Biocides Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Biocides Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

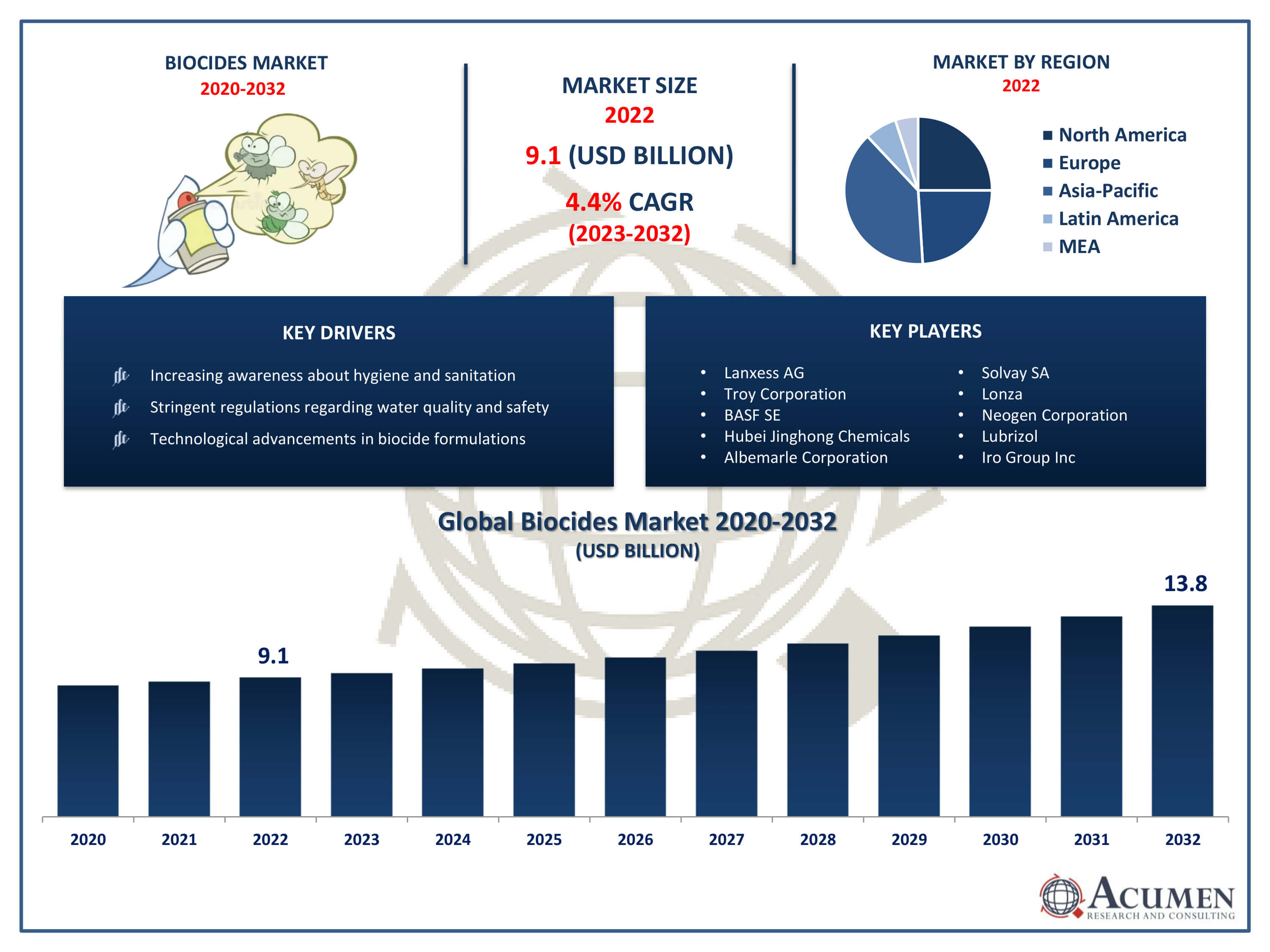

The Biocides Market Size accounted for USD 9.1 Billion in 2022 and is projected to achieve a market size of USD 13.8 Billion by 2032 growing at a CAGR of 4.4% from 2023 to 2032.

Biocides Market Highlights

- Global biocides market revenue is expected to increase by USD 13.8 billion by 2032, with a 4.4% CAGR from 2023 to 2032

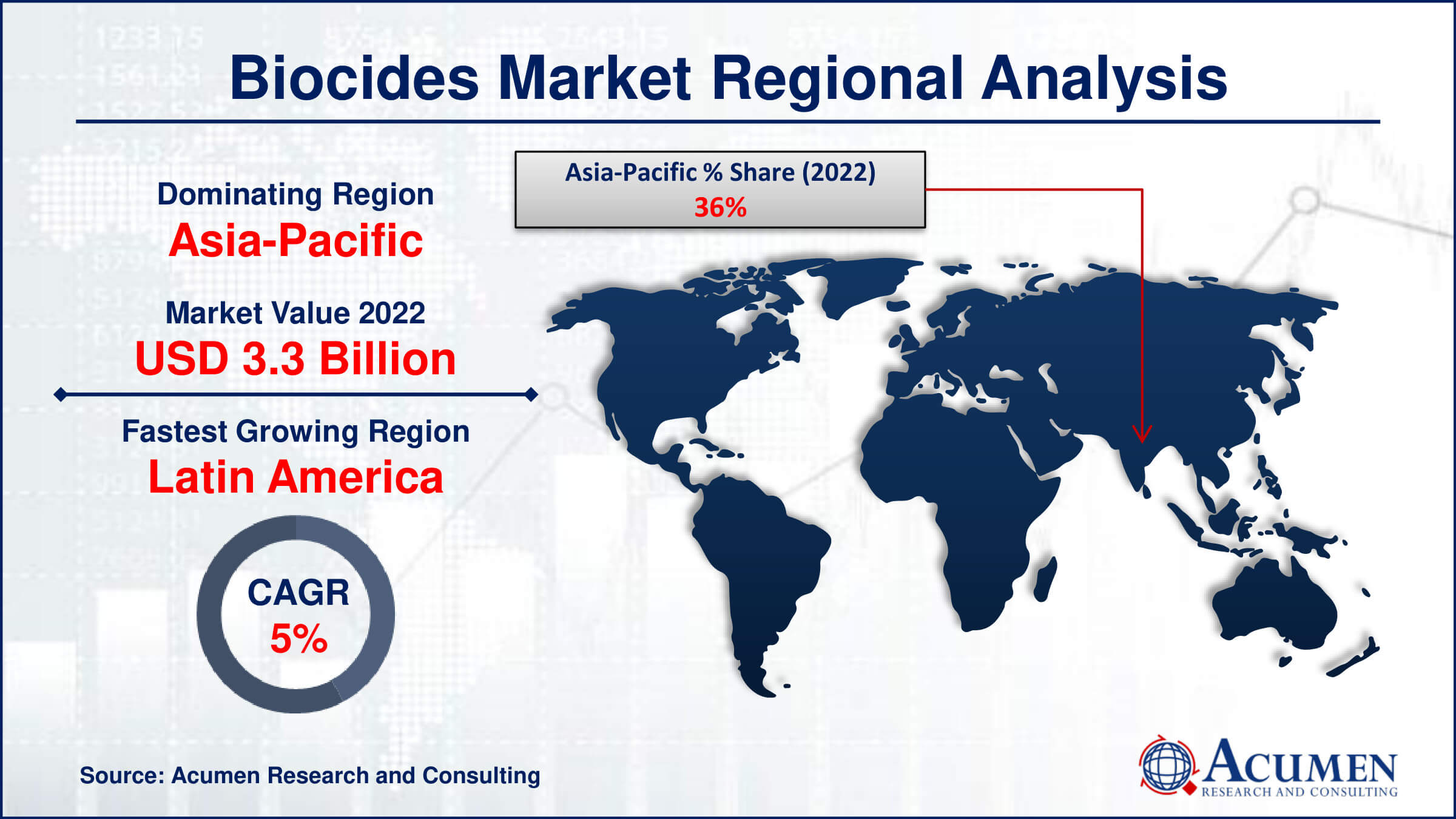

- Asia-Pacific region led with more than 36% of biocides market share in 2022

- Latin America biocides market growth will record a CAGR of more than 5.1% from 2023 to 2032

- By type, the halogen compounds are the largest segment of the market, accounting for over 26% of the global market share

- By application, the water treatment is one of the largest and fastest-growing segments of the biocides industry

- Increasing awareness about hygiene and sanitation, drives the biocides market value

Biocides are chemical substances or microorganisms used to control or inhibit the growth of harmful organisms such as bacteria, fungi, algae, and viruses. They find applications across various industries including water treatment, agriculture, healthcare, personal care, and construction to prevent the proliferation of pathogens and spoilage organisms. Biocides function by disrupting essential cellular processes or structures in target organisms, thereby rendering them inactive or killing them outright.

Biocides are chemical substances or microorganisms used to control or inhibit the growth of harmful organisms such as bacteria, fungi, algae, and viruses. They find applications across various industries including water treatment, agriculture, healthcare, personal care, and construction to prevent the proliferation of pathogens and spoilage organisms. Biocides function by disrupting essential cellular processes or structures in target organisms, thereby rendering them inactive or killing them outright.

The market for biocides has witnessed significant growth in recent years, driven by several factors. One major driver is the increasing awareness of hygiene and sanitation across various sectors, particularly in healthcare and food processing industries. For instance, the Safeguard Spread Health across China, Handwashing in Action Program initiated at the Beijing Water Cube in 2023 aims to educate 100 million people on hygiene practices and proper handwashing techniques as part of Safeguard's commitment to the #Spread Health across China# initiative since 2020. Additionally, the growing demand for clean water, coupled with stringent regulations regarding water quality and safety, has led to the widespread adoption of biocides in water treatment applications. For example, U.S. water quality regulations are stringent, supporting the use of EPA-registered biocides in water treatment plants, with facilities like the Blue Plains Advanced WWTP actively utilizing biocides. Furthermore, the expansion of key end-user industries such as agriculture, paints and coatings, and personal care products has also contributed to the growth of the biocides market. Moreover, technological advancements and innovations in biocide formulations have led to the development of more effective and environmentally friendly products, further driving market growth.

Global Biocides Market Trends

Market Drivers

- Increasing awareness about hygiene and sanitation

- Stringent regulations regarding water quality and safety

- Technological advancements in biocide formulations

- Growing demand for clean water

Market Restraints

- Regulatory restrictions on certain biocide compounds

- Concerns about environmental impact and bioaccumulation

Market Opportunities

- Development of environmentally friendly biocide formulations

- Integration of biocides in novel applications such as healthcare and electronics

Biocides Market Report Coverage

| Market | Biocides Market |

| Biocides Market Size 2022 | USD 9.1 Billion |

| Biocides Market Forecast 2032 |

USD 13.8 Billion |

| Biocides Market CAGR During 2023 - 2032 | 4.4% |

| Biocides Market Analysis Period | 2020 - 2032 |

| Biocides Market Base Year |

2022 |

| Biocides Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Lanxess AG, Troy Corporation, BASF SE, Hubei Jinghong Chemicals Co. Ltd., Albemarle Corporation, Shanghai ZhongxinYuxiang Chemicals Co. Ltd., Solvay SA, Lonza, Neogen Corporation, Lubrizol, Iro Group Inc, and Wuxi Honor Shine Chemical Co. Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Biocides are a diverse group of chemical substances or microorganisms that are designed to control, prevent, or destroy harmful organisms such as bacteria, fungi, algae, and viruses. They play a crucial role in various industries where the growth of these organisms can lead to spoilage, contamination, or health hazards. Biocides work by disrupting essential cellular processes or structures in target organisms, ultimately leading to their inactivation or death. These substances are employed in a wide range of applications spanning industries such as water treatment, agriculture, healthcare, personal care, and manufacturing. In water treatment, biocides are utilized to disinfect and purify water by eliminating pathogens and preventing microbial growth in reservoirs, pipelines, and storage tanks. In agriculture, they are used to protect crops from fungal diseases, bacterial infections, and other pests, thereby enhancing crop yield and quality. Biocides also find extensive use in healthcare settings for disinfecting surfaces, medical equipment, and healthcare facilities to prevent the spread of infectious diseases.

The biocides industry has experienced robust growth in recent years, propelled by increasing concerns regarding hygiene, sanitation, and water quality across various industries. For instance, the 2023 Water Quality Survey reveals that concern about the quality of unfiltered tap water in American homes has more than doubled, increasing by 106% since 2021. Stringent regulations aimed at ensuring water safety and quality has further bolstered the demand for biocides in water treatment applications. For example, the U.S. Environmental Protection Agency (EPA) is anticipated to introduce new measures to eliminate lead from drinking water.

Moreover, heightened awareness about the spread of pathogens and infectious diseases has led to a surge in the use of biocides in healthcare facilities, food processing, and personal care products. These factors, combined with the expansion of key end-user industries such as agriculture, paints and coatings, and household disinfectants, have contributed to the sustained growth of the biocides industry. Furthermore, technological advancements in biocide formulations have resulted in the development of more effective and environmentally friendly products, driving further market growth. Manufacturers are investing in research and development to create biocides with enhanced efficacy, longer persistence, and reduced environmental impact.

Biocides Market Segmentation

The global biocides market segmentation is based on type, application, and geography.

Biocides Market By Type

- Halogen Compounds

- Metallic Compounds

- Quaternary Ammonium Compounds

- Phenolic

- Organosulfur

- Organic Acids

- Others

In terms of types, the halogen compounds segment accounted for the largest market share in 2022. Halogen-based biocides, such as chlorine and bromine compounds, are extensively utilized in water treatment, disinfection, and sanitization processes across various industries. The versatility of halogen compounds in effectively destroying a broad spectrum of microorganisms has made them indispensable in ensuring water quality and safety, particularly in public water systems, swimming pools, and industrial cooling towers. Moreover, the demand for halogen-based biocides has been bolstered by their efficacy against emerging pathogens and antimicrobial-resistant strains. With increasing concerns about waterborne diseases and the spread of infectious agents, there has been a heightened focus on utilizing biocides capable of swiftly neutralizing harmful microorganisms. Halogen compounds, with their rapid action and proven efficacy, have become the go-to solution for disinfection and microbial control in diverse settings. Additionally, ongoing research and development efforts aimed at enhancing the performance and environmental sustainability of halogen-based biocides are further driving market growth, as manufacturers strive to meet evolving regulatory requirements and consumer preferences.

Biocides Market By Application

- Water Treatment

- Cleaning Products

- Food and Personal Care Products

- Fuel Preservatives

- Furniture and Furnishings

- Leather and Suede

- Clothing and Textiles

- Paints and Coatings

- Others

According to the biocides industry forecast, the water treatment segment is expected to witness significant growth in the coming years. With increasing industrialization, urbanization, and agricultural activities, water sources face contamination from various pollutants and microorganisms, necessitating effective treatment solutions. Biocides play a crucial role in disinfecting water and controlling microbial growth in water systems, including municipal water supplies, industrial cooling towers, and swimming pools. The stringent regulatory landscape, coupled with rising awareness about waterborne diseases, has propelled the demand for biocides in water treatment applications. Moreover, the advent of advanced biocide formulations has contributed to the growth of the water treatment segment. Manufacturers are continually innovating to develop biocides with enhanced efficacy, longer persistence, and reduced environmental impact. These advancements not only improve microbial control but also address concerns related to disinfection by-products and environmental sustainability. Additionally, the expansion of industrial sectors such as power generation, oil and gas, and chemical processing further fuels the demand for biocides in water treatment, as these industries require reliable solutions to maintain water quality standards and prevent equipment fouling.

Biocides Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Biocides Market Regional Analysis

The Asia-Pacific region has emerged as a dominating force in the biocides market, driven by several key factors contributing to its growth and dominance. One primary driver is the rapid industrialization and urbanization witnessed across many countries in the region. With expanding industrial activities comes an increased need for water treatment, sanitation, and hygiene measures, all of which rely heavily on biocides to control microbial growth and ensure product safety. Additionally, the flourishing agricultural sector in countries like China and India, coupled with stringent regulations on agricultural inputs, further drives demand and contributes to the region's dominance in the market. For instance, China allocated subsidies in three installments during 2022 to bolster farm incomes and offset the rising expenses of agricultural inputs: CNY 20 billion (USD 3 billion) in March, CNY 10 billion (USD 1.5 billion) in May, and another CNY 10 billion (USD 1.5 billion) in August.

Furthermore, the Asia-Pacific region benefits from its large population and growing middle-class segment, which drives demand for consumer products such as personal care items, household cleaners, and disinfectants. As consumer awareness regarding hygiene and sanitation increases, so does the demand for biocides in various applications, ranging from antimicrobial coatings to water treatment solutions. For instance, the theme for National Cleanliness Day 2023, "Swachh Bharat: Swasth Bharat," underscores the connection between cleanliness and good health. Moreover, the presence of key market players investing in research and development activities to introduce innovative biocide formulations tailored to the specific needs of the region further strengthens Asia-Pacific's position in the global biocides industry.

Latin America is experiencing rapid growth in the biocides market due to increasing industrial activities and rising awareness regarding hygiene and sanitation. The region's robust agricultural sector, coupled with expanding urban populations, is driving the demand for biocides in various applications such as water treatment, agriculture, and healthcare. Furthermore, favorable government regulations and investments in research and development are fostering innovation and market expansion in Latin America's biocides industry. For instance, the GACC and the Ministry of Agriculture in Brazil agreed on 25 May 2022 to a Protocol concerning Phytosanitary Requirements, facilitating the importation of maize from Brazil. This awareness towards hygiene contributes to the market’s growth in the forecasted year.

Biocides Market Player

Some of the top biocides market companies offered in the professional report include Lanxess AG, Troy Corporation, BASF SE, Hubei Jinghong Chemicals Co. Ltd., Albemarle Corporation, Shanghai ZhongxinYuxiang Chemicals Co. Ltd., Solvay SA, Lonza, Neogen Corporation, Lubrizol, Iro Group Inc, and Wuxi Honor Shine Chemical Co. Ltd.

Frequently Asked Questions

How big is the biocides market?

The biocides market size was USD 9.1 Billion in 2022.

What is the CAGR of the global biocides market from 2023 to 2032?

The CAGR of biocides is 4.4% during the analysis period of 2023 to 2032.

Which are the key players in the biocides market?

The key players operating in the global market are including Lanxess AG, Troy Corporation, BASF SE, Hubei Jinghong Chemicals Co. Ltd., Albemarle Corporation, Shanghai ZhongxinYuxiang Chemicals Co. Ltd., Solvay SA, Lonza, Neogen Corporation, Lubrizol, Iro Group Inc, and Wuxi Honor Shine Chemical Co. Ltd.

Which region dominated the global biocides market share?

Asia-Pacific held the dominating position in biocides industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Latin America region exhibited fastest growing CAGR for market of biocides during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global biocides industry?

The current trends and dynamics in the biocides market growth include increasing awareness about hygiene and sanitation, stringent regulations regarding water quality and safety, and technological advancements in biocide formulations.

Which type held the maximum share in 2022?

The halogen compounds type held the maximum share of the biocides industry.