Building Thermal Insulation Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Building Thermal Insulation Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Global Building Thermal Insulation Market Size accounted for USD 29.6 Billion in 2023 and is estimated to achieve a market size of USD 48.1 Billion by 2032 growing at a CAGR of 5.7% from 2024 to 2032.

Building Thermal Insulation Market Highlights

- Global building thermal insulation market revenue is poised to garner USD 48.1 billion by 2032 with a CAGR of 5.7% from 2024 to 2032

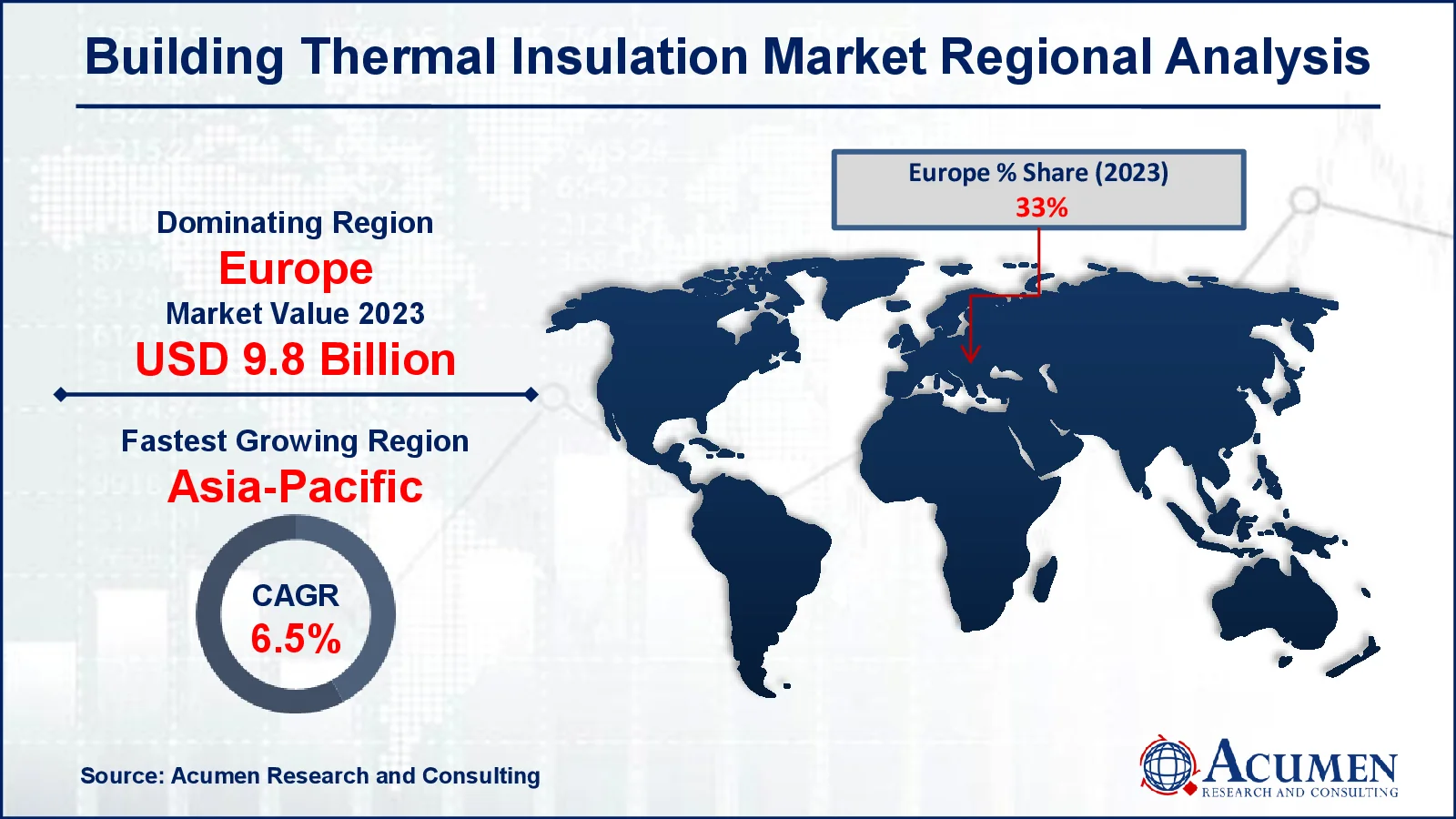

- Europe building thermal insulation market value occupied around USD 9.8 billion in 2023

- Asia-Pacific building thermal insulation market growth will record a CAGR of more than 6.5% from 2024 to 2032

- Among end use, the commercial sub-segment generated over US$ 15.4 billion revenue in 2023

- Based on application, the roof sub-segment generated around 36% building thermal insulation market share in 2023

- Development of eco-friendly and recyclable insulation materials is a popular building thermal insulation market trend that fuels the industry demand

The method of reducing heat transfer between indoor and outdoor environments involves thermal insulation, maintaining ambient temperatures indoors. Thermal insulation in buildings significantly contributes to reducing the carbon footprint by requiring less energy to sustain optimal temperatures and by limiting heat transmission to the external climate. Additionally, it minimizes the impact of outdoor temperatures on indoor environments. Buildings can be thermally insulated using various materials such as fiberglass, plastic foam, and mineral wool, including materials like cotton slag and wool slag. Common foamed materials used include polystyrene, extruded polystyrene, polyurethane, and other plastic variants.

Global Building Thermal Insulation Market Dynamics

Market Drivers

- Stringent energy efficiency regulations in construction

- Growing awareness of environmental sustainability

- Rising demand for energy-efficient buildings.

- Advancements in insulation materials and technologies

Market Restraints

- High initial costs of advanced insulation materials

- Challenges in retrofitting existing structures

- Limited adoption due to lack of awareness in certain regions

Market Opportunities

- Expansion in emerging markets with increasing construction activities

- Technological innovations driving improved insulation performance

- Government incentives promoting energy-efficient construction

Building Thermal Insulation Market Report Coverage

| Market | Building Thermal Insulation Market |

| Building Thermal Insulation Market Size 2022 |

USD 29.6 Billion |

| Building Thermal Insulation Market Forecast 2032 | USD 48.1 Billion |

| Building Thermal Insulation Market CAGR During 2023 - 2032 | 5.7% |

| Building Thermal Insulation Market Analysis Period | 2020 - 2032 |

| Building Thermal Insulation Market Base Year |

2022 |

| Building Thermal Insulation Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, By End-use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BASF SE, Johns Manville Corporation, Kingspan Group plc, Saint-Gobain SA., Knauf Insulation, Inc., Huntsman Corporation, Owens Corning, Rockwool International A/S, Cabot Corporation, Firestone Building Products Company, Dow Corning Corporation, and URSA Insulation, SA. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Building Thermal Insulation Market Insights

Anticipated growth is poised to drive increased residential and commercial adoption of this product, aiming to reduce overall energy costs, bolstered by a growing awareness of energy conservation. The market is expected to benefit significantly from favorable regulations incentivizing reduced energy consumption. Thermal isolation, by reducing dependency on Heating, Ventilation, and Air Conditioning (HVAC) systems, contributes to lowered energy consumption, fostering market growth. Within North America, the U.S. holds the largest market share. Initiatives like the WAP, focused on widespread product adoption in low-income households, are expected to play a pivotal role in propelling this growth.

Favorable building codes in the United States and Canada, along with initiatives like the Leadership in Energy and Environmental Design (LEED) and other national energy certification agencies, are anticipated to positively influence the demand for thermal insulation in buildings, particularly supported by the Green Building Council (USGBC). However, stringent regulations imposed by the U.S. Environmental Protection Agency (EPA) on the use of foamed plastics, attributed to their low biodegradability and carcinogenic nature, could potentially hinder market growth.

During the building thermal insulation industry forecast period, the environmental impacts of insulation materials are likely to shift the industry's focus towards the development of environmentally friendly products. Additionally, the projected rise in plastic foam prices is expected to adversely affect industry growth, prompting the development of alternative products. Stringent regulations governing conventional materials, such as plastic foams, have amplified the popularity of recyclable insulation. The increasing preference among homeowners, architects, and companies for green, biodegradable, and recyclable products is anticipated to elevate the risk of market substitutes, driven by growing environmental awareness.

Building Thermal Insulation Market Segmentation

The worldwide market for building thermal insulation is split based on product, application, end-use, and geography.

Building Thermal Insulation Market By Product

- Glass Wool

- Mineral Wool

- Cellulose

- XPS

- EPS

- Others

Expanded polystyrene (EPS) is poised to exhibit the highest compound annual growth rate (CAGR) in revenues over the projectied period, attributed to its exceptional thermal insulation properties and long service life. The product's non-toxic, versatile, and recyclable features are expected to drive increased preference, further contributing to its growth.

Extracted polystyrene (XPS), known for its ability to mitigate humidity-based damage, water resistance, and energy efficiency, is estimated to experience substantial growth during the building thermal insulation market forecast period. Its capacity to inhibit fungal or microbial growth in insulated spaces is anticipated to bolster this growth trajectory.

Mineral wool insulation, which accounted for an estimated significant market share in 2023, is projected to witness significant growth. Its superior attributes, including fire safety, heat barriers, ecological compliance, and dimensional stability, position it for substantial expansion. The increasing adoption of mineral wool in thermal barrier applications is expected to drive growth.

Other products such as aerogel, cotton wool, and wool slag are forecasted to register moderate growth, propelled by increasing product penetration in North America. Moreover, the rising preference for thermal insulation construction as an alternative to foamed plastic insulation is anticipated to stimulate further growth.

Building Thermal Insulation Market By Applications

- Walls

- Roof

- Floor

According to building thermal insulation industry analysis, roof appliances accounted for over 36% of the market in 2023 and are projected to experience substantial growth in the forecast period, attributed to increasing heat diffusion from sunlight through roofs. Moreover, the rising number of single housing units will contribute to market expansion.

In 2023, wall insulation had a significant market share in the thermal insulation market for buildings and was anticipated to grow in terms of revenue during the forecast period. This growth is driven by the increasing use of insulation products in exterior and inland facilities. Additionally, increased product penetration is expected to bolster industry growth for cavity wall insulation.

Moderate growth is projected for HVAC applications due to the escalating demand to reduce energy costs. Thermal insulation appliances for flooring, including garage, basement, cantilever, and space, play a crucial role. The market for floor isolation in extremely cold regions is expected to grow due to increased product penetration.

Building Thermal Insulation Market By End-uses

- Commercial

- Residential

As per the building thermal insulation market forecast, the commercial construction sector, approximately 52% of the total revenue in 2023 was attributed. The forecasted growth is anticipated to be fueled by heightened emphasis on energy efficiency in commercial and public buildings. This emphasis stems from elevated energy costs, leading to increased maintenance expenses.

Residential construction is estimated to experience a significant rise of 48 percent during the forecast period, primarily driven by the substantial growth in single-unit housing and the ongoing renovation and reinsulation of older houses. Additionally, the projected increase in multi-family building activities is poised to further support market expansion.

Building Thermal Insulation Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Building Thermal Insulation Market Regional Analysis

In 2023, Europe held the largest building thermal insulation market share, with more than 33%. It is anticipated to remain the main market by 2032. Initiatives promoting thermal insulation for energy conservation, such as the registration, evaluation, authorizations, and limitation of chemicals (REACH) by the European Commission, are expected to drive regional growth. In North America, a surge in residential and commercial building operations, coupled with stringent adherence to green building codes, is projected to stimulate growth by reducing energy consumption per structure. Favorable government regulations are also anticipated to bolster growth for both residential and commercial structures over the forecast period. The Asia-Pacific region, experiencing increasing construction activities due to growing population demands, is expected to achieve the highest growth rates. China, propelled by government efforts to enhance public infrastructure, is estimated to hold the largest share in this region. However, in Central and South America, political and economic instability may adversely impact regional market growth. Yet, governmental efforts to improve the economic situation are expected to spur growth in the near future.

Building Thermal Insulation Market Players

Some of the top Building Thermal Insulation companies offered in our report include BASF SE, Johns Manville Corporation, Kingspan Group plc, Saint-Gobain SA., Knauf Insulation, Inc., Huntsman Corporation, Owens Corning, Rockwool International A/S, Cabot Corporation, Firestone Building Products Company, Dow Corning Corporation, and URSA Insulation, SA.

Frequently Asked Questions

How big is the building thermal insulation market?

The market size of building thermal insulation was USD 29.6 billion in 2023.

What is the CAGR of the global building thermal insulation market from 2024 to 2032?

The CAGR of building thermal insulation is 5.7% during the analysis period of 2024 to 2032.

Which are the key players in the building thermal insulation market?

The key players operating in the global market are including BASF SE, Johns Manville Corporation, Kingspan Group plc, Saint-Gobain SA., Knauf Insulation, Inc., Huntsman Corporation, Owens Corning, Rockwool International A/S, Cabot Corporation, Firestone Building Products Company, Dow Corning Corporation, and URSA Insulation, SA.

Which region dominated the global building thermal insulation market share?

Europe held the dominating position in building thermal insulation industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of building thermal insulation during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global building thermal insulation industry?

The current trends and dynamics in the building thermal insulation industry include stringent energy efficiency regulations in construction, growing awareness of environmental sustainability, rising demand for energy-efficient buildings, and advancements in insulation materials and technologies.

Which product held the maximum share in 2023?

The EPS product held the maximum share of the building thermal insulation industry.