Canine Orthopedics Market | Acumen Research and Consulting

Canine Orthopedics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

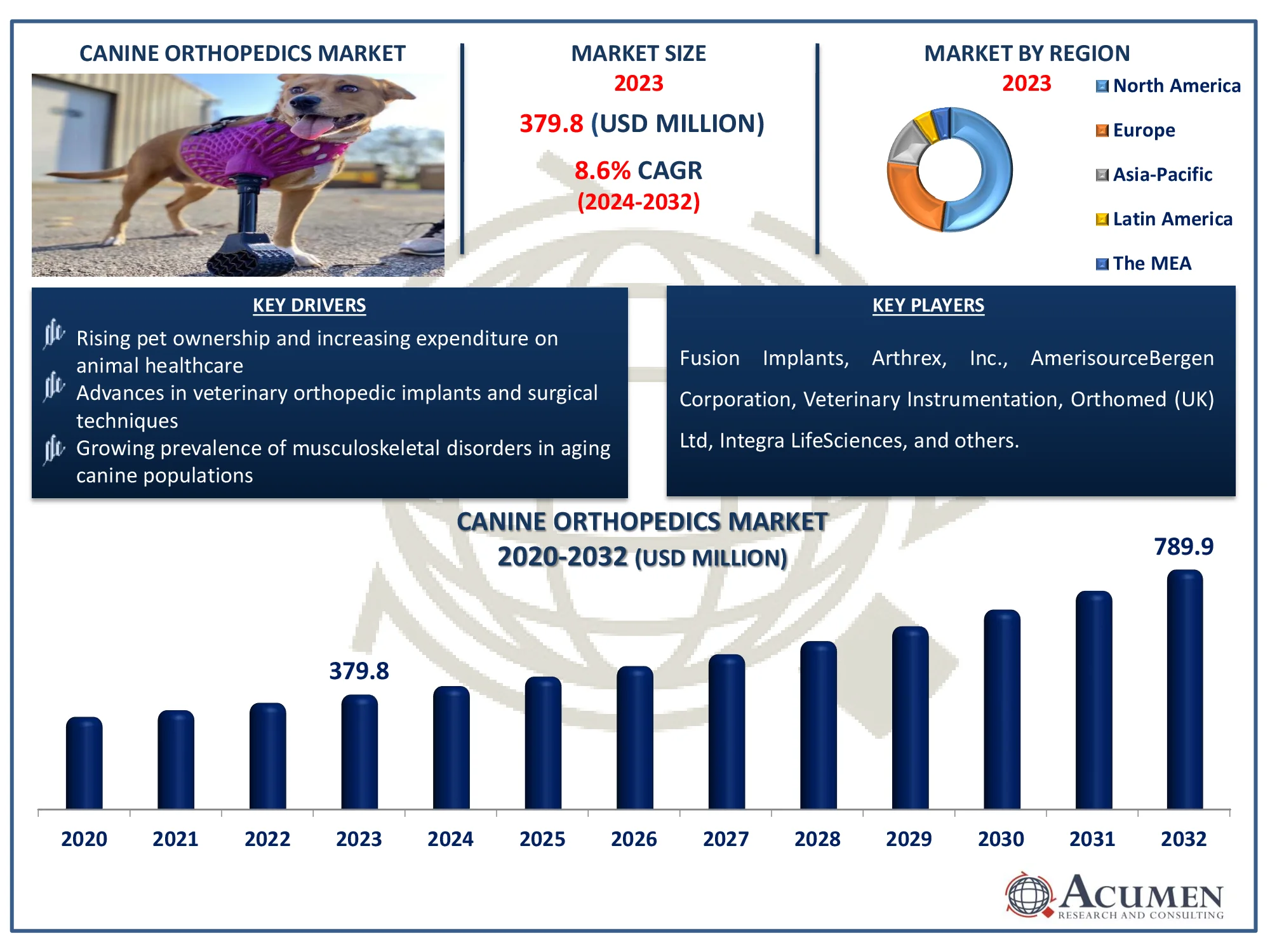

The Global Canine Orthopedics Market Size accounted for USD 379.8 Million in 2023 and is estimated to achieve a market size of USD 789.9 Million by 2032 growing at a CAGR of 8.6% from 2024 to 2032.

Canine Orthopedics Market Highlights

- The global canine orthopedics market is projected to reach USD 789.9 million by 2032, with a CAGR of 8.6% from 2024 to 2032

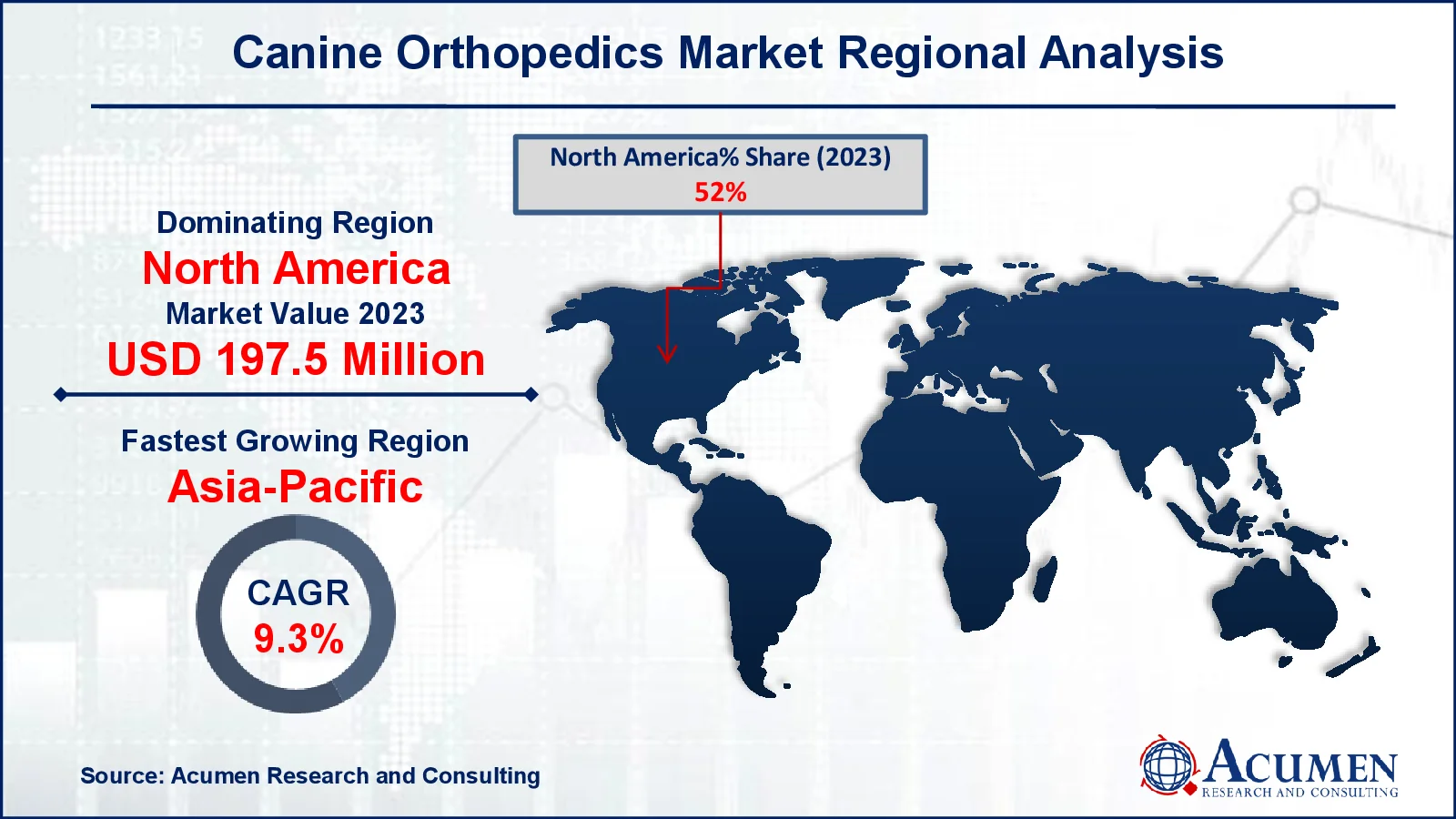

- In 2023, the North American canine orthopedics market held a value of approximately USD 197.5 million

- The Asia-Pacific region is expected to grow at a CAGR of over 9.3% from 2024 to 2032

- The TPLO application sub-segment captured 29% of the market share in 2023

- The hospitals & clinics as a end-user accounted for 90% of the market share in 2023

- Expanding use of advanced surgical technique and veterinary orthopedic implants is the canine orthopedics market trend that fuels the industry demand

Canine orthopedics is the specialty of veterinary medicine that studies, treats, and manages musculoskeletal diseases in dogs. Fractures, joint dislocations, ligament injuries, hip dysplasia, and arthritis are some of the disorders that can impair a dog's movement and well-being. The specialty employs a variety of surgical and non-surgical treatments, such as orthopedic implants, joint replacement surgeries, and rehabilitation therapies.

The Orthopedic Foundation for Animals (OFA) has invested more than $3 million in research to reduce the incidence and prevalence of hereditary diseases in companion animals. Projects are financed by the AKC Canine Health Foundation (CHF), the Morris Animal Foundation (MAF), and, on occasion, direct grants. Canine orthopedics is constantly improving as veterinary technology advances, enabling better treatment options and faster recovery times for dogs.

Global Canine Orthopedics Market Dynamics

Market Drivers

- Rising pet ownership and increasing expenditure on animal healthcare

- Advances in veterinary orthopedic implants and surgical techniques

- Growing prevalence of musculoskeletal disorders in aging canine populations

Market Restraints

- High cost of canine orthopedic surgeries and implants

- Limited awareness and access to specialized veterinary orthopedic care

- Stringent regulatory approvals for veterinary medical devices

Market Opportunities

- Increasing demand for minimally invasive orthopedic procedures in canines

- Expansion of pet insurance coverage for orthopedic treatments

- Growth of emerging markets with rising veterinary infrastructure

Canine Orthopedics Market Report Coverage

|

Market |

Canine Orthopedics Market |

|

Canine Orthopedics Market Size 2023 |

USD 379.8 Million |

|

Canine Orthopedics Market Forecast 2032 |

USD 789.9 Million |

|

Canine Orthopedics Market CAGR During 2024 - 2032 |

8.6% |

|

Canine Orthopedics Market Analysis Period |

2020 - 2032 |

|

Canine Orthopedics Market Base Year |

2023 |

|

Canine Orthopedics Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Product, By Application , By End Use, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Fusion Implants, AmerisourceBergen Corporation, Arthrex, Inc., Veterinary Instrumentation, Orthomed (UK) Ltd, Integra LifeSciences, DePuy Synthes (Johnson & Johnson), Vimian Group AB, Narang Medical Limited, and B. Braun Melsungen AG. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Canine Orthopedics Market Insights

The expanding humanization of pets has resulted in increased spending on their medical care, particularly complex orthopedic procedures. According to the US Chamber of Commerce, Americans spent $123 billion on pets in 2021, a 13% increase over the previous year. More than 114 million households in the United States own a dog or cat. With 32% of millennials and 14% of Gen Z keeping dogs, expenditure on pets is anticipated to increase for many years. Pet owners are increasingly prepared to pay in surgical procedures to improve their pets' mobility and quality of life. This trend is increasing demand for novel orthopedic implants and procedures.

Continuous advancements in veterinary orthopedic implants have transformed canine orthopedics. Puenhua (Ningbo) Medical Technology Co., Ltd is an example of a manufacturing and trade company that provides a wide range of veterinary orthopedic implants and instruments. The company's export percentage ranges from 91% to 100%. It mainly exports to North America, Europe, South America, Asia, the Middle East, Oceania, and Africa.

In addition, in June 2023, Vimian bought New Generation Devices to broaden its veterinary orthopedic implant options. By delivering a diverse range of veterinary orthopedic implants and instruments to global markets, the company improves the accessibility and adoption of modern treatments. As a result, veterinarians are progressively adopting innovative technologies, which fuel market growth.

Canine orthopedic operations like joint replacements and fracture repair, can be costly due to the need for specific equipment and expertise. The high cost limits accessibility, particularly for pet owners without insurance or in low-income areas. Despite rising demand, this financial barrier limits market growth.

Pet owners and veterinarians are increasingly looking for minimally invasive surgeries to alleviate pain, recuperation time, and post-operative complications. Key manufacturers also design novel minimally invasive surgeries, which are driving the veterinary orthopedics market upward. For example, in January 2024, Laurent Guiot, DVM, DACVS, DECVS, created a robotic device to aid in minimally invasive orthopedic surgery for dogs and cats. This increased desire opens up prospects for innovation and expansion in the canine orthopaedic market.

Canine Orthopedics Market Segmentation

The worldwide market for canine orthopedics is split based on product, application, end use, and geography.

Canine Orthopedics Market By Product

- Implants

- Plates

- TPLO Plates

- TTA Plates

- Specialty Plates

- Trauma Plates

- Others

- Others

- Plates

- Instruments

According to the canine orthopedics industry analysis, implants dominate the sector due to their importance in treating fractures, joint ailments, and skeletal deformities. Biomaterial advancements, 3D printing, and personalized implant designs have all improved surgical results and durability. The increased need for joint replacements, plates, and screws among older and injured dogs drives market expansion. Furthermore, increased veterinary skill and access to modern surgical methods have boosted the global usage of orthopedic implants.

Canine Orthopedics Market By Application

- TTA

- TPLO

- Trauma

- Joint Replacement

- Others

The Tibial Plateau Leveling Osteotomy (TPLO) category is predicted to dominate the canine orthopedics market due to its high success rate in treating cranial cruciate ligament (CCL) injuries, which are among the most frequent orthopedic diseases in dogs. TPLO provides better long-term mobility, faster healing, and a lower risk of arthritis than previous procedures. The increased use of this treatment by veterinary surgeons, combined with developments in TPLO plates and surgical techniques, contributes to its canine orthopedic treatment market leadership. Additionally, increased pet insurance coverage and owner willingness to pay in innovative therapies contribute to the growing demand for TPLO operations.

Canine Orthopedics Market By End Use

- Hospitals & Clinics

- Others

According to the canine orthopedics market forecast, hospitals and clinics are the key end-users because they have access to specialized veterinary surgeons, advanced diagnostic technologies, and surgical infrastructure. These institutions provide a wide range of orthopedic operations, such as TPLO, joint replacements, and fracture repairs, offering comprehensive care for canine musculoskeletal disorders. The growing number of veterinary hospitals and specialist clinics, combined with increased pet owner awareness, reinforces their canine orthopedic treatment market dominance. Furthermore, the provision of post-surgical rehabilitation and emergency care services in hospitals improves treatment outcomes, giving them an advantage over other end-user groups.

Canine Orthopedics Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Canine Orthopedics Market Regional Analysis

For several reasons, North America dominates the canine orthopedics market due to high pet ownership rates, increased spending on veterinary care, and widespread use of modern orthopedic procedures. For example, in 2023, dog-owning families spent more per household on veterinary care in a typical year than cat-owning households did in 2024. According to the American Veterinary Medical Association, the average amount for dog owners declined by 7% to $580, while cat owners saw a 6% increase to $433. Furthermore, constant developments in orthopedic implants and surgical techniques help to maintain the region's dominant position. For example, in July 2024, a scientist from Wayne State University (WSU), Dr. Rahul Vaidya, created Bonesetter software, an economical and effective tool for surgery planning in human and animal orthopedic surgeries. The program enables orthopedic surgeons to import digital photos, correctly size implants, and plan surgeries in real time, while also evolving in response to user comments.

The Asia-Pacific region is seeing strong growth in the canine orthopedics market due to increased knowledge of modern orthopedic treatments and the expansion of veterinary facilities, which contribute to market expansion. For example, in April 2024, MaxPetZ Veterinary Hospital in India announced the adoption of 3D printing technology for reconstructive surgery and custom prostheses in a variety of medical fields, including orthopedics and cancer. This novel approach will improve surgical planning and precision, allowing veterinarians to design tailored implants and teaching aids, ultimately increasing the quality of treatment and results for animals. Furthermore, foreign corporations are progressively entering the region, raising the availability of high-quality orthopedic implants and procedures.

Canine Orthopedics Market Players

Some of the top canine orthopedics companies offered in our report include Fusion Implants, AmerisourceBergen Corporation, Arthrex, Inc., Veterinary Instrumentation, Orthomed (UK) Ltd, Integra LifeSciences, DePuy Synthes (Johnson & Johnson), Vimian Group AB, Narang Medical Limited, and B. Braun Melsungen AG.

Frequently Asked Questions

How big is the canine orthopedics market?

The canine orthopedics market size was valued at USD 379.8 million in 2023.

What is the CAGR of the global canine orthopedics market from 2024 to 2032?

The CAGR of canine orthopedics is 8.6% during the analysis period of 2024 to 2032.

Which are the key players in the canine orthopedics market?

The key players operating in the global market are including Fusion Implants, AmerisourceBergen Corporation, Arthrex, Inc., Veterinary Instrumentation, Orthomed (UK) Ltd, Integra LifeSciences, DePuy Synthes (Johnson & Johnson), Vimian Group AB, Narang Medical Limited, and B. Braun Melsungen AG

Which region dominated the global canine orthopedics market share?

North America held the dominating position in canine orthopedics industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of canine orthopedics during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global canine orthopedics industry?

The current trends and dynamics in the canine orthopedics industry include rising pet ownership and increasing expenditure on animal healthcare, advances in veterinary orthopedic implants and surgical techniques, and growing prevalence of musculoskeletal disorders in aging canine populations.

Which application held the maximum share in 2023?

The TPLO application held the maximum share of the canine orthopedics industry.