Oil & Gas Data Management Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Oil & Gas Data Management Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

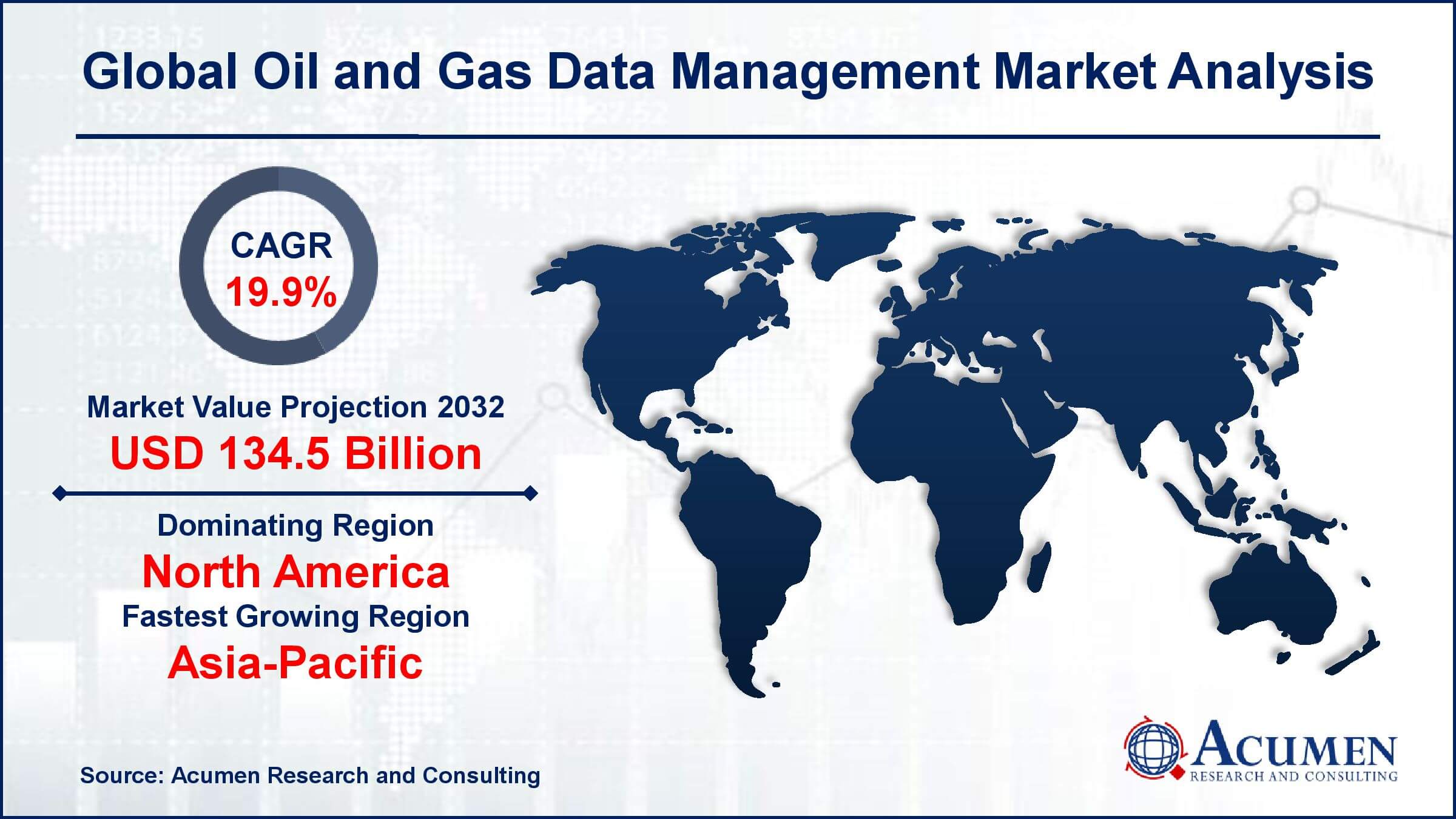

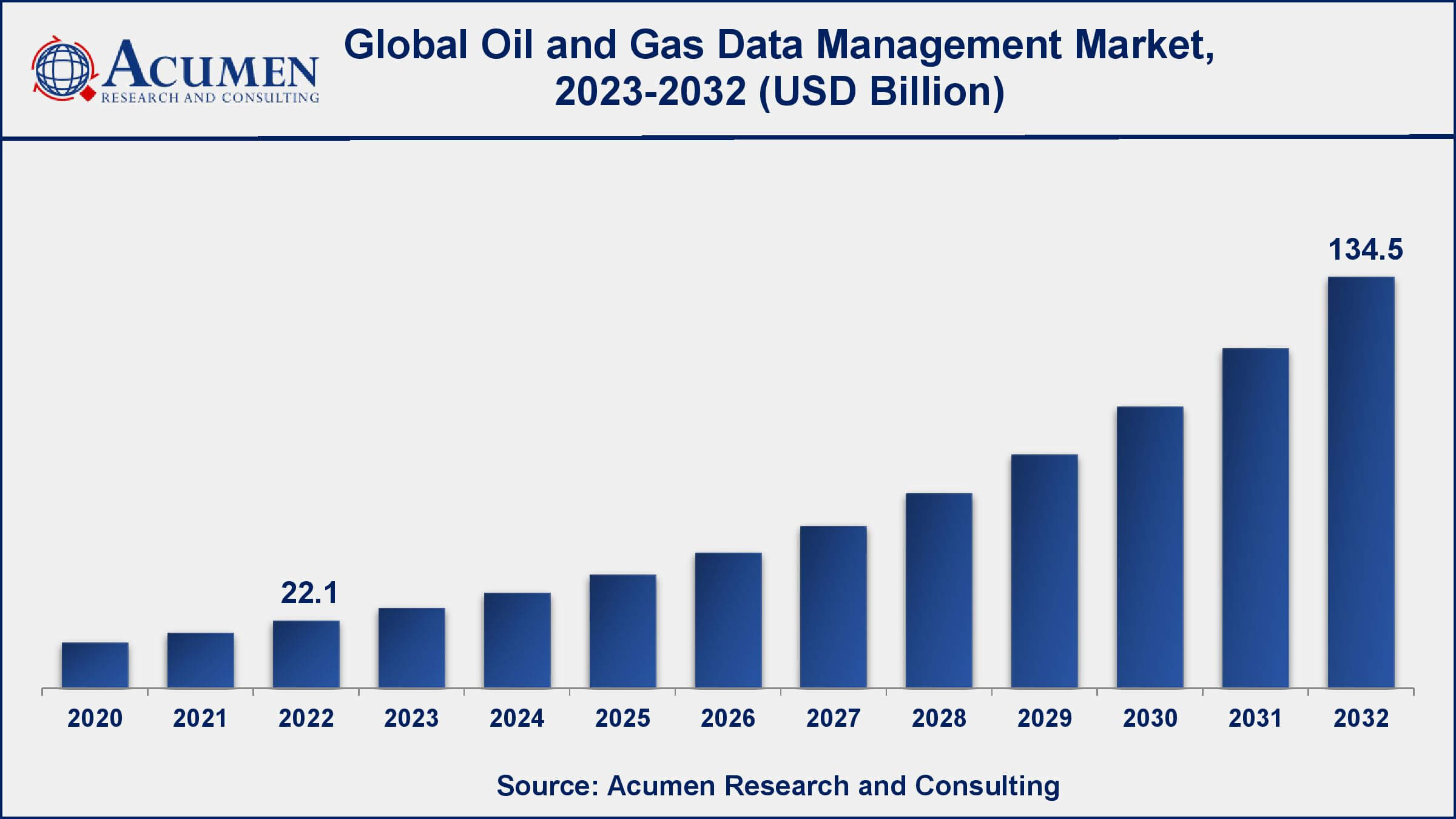

The Global Oil & Gas Data Management Market Size accounted for USD 22.1 Billion in 2022 and is estimated to achieve a market size of USD 134.5 Billion by 2032 growing at a CAGR of 19.9% from 2023 to 2032.

Oil & Gas Data Management Market Highlights

- Global oil & gas data management market revenue is poised to garner USD 134.5 billion by 2032 with a CAGR of 19.9% from 2023 to 2032

- North America oil & gas data management market value occupied more than USD 6 billion in 2022

- Asia-Pacific oil & gas data management market growth will record a CAGR of more than 20% from 2023 to 2032

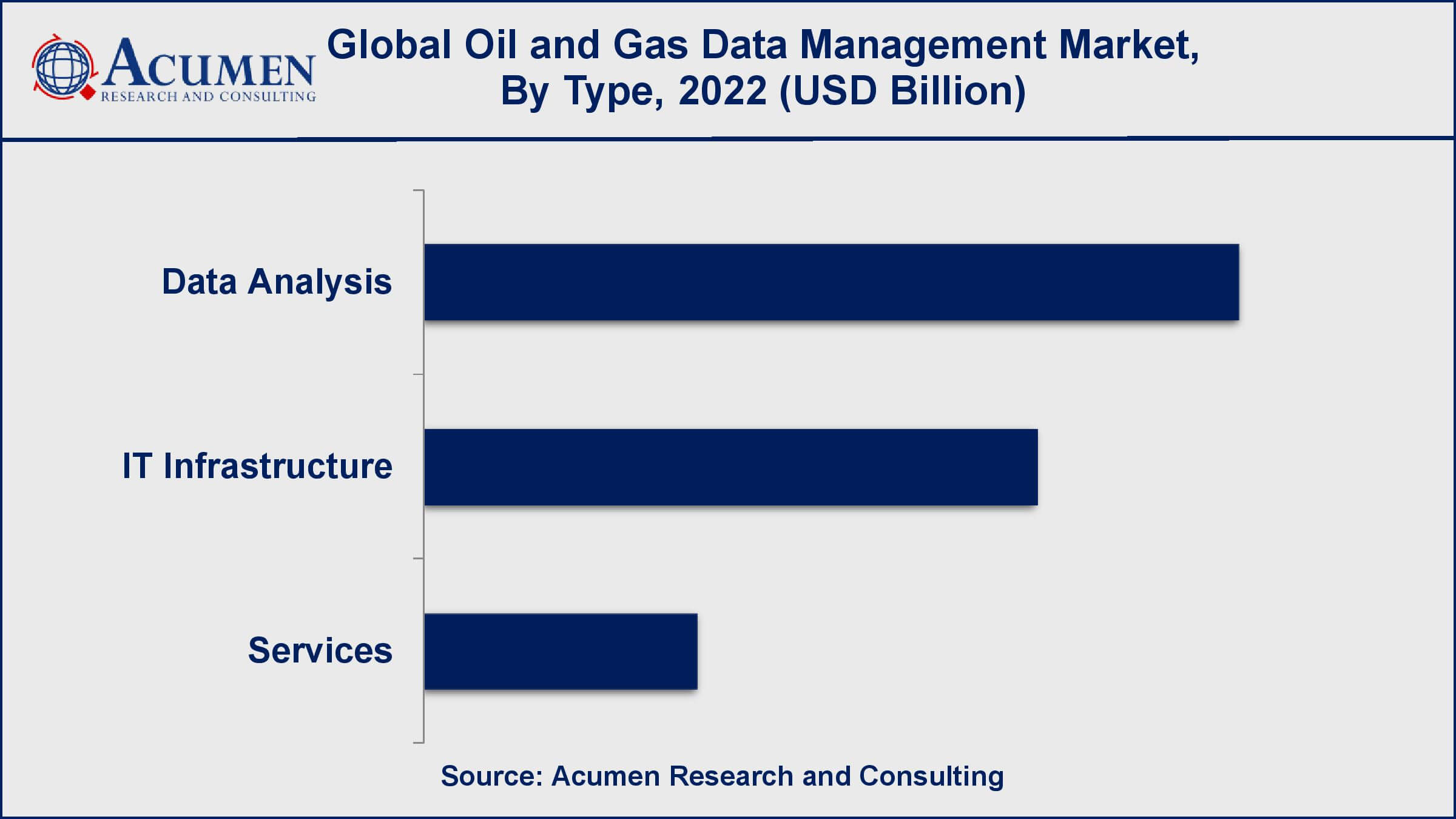

- Among type, the data analysis sub-segment generated over US$ 10.6 billion revenue in 2022

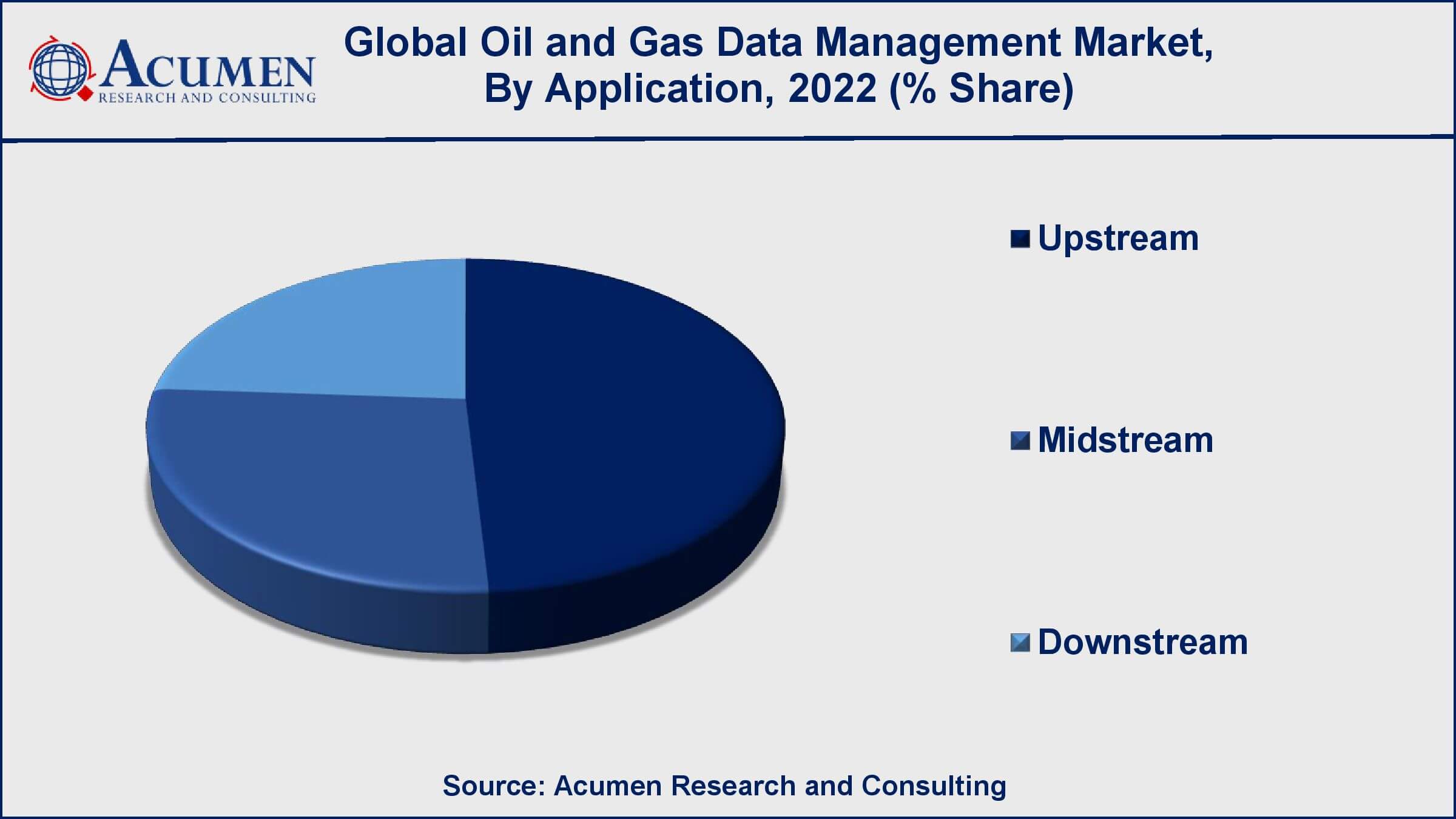

- Based application, the upstream sub-segment generated around 49% share in 2022

- Increasing demand for renewable energy is a popular oil & gas data management market trend that fuels the industry demand

Data management software helps businesses and organizations to manage and access data efficiently on a real-time basis. Several software development providers and vendors are laying importance on the enhancement of this software by means of integrating value-added processing including data analytics, regulatory compliance management tools, data warehousing, and other characteristics for instance process design control. Moreover, data management mainly incorporates a set of recent-generation technologies and architectures. They are specially designed to extract important data from the huge volume of structured or unstructured information by enabling high-velocity capture and analysis.

Global Oil & Gas Data Management Market Dynamics

Market Drivers

- Increasing demand for oil and gas

- Advancements in technology

- Rising operational efficiency

Market Restraints

- High implementation costs

- Complex data management requirements

Market Opportunities

- Increasing adoption of advanced technologies

- Rising demand for data analytics

- Growing need for cybersecurity

Oil & Gas Data Management Market Report Coverage

| Market | Oil & Gas Data Management Market |

| Oil & Gas Data Management Market Size 2022 | USD 22.1 Billion |

| Oil & Gas Data Management Market Forecast 2032 | USD 134.5 Billion |

| Oil & Gas Data Management Market CAGR During 2023 - 2032 | 19.9% |

| Oil & Gas Data Management Market Analysis Period | 2020 - 2032 |

| Oil & Gas Data Management Market Base Year | 2022 |

| Oil & Gas Data Management Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Deployment Model, By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Capgemini S.A., EMC Corporation, IBM Corporation, Newgen Software, Inc., Cisco Systems, Inc., SAP SE, Tata Consultancy Services Ltd., Oracle Corporation, Halliburton, Informatica Corporation, and Schlumberger Limited. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Oil & Gas Data Management Market Insights

The growing popularity of predictive analytics solutions & real-time analysis, performance improvement & operational efficiency, and rising awareness among the end-users are some of the major factors driving the growth of the market during the forecast period 2018-2026. The growing adoption of IoT and AI is expected to improve the large-scale implementation of data management software by large and small-scale organizations in the oil and gas market. Additionally, other factors such as next-generation data center evolution, cloud platform adoption, and cost-effective & flexible data management solutions are increasing the demand for the market. However, lack of data security and misuse of gathered information are some of the restraining factors for the growth of the market.

Oil & Gas Data Management Market Segmentation

The worldwide market for oil & gas data management is split based on deployment model, type, application, and geography.

Oil & Gas Data Management Deployment Models

- On-Premise

- Cloud

According to our oil and gas data management industry analysis, on-premise solutions continue to be popular among certain segments of the market, particularly those with concerns about data security and privacy, or who require specialised hardware or software that cannot be easily migrated to the cloud. On-premise solutions also offer more control and customization options, which can be beneficial for organisations with complex data management needs.

Cloud-based solutions, on the other hand, are expected to be the fastest-growing deployment model in the coming years. One of the primary benefits of cloud-based solutions is their scalability and flexibility. They can be easily scaled up or down to meet the needs of the organisation, making them ideal for the volatile and dynamic nature of the oil and gas industry. Cloud-based solutions also provide faster implementation times, lower upfront costs, and improved accessibility and collaboration.

Oil & Gas Data Management Types

- Data Analysis

- IT Infrastructure

- Services

According to the oil and gas data management market forecast, data analysis will be the fastest-growing type in the coming years, driven by the industry's increasing volume of data and the growing demand for advanced analytics to extract insights and drive decision-making. Companies that can offer effective data management and analytics solutions will be well-positioned to capitalise on this opportunity.

IT infrastructure, which includes hardware and software systems such as servers, storage, and networking equipment, is also a significant market segment, as effective data management necessitates a strong IT infrastructure to store, process, and analyse data. The demand for IT infrastructure is expected to increase as the volume of data generated by the industry grows.

Services, such as consulting, implementation, and support, are also important market segments because they enable businesses to effectively implement and maintain data management solutions. Services also allow businesses to differentiate themselves by offering tailored solutions and high-quality customer support.

Oil & Gas Data Management Applications

- Upstream

- Midstream

- Downstream

In the oil and gas data management market, the upstream segment is currently the largest and fastest-growing application. The exploration, development, and production of oil and gas resources generates a large volume of complex data that must be effectively managed and analysed to support decision-making in the upstream segment.

One of the main factors propelling the upstream segment's growth is the rising complexity of oil and gas operations, the rising demand for data analytics to extract insights and drive decision-making, and the rising adoption of cutting-edge technologies like big data analytics and the Internet of Things (IoT) in the industry.

Oil & Gas Data Management Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Oil & Gas Data Management Market Regional Analysis

North America is expected to hold the major share during the forecast period 2023-2032 owing to the increasing number of mid-sized and small enterprises inclining towards data management software. The growing IT infrastructure especially in U.S. and Canada is one of the major factors driving the market in this region.

Asia-Pacific is expected to witness significant growth owing to the increasing adoption rate of digitalization in data management. Additionally, the change in oil and gas policies and the increase in the need for advanced analytics solutions and services in the oil and gas industries is propelling the growth of the market in this region.

Europe is expected to show healthy growth during the forecasted period owing to the increasing IT population and industrialization. Additionally, LAMEA is expecting steady growth due to the limited availability of efficient infrastructure.

Oil & Gas Data Management Market Players

Some of the top oil & gas data management companies offered in the professional report include Capgemini S.A., EMC Corporation, IBM Corporation, Newgen Software, Inc., Cisco Systems, Inc., SAP SE, Tata Consultancy Services Ltd., Oracle Corporation, Halliburton, Informatica Corporation, and Schlumberger Limited.

Frequently Asked Questions

What was the market size of the global oil & gas data management in 2022?

The market size of oil & gas data management was USD 22.1 billion in 2022.

What is the CAGR of the global oil & gas data management market from 2023 to 2032?

The CAGR of oil & gas data management is 19.9% during the analysis period of 2023 to 2032.

Which are the key players in the oil & gas data management market?

The key players operating in the global market are including Capgemini S.A., EMC Corporation, IBM Corporation, Newgen Software, Inc., Cisco Systems, Inc., SAP SE, Tata Consultancy Services Ltd., Oracle Corporation, Halliburton, Informatica Corporation, and Schlumberger Limited.

Which region dominated the global oil & gas data management market share?

North America held the dominating position in oil & gas data management industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of oil & gas data management during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global oil & gas data management industry?

The current trends and dynamics in the oil & gas data management industry include increasing demand for oil and gas, advancements in technology, and rising operational efficiency.

Which deployment model held the maximum share in 2022?

The on-premise deployment model held the maximum share of the oil & gas data management industry.