Bag-in-Box Packaging Machine Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Bag-in-Box Packaging Machine Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

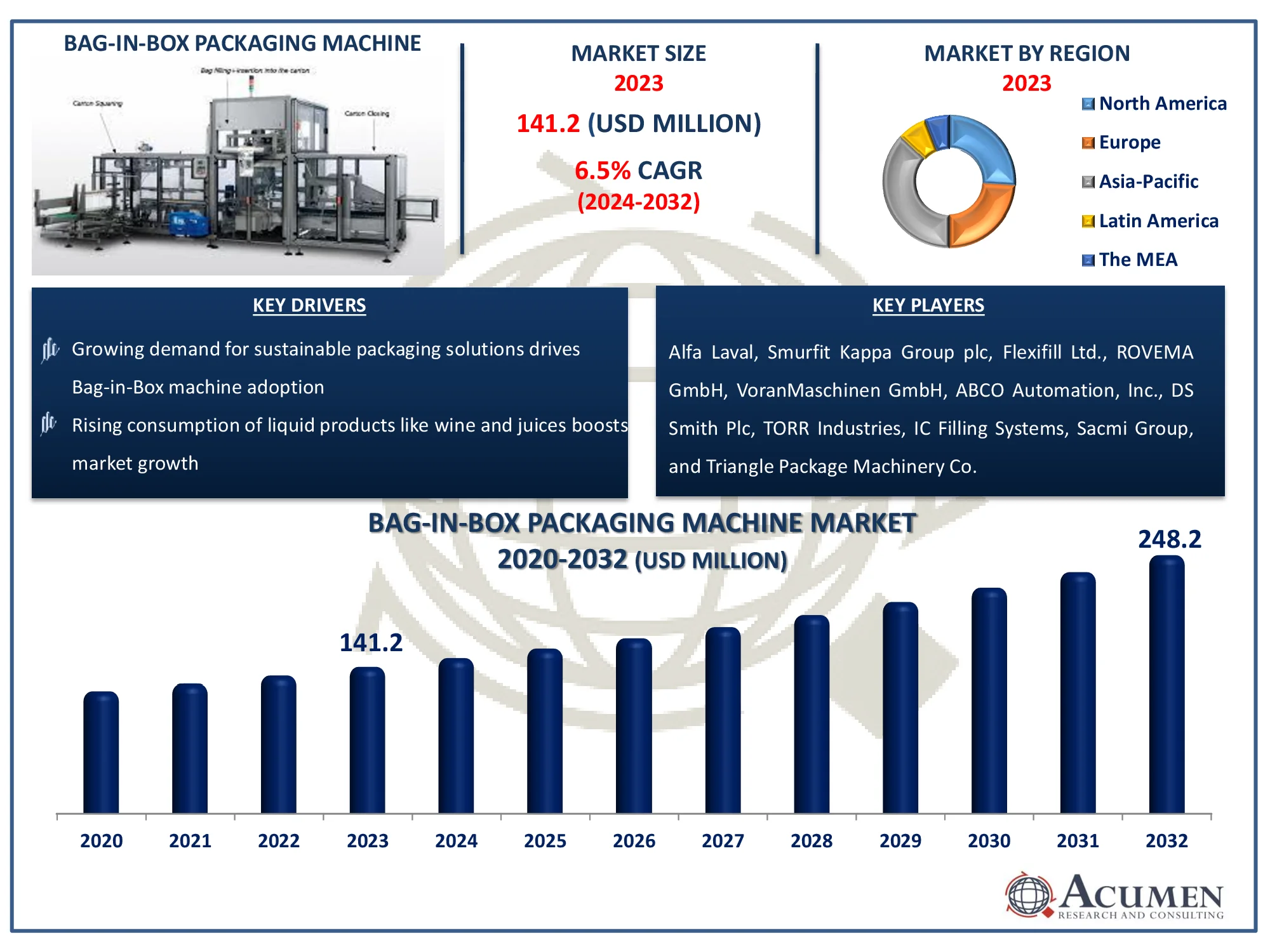

The Global Bag-in-Box Packaging Machine Market Size accounted for USD 141.2 Million in 2023 and is estimated to achieve a market size of USD 248.2 Million by 2032 growing at a CAGR of 6.5% from 2024 to 2032.

Bag-in-Box Packaging Machine Market Highlights

- Global bag-in-box packaging machine market revenue is poised to garner USD 248.2 million by 2032 with a CAGR of 6.5% from 2024 to 2032

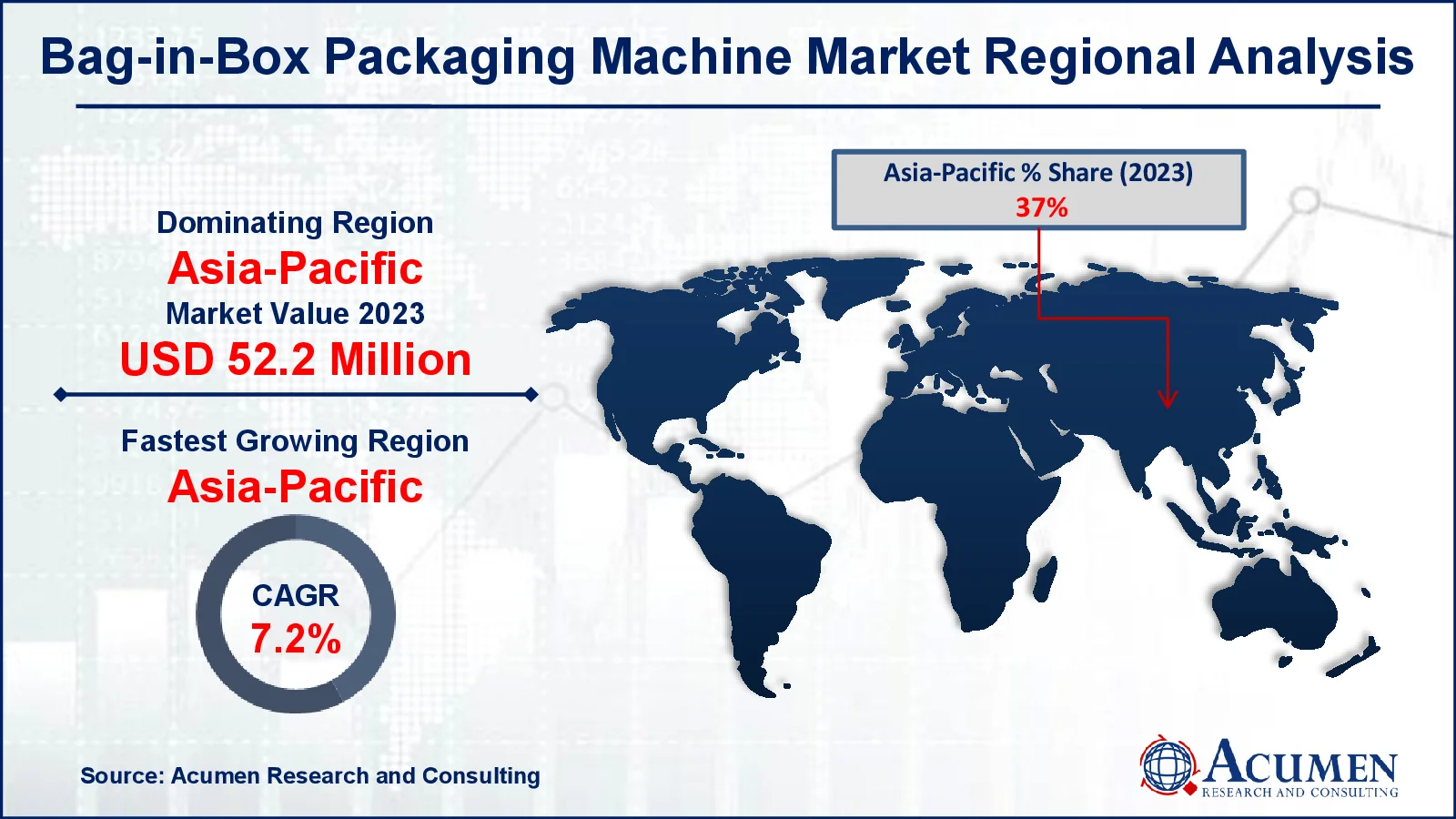

- Asia-Pacific bag-in-box packaging machine market value occupied around USD 52.2 million in 2023

- Asia-Pacific bag-in-box packaging machine market growth will record a CAGR of more than 7.2% from 2024 to 2032

- Among machine type, the standalone units sub-segment generated noteworthy revenue in 2023

- Based on filling technology, the aseptic filling sub-segment generated significant bag-in-box packaging machine market share in 2023

- Rising interest in premium beverages creates niche opportunities for bag-in-box machines is a popular bag-in-box packaging machine market trend that fuels the industry demand

A bag-in-box packaging machine is intended to quickly fill and seal liquid or semi-liquid products into flexible, long-lasting bags, which are then placed inside a protective box. This packaging solution extends product shelf life by decreasing air exposure, making it ideal for perishables like wine, juice, and milk. The machine employs a multi-step process that includes bag inflation, filling, sealing, and packaging to maintain exact control and prevent contamination and product loss. It is frequently utilized in the food and beverage industry, as well as non-food industries including chemicals and medicines. Bag-in-Box packaging is popular because of its environmentally friendly, lightweight design, and potential to cut transportation and storage expenses.

Automatic bag-in-box packaging machines are linked with control systems to form a full automated line for the faster production of bag-in-box containers. Many manufacturers favor semiautomatic bag-in-box packaging machines as they are best suited for limited production. Semi-automatic mode for bag-making machines, bag fillers, cartoners and bag inserters are types.

Global Bag-in-Box Packaging Machine Market Dynamics

Market Drivers

- Growing demand for sustainable packaging solutions drives bag-in-box machine adoption

- Rising consumption of liquid products like wine and juices boosts market growth

- Cost-effective packaging methods appeal to manufacturers seeking operational efficiency

- Increased focus on reducing food and beverage wastage accelerates machine adoption

Market Restraints

- High initial investment costs limit small-scale manufacturers

- Limited awareness of bag-in-box benefits in emerging markets hinders expansion

- Competition from alternative packaging methods like bottles slows market penetration

Market Opportunities

- Expanding demand for eco-friendly packaging offers growth potential

- Innovations in automation and machine efficiency open new market avenues

- Growing e-commerce sector increases demand for durable, transport-friendly packaging

Bag-in-Box Packaging Machine Market Report Coverage

| Market | Bag-in-Box Packaging Machine Market |

| Bag-in-Box Packaging Machine Market Size 2022 |

USD 141.2 Million |

| Bag-in-Box Packaging Machine Market Forecast 2032 | USD 248.2 Million |

| Bag-in-Box Packaging Machine Market CAGR During 2023 - 2032 | 6.5% |

| Bag-in-Box Packaging Machine Market Analysis Period | 2020 - 2032 |

| Bag-in-Box Packaging Machine Market Base Year |

2022 |

| Bag-in-Box Packaging Machine Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Machine Type, By Automation Type, By Output Capacity, By Filling Technology, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Alfa Laval, Smurfit Kappa Group plc, Flexifill Ltd., ROVEMA GmbH, VoranMaschinen GmbH, ABCO Automation, Inc., DS Smith Plc, TORR Industries, IC Filling Systems, Sacmi Group, and Triangle Package Machinery Co. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Bag-in-Box Packaging Machine Market Insights

The growing global focus on environmental sustainability is a major driver of the bag-in-box packaging machine industry. Consumers and organizations alike are becoming more aware of their environmental impact, prompting a move toward eco-friendly packaging options. Bag-in-Box solutions are much more effective at reducing packaging waste than traditional techniques such as bottles and cans. They utilize less material overall, including both the flexible inside bag and the exterior box, which makes them more environmentally friendly. Furthermore, because of their decreased weight and compact design, these systems can save transportation costs and carbon emissions, making them desirable to businesses looking to reduce their carbon impact. This trend in customer preference for sustainable solutions, combined with governmental pushes for greener practices, has greatly increased demand for Bag-in-Box packaging machinery in industries such as food, beverages, and home goods.

Despite the multiple benefits provided by bag-in-box packing equipment, the high initial investment costs are a considerable obstacle, particularly for small and medium-sized businesses (SMEs). These machines demand a significant amount of money for purchase, installation, and maintenance, which can put a strain on smaller enterprises' resources. Furthermore, the cost of training staff to run the technology and integrating it into existing production lines increases the financial load. This financial constraint limits the use of Bag-in-Box devices, especially in price-sensitive sectors.

As environmental rules tighten, there is an increasing demand for bag-in-box packaging machinery in markets focused on sustainability. The rising need for environmentally friendly packaging materials in industries such as food, beverage, and medicines creates considerable growth opportunities.

Bag-in-Box Packaging Machine Market Segmentation

The worldwide market for bag-in-box packaging machine is split based on machine type, automation type, output capacity, filling technology, end users, and geography.

Bag in Box Packaging Machine Market By Machine Type

- Standalone Units

- Integrated Systems

According to bag-in-box packaging machine industry analysis, by type of machine, the market is segmented and integrated independently. Standalone packaging machines account for the largest percentage. Standalones are automatic or semi-automatic equipment that build a bag-in-box packaging line without the use of any additional machines. An integrated bag-in-box packaging machine is made up of a single packaging line that is connected to all activities via simulation software or control systems. The integrated bag-in-box packaging systems handle all activities, including bag formation, filling, cardboarding, case builders, and bag inserts and sealers.

Bag in Box Packaging Machine Market By Automation Type

- Semi-automatic

- Automatic

The semi-automatic bag-in-box packaging machines are used in limited production by most of the local beverage manufacturers in Europe. The move from semi-automatic packaging machines to fully automated packaging machine solutions means that more automation is achieved, including machine vision, security control and even remote surveillance. The demand for bag-in-box packaging machines in the European region is expected to affect all these factors. Based on PC Control Technology, a Belgian bag-in-box packaging machine manufacturer, Pattyn Packaging balances its performance and costs. For product packagings, including food, oil, greases and liquid sugar, the Company manufactures fully automatic packagings for packagging, which are hygienically packaged using the packaging bag-in-box.

Bag in Box Packaging Machine Market By Output Capacity

- Above 100 Bags/Min

- 51 - 100 Bags/Min

- 11 - 50 Bags/Min

- Up to 10 Bags/Min

In the bag-in-box packaging machine market forecast period, the "51-100 Bags/Min" sector is predicted to be very important. This is because it finds a compromise between high efficiency and moderate cost, making it ideal for mid-sized firms seeking to enhance production without paying the higher expenses associated with machines with capacities more than 100 bags per minute. The 51-100 Bags/Min range allows for flexibility in production capacity, making it appealing to a wide range of industries including food and beverage, dairy, and personal care. This adaptability, combined with low operational costs, puts it as a significant driver of market expansion.

Bag in Box Packaging Machine Market By Filling Technology

- Aseptic Filling

- Non-aseptic Filling

The aseptic filling sector is predicted to hold the greatest proportion of the bag-in-box packaging machine market. This is driven by a growing need for longer shelf life, notably in the food, beverage, and pharmaceutical industries, where product sterility is critical. Aseptic filling guarantees that items are packed in a sterile environment, reducing contamination and maintaining product integrity without the use of preservatives. As consumer preferences evolve toward healthier, preservative-free food, the use of aseptic filling equipment increases. This method also eliminates the requirement for refrigeration, making it more affordable and desirable to producers.

Bag in Box Packaging Machine Market By End Use

- Food

- Beverages

- Household Products

- Industrial Products

- Healthcare & Personal Care

- Lubricants & Paints

The alcoholic sector is expected to experience lucrative increase based on drink end use. Drinking end-use industries are gradually choosing custom packaging machine solutions for wine packaging to stand out among other key players. As industries choose automatic bag-in-box solutions for bag-in-box packaging machines to improve efficiency, automatic markets are expected to be in demand during the period of forecasting.

Bag-in-Box Packaging Machine Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Bag-in-Box Packaging Machine Market Regional Analysis

The market for bag-in-box machines in the Asia-Pacific represents the highest value of CAGR. It is estimated that over the forecast period, the Asia-Pacific packaging machinery market will record a CAGR of approximately 7.2%. Asia is quickly upgrading the packaging machinery industry due to industrialization and urbanization. In the merging countries in Asia, such as China, India and Malaysia, many manufacturers and brand owners have succeeded. Due to the growing demand for quality products, India's packaging machine market is anticipated to be the most expanding in the forecast period.

Europe has the highest population of wine drinkers, and most wine producers pack their wines in bag-in-box formats. In terms of price, convenience and quality, Bag-in-box packaging formats offer more diverse options than traditional bottles. The automated bag-in-box storage device industry is maturing in advanced nations such as the US, Germany, France, the UK, and Italy, and is anticipated to experience small to mild development over the prediction era. Automated bag-in-box machines for higher output and efficiency are most often used. Bag-in-box alternatives are used end-use by meat, drinks, agricultural goods, family goods, lacquer and lubricants, as well as medical and personal care. It is estimated that, in 2023, the semi-automated bag-in-box packaging machines sector represented both in value and in volume the highest market share.

Bag-in-Box Packaging Machine Market Players

Some of the top bag-in-box packaging machine companies offered in our report includes Alfa Laval, Smurfit Kappa Group plc, Flexifill Ltd., ROVEMA GmbH, VoranMaschinen GmbH, ABCO Automation, Inc., DS Smith Plc, TORR Industries, IC Filling Systems, Sacmi Group, and Triangle Package Machinery Co.

Frequently Asked Questions

How big is the bag-in-box packaging machine market?

The bag-in-box packaging machine market size was valued at USD 141.2 million in 2023.

What is the CAGR of the global bag-in-box packaging machine market from 2024 to 2032?

The CAGR of bag-in-box packaging machine is 6.5% during the analysis period of 2024 to 2032.

Which are the key players in the bag-in-box packaging machine market?

The key players operating in the global market are including Alfa Laval, Smurfit Kappa Group plc, Flexifill Ltd., ROVEMA GmbH, VoranMaschinen GmbH, ABCO Automation, Inc., DS Smith Plc, TORR Industries, IC Filling Systems, Sacmi Group, and Triangle Package Machinery Co.

Which region dominated the global bag-in-box packaging machine market share?

Asia-Pacific held the dominating position in bag-in-box packaging machine industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of bag-in-box packaging machine during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global bag-in-box packaging machine industry?

The current trends and dynamics in the bag-in-box packaging machine industry include growing demand for sustainable packaging solutions drives bag-in-box machine adoption, rising consumption of liquid products like wine and juices boosts market growth, cost-effective packaging methods appeal to manufacturers seeking operational efficiency, and increased focus on reducing food and beverage wastage accelerates machine adoption.

Which machine type held the maximum share in 2023?

The standalone units held the notable share of the bag-in-box packaging machine industry.