Beta Glucan Market | Acumen Research and Consulting

Beta Glucan Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

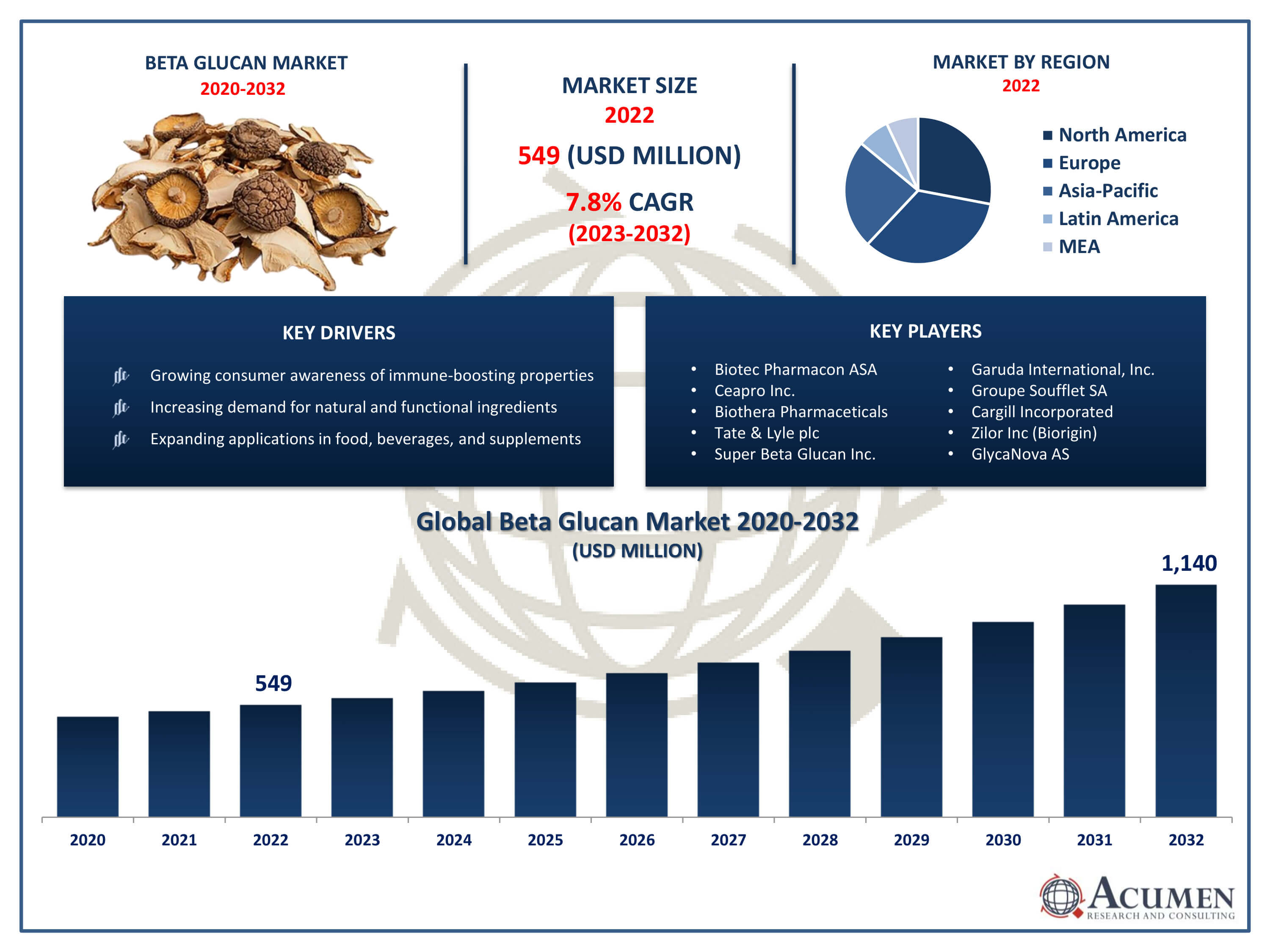

The Beta Glucan Market Size accounted for USD 549 Million in 2022 and is projected to achieve a market size of USD 1,140 Million by 2032 growing at a CAGR of 7.8% from 2023 to 2032.

Beta Glucan Market Highlights

- Global beta glucan market revenue is expected to increase by USD 1,140 million by 2032, with a 7.8% CAGR from 2023 to 2032

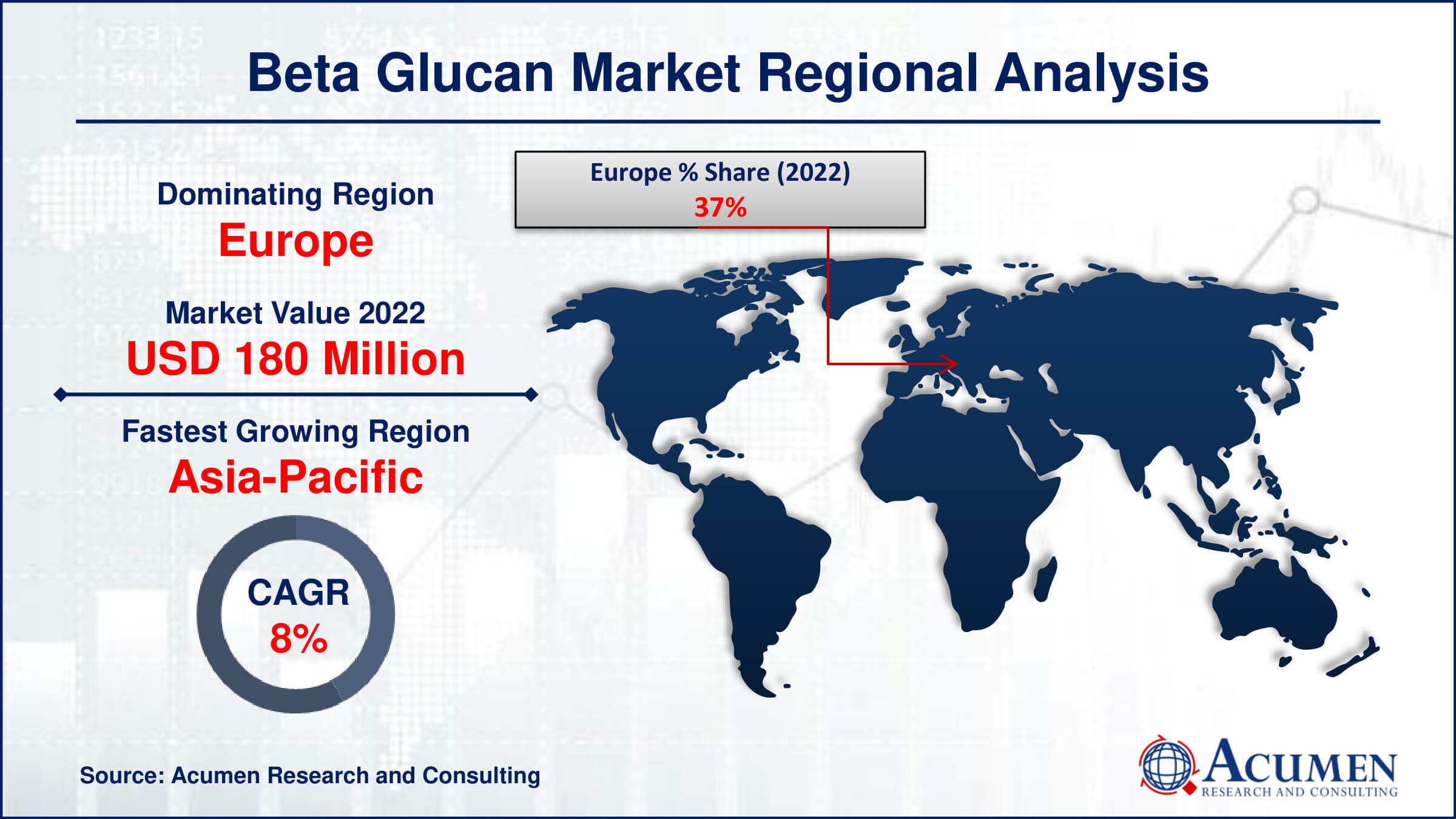

- Europe region led with more than 37% of beta glucan market share in 2022

- Asia-Pacific beta glucan market growth will record a CAGR of more than 8.5% from 2023 to 2032

- By source, the cereal segment captured more than 34% of revenue share in 2022.

- By application, the food & beverages segment is projected to expand at the fastest CAGR over the projected period

- Increasing demand for immune-boosting ingredients amid global health concerns, drives the beta glucan market value

Beta-glucans, polysaccharides present in the cell walls of bacteria, fungi, yeasts, and plants like oats, barley, and certain mushrooms, have garnered attention for their potential health perks such as immune system modulation and cholesterol reduction. These compounds stimulate the immune system by enhancing the activity of macrophages and natural killer cells, while also aiding in blood sugar regulation and cardiovascular health. In recent years, there has been remarkable growth in the market for beta-glucans, driven by heightened consumer awareness of their benefits and a growing interest in natural and functional ingredients. With the surge in demand for immune-boosting products amid global health concerns, beta-glucans are increasingly being incorporated into various food, beverage, and dietary supplement formulations. Moreover, the cosmetics and personal care industry has shown interest in leveraging beta-glucans for potential skin health benefits. As ongoing research uncovers more health advantages, the beta-glucan market is poised for further expansion, presenting opportunities for innovation and product development across multiple sectors.

Beta-glucans, polysaccharides present in the cell walls of bacteria, fungi, yeasts, and plants like oats, barley, and certain mushrooms, have garnered attention for their potential health perks such as immune system modulation and cholesterol reduction. These compounds stimulate the immune system by enhancing the activity of macrophages and natural killer cells, while also aiding in blood sugar regulation and cardiovascular health. In recent years, there has been remarkable growth in the market for beta-glucans, driven by heightened consumer awareness of their benefits and a growing interest in natural and functional ingredients. With the surge in demand for immune-boosting products amid global health concerns, beta-glucans are increasingly being incorporated into various food, beverage, and dietary supplement formulations. Moreover, the cosmetics and personal care industry has shown interest in leveraging beta-glucans for potential skin health benefits. As ongoing research uncovers more health advantages, the beta-glucan market is poised for further expansion, presenting opportunities for innovation and product development across multiple sectors.

Global Beta Glucan Market Trends

Market Drivers

- Growing consumer awareness of health benefits associated with beta-glucans

- Increasing demand for immune-boosting ingredients amid global health concerns

- Expansion of the functional food and functional beverages industry

- Rising interest in natural and plant-based protein supplements

- Positive research findings supporting cardiovascular and immune health benefits

Market Restraints

- High production costs and extraction challenges

- Limited availability in certain natural sources

Market Opportunities

- Rising interest in skin health applications for cosmetics

- Integration into personalized nutrition trends

Beta Glucan Market Report Coverage

| Market | Beta Glucan Market |

| Beta Glucan Market Size 2022 | USD 549 Million |

| Beta Glucan Market Forecast 2032 | USD 1,140 Million |

| Beta Glucan Market CAGR During 2023 - 2032 | 7.8% |

| Beta Glucan Market Analysis Period | 2020 - 2032 |

| Beta Glucan Market Base Year |

2022 |

| Beta Glucan Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Source, By Product, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BiotecPharmacon ASA, Ceapro Inc., BiotheraPharmaceticals, Tate & Lyle plc (Tate & Lyle Oat Ingredients), Super Beta Glucan Inc., Garuda International, Inc., Groupe Soufflet SA (AIT Ingredients), Cargill Incorporated, Zilor Inc (Biorigin), GlycaNova AS, Millipore Sigma, and Lesaffre Human Care. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Structurally, beta-glucans consist of glucose molecules linked together in a specific arrangement, and this unique structure is believed to contribute to their biological activities. The applications of beta-glucan are diverse, spanning across various industries. In the food sector, beta-glucans are incorporated into products like oat-based cereals, bread, and snacks, offering not only nutritional value but also cholesterol-lowering effects. In the pharmaceutical and nutraceutical industries, beta-glucans are utilized in dietary supplements, promoting immune system support. For instance, in November 2022, Ceapro Inc. began a new phase focused on enhancing its innovative Pressurized Gas eXpanded (PGX) technology to develop pharmaceutical and nutraceutical products. Additionally, the cosmetic industry has recognized the potential skin health benefits of beta-glucans, leading to their inclusion in skincare products for moisturization and anti-aging purposes. The versatility of beta-glucans in addressing health and wellness concerns positions them as valuable ingredients in a wide array of consumer products.

In recent years, there has been a notable surge in the beta-glucan market, largely fueled by heightened consumer awareness of the health benefits these polysaccharides offer. The demand for immune-boosting products has particularly driven this growth, supported by ongoing global health challenges. For instance, in August 2023, Immudyne Nutritional unveiled PureMune, a beta-glucan ingredient which increase the immune system, crafted in an FDA-registered facility. Industries like food, beverage, and dietary supplements have embraced beta-glucans as sought-after ingredients due to their perceived health advantages. This trend reflects a growing preference for natural and functional ingredients, with beta-glucans proving versatile across various product formulations. Whether incorporated into heart-healthy oat-based foods or as mushroom extracts in supplements, beta-glucans provide manufacturers with diverse options to cater to the needs of health-conscious consumers.

Beta Glucan Market Segmentation

The global beta glucan market segmentation is based on source, product, application, and geography.

Beta Glucan Market By Source

- Cereal

- Yeast

- Mushroom

- Seaweed

According to the beta glucan industry analysis, the cereal segment accounted for the largest market share in 2022. This growth is owing to the increasing consumer preference for functional and health-promoting breakfast options. Cereals fortified with beta-glucans, often derived from oats and barley, have gained popularity due to their cholesterol-lowering properties and potential cardiovascular health benefits. As consumers become more health-conscious and seek convenient yet nutritious morning meal choices, beta-glucan-enriched cereals have emerged as a compelling option, aligning with the broader trend of incorporating functional ingredients into daily diets. The rising prevalence of lifestyle-related health concerns, such as high cholesterol and cardiovascular issues, has driven the demand for cereals containing beta-glucans.

Beta Glucan Market By Product

- Insoluble

- Soluble

In terms of products, the soluble segment is expected to witness significant growth in the coming years. This growth is driven by the increasing recognition of its health benefits and versatile applications in various industries. Soluble beta-glucans, derived from sources like oats, barley, and certain mushrooms, have gained prominence for their ability to dissolve in water, making them easily incorporated into a range of food and beverage products. This solubility enhances their functional properties and bioavailability, contributing to the appeal of these polysaccharides in the market. One of the key factors fueling the growth of the soluble segment is the demand for products promoting heart health and immune support. Soluble beta-glucans have been shown to have a positive impact on cholesterol levels, making them sought after in functional foods designed to address cardiovascular wellness.

Beta Glucan Market By Application

- Food & Beverages

- Animal Feed

- Pharmaceuticals

- Cosmetics & Personal Care

- Others

According to the beta glucan market forecast, the food & beverages segment is expected to witness significant growth in the coming years. Beta-glucans, derived from sources like oats, barley, and certain mushrooms, are increasingly incorporated into a variety of food and beverage formulations due to their recognized health benefits. These polysaccharides are well-regarded for their ability to contribute to heart health, boost immune function, and provide soluble fiber, aligning with the growing trend of consumers seeking products that support their overall well-being. For instance, BENEO unveiled its inaugural barley beta-glucan product, Orafti β-Fit, in July 2023, aimed at promoting heart health and aiding in blood sugar management. One of the key drivers of growth in this segment is the proactive shift towards healthier eating habits and the desire for products that offer both nutrition and functionality. Beta-glucans are being utilized in a range of food and beverage categories, including breakfast cereals, bakery products, dairy, and functional beverages. As consumers become more informed about the link between diet and health, the incorporation of beta-glucans into familiar and widely consumed items provides a convenient and accessible way for individuals to adopt a health-conscious lifestyle.

Beta Glucan Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Beta Glucan Market Regional Analysis

Europe has emerged as a dominant force in the beta-glucan market due to a confluence of factors highlighting a robust focus on health and wellness, coupled with a proactive approach to integrating functional ingredients into various products. The region's populace, increasingly health-conscious, actively seeks out foods and supplements that offer nutritional benefits while supporting a healthy lifestyle. For instance, in April 2024, Kemin Industries, a leading global provider of ingredients, obtained novel food approval from the European Commission for BetaVia Pure, featuring a high concentration of 95% beta 1,3 glucan. Beta-glucans, renowned for their immune-boosting and cholesterol-lowering properties, resonate strongly with these health-oriented consumer preferences, fueling their popularity in European markets. For instance, according to the European Food Safety Authority (EFSA), consuming beta-glucan regularly aids in preserving healthy blood cholesterol levels, thus reducing the likelihood of developing heart disease. Moreover, responding swiftly to the escalating demand for functional ingredients, the European food and beverage industry prominently features beta-glucans in a diverse array of products. Oats, barley, and mushrooms, rich sources of beta-glucans, find widespread use in European food formulations, including cereals, bread, pasta, and dairy items. Moreover, substantial investments in research and development within the region further propel the growth of beta-glucans. The dominance of the European market also stems from stringent regulatory standards that prioritize consumer safety and product quality, fostering trust in beta-glucan-infused products.

The Asia Pacific region has emerged as the fastest-growing market for beta glucan due to increasing consumer awareness about its health benefits, including immune system support and cholesterol reduction. For instance, Dr. Reddy's Laboratories made their debut in the infant nutrition market in July 2023 by launching CeleHealth Kidz Immuno Plus Gummies in India. This introduction aims to address concerns about children's immunity and fulfill their dietary requirements. Additionally, rising disposable incomes and changing dietary preferences have fueled the demand for functional food and supplements containing beta glucan. Furthermore, the region's thriving food and beverage industry and expanding pharmaceutical sector contribute to the rapid growth of the beta glucan market in Asia Pacific.

Beta Glucan Market Player

Some of the top beta glucan market companies offered in the professional report include BiotecPharmacon ASA, Ceapro Inc., BiotheraPharmaceticals, Tate & Lyle plc (Tate & Lyle Oat Ingredients), Super Beta Glucan Inc., Garuda International, Inc., Groupe Soufflet SA (AIT Ingredients), Cargill Incorporated, Zilor Inc (Biorigin), GlycaNova AS, Millipore Sigma, and Lesaffre Human Care.

Frequently Asked Questions

How big is the beta glucan market?

The beta glucan market size was USD 549 Million in 2022.

What is the CAGR of the global beta glucan market from 2023 to 2032?

The CAGR of beta glucan is 7.8% during the analysis period of 2023 to 2032.

Which are the key players in the beta glucan market?

The key players operating in the global market are including BiotecPharmacon ASA, Ceapro Inc., BiotheraPharmaceticals, Tate & Lyle plc (Tate & Lyle Oat Ingredients), Super Beta Glucan Inc., Garuda International, Inc., Groupe Soufflet SA (AIT Ingredients), Cargill Incorporated, Zilor Inc (Biorigin), GlycaNova AS, Millipore Sigma, and Lesaffre Human Care.

Which region dominated the global beta glucan market share?

North America held the dominating position in beta glucan industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of beta glucan during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global beta glucan industry?

The current trends and dynamics in the beta glucan industry include growing consumer awareness of immune-boosting properties, increasing demand for natural and functional ingredients, and expanding applications in food, beverages, and supplements.

Which product held the maximum share in 2022?

The soluble product held the maximum share of the beta glucan industry.