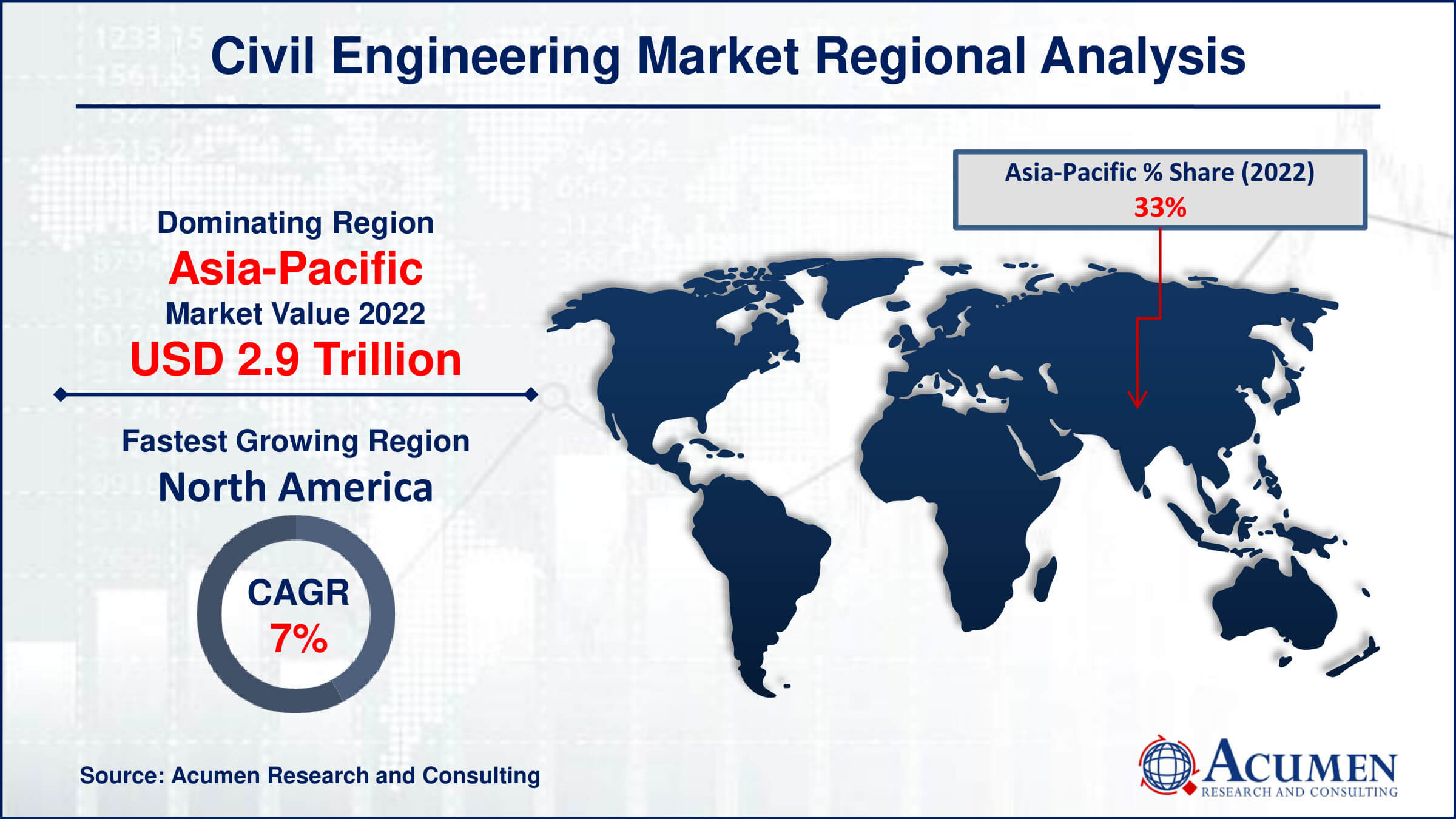

- Asia-Pacific civil engineering market value occupied around USD 2.9 trillion in 2022

- North America civil engineering market growth will record a CAGR of more than 7% from 2023 to 2032

- Among service, the construction sub-segment generated over US$ 2.4 trillion revenue in 2022

- Based on customer, the government sub-segment generated around 42% share in 2022

- Collaboration through public-private partnerships (PPPs) for project financing and execution is a popular civil engineering market trend that fuels the industry demand

The foundation of contemporary infrastructure is provided by the civil engineering industry, which is responsible for the planning, building, and upkeep of crucial public works initiatives. Civil engineering projects play a crucial role in promoting economic growth and improving the standard of living for communities across the globe. These projects range from transportation systems like roads and bridges to water supply networks and urban development initiatives. Civil engineering services are in high demand due to population increase, urbanization, and rising environmental concerns. Furthermore, technological developments are changing the construction sector and promoting innovation, efficiency, and sustainability. Examples of these developments include artificial intelligence, BIM, and sustainable building techniques.

Global Civil Engineering Market Dynamics

Market Drivers

- Urbanization and population growth fueling demand for infrastructure

- Government investments in large-scale infrastructure projects

- Advancements in construction technology enhancing efficiency

- Growing awareness and demand for sustainable construction practices

Market Restraints

- Budget limitations hindering project funding

- Regulatory complexities delaying project approvals

- Shortages of skilled labor impacting project execution

- Volatility in construction material prices affecting project costs

Market Opportunities

- Expansion into renewable energy infrastructure projects

- Participation in smart city development initiatives

- Involvement in infrastructure rehabilitation and maintenance

Civil Engineering Market Report Coverage

| Market | Civil Engineering Market |

| Civil Engineering Market Size 2022 | USD 8.7 Trillion |

| Civil Engineering Market Forecast 2032 | USD 15.4 Trillion |

| Civil Engineering Market CAGR During 2023 - 2032 | 5.9% |

| Civil Engineering Market Analysis Period | 2020 - 2032 |

| Civil Engineering Market Base Year |

2022 |

| Civil Engineering Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Service, By Application, By Customer, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AECOM, Amec Foster Wheeler plc, United States Army Corps of Engineers, SNC-Lavalin, Jacobs Engineering Group, Inc., Galfar Engineering & Contracting SAOG, Fluor Corporation, HDR, Inc., Tetra Tech, Inc., and Stantec, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Civil Engineering Market Insights

Urbanization and population growth especially in developing economies are the main factors driving the demand for civil engineering services. Government initiatives worldwide aimed at infrastructure development, along with rising private sector investments, also significantly contribute to market growth. Technological advancements also play a crucial role, with innovations in materials, construction techniques, and digital tools enhancing project efficiency, reducing costs, and promoting sustainable development. The demand for green infrastructure is driven by rising environmental concerns and the push for eco-friendly solutions.

The market has potential, but a number of obstacles prevent it from expanding. Budgetary restrictions in the public and private sectors can make it difficult to invest in major infrastructure projects, which might cause delays or reduce the scope of construction. Obstacles include bureaucratic procedures and complicated regulatory frameworks, which can cause project delays and higher compliance costs. These difficulties are made worse by a lack of skilled labor and price fluctuation for building supplies, which affects project finances and execution.

Despite these obstacles, civil engineering firms have a lot of chances. Opportunities for businesses that specialize in the design and building of solar, wind, and other renewable energy infrastructure are presented by the shift to renewable energy sources. Demand for digital infrastructure, technology-driven projects, and intelligent transportation systems are increased by the rise of smart cities and digitalization. Furthermore, opportunities for businesses that specialize in maintenance, repair, and renewal projects are presented by the necessity for infrastructure rehabilitation in ageing economies. PPPs, or public-private partnerships, provide additional channels for cooperation by enabling civil engineering firms to take part in a range of projects and share risks with governmental organizations. These chances, along with continuous technical development, set up the civil engineering market for future expansion and creativity.

Civil Engineering Market Segmentation

The worldwide market for civil engineering is split based on service, application, customer, and geography.

Civil Engineering Services

- Planning & Design

- Construction

- Maintenance

- Other

According to civil engineering industry analysis, the construction sector is the largest service category in the market. The practical application of planning and design blueprints is what construction activities include, converting abstract concepts into concrete infrastructure projects. This section includes a variety of jobs, such as utility installation, structural assembly, and earthwork. Construction-focused civil engineering firms are essential to the realisation of projects because they guarantee quality control, regulatory compliance, and safety standards are followed at every stage of the building process. The worldwide construction industry is thriving due to factors such as population increase, urbanisation, and the need for sustainable solutions to meet changing societal expectations for infrastructure development.

Civil Engineering Applications

- Real Estate

- Infrastructure

- Industrial

The real estate industry leads the sector in terms of application categories and it will expected to grow during the Civil engineering industry forecast period. The construction of residential, commercial, and mixed-use properties in the real estate industry depends heavily on civil engineering services. The effective and sustainable development of real estate projects is ensured by these services, which include site assessment, land surveying, infrastructure design, and construction management. For the purpose of maximising land use, improving environmental sustainability, and upholding building and zoning standards, civil engineers are essential. Population growth, urbanisation, and economic development are some of the causes driving the real estate segment's steady rise and creating a need for new residential and commercial properties. In the real estate industry, trends like mixed-use projects and urban redevelopment also drive up demand for civil engineering services. The real estate sector continues to be a pillar of the civil engineering business, providing a variety of avenues for expansion and innovation as the world's urban population continues to rise.

Civil Engineering Customers

- Government

- Private

- Other

The government sector is by far the largest customer segment in the civil engineering market. Local, state, and federal governments are just a few of the many government organisations that use civil engineering services. To address the increasing requirements of its constituents, these organisations make significant investments in infrastructure development projects, such as erecting public buildings, roads, bridges, and water supply systems. Government-funded projects are frequently extensive, long-term endeavours with the goals of boosting economic growth, advancing public safety, and upgrading transportation networks. Civil engineering companies that work with the government have a lot on their plate. They have to achieve strict quality and safety standards, negotiate complicated regulatory frameworks, and comply with strict procurement procedures. Notwithstanding difficulties, the government sector is a major player in the civil engineering industry since it provides stability and a constant flow of projects. Governments continue to be a major source of demand for civil engineering services as they prioritise infrastructure investment to meet societal requirements and spur economic development.

Civil Engineering Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Civil Engineering Market Regional Analysis

Asia-Pacific is the largest region in the market study for civil engineering. The area is experiencing substantial investments in infrastructure projects due to rapid urbanization, population growth, and economic development. Governments are prioritizing the development of urban infrastructure, utilities, and transportation networks to sustain the region's growing urban population and spur economic growth. Additionally, the demand for civil engineering services is driven by growing industrialization and the emergence of new economies. This dominance of the Asia-Pacific region in the civil engineering market presents significant opportunities for industry expansion globally.

Regarding civil engineering market analysis, besides the significant investments in infrastructure, various developing markets are implementing financial incentives to promote regional development and infrastructure. Moreover, the rapid increase in the global population is anticipated to drive substantial demand for residential infrastructure and construction activities. Furthermore, while regulations in North America and Europe concerning VOC emissions during construction are likely to boost demand for precast construction products, the industry is increasingly focusing on sustainable practices and eco-friendly building products globally. Additionally, the introduction of new technologies and materials is expected to offer lucrative opportunities for industry players during the civil engineering market forecast period.

Civil Engineering Market Players

Some of the top civil engineering companies offered in our report includes AECOM, Amec Foster Wheeler plc, United States Army Corps of Engineers, SNC-Lavalin, Jacobs Engineering Group, Inc., Galfar Engineering & Contracting SAOG, Fluor Corporation, HDR, Inc., Tetra Tech, Inc., and Stantec, Inc.

Frequently Asked Questions

How big is the civil engineering market?

The civil engineering market size was valued at USD 8.7 trillion in 2022.

What is the CAGR of the global civil engineering market from 2023 to 2032?

The CAGR of civil engineering is 5.9% during the analysis period of 2023 to 2032.

Which are the key players in the civil engineering market?

The key players operating in the global market are including AECOM, Amec Foster Wheeler plc, United States Army Corps of Engineers, SNC-Lavalin, Jacobs Engineering Group, Inc., Galfar Engineering & Contracting SAOG, Fluor Corporation, HDR, Inc., Tetra Tech, Inc., and Stantec, Inc.

Which region dominated the global civil engineering market share?

Asia-Pacific held the dominating position in civil engineering industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of civil engineering during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global civil engineering industry?

The current trends and dynamics in the civil engineering industry include urbanization and population growth fueling demand for infrastructure, government investments in large-scale infrastructure projects, advancements in construction technology enhancing efficiency, and growing awareness and demand for sustainable construction practices.

Which application held the maximum share in 2022?

The real estate application held the maximum share of the civil engineering industry.