Ceramic Coating Market Size - Global Industry Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Ceramic Coating Market Size - Global Industry Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Global Ceramic Coating Market Size Accounted for USD 9,854 Million in 2021 and is predicted to be worth USD 18,641 Million by 2030, with a CAGR of 7.5% during the forthcoming period from 2022 to 2030.

The key factors propelling the growth of the ceramic coating market share over the projected timeframe include the expanding automotive sector, increasing demand for unique coatings with remarkable properties, increasing healthcare and aerospace applications, as well as growing preference for antiviral coatings. Furthermore, as ceramic coating promotes greater heat resistance and fewer atmospheric emissions, demand for ceramic coating is expected to expand. These factors are expected to drive the ceramic coating market value during the forecast period.

Ceramic coating is an inorganic substance that is used in high-temperature applications. This type of product is often composed of titania, silica, silicon carbide, alumina-magnesia, hafnia, alumina, and silicon nitride. Furthermore, it provides higher anti-erosion, heat resistance, and long-term productivity, which may increase the ceramic coating market potential. Ceramic coating is a transparent layer that contains a liquid composite material that forms molecular bonds with a paint solution. The ceramic coating is made up of nanotechnology that is invisible to the human eye, and so when polishing the body of automobiles, these particles form a common chemical bond with the sprayed paint and fill gaps on the bodywork. Ceramic coatings can be used in a variety of industries. It is usually deduced by creating various developments, such as thermal spray, chemical vapor deposition (CVD), physical vapor deposition (PVD), as well as others.

Global Ceramic Coating Market DRO’s

Market Drivers

- Growing demand for ceramic coatings in the automobile industry

- Rising application of the product in the healthcare system

- Increasing consumption of coating materials in the Asia-Pacific region

Market Restraints

- High product cost.

- COVID-19 influence on the automobile sector

Market Opportunities

- New and Sustainable Product advancements for various industries

- Emerging Markets across a wide range of industries

Ceramic Coating Market Report Coverage

| Market | Ceramic Coating Market |

| Ceramic Coating Market Size 2021 | USD 9,854 Million |

| Ceramic Coating Market Forecast 2030 | USD 18,641 Million |

| Ceramic Coating Market CAGR | 7.5% During 2022 - 2030 |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 - 2030 |

| Segments Covered | By Product, By Technology, By Application And By Region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Bodycote, Dow DuPont Inc, Akzo Nobel N.V., Praxair Surface Technologies, Inc., APS Materials, Inc., Keronite Group Ltd., Element 119, Ultramet, Inc., Aremco Products, Inc., Cetek Ceramic Technologies Ltd., Saint-Gobain S.A., and NanoShine Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

The ceramic coating offers enhanced heat resistance while emitting less pollution into the atmosphere. These aspects are expected to boost the ceramic coating market growth for the entire forecast period. Furthermore, due to their ideal features of abrasive wear and corrosion resistance, as well as being great thermal insulation, these materials are progressively finding uses on metal components in automobiles. Furthermore, the defense and aerospace industries are increasing their use of oxide as well as carbide coatings. These coats are exclusively utilized in space shuttles, insulating tiles, rocket exhaust cones, and engine components, and are incorporated in the windscreen panes of several airplanes.

The ceramic coating market trend is anticipated to increase as a result of important factors such as the constant transformation of passenger & commercial cars, the growing preference for visually beautiful and technically sophisticated automotive illumination, and the increasing preference among Manufacturers and aftermarket dealers. Furthermore, rising disposable income among consumers as well as rising road security concerns about commercial and passenger vehicles, are likely to drive the ceramic coating market expansion throughout the projection period. Aside from that, coatings are added using processes like physical vapor deposition, thermal spray, and others to increase the life span of the machine's parts of the body. As a result, these factors are projected to drive demand for the ceramic coatings market growth.

Ceramic Coating Market Segmentation

The global ceramic coating market segmentation is based on the product, technology, application, and geographical region.

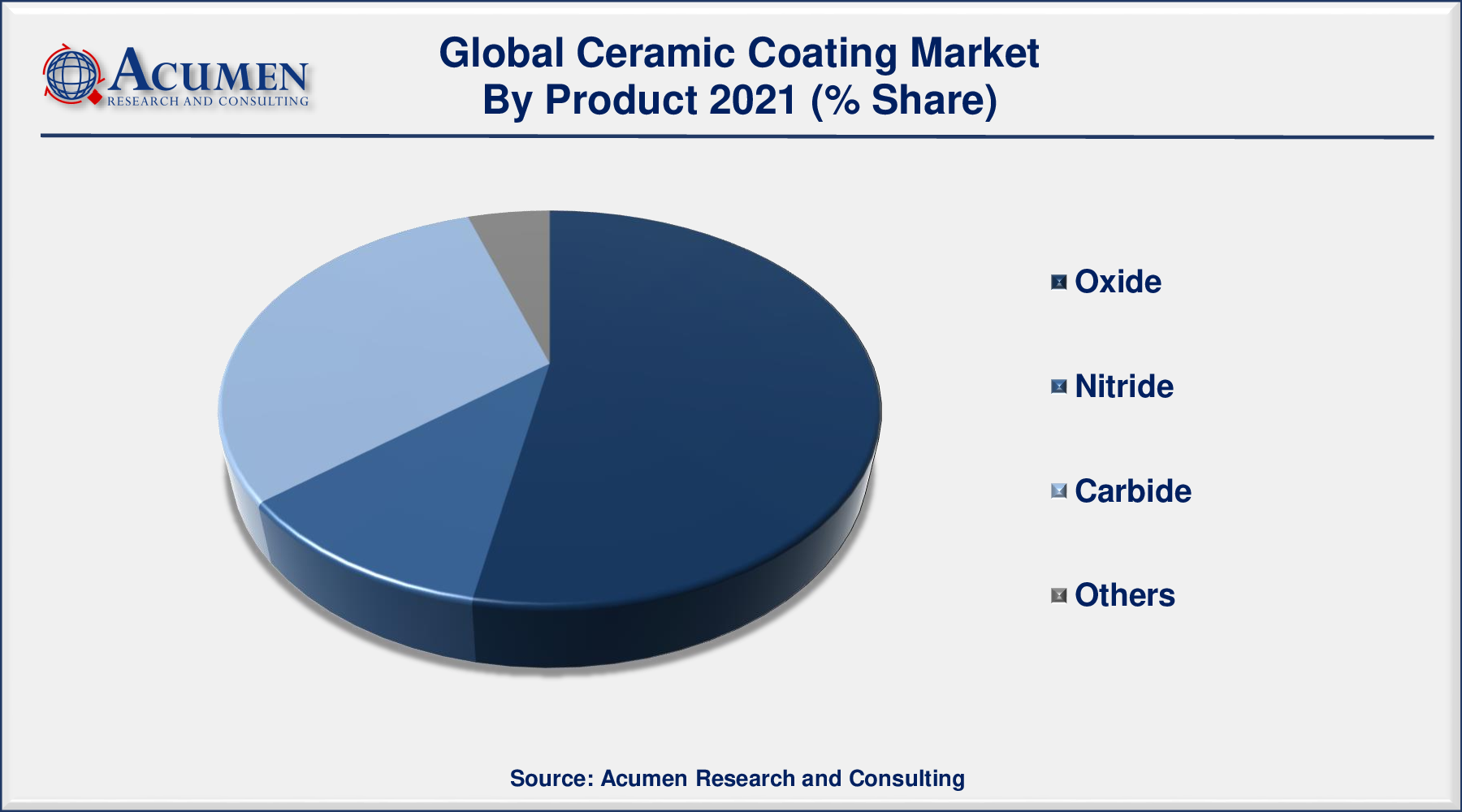

Market by Product

- Oxide

- Nitride

- Carbide

- Others

Based on the product, the oxide segment is anticipated to gain significant market share in 2021. Oxide coatings provide exceptional electrical and thermal insulation, as well as corrosion and wear protection. Furthermore, oxides are less expensive than other coatings like carbide as well as nitride. This coating is widely used in the steel industry to coat guide bars, chimneys, pumps, refractory bricks, and bearings. The growing application of these coatings in the automobile and oil and gas industries is likely to drive demand for ceramic coatings.

Market by Technology

- Thermal Spray

- Chemical Vapor Deposition

- Physical Vapor Deposition

- Others

According to a ceramic coating industry analysis, the thermal spray segment will lead the market in 2021. Thermal spray coating is becoming more widespread due to benefits such as excellent wear and corrosive resistance as well as the ability to produce substantially thicker coatings at greater deposition potential than conventional surface treatments. Thermal spray dominates the ceramic coating sector because it has a high density, which allows it to be employed in any material characteristics. Ceramic is primarily used in thermal spray techniques for dielectric strength, sliding wear, thermal barriers, as well as corrosion protection.

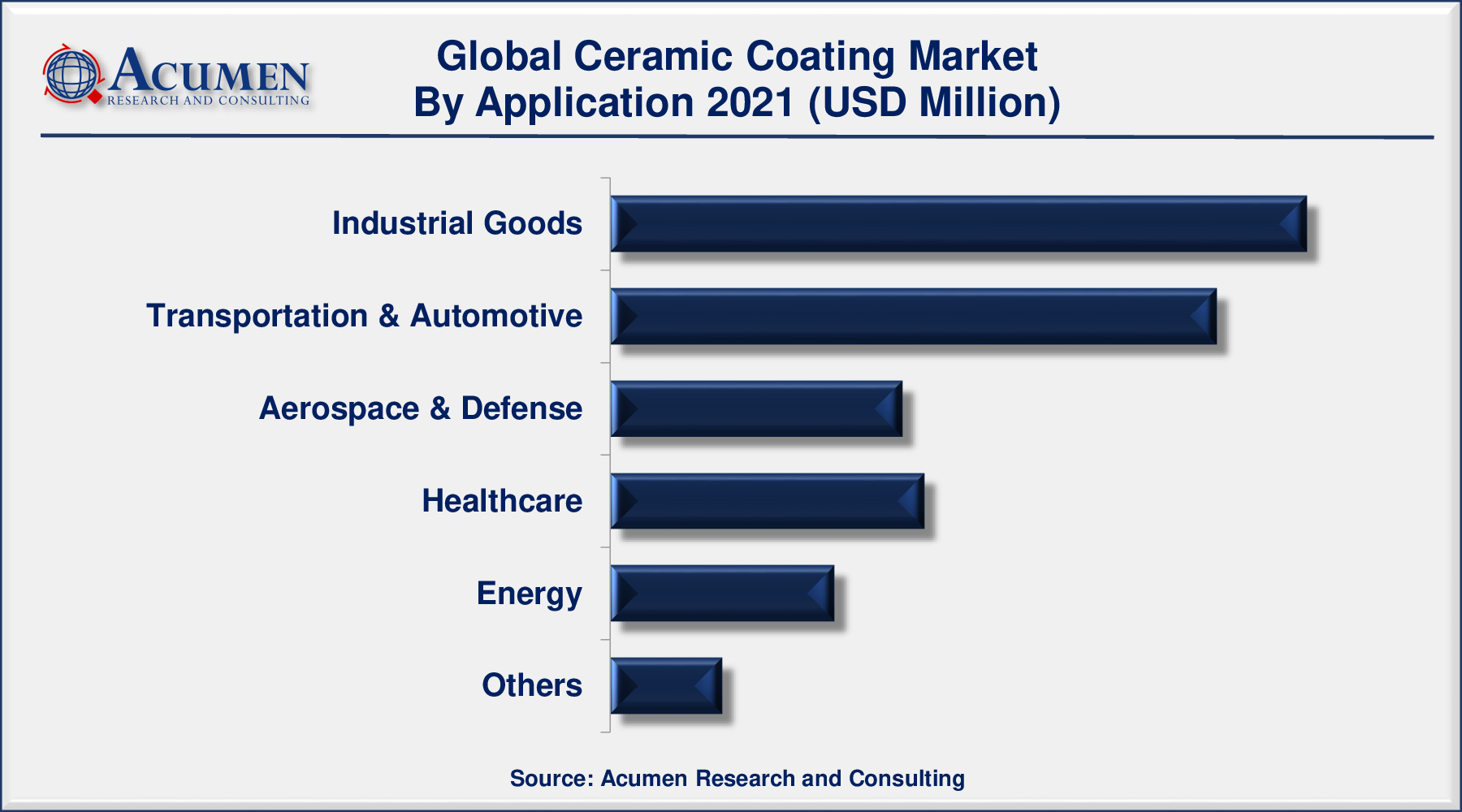

Market by Application

- Industrial Goods

- Transportation & Automotive

- Aerospace & Defense

- Healthcare

- Energy

- Others

According to the ceramic coating market forecast, the transportation & automotive segment is expected to grow at a substantial rate in the coming years. This expansion is due to increased product acceptance in the automobile sector. Ceramic coatings are widely used on vehicle interior and exterior surfaces. Also, rising vehicle manufacturing, particularly in Asia-Pacific as well as Europe, is a major driver of the ceramic coating industry. Ceramic coating can also be used in engine components to enhance reduce friction, and heat shielding, and boost automobile resistance properties.

Ceramic Coating Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

Expanding Automotive industry in the Asia-Pacific, Drives Regional Market Growth

In 2021, Asia-Pacific dominated the market, accounting for more than one-third of worldwide consumption. This expansion is due to the rising expansion in the healthcare and automotive industries may propel the worldwide ceramic coatings market during the anticipated decade. Cheaper rates are mostly related to lower-quality products, not to lower operating costs. Massive expenditure from emerging economies like India, China, and Japan characterizes consumer demands. However, increased investment by prominent companies in emerging economies to develop and enhance the ceramic coatings market growth is predicted to boost potential global ceramic coatings industry growth. China is the major Asia-Pacific consumer of ceramic coatings, with applications in medicinal, defense, aerospace, and other industries.

Ceramic Coating Market Players

Some of the prominent global ceramic coating market companies are Bodycote, Dow DuPont Inc, Akzo Nobel N.V., Praxair Surface Technologies, Inc., APS Materials, Inc., Keronite Group Ltd., Element 119, Ultramet, Inc., Aremco Products, Inc., Cetek Ceramic Technologies Ltd., Saint-Gobain S.A., and NanoShine Ltd.

Frequently Asked Questions

How much was the global ceramic coating market size in 2021?

The global ceramic coating market size in 2021 was accounted to be USD 9,854 Million.

What will be the projected CAGR for global ceramic coating market during forecast period of 2022 to 2030?

The projected CAGR of Ceramic Coating during the analysis period of 2022 to 2030 is 7.5%

Which are the prominent competitors operating in the market?

The prominent players of the global ceramic coating market involve Bodycote, Dow DuPont Inc, Akzo Nobel N.V., Praxair Surface Technologies, Inc., APS Materials, Inc., Keronite Group Ltd., Element 119, Ultramet, Inc., Aremco Products, Inc., Cetek Ceramic Technologies Ltd., Saint-Gobain S.A., and NanoShine Ltd.

Which region held the dominating position in the global ceramic coating market?

Asia-Pacific held the dominating share for ceramic coating during the analysis period of 2022 to 2030.

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

North America region exhibited fastest growing CAGR for ceramic coating during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global ceramic coating market?

Growing demand for ceramic coatings in the automobile industry, as well as rising application of the product in the healthcare system are the prominent factors that fuel the growth of global ceramic coating market.

By segment application, which sub-segment held the maximum share?

Based on application, industrial goods segment hold the maximum share for ceramic coating market in 2021.