Blockchain in Healthcare Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Blockchain in Healthcare Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

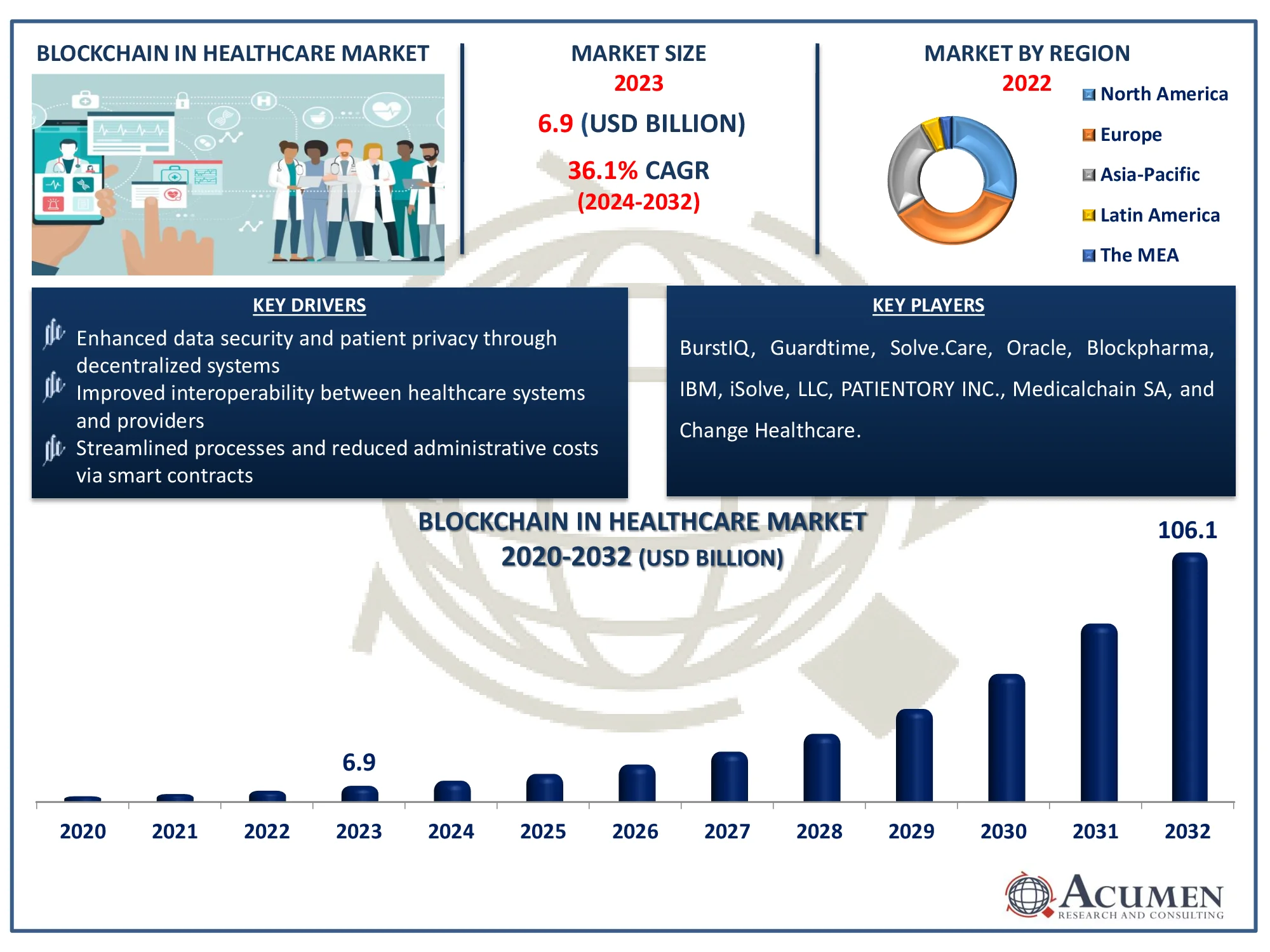

The Global Blockchain in Healthcare Market Size accounted for USD 6.9 Billion in 2023 and is estimated to achieve a market size of USD 106.1 Billion by 2032 growing at a CAGR of 36.1% from 2024 to 2032.

Blockchain in Healthcare Market Highlights

- The global blockchain in healthcare market is projected to reach USD 106.1 billion by 2032, with a CAGR of 36.1% from 2024 to 2032

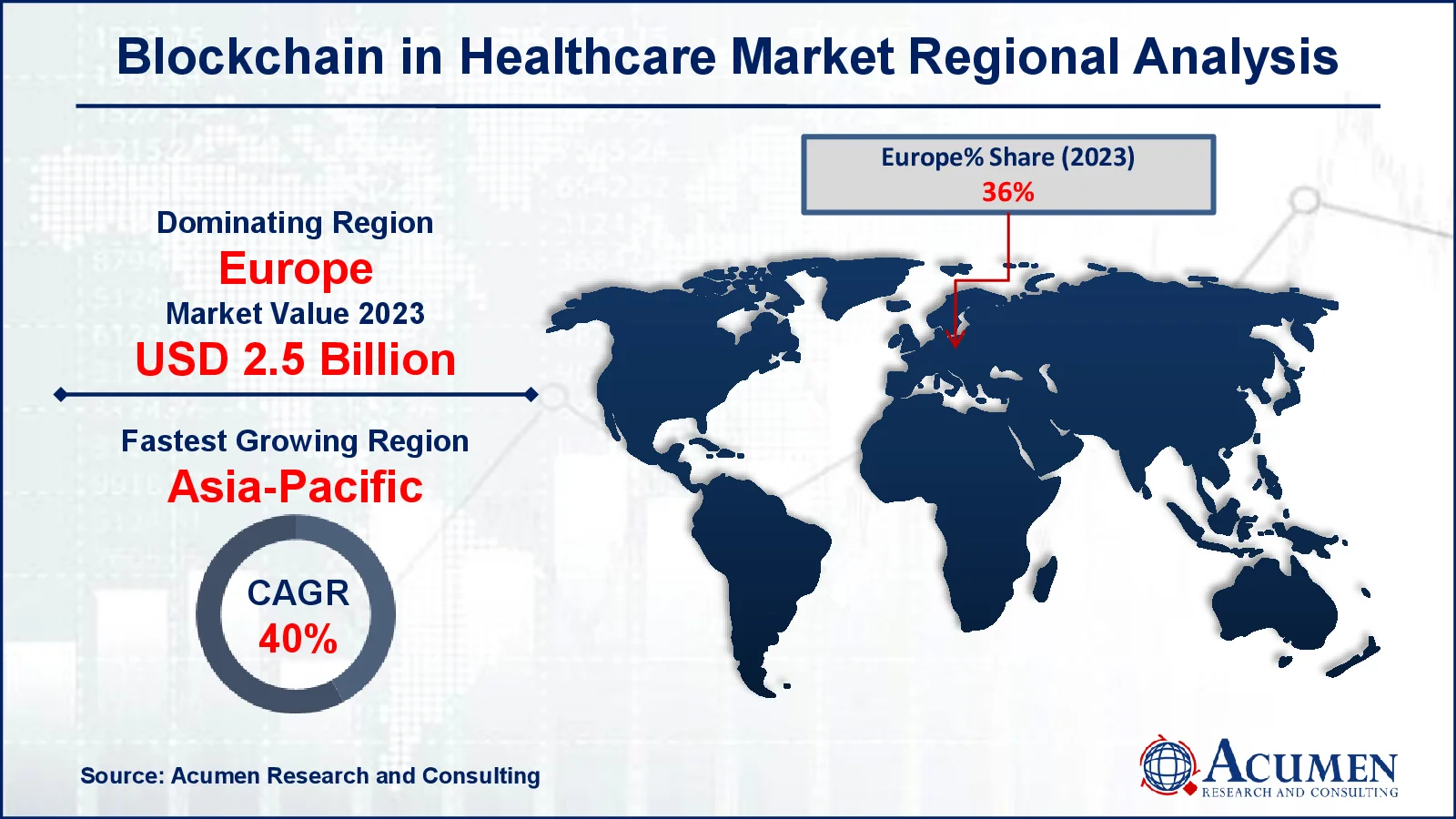

- In 2023, the European blockchain in healthcare market was valued at approximately USD 2.5 billion

- The Asia-Pacific region is anticipated to grow at a CAGR exceeding 40% from 2024 to 2032

- The public network type held 57% of the market share in 2023

- The supply chain management application sub-segment accounted for 26% of the market share in 2023

- Biopharmaceutical and medical device companies, as end-users, captured 41% of the market share in 2023

- Healthcare organizations are leveraging blockchain to enhance the traceability and authenticity of pharmaceuticals and medical devices in the supply chain is the blockchain in healthcare market trend that fuels the industry demand

The blockchain is a distributed database that stores records of all transactions and payments made by different parties. The blockchain includes a precise and verifiable record of every transaction ever made. Blockchain technology is an innovative and critical technology since it serves as proof of all transactions on the network. It generates a chain of all the blocks stored in the system. The blockchain technology contributes to the maintenance of a complete database of all addresses and their balances from the origin blocks to the most recent blocks, which is critical for driving market growth.

Global Blockchain in Healthcare Market Dynamics

Market Drivers

- Enhanced data security and patient privacy through decentralized systems

- Improved interoperability between healthcare systems and providers

- Streamlined processes and reduced administrative costs via smart contracts

Market Restraints

- Regulatory and compliance challenges in implementing blockchain technology

- High initial setup costs and the need for specialized expertise

- Limited awareness and understanding of blockchain among healthcare stakeholders

Market Opportunities

- Increased patient engagement and control over personal health data

- Potential for innovative solutions in supply chain management for pharmaceuticals

- Growth in telehealth and remote patient monitoring solutions utilizing blockchain

Blockchain in Healthcare Market Report Coverage

| Market | Blockchain in Healthcare Market |

| Blockchain in Healthcare Market Size 2022 |

USD 6.9 Billion |

| Blockchain in Healthcare Market Forecast 2032 | USD 106.1 Billion |

| Blockchain in Healthcare Market CAGR During 2023 - 2032 | 36.1% |

| Blockchain in Healthcare Market Analysis Period | 2020 - 2032 |

| Blockchain in Healthcare Market Base Year |

2022 |

| Blockchain in Healthcare Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Network Type, By Application, By End-Users, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BurstIQ, Guardtime, Solve.Care, Oracle, Blockpharma, IBM, iSolve, LLC, PATIENTORY INC., Medicalchain SA, and Change Healthcare. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Blockchain in Healthcare Market Insights

The global blockchain in healthcare market is being pushed primarily by an increase in demand for innovative and advanced technologies in banking, financial institutions, insurance, and other sectors. Rising bit coin market capitalization and an increased need for speedier transactions have spurred market expansion. The use of block chain in healthcare is still in its early stages, but it is expected to increase steadily. Furthermore, increased healthcare spending and the adoption of healthcare IT have fueled market expansion.

However, people in developing nations are not aware of the benefits of this technology. Thus, a lack of public knowledge may limit the market's growth. The high adoption of blockchain technology for payments, smart contracts, and digital identities will generate a tremendous opportunity for blockchain development in the healthcare market during the projection period.

Blockchain technology has transformed the pharmaceutical industry, including drug discovery, development, and delivery. The introduction of the drug, which reduced the length of the clinical trial, has aided in the release of new and advanced treatments into the market.

Increased patient engagement and control over personal health data represent a big opportunity for blockchain in the healthcare industry. For instance, a recent survey found that patients are concerned about the security and confidentiality of their personal health information in this interconnected society. According to a survey conducted by the American Medical Association (AMA), more than 92% of patients believe that privacy is a fundamental right and that their health data should not be sold. Patients may securely store and manage their health information using blockchain technology, guaranteeing they have access to it at all times. This decentralization allows individuals to make more informed decisions about their care and treatment alternatives, resulting in more engagement in their healthcare journey.

Furthermore, blockchain enables the sharing of health records among authorized providers while protecting privacy, resulting in better care coordination. As patients become more engaged, healthcare companies can benefit from increased data accuracy and insights, ultimately improving patient outcomes.

Blockchain in Healthcare Market Segmentation

The worldwide market for blockchain in healthcare is split based on network type, application, end-users, and geography.

Blockchain in Healthcare Network Type

- Private

- Public

- Others

According to the blockchain in healthcare industry analysis, because of its widespread adoption by government organizations and other government agencies, the general public is likely to hold the majority of the market share. These networks enable various parties, including patients, providers, and insurers, to securely access and verify data without relying on a central authority, boosting collaboration. Furthermore, public blockchains enable the sharing of health records and clinical data while maintaining data integrity and confidentiality, making them extremely useful for healthcare applications.

Blockchain in Healthcare Application

- Clinical Data Exchange & Interoperability

- Claims Adjudication & Billing

- Supply Chain Management

- Clinical Trials & eConsent

- Others

According to the blockchain in healthcare industry analysis, the major application of blockchain in the healthcare business is supply chain management, which improves medical product traceability and security. Healthcare providers can use blockchain's transparency to trace drugs, medical devices, and equipment from manufacturing to delivery, lowering the danger of counterfeit goods. This assures regulatory compliance and builds trust in the supplier chain. Additionally, blockchain's immutable record enables efficient inventory management and recall processes, making it critical for healthcare logistics.

Blockchain in Healthcare End-users

- Providers

- Payers

- Biopharmaceutical & Medical Device Companies

- Others

According to the blockchain in healthcare market forecast, biopharmaceutical and medical device firms lead the market due to their need for improved data security, traceability, and compliance. Blockchain enables these organizations to keep an immutable record of clinical trials, medicine development, and product testing, ensuring data integrity and regulatory compliance. It also enables the secure exchange of critical research and patient data across worldwide supply chains, reducing dangers such as counterfeit items. This adoption increases transparency, efficiency, and confidence in the pharmaceutical and medical device manufacturing and distribution processes.

Blockchain in Healthcare Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Blockchain in Healthcare Market Regional Analysis

For several reasons, Europe dominates blockchain in healthcare market, which is owing to the widespread acceptance of blockchain technology. The market will develop as the IT population and industrialization grow, finance becomes available, and healthcare infrastructure continues to improve. The increasing implementation of blockchain in healthcare will help to drive market growth. Furthermore, changes in regulatory rules and an increase in the need for advanced analytics solutions and services in the healthcare industry are driving the growth of the blockchain in healthcare market in this area. The primary driver of market expansion is the rising demand for smart city infrastructure and healthcare, combined with rapid infrastructure development and favorable economic conditions. Furthermore, several government measures to promote digitization are projected to create new growth prospects for businesses. The rapidly rising digitalization will give an excellent platform for market growth.

Asia-Pacific has the second largest market, due to increased healthcare spending, and advanced technology. An increasing number of mid-sized and small businesses are turning to advanced technology, is one of the primary factors driving the market in this region. Huge spending on healthcare technology and increased investment will help the sector thrive.

The Middle East and Africa have the smallest market share due to the existence of poor-economy countries in the African area. The Middle East dominates the Middle East and Africa market due to the presence of well-developed economies such as Kuwait, Qatar, Oman, and others. The Middle Eastern countries' high spending will help them earn a significant portion of the blockchain in healthcare market. On the other hand, the African region will provide a significant possibility for market development.

Blockchain in Healthcare Market Players

Some of the top blockchain in healthcare companies offered in our report include BurstIQ, Guardtime, Solve.Care, Oracle, Blockpharma, IBM, iSolve, LLC, PATIENTORY INC., Medicalchain SA, and Change Healthcare.

Frequently Asked Questions

How big is the blockchain in healthcare market?

The blockchain in healthcare market size was valued at USD 6.9 billion in 2023.

What is the CAGR of the global blockchain in healthcare market from 2024 to 2032?

The CAGR of blockchain in healthcare is 36.1% during the analysis period of 2024 to 2032.

Which are the key players in the blockchain in healthcare market?

The key players operating in the global market are including BurstIQ, Guardtime, Solve.Care, Oracle, Blockpharma, IBM, iSolve, LLC, PATIENTORY INC., Medicalchain SA, and Change Healthcare.

Which region dominated the global blockchain in healthcare market share?

Europe held the dominating position in blockchain in healthcare industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of blockchain in healthcare during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global blockchain in healthcare industry?

The current trends and dynamics in the blockchain in healthcare industry include enhanced data security and patient privacy through decentralized systems, improved interoperability between healthcare systems and providers, and streamlined processes and reduced administrative costs via smart contracts.

Which network type held the maximum share in 2023?

The public network type held the maximum share of the blockchain in healthcare industry.