Activated Alumina Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Activated Alumina Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

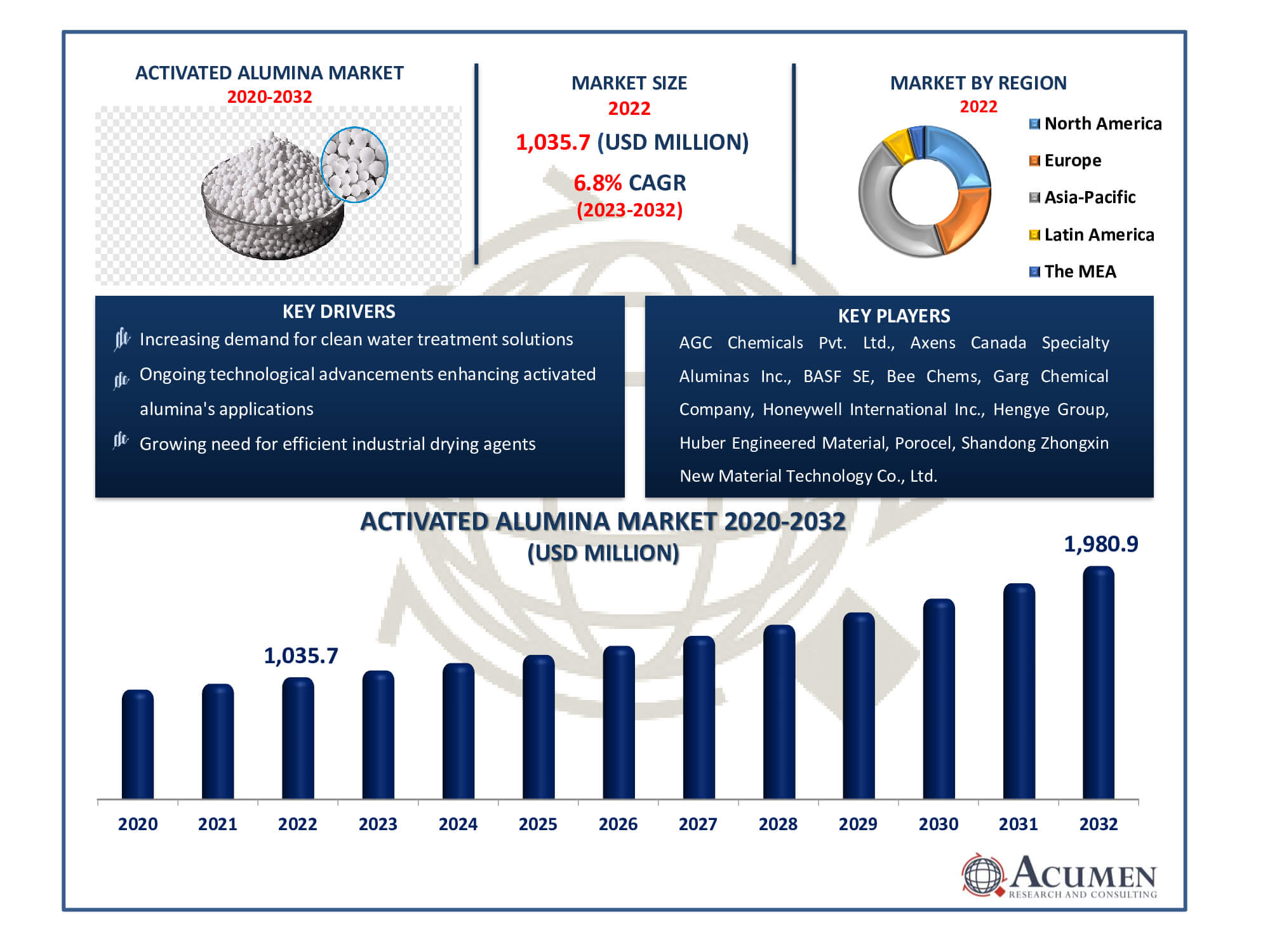

Request Sample Report

The Activated Alumina Market Size accounted for USD 1,035.7 Million in 2022 and is estimated to achieve a market size of USD 1,980.9 Million by 2032 growing at a CAGR of 6.8% from 2023 to 2032.

Activated Alumina Market Highlights

- Global activated alumina market revenue is poised to garner USD 1,980.9 million by 2032 with a CAGR of 6.8% from 2023 to 2032

- Asia-Pacific activated alumina market value occupied around USD 455.7 million in 2022

- North America activated alumina market growth will record a CAGR of more than 7% from 2023 to 2032

- Among application, the fluoride adsorbent sub-segment generated over US$ 331.4 million revenue in 2022

- Based on end-user, the water treatment sub-segment generated around 34% share in 2022

- Integration into innovative filtration systems for diverse industries is a popular activated alumina market trend that fuels the industry demand

Aluminium oxide in the form of activated alumina is a very porous material. Dehydroxylating aluminium hydroxide produces a material with a large surface area and a network of holes. Its porous structure allows it to absorb a large amount of moisture and some gases from the surrounding atmosphere. It is extensively used as a desiccant in many industrial processes to remove moisture from air and gases, as a catalyst in some chemical reactions, and in water treatment to eliminate impurities such as fluoride, arsenic, and other toxins. The global activated alumina market is expanding as a result of its diverse uses across sectors. Because of its high adsorption capacity and chemical stability, activated alumina is widely used as a desiccant, catalyst, and in water treatment. The increasing need for clean water treatment solutions, rigorous air purification requirements, and the growing need for efficient drying agents in various industrial processes are driving the growth of this market. Furthermore, constant research and technical breakthroughs help to improve its performance and broaden its uses.

Global Activated Alumina Market Dynamics

Market Drivers

- Increasing demand for clean water treatment solutions

- Stringent regulations for air purification standards

- Growing need for efficient industrial drying agents

- Ongoing technological advancements enhancing activated alumina's applications

Market Restraints

- Fluctuating raw material prices impacting production costs

- Environmental concerns regarding disposal of used activated alumina

- Competition from alternative adsorbents and purification technologies

Market Opportunities

- Rising focus on wastewater treatment in emerging economies

- Development of specialized activated alumina variants for niche applications

- Adoption in pharmaceutical and healthcare sectors for purification needs

Activated Alumina Market Report Coverage

| Market | Activated Alumina Market |

| Activated Alumina Market Size 2022 | USD 1,035.7 Million |

| Activated Alumina Market Forecast 2032 | USD 1,980.9 Million |

| Activated Alumina Market CAGR During 2023 - 2032 | 6.8% |

| Activated Alumina Market Analysis Period | 2020 - 2032 |

| Activated Alumina Market Base Year |

2022 |

| Activated Alumina Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Form, By Application, By End-use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AGC Chemicals Pvt. Ltd., Axens Canada Specialty Aluminas Inc., BASF SE, Bee Chems, Garg Chemical Company, Honeywell International Inc., Hengye Group, Huber Engineered Material, Porocel, Shandong Zhongxin New Material Technology Co., Ltd., Sigma-Aldrich Corporation, Sorbead India, and Sumitomo Chemical Co., Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Activated Alumina Market Insights

The activated alumina industry forecast period is expected to drive growth in the activated alumina market due to stringent regulations addressing sodium, fluoride, hydrogen fluoride, and fluorine contamination. Organizations such as IARC and the World Health Organization (WHO) are actively monitoring and regulating standards for fluorine contamination in water. Activated alumina is widely used to absorb fluoride, sodium fluoride, hydrogen fluoride, and fluorine impurities from water.

Activated alumina, a highly porous and granular form of aluminum oxide, finds extensive application in industries such as oil & gas, water treatment, and chemical manufacturing as a desiccant, adsorbent, and catalyst. It is produced by dehydroxylating aluminum hydroxide, resulting in its high surface area, which ensures excellent adsorption capabilities. Notably, activated alumina is a common Claus catalyst, featuring numerous catalytic sites that facilitate the absorption of hydrogen sulfide and sulfur dioxide during the Claus process to produce elemental sulfur. In the oil and gas sector, activated alumina is widely utilized as a dryer and adsorbent. Its applications include the removal of moisture from natural gas, elimination of sulfur compounds, dehydration of high-acidity gas, ethanol purification, feedstock refining, paraffin separation, and sweetening of streams.

On the positive side, the increasing popularity of Activated Alumina stems from their numerous advantages. These systems can effectively track assets and individuals while recording crucial data. Moreover, their ability to operate continuously without interruptions further enhances their appeal. The realization of these benefits is expected to create multiple opportunities in the Activated Alumina market in the coming years.

Fast Growth in the Fuel-Activated Alumina Market for the Water Treatment Infrastructure Industry

One of the biggest global problems is the worldwide water scarcity. As the population around the world increases, the demand for water increases considerably. According to a United Nations report, the population of 1.8 billion is expected to live in areas with absolute water shortages by 2050, and governments around the world therefore invest in water treatment infrastructure and technologies to tackle this problem. The Chinese Government, for example, spends approximately US$ 110 billion each year to protect the environment and to control pollution, including waste water treatment. Some major contaminants in water streams are arsenic, lead and fluoride. Activated alumina helps to effectively remove these pollutants. As a result, the demand for activated alumina is projected to increase investments in waste water treatment and in water recycling in the near future.

Activated Alumina Market Segmentation

The worldwide market for activated alumina is split based on form, application, end-use, end-user, and geography.

Activated Alumina Forms

- Beads

- Powder

According to activated alumina industry analysis, the beads segment constituted a significant portion of the global activated alumina market in 2022, particularly in terms of form. Activated alumina beads exhibit high absorbency across various applications, boasting a high surface-to-mass ratio and versatile capabilities. These beads are extensively utilized for removing impurities such as fluoride in water treatment applications. Additionally, they play a crucial role in dehydrating compressed air and gases like liquid petroleum gas (LPG) and compressed natural gas (CNG) within the oil & gas sector. The rapid expansion of water treatment infrastructure in developing economies is anticipated to drive substantial growth in the beads sector.

Activated Alumina Applications

- Bio Ceramics

- Catalyst

- Desiccant

- Fluoride Adsorbent

- Others

Fluoride adsorbents currently hold the highest proportion of the activated alumina market's spectrum of applications. This superiority results from activated alumina's remarkable capacity to adsorb fluoride in a variety of contexts, most notably water treatment procedures. Its porous structure and large surface area allow for effective fluoride removal, resolving worries about contamination. Activated alumina meets strict criteria and has a considerable market share in this particular application due to its robust performance in fluoride adsorption.

Activated Alumina End-Uses

- Healthcare

- Water Treatment

- Oil & gas

- Plastics

- Others

As per the activated alumina market forecast, it is projected that a considerable segment of the worldwide market would experience significant growth within the water treatment industry. Between 2023 and 2032, this segment is projected to experience substantial growth. Meanwhile, the oil & gas segment is expected to hold the largest share in the activated alumina market. Specifically, the gas dehydration sub-category within the oil & gas segment is forecasted to undergo significant expansion. Activated alumina possesses distinct characteristics, including a high surface area and a highly porous structure. These attributes contribute to its extensive application, particularly in water treatment plants, thereby driving the increased demand for activated alumina products in the water treatment industry.

Activated Alumina Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

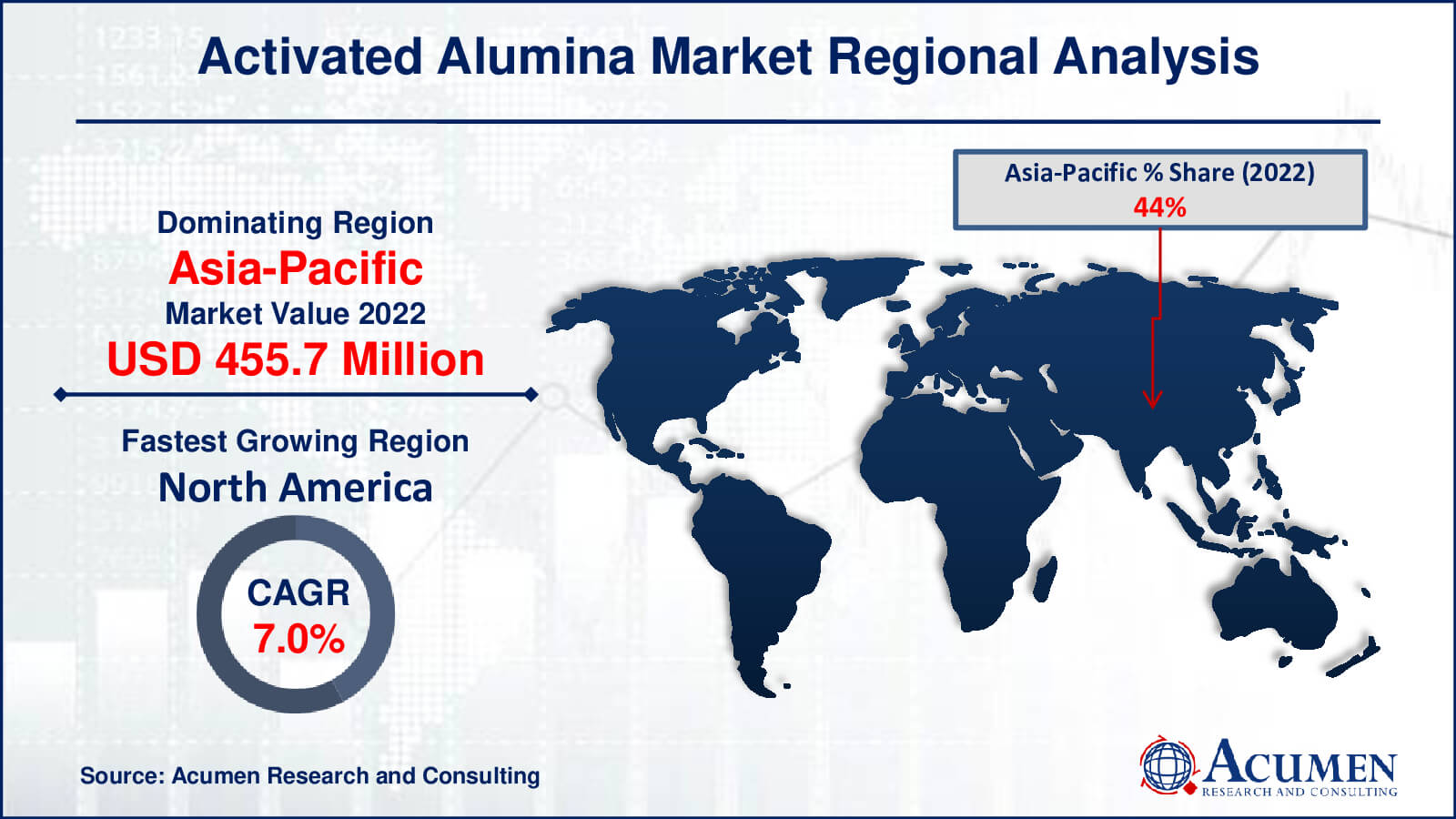

Activated Alumina Market Regional Analysis

Asia-Pacific is the largest market for activated alumina due to growing industrialization, rising water treatment programmes, and strong demand from a variety of industries. China and India are leading the way in this industry due to their rapidly growing populations and industrialization. The need for activated alumina is being supported by these countries' large investments in water treatment facilities, which are made in response to strict regulations and challenges related to water shortages.

However, out of all the markets in this region, North America is the one expanding at the highest rate. This increase can be ascribed to technological developments, growing environmental awareness, and proactive water quality control. The adoption of activated alumina for water treatment applications is driven by the region's increased emphasis on clean water efforts, strict environmental legislation, and trend towards sustainable practices.

The rapidly expanding activated alumina market in North America is also being driven by investments in cutting-edge filtration and purification technologies as a result of growing awareness of the problems associated with water contamination. Moreover, North American industries like chemical manufacturing, oil and gas, and pharmaceuticals are actively using activated alumina for a variety of purposes, which is helping to accelerate the product's market expansion in the area.

Activated Alumina Market Players

Some of the top activated alumina companies offered in our report includes AGC Chemicals Pvt. Ltd., Axens Canada Specialty Aluminas Inc., BASF SE, Bee Chems, Garg Chemical Company, Honeywell International Inc., Hengye Group, Huber Engineered Material, Porocel, Shandong Zhongxin New Material Technology Co., Ltd., Sigma-Aldrich Corporation, Sorbead India, and Sumitomo Chemical Co., Ltd.

Frequently Asked Questions

How big is the activated alumina market?

The market size of activated alumina was USD 1,035.7 million in 2022.

What is the CAGR of the global activated alumina market from 2023 to 2032?

The CAGR of activated alumina is 6.8% during the analysis period of 2023 to 2032.

Which are the key players in the Activated Alumina market?

The key players operating in the global market are including AGC Chemicals Pvt. Ltd., Axens Canada Specialty Aluminas Inc., BASF SE, Bee Chems, Garg Chemical Company, Honeywell International Inc., Hengye Group, Huber Engineered Material, Porocel, Shandong Zhongxin New Material Technology Co., Ltd., Sigma-Aldrich Corporation, Sorbead India, and Sumitomo Chemical Co., Ltd.

Which region dominated the global activated alumina market share?

Asia-Pacific held the dominating position in activated alumina industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of activated alumina during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global activated alumina industry?

The current trends and dynamics in the activated alumina industry include increasing demand for clean water treatment solutions, stringent regulations for air purification standards, growing need for efficient industrial drying agents, and ongoing technological advancements enhancing activated alumina's applications.

Which form held the maximum share in 2022?

The beads form held the maximum share of the activated alumina industry.