Healthcare It Market | Acumen Research and Consulting

Healthcare IT Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

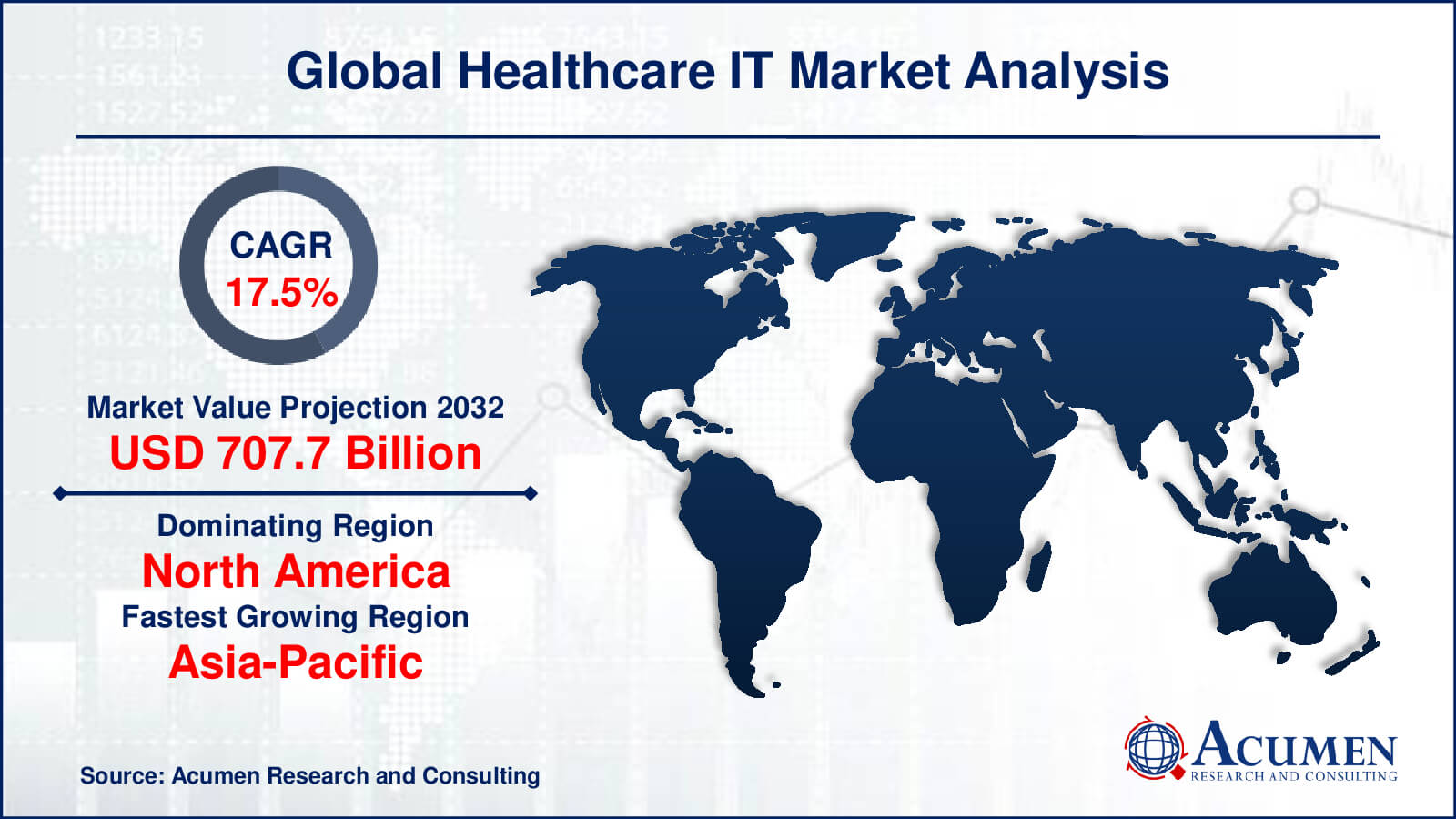

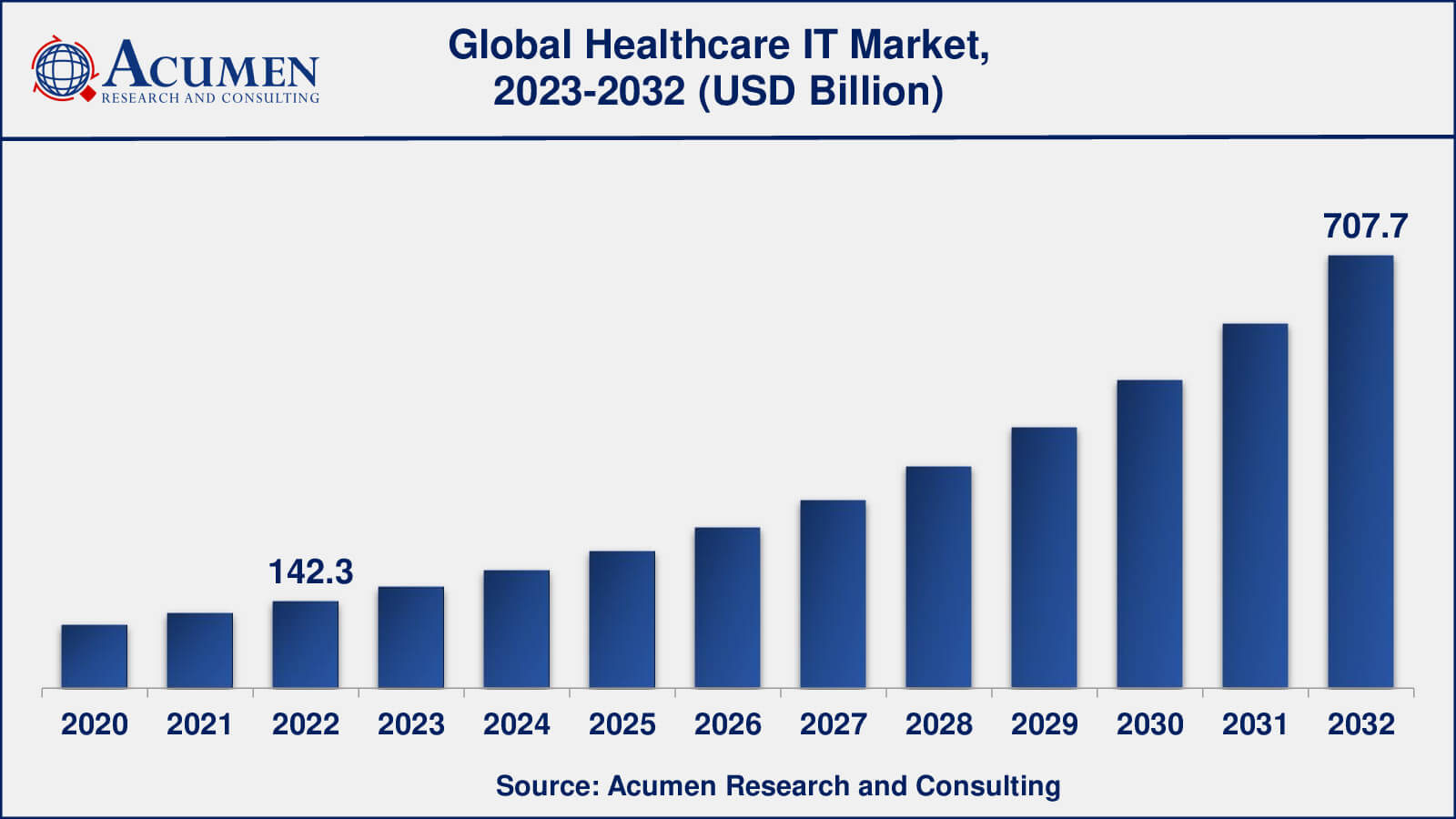

The Global Healthcare IT Market Size collected USD 142.3 Billion in 2022 and is set to achieve a market size of USD 707.7 Billion in 2032 growing at a CAGR of 17.5% from 2023 to 2032.

Healthcare IT Market Statistics

- Global healthcare IT market revenue is estimated to reach USD 707.7 billion by 2032 with a CAGR of 17.5% from 2023 to 2032

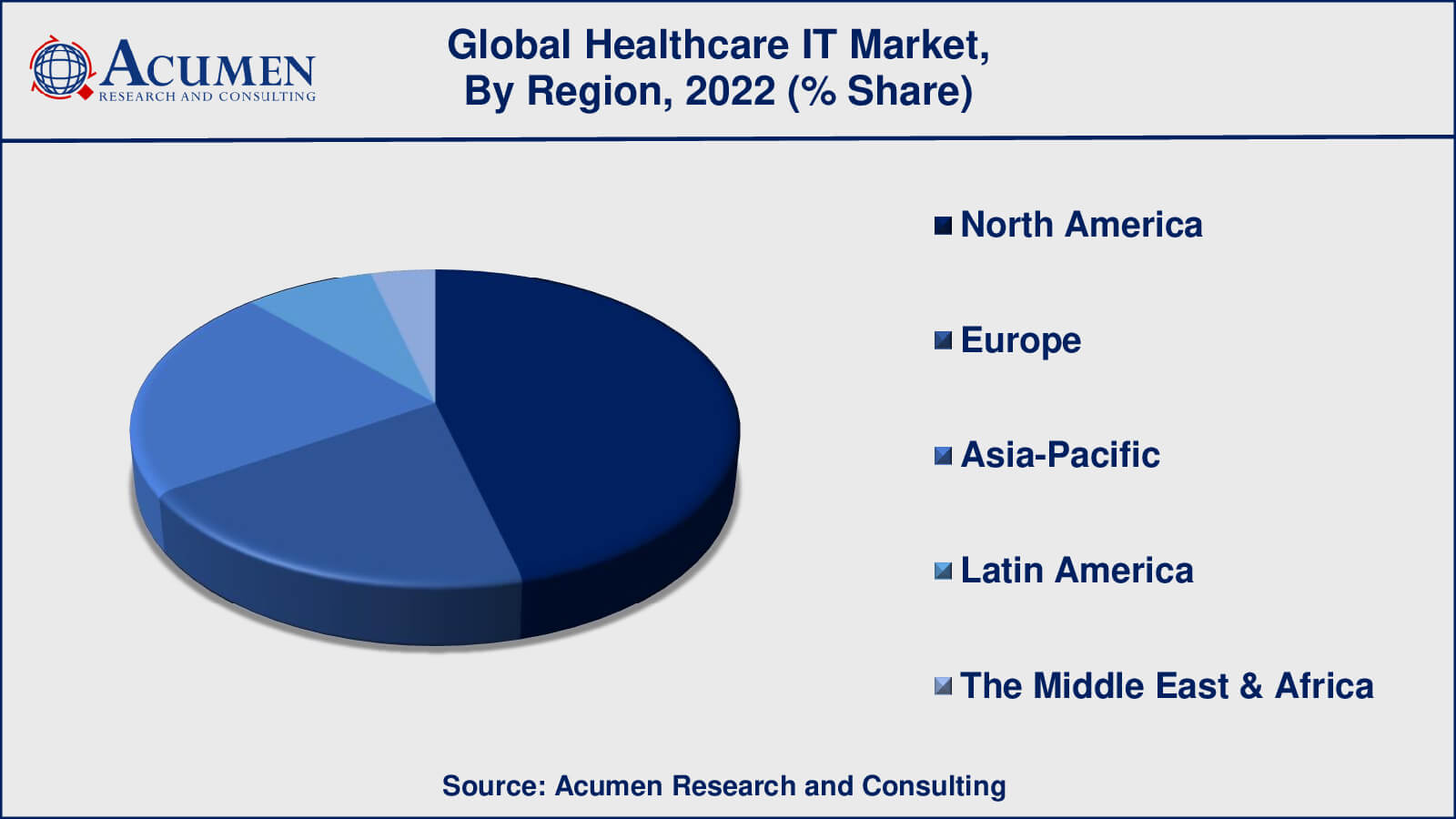

- North America healthcare IT market value occupied around USD 65.5 billion in 2022

- Asia-Pacific healthcare IT market growth will register a CAGR of around 18% from 2023 to 2032

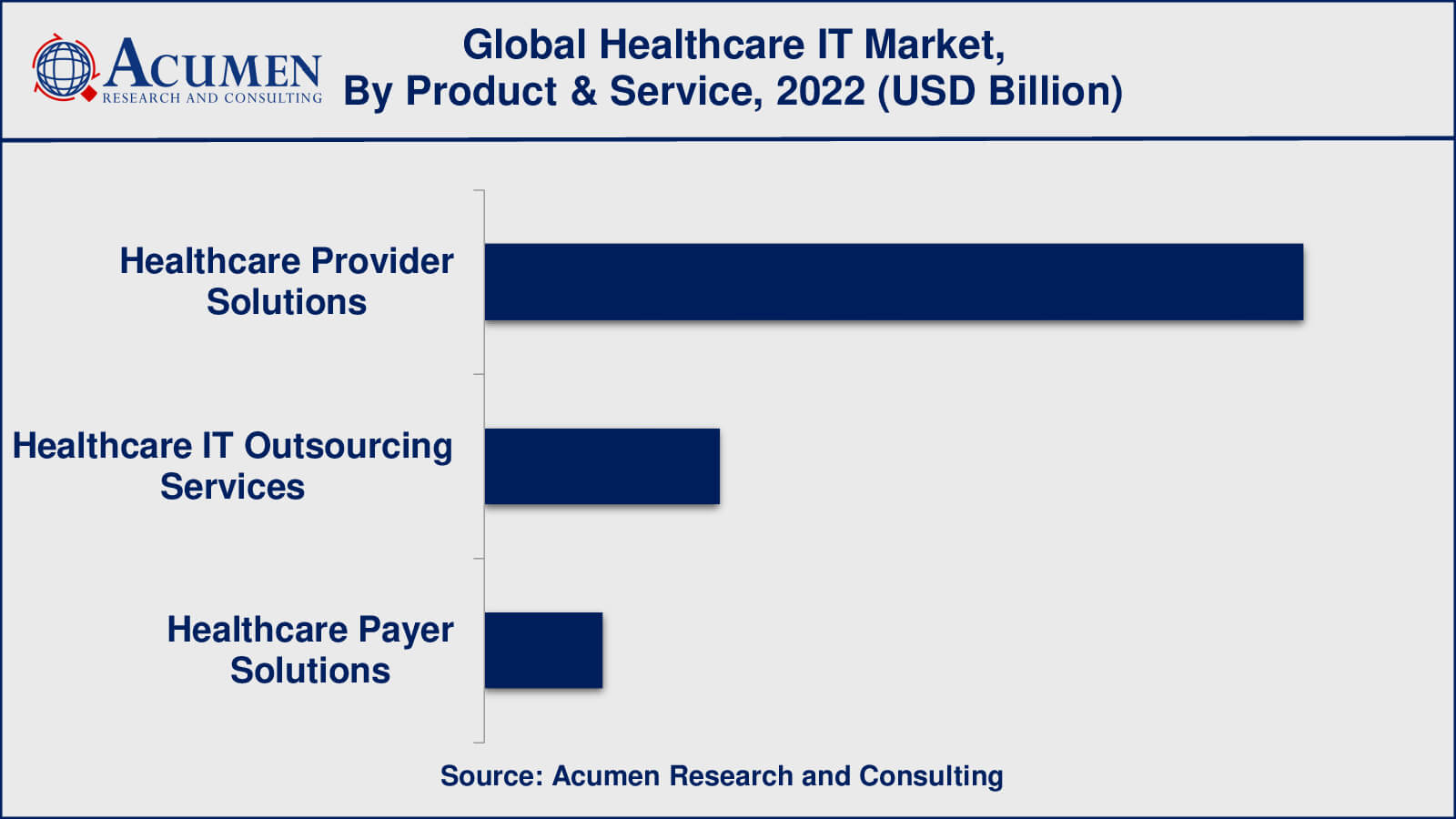

- Among product & service, the healthcare provider solutions sub-segment generated over US$ 99.6 billion revenue in 2022

- Based on end-user, the healthcare providers sub-segment generated more than 50% share in 2022

- Rise of artificial intelligence (AI) and machine learning is a popular healthcare IT market trend that fuels the industry demand

Healthcare IT refers to the offering of IT solutions to the healthcare industry. Healthcare IT solutions provide improved management of data and safe exchange of health-related information with the government, patients, consumers, and insurers. Healthcare IT solutions witness a massive demand for general applications including medical record systems and electronic health along with computerized physician order entry systems. It also provides specialized solutions such as clinical trial management systems, data mining systems, and clinical decision support systems. Moreover, several software solutions such as e-prescribing systems, hospital information systems, ambulatory care management systems, patient management systems, etc are being widely adopted by hospitals and clinics to deliver improved and efficient care for patients. The advantages of adopting healthcare IT solutions result in a reduction in healthcare costs, a decline in medical errors, and increased successful medical procedure outcomes coupled with growth in the productivity of healthcare.

For example, the government of the U.S. passed various regulatory norms and acts thus focusing on the endorsement of e-healthcare by both private and public sector units, hence decreasing healthcare costs. In addition, the commencement of cloud computing in the healthcare industry has further attenuated the overall real-time exchange of data. Owing to the fast transformation witnessed in developed economies such as the US in North America and EU5 countries in Europe, the outsourcing of information technology to several other countries wherein relatively cheaper solutions can be achieved has been greatly exploited by key market players. Other countries such as China, India, Singapore, and Indonesia are declared as the major information technology outsourcing centers, thus serving other nations in keeping down their IT expenses. The key areas where healthcare IT solutions can be deployed include pharmaceutical research, biomedical research, proteomics, and genetics as well as life science information technology, bio-simulation, disease research, biotechnology, and others. The application of healthcare IT in forensics and insurance is a rising trend.

Global Healthcare IT Market Dynamics

Market Drivers

- Increasing demand for digital healthcare solutions

- Growing adoption of electronic health records (EHRs)

- Rising government initiatives to promote healthcare IT

Market Restraints

- Data security and privacy concerns

- High implementation costs

- Lack of interoperability

Market Opportunities

- Increasing focus on improving the quality of patient care

- Adoption of cloud-based healthcare solutions

- Increasing use of telemedicine

Healthcare IT Market Report Coverage

| Market | Healthcare IT Market |

| Healthcare IT Market Size 2022 | USD 142.3 Billion |

| Healthcare IT Market Forecast 2032 | USD 707.7 Billion |

| Healthcare IT Market CAGR During 2023 - 2032 | 17.5% |

| Healthcare IT Market Analysis Period | 2020 - 2032 |

| Healthcare IT Market Base Year | 2022 |

| Healthcare IT Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product & Service, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Allscripts Healthcare Solutions, Inc., McKesson Corporation, Epic Systems Corporation, Athenahealth, Inc., Siemens Healthcare, GE Healthcare, Carestream Health Cerner Corporation, eClinicalworks, and Philips Healthcare. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Healthcare IT Market Growth Factors

Growing demand for adherence to regulatory guidelines is a key factor driving the growth of the global healthcare IT market. Rising initiatives by governments for high return on investment, e-health coupled with rising needs to retrench escalating costs of healthcare. Moreover, scarcity of knowledge of the in-house information technology domain as well as reluctance among various end users to adopt new trends is some major factors hampering the growth of the healthcare IT market.

Healthcare IT Market Segmentation

The worldwide market for healthcare IT is categorized based on product & service, end-user, and geography.

Healthcare IT Industry Product & Service Outlook

- Healthcare Provider Solutions

- Clinical Solutions

- Non-Clinical Solutions

- Healthcare Payer Solutions

- Pharmacy

- Analysis and Audit

- Claims Management

- Fraud Management

- Computer-Assisted Coding Systems

- Payment Management

- Provider Network Management

- Member Eligibility Management

- Customer Relationship Management

- Medical Document Management

- Other (General Ledger & Payroll Management)

- Healthcare IT Outsourcing Services

- Payer Healthcare IT Outsourcing Services

- Provider Healthcare IT Outsourcing Services

- IT Infrastructure Management Services

- Operational Healthcare IT Outsourcing Services

Healthcare provider solutions, according to the healthcare IT industry analysis, refer to a variety of software and technology tools designed to assist healthcare providers in managing patient care, streamlining operations, and improving efficiency. These solutions are applicable in a variety of healthcare settings, such as hospitals, clinics, and physician practices. Electronic healthcare records (EHRs), clinical decision support systems (CDSS), telemedicine, patient engagement solutions, and healthcare analytics are some of the healthcare provider solutions. The significance of healthcare provider solutions lies in their ability to improve patient care quality, lower healthcare costs, and increase operational efficiency. Healthcare providers can better manage patient care, reduce medical errors, and improve patient outcomes by implementing these solutions. They can also assist providers in meeting regulatory requirements and improving their financial performance.

Healthcare IT Industry End-User Outlook

- Healthcare Providers

- Hospitals

- Diagnostic & Imaging Centers

- Pharmacies

- Nursing Homes

- Others

- Healthcare Payers

- Public Payers

- Private Payers

According to the healthcare IT market forecast, the healthcare provider sub-segment will gain a significant market share between 2023 and 2032. Healthcare providers are widely regarded as the primary users of healthcare IT solutions. This is due to the fact that healthcare providers are responsible for directly providing healthcare services to patients, and healthcare IT solutions are critical to managing patient care and improving clinical outcomes. Electronic health records (EHRs), telemedicine, clinical decision support systems, healthcare analytics, and patient engagement solutions are used by healthcare providers to manage patient care, reduce medical errors, and improve patient outcomes.

In contrast, healthcare payers use healthcare IT solutions to manage claims, improve data analytics, and reduce administrative costs. Claims management systems, payment processing solutions, and population health management tools are popular healthcare IT solutions for healthcare payers.

Healthcare IT Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Healthcare IT Market Regional Analysis

North America is the biggest market for healthcare IT solutions and is projected to keep on dominating the market owing to the rapid adoption rate of advanced technologies such as telemedicine, EHRs, and healthcare analytics. The presence of major healthcare IT companies, as well as favorable government policies, is fueling market growth in this region.

Europe is another significant market for healthcare IT solutions, owing to rising government investments in healthcare infrastructure and the acceptance of electronic health initiatives. In addition, the region is seeing an increase in demand for telemedicine and remote patient monitoring solutions.

Due to rising healthcare spending, increased adoption of digital technologies, and the rising prevalence of chronic diseases, Asia-Pacific is expected to be the fastest-growing market for healthcare IT solutions. In addition, the region is seeing the emergence of new healthcare IT companies as well as partnerships with established players.

Healthcare IT Market Players

Some of the healthcare IT companies include Allscripts Healthcare Solutions, Inc., McKesson Corporation, Epic Systems Corporation, Athenahealth, Inc., Siemens Healthcare, GE Healthcare, Carestream Health, Cerner Corporation, eClinicalworks, and Philips Healthcare.

Frequently Asked Questions

What was the market size of the global healthcare IT in 2022?

The market size of healthcare IT was USD 142.3 Billion in 2022.

What is the CAGR of the global healthcare IT market from 2023 to 2032?

The CAGR of healthcare IT is 17.5% during the analysis period of 2023 to 2032.

Which are the key players in the Healthcare IT market?

The key players operating in the global market are including Allscripts Healthcare Solutions, Inc., McKesson Corporation, Epic Systems Corporation, Athenahealth, Inc., Siemens Healthcare, GE Healthcare, Carestream Health, Cerner Corporation, eClinicalworks, and Philips Healthcare.

Which region dominated the global healthcare IT market share?

North America held the dominating position in healthcare IT industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of healthcare IT during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global healthcare IT industry?

The current trends and dynamics in the healthcare IT industry include increasing demand from various end-use industries, growing demand for durable and long-lasting coatings, and rising consumer awareness about the benefits of healthcare IT.

Which product & service held the maximum share in 2022?

The healthcare provider solutions product & service held the maximum share of the healthcare IT industry.