Bio-Based Polymer Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Bio-Based Polymer Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Bio-Based Polymer Market Size accounted for USD 8.7 Billion in 2023 and is estimated to achieve a market size of USD 14.5 Billion by 2032 growing at a CAGR of 5.9% from 2024 to 2032.

Bio-Based Polymer Market Highlights

- Global bio-based polymer market revenue is poised to garner USD 14.5 billion by 2032 with a CAGR of 5.9% from 2024 to 2032

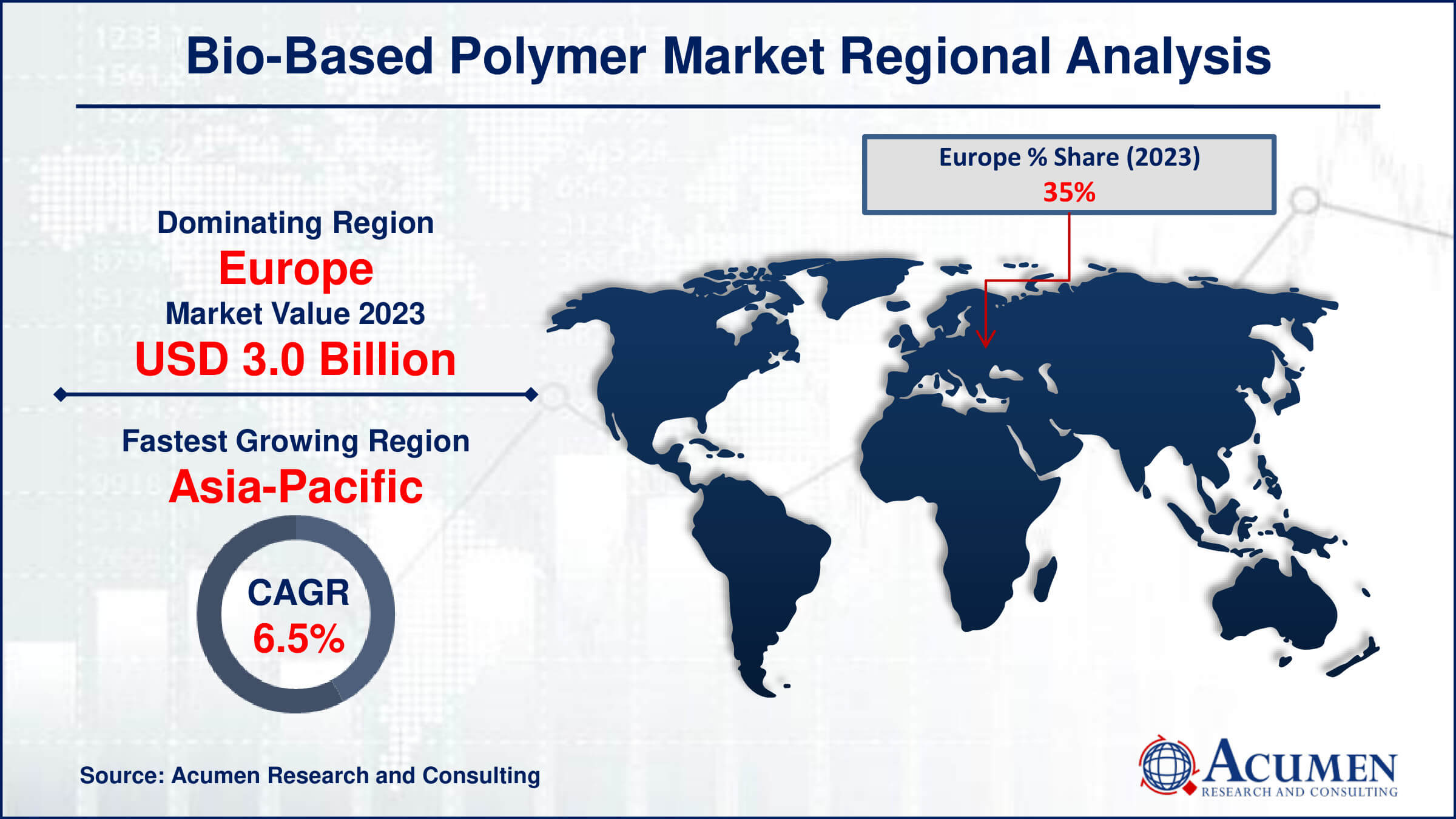

- Europe bio-based polymer market value occupied around USD 3.0 billion in 2023

- Asia-Pacific bio-based polymer market growth will record a CAGR of more than 6.5% from 2024 to 2032

- Among raw material, the polyamide (PA) sub-segment generated noteworthy revenue in 2023

- Based on end use, the packaging sub-segment generated significant bio-based polymer market share in 2023

- Increasing investments in bio-based polymer production facilities is a popular bio-based polymer market trend that fuels the industry demand

Bio-based polymers are made from renewable biological sources such as plants, animals, or microbes, as opposed to typical polymers made from petroleum. These polymers can be naturally occurring, such as cellulose and starch, or synthesized from bio-based monomers, such as polylactic acid (PLA) derived from corn starch or polyhydroxyalkanoates (PHA) created through bacterial fermentation. Bio-based polymers provide a number of environmental benefits, including reduced reliance on fossil fuels, lower carbon footprints, and improved biodegradability, which aids in the reduction of plastic pollution. They can be employed in a variety of industries, including packaging, textiles, automotive, and medical devices. Despite their benefits, bio-based polymers frequently encounter problems such as higher manufacturing costs and performance limits when compared to traditional plastics. However, current research and technical improvements seek to increase their economic viability and functional qualities, hence encouraging their usage in a variety of industries.

Global Bio-Based Polymer Market Dynamics

Market Drivers

- Increasing demand for sustainable and eco-friendly materials

- Government regulations promoting the use of bio-based products

- Advances in bio-based polymer technology

- Growing awareness among consumers about environmental issues

Market Restraints

- High production costs compared to conventional polymers

- Limited availability of raw materials

- Challenges in achieving performance parity with petroleum-based polymers

Market Opportunities

- Development of innovative bio-based polymer applications in various industries

- Expansion into emerging markets with growing environmental regulations

- Collaboration between companies and research institutions for advanced solutions

Bio-Based Polymer Market Report Coverage

| Market | Bio-Based Polymer Market |

| Bio-Based Polymer Market Size 2022 | USD 8.7 Billion |

| Bio-Based Polymer Market Forecast 2032 | USD 14.5 Billion |

| Bio-Based Polymer Market CAGR During 2023 - 2032 | 5.9% |

| Bio-Based Polymer Market Analysis Period | 2020 - 2032 |

| Bio-Based Polymer Market Base Year |

2022 |

| Bio-Based Polymer Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Raw Material, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BASF, Evonik Industries, DSM, Mitsui Chemicals, Cereplast, Bayer Material, Braskem, Biosphere Industries, DowDuPont, and Arkema. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Bio-Based Polymer Market Insights

The global bio-based polymer industry is poised for significant growth, driven by several key factors. Stringent government regulations aimed at reducing the use of synthetic polymers and the increasing adoption of plant-based polymer products by manufacturers are major catalysts for this growth. These regulations are designed to encourage the shift towards sustainable and eco-friendly materials, thereby promoting the use of bio-based polymers. Additionally, the flourishing construction and automotive sectors across the globe are contributing to this trend. Manufacturers in these industries are increasingly focusing on reducing their carbon footprints, leading to a higher demand for eco-friendly products. This shift is further supported by growing consumer awareness and preference for sustainable alternatives.

However, the market faces certain challenges that could impede its growth. One of the primary restraints is the high cost associated with the production and operation of bio-based polymers. These costs are often higher than those of conventional synthetic polymers, making them less competitive in terms of pricing. Moreover, the lack of a developed supply-value chain poses a significant hurdle. The infrastructure for sourcing, processing, and distributing bio-based raw materials is not as established as that for synthetic polymers, which can lead to supply chain inefficiencies and higher costs.

Despite these challenges, the market presents numerous opportunities for growth. Rapid technological advancements by major players in the industry are paving the way for innovative product offerings. Significant investments in research and development activities are driving the creation of new and improved bio-based polymer products. Additionally, companies are increasingly focusing on developing countries to tap into untapped markets. These regions often have growing economies and increasing environmental regulations, making them ripe for the adoption of bio-based polymers. By strategically expanding into these markets, companies can generate new revenue streams and bolster the growth of the global bio-based polymer market.

Bio-Based Polymer Market Segmentation

The worldwide market for bio-based polymer is split based on raw material, end use, and geography.

Bio-Based Polymer Raw Materials

- Polyethylene (PE)

- Polyamide (PA)

- Polylactic Acid (PLA)

- Polyethylene Terephthalate (PET)

- Others

According to bio-based polymer industry analysis, the polyamide (PA) sector is expected to have the highest market share. This dominance can be ascribed to numerous variables. Polyamide, generally known as nylon, is widely prized for its remarkable mechanical features, such as high strength, durability, and resistance to wear and abrasion. These qualities make it ideal for a variety of applications, particularly in the automotive and textile sectors. The automobile industry, in particular, benefits from bio-based polyamides lightweight and high-performance properties, which help to reduce vehicle weight and improve fuel efficiency.

Moreover, the trend toward sustainable and environmentally friendly materials is pushing up demand for bio-based polyamides. These polymers are made from renewable resources, reducing reliance on fossil fuels and lowering carbon emissions. Innovations in bio-based polyamide production technology have also increased their cost-effectiveness and performance, making them more competitive with traditional petroleum-based polyamides. Furthermore, growing consumer awareness and governmental backing for sustainable products are accelerating the use of bio-based polyamides. Governments and environmental agencies throughout the world are enacting laws and incentives to encourage the use of eco-friendly materials, creating a favorable environment for the expansion of the bio-based polyamide segment.

Bio-Based Polymer End Uses

- Textile

- Automotive

- Industrial

- Agriculture

- Packaging

- Others

The packaging category is anticipate to lead the market and it is expected to maintain same position throughout bio-based polymer industry forecast period. This significance is due to the growing demand for sustainable packaging solutions in a variety of industries. Consumers and businesses alike are becoming more ecologically concerned, resulting in a preference for materials with lower environmental impact. Bio-based polymers are a feasible alternative to traditional plastics since they are made from renewable resources and are more biodegradable. Bio-based polymers are rapidly being used in the packaging business, particularly for food and drinks, to meet severe environmental laws while also appealing to eco-conscious consumers. Bio-based polymer technological innovations have improved these materials characteristics, making them appropriate for a variety of packaging applications, including flexible and rigid packaging. Additionally, big brands are committed to sustainability targets, accelerating the transition to bio-based packaging materials. This trend is encouraged by government measures that encourage the use of environmentally friendly materials, reinforcing the packaging segment's dominant position in the bio-based polymer market.

Bio-Based Polymer Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Bio-Based Polymer Market Regional Analysis

In terms of bio-based polymer market analysis, in Europe, the market is projected to account for a significant revenue share, driven by stringent government regulations regarding polymer use. These regulations aim to reduce environmental impact and promote sustainability, thereby boosting the demand for bio-based polymers. Additionally, favorable government policies and increasing awareness activities about the benefits of plant-based polymer products are further supporting market growth in this region.

Conversely, the Asia-Pacific region is expected to witness rapid growth in the bio-based polymer market forecast period. This growth is primarily fueled by a booming automotive sector and a rising demand for environmentally friendly products from manufacturers. The region benefits from favorable business policies and strategic initiatives by companies to tap into developing markets, which aim to increase profit margins and enhance business presence. These factors collectively support the expansion of the bio-based polymer market in Asia-Pacific, making it a key area of focus for industry players looking to capitalize on emerging opportunities.

Bio-Based Polymer industry Players

Some of the top bio-based polymer companies offered in our report includes BASF, Evonik Industries, DSM, Mitsui Chemicals, Cereplast, Bayer Material, Braskem, Biosphere Industries, DowDuPont, and Arkema.

Frequently Asked Questions

How big is the bio-based polymer market?

The bio-based polymer market size was valued at USD 8.7 billion in 2023.

What is the CAGR of the global bio-based polymer market from 2024 to 2032?

The CAGR of bio-based polymer is 5.9% during the analysis period of 2024 to 2032.

Which are the key players in the bio-based polymer market?

The key players operating in the global market are including BASF, Evonik Industries, DSM, Mitsui Chemicals, Cereplast, Bayer Material, Braskem, Biosphere Industries, DowDuPont, and Arkema.

Which region dominated the global bio-based polymer market share?

Europe held the dominating position in bio-based polymer industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of bio-based polymer during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global bio-based polymer industry?

The current trends and dynamics in the bio-based polymer industry include increasing demand for sustainable and eco-friendly materials, government regulations promoting the use of bio-based products, advances in bio-based polymer technology, and growing awareness among consumers about environmental issues.

Which end use held the maximum share in 2023?

The packaging end use held the maximum share of the bio-based polymer industry.