Aviation Software Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Aviation Software Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

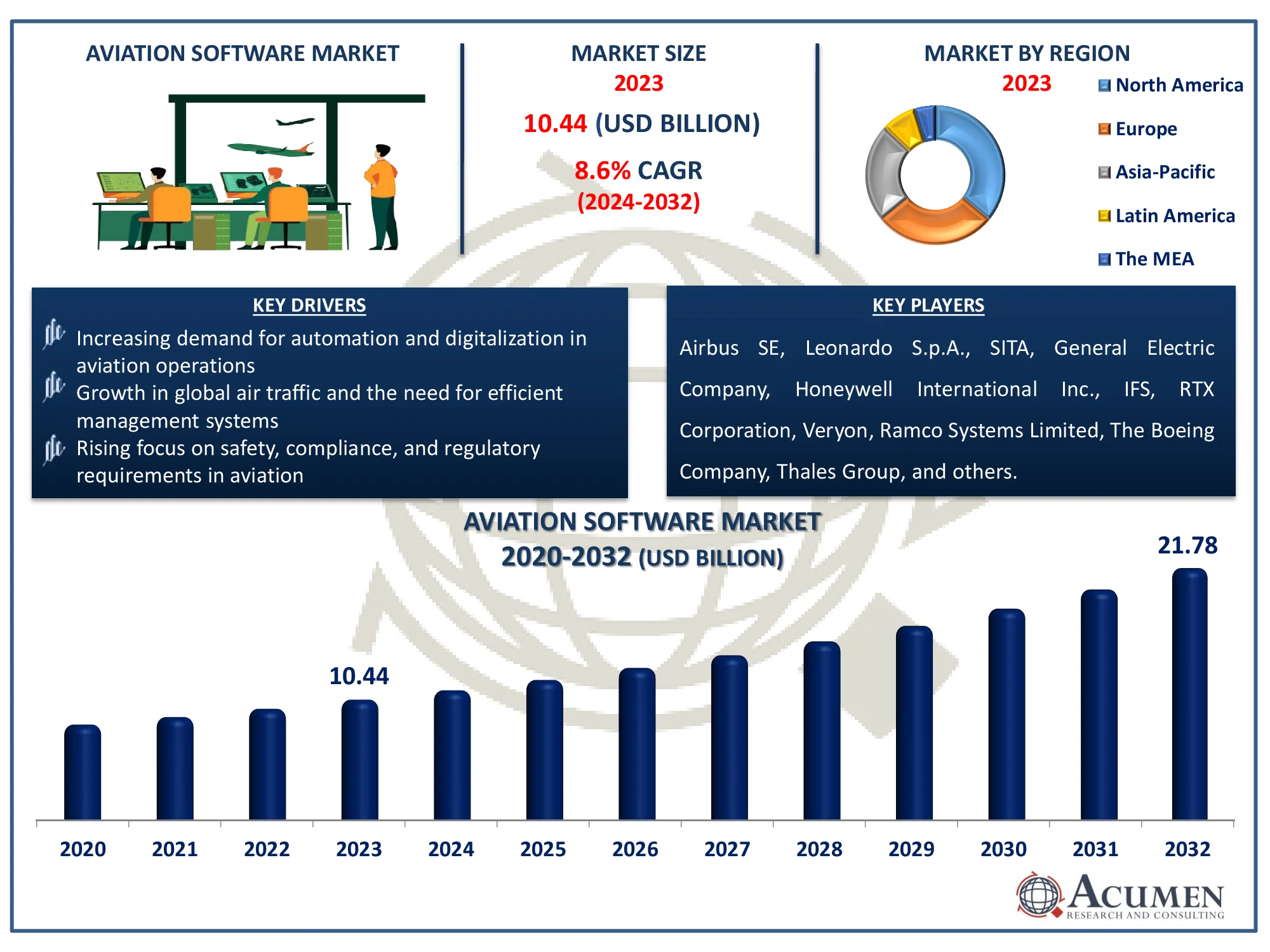

The Global Aviation Software Market Size accounted for USD 10.44 Billion in 2023 and is estimated to achieve a market size of USD 21.78 Billion by 2032 growing at a CAGR of 8.6% from 2024 to 2032.

Aviation Software Market Highlights

- The global aviation software market is projected to reach USD 21.78 billion by 2032, with a CAGR of 8.6% from 2024 to 2032

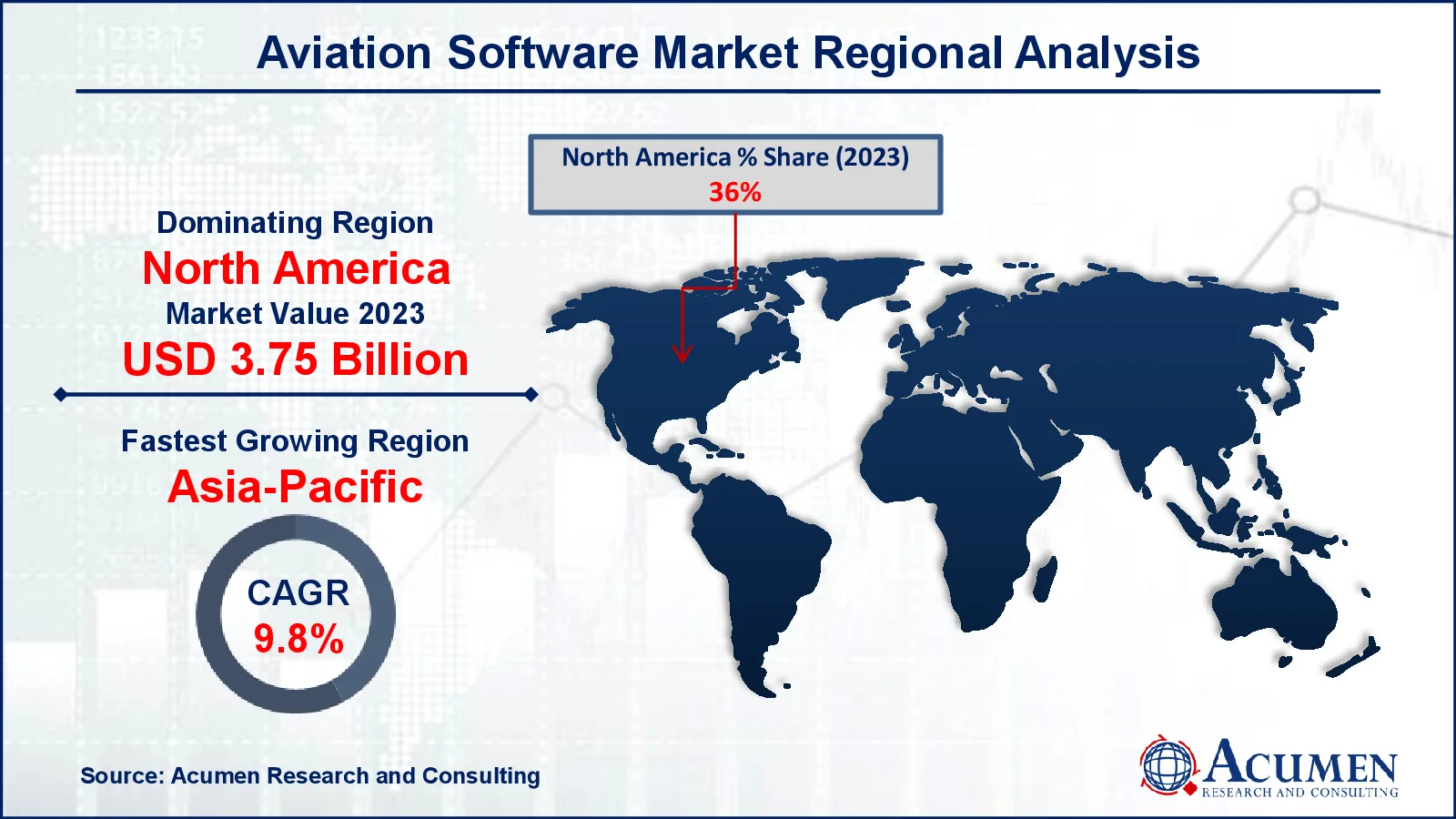

- In 2023, the North American aviation software market was valued at approximately USD 3.75 billion

- The Asia-Pacific region is expected to grow at a CAGR of over 9.8% from 2024 to 2032

- Cloud deployment accounted for 65% of the market share in 2023

- Among application, the airlines sub-segment held 76% of the market share in 2023

- Increasing integration of artificial intelligence and machine learning for predictive maintenance and operational optimization is an aviation software market trend that fuels the industry demand

Aviation software refers to specialized programs and systems that support numerous operational, management, and technical functions in the aviation business. These applications improve productivity, safety, and compliance for airlines, airports, and aviation service providers. For instance, the Aircraft Safety Action Program (ASAP) is designed to improve aircraft safety by reducing accidents and incidents. It encourages the voluntary reporting of safety concerns and events identified by employees of specific certificate holders.

Common applications of aviation software include flight operations management, crew scheduling, maintenance tracking, and air traffic control systems. They also provide passenger services like booking, check-in, and seat assignments. Aviation software also helps with cargo management, airport operations, and regulatory compliance. Entire, these solutions help to streamline procedures, decrease costs, and enhance the entire customer experience.

Global Aviation Software Market Dynamics

Market Drivers

- Increasing demand for automation and digitalization in aviation operations

- Growth in global air traffic and the need for efficient management systems

- Rising focus on safety, compliance, and regulatory requirements in aviation

Market Restraints

- High initial investment and implementation costs for software solutions

- Security concerns and vulnerabilities in aviation software systems

- Integration challenges with existing legacy systems in the aviation industry

Market Opportunities

- Expansion of cloud-based software solutions offering scalability and flexibility

- Growing adoption of artificial intelligence and machine learning in aviation software

- Increasing demand for eco-friendly solutions to optimize fuel consumption and reduce emissions

Aviation Software Market Report Coverage

|

Market |

Aviation Software Market |

|

Aviation Software Market Size 2023 |

USD 10.44 Billion |

|

Aviation Software Market Forecast 2032 |

USD 21.78 Billion |

|

Aviation Software Market CAGR During 2024 - 2032 |

8.6% |

|

Aviation Software Market Analysis Period |

2020 - 2032 |

|

Aviation Software Market Base Year |

2023 |

|

Aviation Software Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Software Type, By Deployment, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Airbus SE, Leonardo S.p.A., SITA, General Electric Company, Honeywell International Inc., IFS, RTX Corporation, Veryon, Ramco Systems Limited, The Boeing Company, Thales Group, CHAMP Cargosystems, Indra Avitech GmbH, and Bigscal Technologies Pvt. Ltd. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Aviation Software Market Insights

The aviation industry is increasingly relying on automation and digital technologies to streamline operations and eliminate human error. Automated methods for flight planning, personnel scheduling, and maintenance management greatly improve operational efficiency. Digitalization also enables faster data processing and real-time decision-making, which helps airlines and airports enhance performance. According to MITRE Corporation, Digital Copilot is a mobile application designed to give solo pilots an automated second set of eyes in the cockpit. Mobile apps have also been developed for general aviation pilots to help them avoid runway safety problems and enhance departure time planning for business jet operators. The requirement to handle increasing aviation traffic while adhering to tight regulatory criteria is driving this automation trend.

The installation of modern aviation software frequently necessitates considerable upfront investments in both technology and training. This might be a challenge, particularly for smaller operators or airports with limited resources. The complexity of modifying software to meet unique operating requirements adds to the expense. Furthermore, continuing maintenance, updates, and system interfaces increase the overall financial load, making adoption a difficult decision for some organizations in the market.

Growing innovations in aviation industry prompted market growth in near future. For instance, NASA announced in May 2024 the release of the new Aviary modeling tool for simulating conceptual aircraft designs. The program digitally tests aircraft concepts before putting them into the real world, reducing the expenditures of flight testing.

Cloud-based aviation software solutions present a significant opportunity, as they offer scalability, flexibility, and reduced IT overhead. Airlines and airports can access these solutions on a pay-as-you-go basis, which lowers capital expenditures. Cloud systems also enable easier collaboration and data sharing across global operations, helping businesses stay responsive to market changes. For instance, DFS Aviation Services GmbH (DAS), a branch of DFS Deutsche Flugsicherung GmbH, introduced the "PHOENIX WebInnovation" cloud system for air traffic control at Memmingen Airport in May 2024. This system is the first of its type; it works entirely on public cloud infrastructure and is a technological game changer in the air traffic control industry. At smaller airports, it has proven to be an innovative information tool that employs cutting-edge technology. This program is cloud-based and runs on SysEleven's Kubernetes platform. As more aviation organizations migrate to cloud platforms, the demand for cloud-based software solutions is expected to grow rapidly.

Aviation Software Market Segmentation

The worldwide market for aviation software is split based on type, deployment, application, and geography.

Aviation Software Types

- Management Software

- Analysis Software

- Design Software

- Simulation Software

- MRO Software

According to the aviation software industry analysis, management software is predicted to dominate the market due to its capacity to automate a variety of processes such as flight scheduling, crew management, and maintenance tracking. These technologies improve efficiency by automating manual activities, allocating resources more effectively, and maintaining regulatory compliance. As the aviation sector expands, there is a greater need for software solutions that combine many operations into a single platform. This trend toward comprehensive management software promotes operational improvement and cost savings, positioning it as a market leader.

Aviation Software Deployments

- On-Premises

- Cloud

The cloud category dominates the aviation software market because of its scalability, cost-effectiveness, and adaptability. Cloud-based solutions enable aviation organizations to effortlessly manage and access data from any location, improving collaboration and real-time decision-making. These platforms eliminate the need for expensive on-premise infrastructure while providing rapid upgrades and maintenance. As the aviation industry embraces digital transformation, the shift to cloud computing fuels growth and innovation.

Aviation Software Applications

- Airport

- Airlines

According to the aviation software market forecast, airlines dominate industry because they require complete solutions to manage a variety of operations, including flight scheduling, crew management, and passenger services. These software solutions assist airlines in maximizing productivity, improving customer experience, and ensuring regulatory compliance. The increasing demand for digitalization and automation in airline operations drives software adoption throughout the industry. As airlines develop globally, their reliance on modern aviation software solutions is projected to grow, strengthening their market leadership.

Aviation Software Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Aviation Software Market Regional Analysis

For several reasons, North America dominates the aviation software market thanks to its well-established aviation industry, which includes major airlines, airports, and aviation service providers that use advanced software solutions. The region benefits from significant investments in digital transformation, automation, and regulatory compliance, which increases demand for new software solutions. For example, According to International Federation of Robotics, companies in the United States make significant investments in robots. On Apr 30, 2024, Manufacturing enterprises in the United States have invested extensively in automation: total industrial robot installations increased by 12% to 44,303 units in 2023. Furthermore, the presence of major software vendors and extensive technological infrastructure reinforces its market dominance.

Asia-Pacific is experiencing rapid growth in the aviation software industry, primarily to the rising aviation sector in countries such as China, India, and Japan. Increased flight traffic, and government funding for aviation infrastructure development are all driving demand for aviation software. For instance, according to the India Brand Equity Foundation, the Indian government intends to invest $1.83 billion in airport infrastructure and aviation navigation services by 2026. India plans to build 220 new airports by 2025, according to Ministry of Civil Aviation. As more airlines and airports in the region digitize their operations, the demand for advanced management and automation solutions increases.

Aviation Software Market Players

Some of the top aviation software companies offered in our report include Airbus SE, Leonardo S.p.A., SITA, General Electric Company, Honeywell International Inc., IFS, RTX Corporation, Veryon, Ramco Systems Limited, The Boeing Company, Thales Group, CHAMP Cargosystems, Indra Avitech GmbH, and Bigscal Technologies Pvt. Ltd.

Frequently Asked Questions

How big is the aviation software market?

The aviation software market size was valued at USD 10.44 billion in 2023.

What is the CAGR of the global aviation software market from 2024 to 2032?

The CAGR of aviation software is 8.6% during the analysis period of 2024 to 2032.

Which are the key players in the aviation software market?

The key players operating in the global market are including Airbus SE, Leonardo S.p.A., SITA, General Electric Company, Honeywell International Inc., IFS, RTX Corporation, Veryon, Ramco Systems Limited, The Boeing Company, Thales Group, CHAMP Cargosystems, Indra Avitech GmbH, and Bigscal Technologies Pvt. Ltd.

Which region dominated the global aviation software market share?

North America held the dominating position in aviation software industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of aviation software during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global aviation software industry?

The current trends and dynamics in the aviation software industry include increasing demand for automation and digitalization in aviation operations, growth in global air traffic and the need for efficient management systems, and rising focus on safety, compliance, and regulatory requirements in aviation.

Which deployment held the maximum share in 2023?

The cloud deployment held the maximum share of the aviation software industry.