Chemical Licensing Market

Published :

Report ID:

Pages :

Format :

Chemical Licensing Market

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

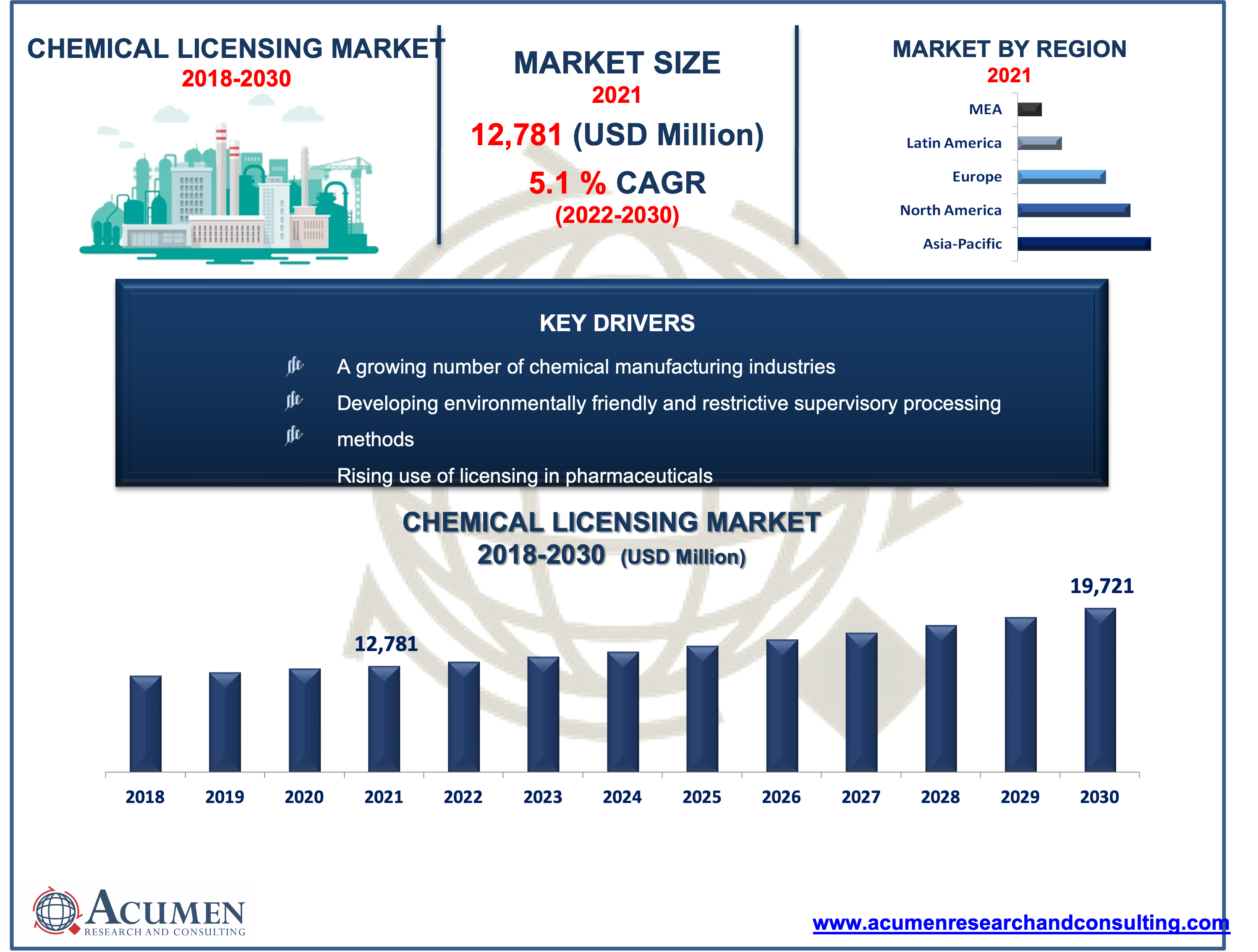

The Global Chemical Licensing Market accounted for US$ 12,781 Mn in 2021 and is expected to reach US$ 19,721 Mn by 2030 with a considerable CAGR of 5.1% during the forecast timeframe of 2022 to 2030.

Over time, chemicals have evolved into an essential and integral part of daily life. The chemical and oil & gas industries are two of the most important factors influencing global economic growth. Chemicals and raw materials are supplied to a wide range of industrial segments, including detergent and household cleaners, textile, pharmaceutical, petroleum & gas, garments, and agrochemicals, to produce final products ranging from energy-efficient housing to paints and beauty products. In order to compete in the marketplace, manufacturers are applying for licenses to acquire ownership of specific chemical technology. One of the most important ways to benefit from new processing techniques is through licensing.

The introduction of various process improvement designs and businesses that play a crucial role in the introduction of new processes and methods has led to an increase in demand for licensing technology. Chemical licensing offerings manufacturer’s exclusive rights to complete any mass-producing interaction or exercises related to the oil and gas industry. Furthermore, chemical technology licensing also ensures that manufacturing process advancements are reasonable and environmentally sustainable.

Drivers

· A growing number of chemical manufacturing industries

· Developing environmentally friendly and restrictive supervisory processing methods

· Rising use of licensing in pharmaceuticals

Restraints

· Expensive licensing fees

· In-house technology development by end-user

Opportunity

· Technological advancements in the chemical industry meet consumer needs and demands while also being environmentally friendly

Report Coverage

| Market | Chemical Licensing Market |

| Market Size 2021 | US$ 12,781 Mn |

| Market Forecast 2030 | US$ 19,721 Mn |

| CAGR | 5.1% During 2022 - 2030 |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 - 2030 |

| Segments Covered | By Type, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Johnson Matthey, Mitsubishi Chemical Corporation, Sumitomo, Shell, Chevron Phillips Chemical Company, Eastman Chemical Company, Exxon Mobil Corporation, Huntsman Corporation, Nova Chemicals Corporation, Sumitomo Chemical, LyondellBase, and Sinopec. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

Chemical Licensing Market Dynamics

Chemical licensing is the kind of protected innovation registration in which technologically advanced end-users can acquire the right to use a specific chemical technology. The expanding manufacturing sector, rising population, and rising regulatory standards in the chemical industry are expected to drive growth in the chemical licensing market. Rising demand for various emission derivatives, as well as the incorporation of efficient technologies to produce these derivatives, are other factors driving the chemical licensing market. Chemical licensing acceptance is nowadays extremely limited, and the increased price of licensing advancements acts as a market constraint. In any case, growing environmental consciousness and more stringent organizational strategies are expected to drive the market in the forecasted period. Furthermore, end-user in-house technological advancement and operational efficiencies, as well as high licensing costs, are expected to limit market growth during the forecast period.

Chemical Licensing Market Segmentation

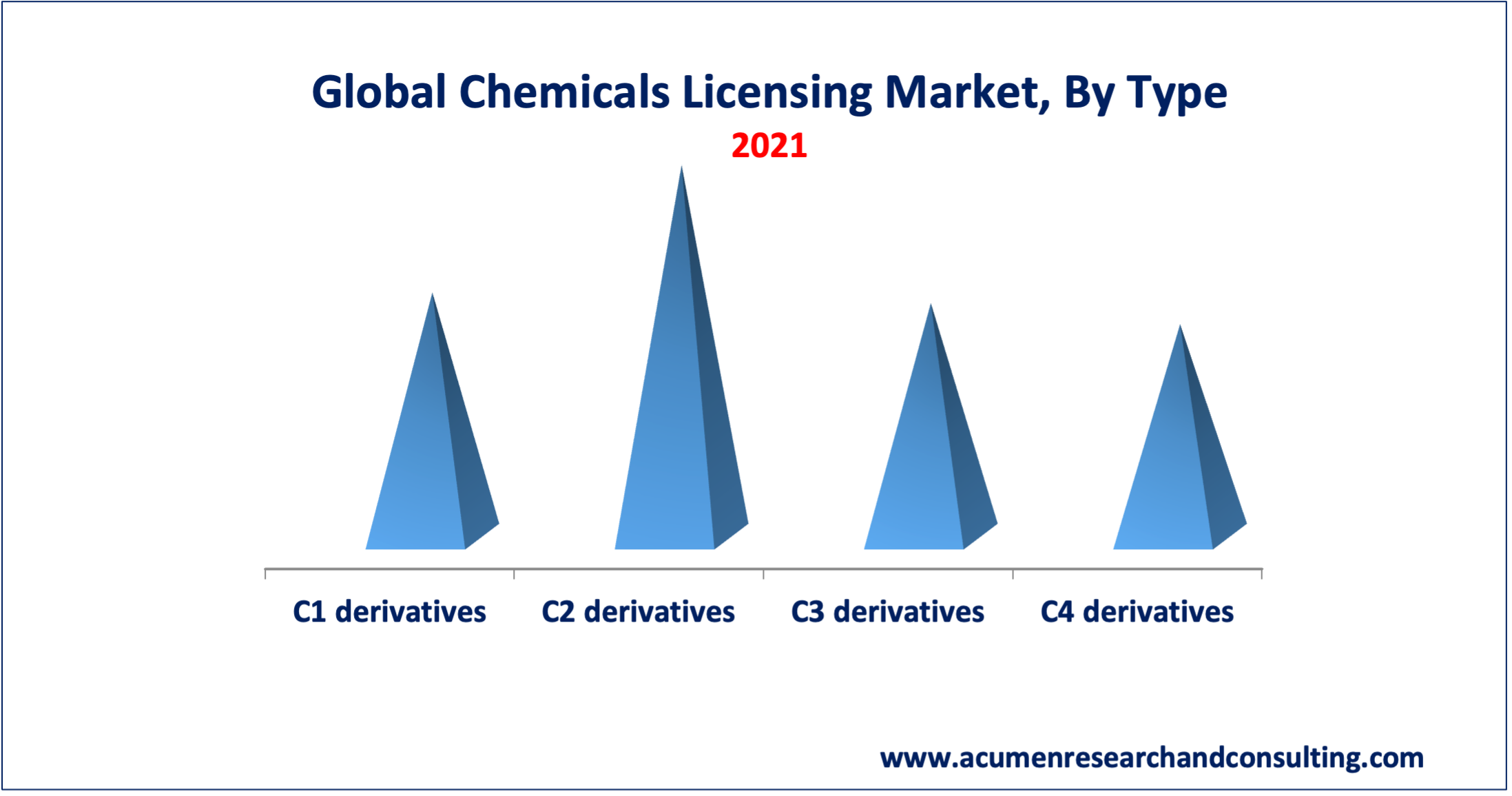

Market by Type

· C1 Derivatives

· C2 Derivatives

· C3 Derivatives

· C4 Derivatives

In terms of type, C2 derivations captured the largest market share in 2021. Advances in polyethylene and EDC-PVC technology are in high demand in the market, propelling the C2 derivatives segment of the chemical licensing market forward. Polyethylene and EDC-PVC technology advancements are in high demand, with polyethylene used in tubes, films, plastic components, and laminates, and ethylene dichloride (EDC) used as solutes in the metal cleanup, textile, and adhesives industries. Due to environmental pressures, solvent markets tend to mature in order to reduce emissions and, in the case of perchloroethylene, decrease.

Market by End-User

· Oil & Gas

· Chemical

· Others

In terms of end-user, the oil and gas segment will have the largest market share in 2021. The rise is particularly the result of companies restructuring their operational processes and beginning to recover from the COVID-19 impact, which previously resulted in hampering containment measures such as remote working, social distancing, and the closure of commercial transactions, resulting in operational challenges. Moreover, rapid advancement in the oil and gas industry as a result of rising demand is one of the factors driving the growth of the chemical licensing market.

In addition, the chemical market is anticipated to expand significantly in the coming years. The chemical industry is critical to the manufacturing sector's economic development and growth. The value-added in the chemical sector is higher than in the majority of other industry sectors. However, Petrochemical products are now found in almost every aspect of daily life, including housing, building, clothing, furniture, medical appliances, household goods, automobiles, horticulture, agriculture, irrigation, packaging, and electronics and electrical, to name a few. Because petrochemicals are widely used, the demand for chemical licensing in the chemical sector is expected to rise during the projected timeline.

Chemical Licensing Market Regional Overview

North America

· U.S.

· Canada

Europe

· U.K.

· France

· Germany

· Spain

· Rest of Europe

Latin America

· Mexico

· Brazil

· Rest of Latin America

Asia-Pacific

· India

· China

· Japan

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· South Africa

· GCC

· Rest of Middle East & Africa

The Asia-Pacific market is expected to grow with a majority share during the forecasting years, owing to the high refinery capacities of India, China, South Korea, and Japan, as well as the need for innovative sustainable, and environmentally friendly production technologies. Asian economies such as China, India, and Thailand are driving the market in the region, with industrial growth and a rise in the number of manufacturing sectors growing significantly. The oil and gas industry is one of India's eight core industries, and its decisions affect all other important sectors of the economy. India's economic growth is inextricably linked to energy demand; thus, demand for oil and gas is expected to rise further, making the industry very appealing to investors. However, increased R&D investment, favorable government subsidiaries, and increased awareness of the relevance and importance of chemical licensing are driving the market growth.

Key Players

Some of the prominent players in global chemical licensing market are Johnson Matthey, Mitsubishi Chemical Corporation, Sumitomo, Shell, Chevron Phillips Chemical Company, Eastman Chemical Company, Exxon Mobil Corporation, Huntsman Corporation, Nova Chemicals Corporation, Sumitomo Chemical, LyondellBase, and Sinopec.

Frequently Asked Questions

How much was the estimated value of the global chemical licensing market in 2021?

The estimated value of global chemical licensing market in 2021 was accounted to be US$12,781 Mn.

What will be the projected CAGR for global chemical licensing market during forecast period of 2022 to 2030?

The projected CAGR of chemical licensing during the analysis period of 2022 to 2030 is 5.1%.

Which are the prominent competitors operating in the market?

The prominent players of the global chemical licensing market involve Johnson Matthey, Mitsubishi Chemical Corporation, Sumitomo, Shell, Chevron Phillips Chemical Company, Eastman Chemical Company, Exxon Mobil Corporation, Huntsman Corporation, Nova Chemicals Corporation, Sumitomo Chemical, LyondellBase, and Sinopec.

Which region held the dominating position in the global chemical licensing market?

Asia-Pacific held the dominating share for chemical licensing during the analysis period of 2022 to 2030

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

North America region exhibited fastest growing CAGR for chemical licensing during the analysis period of 2022 to 2030

What are the current trends and dynamics in the global chemical licensing market?

A growing number of chemical manufacturing industries, developing environmentally friendly and restrictive supervisory processing methods and the rising use of licensing in pharmaceuticals are the prominent factors that fuel the growth of global chemical licensing market

By segment end-user, which sub-segment held the maximum share?

Based on end-user, oil & gas segment held the maximum share for chemical licensing market in 2021