Automotive Wiring Harness Market | Acumen Research and Consulting

Automotive Wiring Harness Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

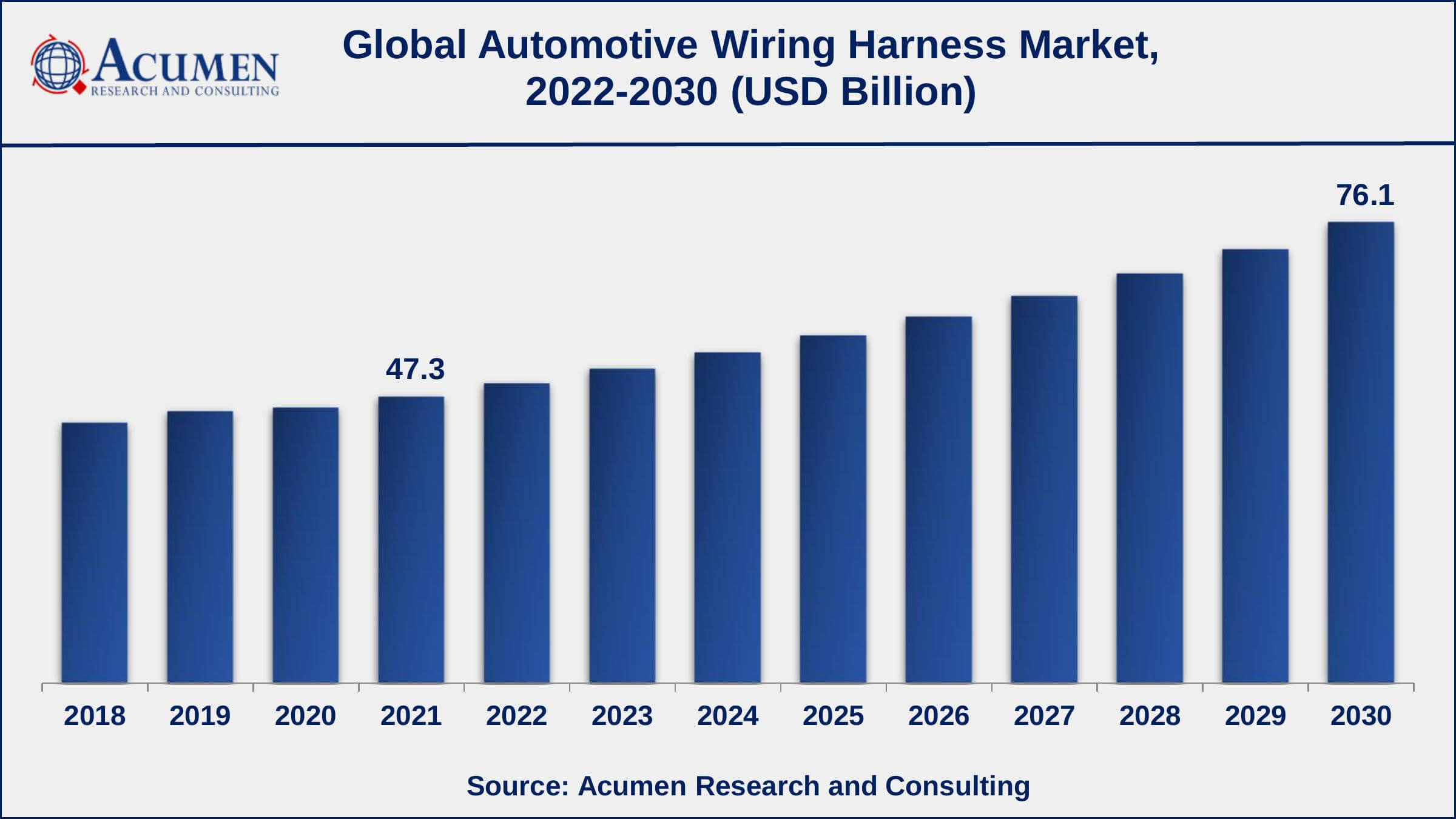

The Global Automotive Wiring Harness Market Size accounted for USD 47.3 Billion in 2021 and is projected to occupy a market size of USD 76.1 Billion by 2030 growing at a CAGR of 5.5% from 2022 to 2030.

Wire harnesses are compactly bundled wires and data circuits that function as the central nervous system of a vehicle. To ensure safety and Plug-in Hybrid Electric Vehicle (PHEV) functions (going, turning and stopping), as well as provide comfort and convenience, automobiles are equipped with various electronics which operate using control signals running on electrical power supplied from the battery. The wire harness is the conduit for the transmission of these signals and electrical power. Automotive wiring harness just like any vehicles is a critical component of electric and hybrid vehicle systems that transmits power and inComponentation. As various governments' emission and safety standards have risen, the need for weight reduction in automobiles has increased. This is expected to be accomplished through design variation and raw material substitution.

Automotive Wiring Harness Market Report Statistics

- Global automotive wiring harness market revenue is estimated to reach USD 76.1 Billion by 2030 with a CAGR of 5.5% from 2022 to 2030

- According to the International Energy Agency, the total number of electric cars in the world reached 16.5 million units in 2021

- Asia-Pacific automotive wiring harness market share generated over 51% shares in 2021

- Europe automotive wiring harness market growth will record substantial CAGR of over 6% from 2022 to 2030

- Based on material, copper recorded around 68% of the overall market share in 2021

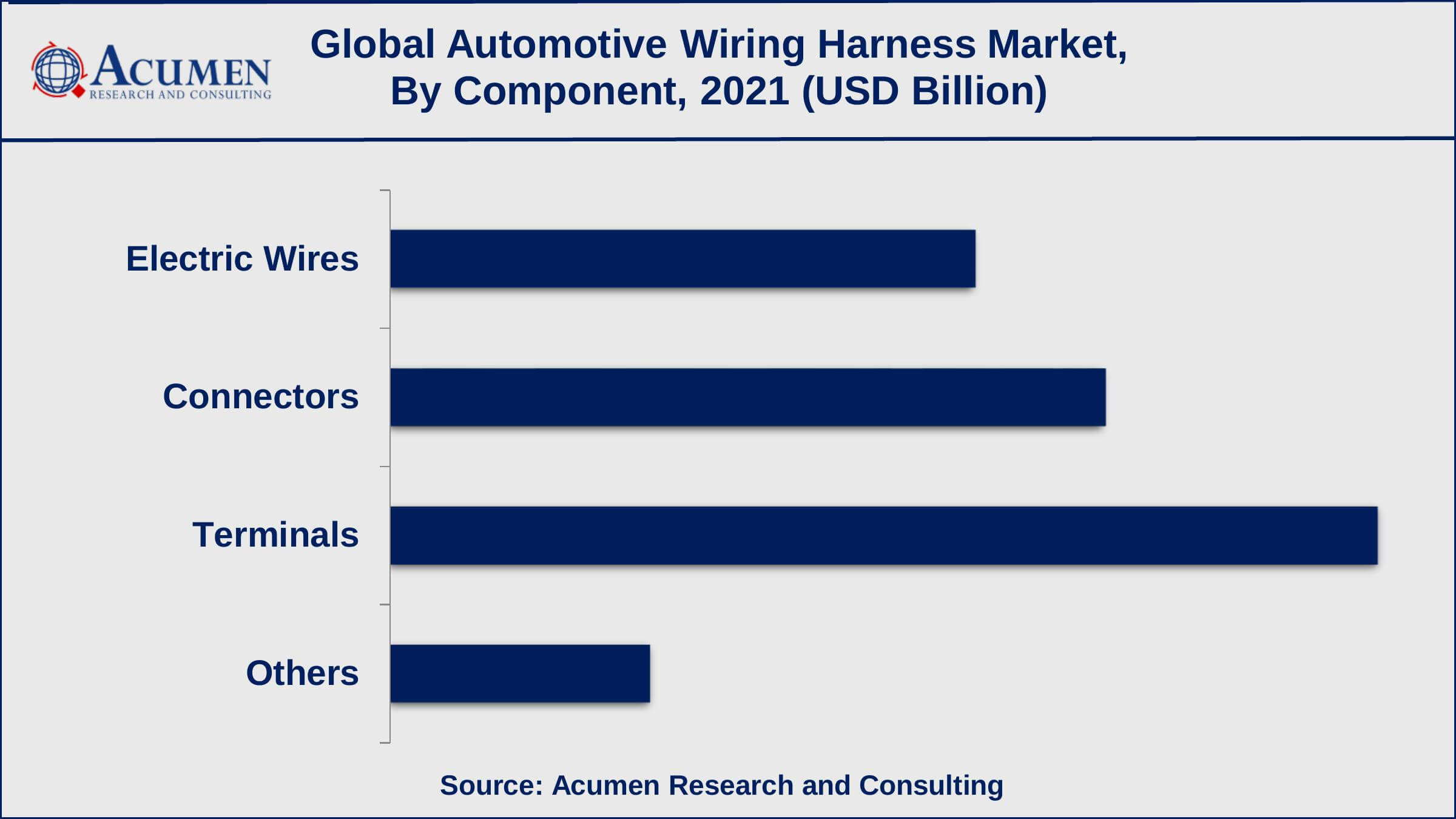

- Among component, terminals generated shares of over 38% in 2021

- Recycling of automotive wiring harness materials is a popular automotive wiring harness market trend that is fueling the industry demand

Global Automotive Wiring Harness Market Dynamics

Market Drivers

- Growth in electric vehicles throughout the globe

- Favorable government support

- Surging electrification of vehicles

- Adoption of vehicles with advanced features

Market Restraints

- Complexity factors associated with automotive wire harnessing on installation

- High maintenance cost

Market Opportunities

- Surging demand for autonomous vehicles

- Demand for lightweight harness

Automotive Wiring Harness Market Report Coverage

| Market | Automotive Wiring Harness Market |

| Automotive Wiring Harness Market Size 2021 | USD 47.3 Billion |

| Automotive Wiring Harness Market Forecast 2030 | USD 76.1 Billion |

| Automotive Wiring Harness Market CAGR During 2022 - 2030 | 5.5% |

| Automotive Wiring Harness Market Analysis Period | 2018 - 2030 |

| Automotive Wiring Harness Market Base Year | 2021 |

| Automotive Wiring Harness Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Material, By Component, By Electric Vehicle, By Vehicle Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Robert Furukawa Electric Co., Ltd., Aptiva PLC, Samvardhana Motherson Group, YURA Tech Corporation, Nexans, Lear Corporation, Sumitomo Electric Industries, Ltd., Leoni AG, and Yazidi Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Automotive Wiring Harness Market Growth Factors

Expanding purchaser disposable income levels, especially in developing countries of Asia Pacific, Latin America, and Eastern Europe, are relied upon to positively affect the market. Moreover, the automotive market in these locales is seeing significant advancement.

Rising combination of electronic gadgets in vehicles has emphatically influenced need for car wiring tackles. Implanting wiring tackle in a vehicle gives various advantages, for example, low likelihood of electrical lack, enhanced eco-friendliness, and upgraded execution. In addition, utilizing innovatively propelled frameworks, for example, infotainment frameworks and propelled driver help frameworks in vehicles is relied upon to drive request over the forecast period.

Expanding acceptance of electric vehicles (EVs) in creating areas is likewise foreseen to drive the automotive wiring harness market as the quantity of electronic segments utilized in EVs is altogether higher than that in customary autos. Expanding tax cuts and motivations by governments over the globe is likewise impelling demand for EVs, thus driving the offers of wiring saddles.

Automotive Wiring Harness Market Segmentation

The global automotive wiring harness market is segmented based on material, component, electric vehicle, vehicle type, application, and geography.

Automotive Wiring Harness Market By Material

- Copper

- Aluminum

- Others

According to an analysis of the automotive wiring harness industry, copper will account for more than 65% of the total market in 2021. Copper has the highest electrical and thermal conductivity of any metal. Cu wire has the lowest resistance to electrical and thermal conduction when compared to aluminum, so it is widely used for wire harnessing in high conductivity applications in automobiles around the world.

Automotive Wiring Harness Market By Component

- Electric Wires

- Connectors

- Terminals

- Others

According to our automotive wiring harness market forecast, the terminals sub-segment is anticipated to hold a prominent market share from 2022 to 2030. Wire terminals are necessary to connect various circuits or systems together in the vehicle. A terminal connector secures wires to a terminal block and is necessary in connecting various circuits of systems together, additionally, providing an electrical ground for a circuit. Terminals can be found in various shapes and size for various circuit protection devices.

Automotive Wiring Harness Market By Electric Vehicle

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

Based on Electric Vehicle, the battery electric vehicle (BEV) sub-segment generated significant market revenue during the forecast period. The demand for battery electric vehicle is growing at an enormous pace post COVID-19 pandemic. According to the International Energy Agency’s Global Electric Vehicle Outlook for the year 2021, despite the economic recessions, a record 3 million new electric vehicle were registered in 2020, a whopping 41% increase from the past year. In comparison to this, the overall automotive market contracted around 16% in 2020.

Automotive Wiring Harness Market By Vehicle Type

- Light Vehicle

- Heavy Vehicle

By vehicle type, the light vehicle sub-segment accounted for significant market share in 2021 and is expected to do so in the coming years. The light vehicle segment includes passenger vehicles and light commercial vehicles. The market is projected to grow in the forecast period due to rise in vehicle production after the downward trend due to COVID-19. Also, growing EVs in passenger vehicles and light commercial vehicle drive the market during the forecast period.

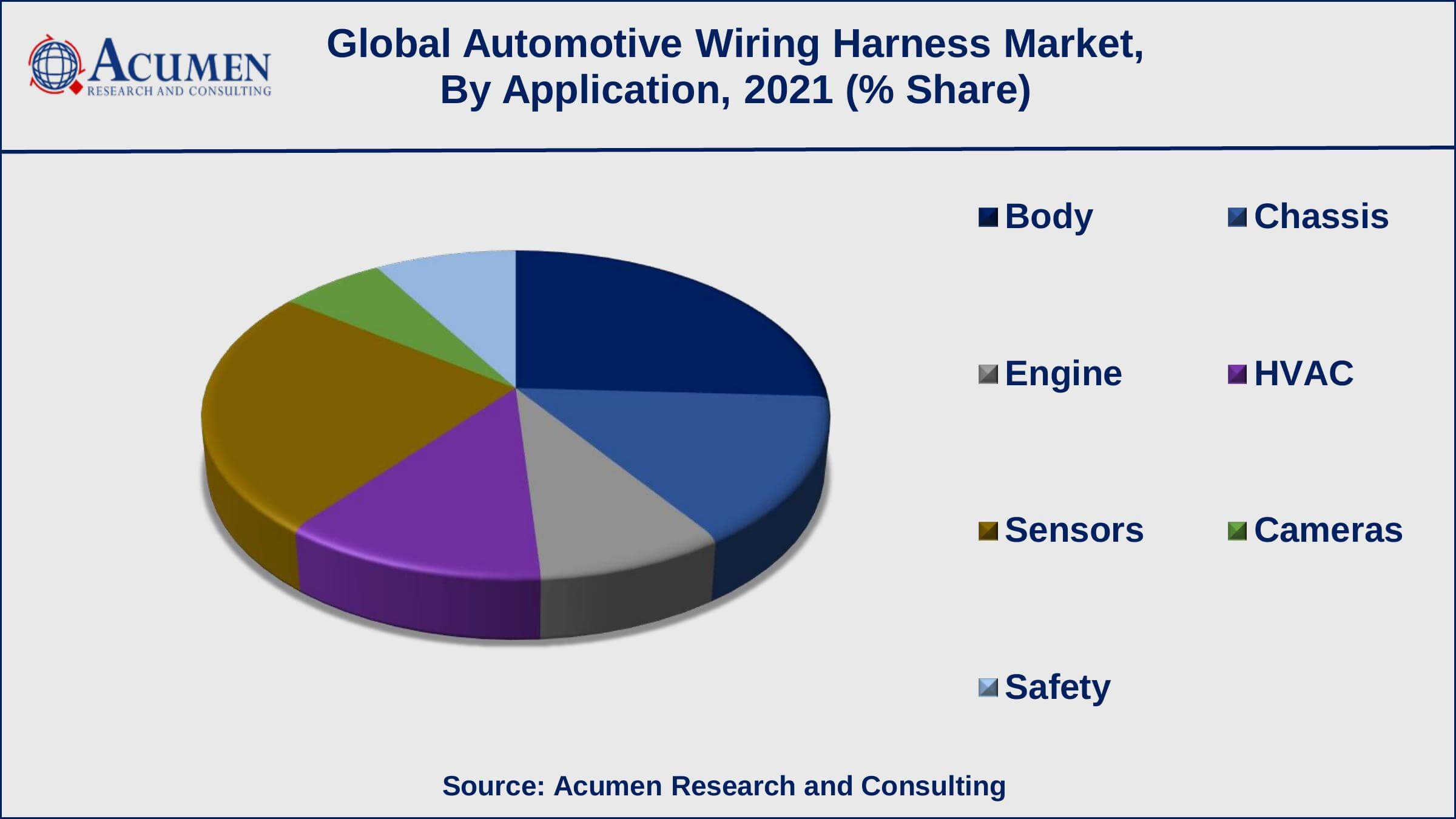

Automotive Wiring Harness Market By Application

- Body

- Chassis

- Engine

- HVAC

- Sensors

- Cameras

- Safety

In terms of value, body sub-segment gathered substantial amount of share starting from 2018 to 2030. Body wiring harness also known as floor harness vary by systems and key function and play an important role in connecting head of the car to the tail of the car or vehicle. The wiring sets are mostly din cable, radio, navigation connections, HDMI and speakers among others. The body harness also includes the roof harness which is functional in operating sunroof/moonroof.

Automotive Wiring Harness Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive Wiring Harness Market Regional Analysis

Asia-Pacific is anticipated to observer profitable development forthcoming due to helpful government initiatives and improving automobile sector. Furthermore, economic growths in countries, for instance, China and India, are anticipated to aid drive the market development. Enormous populace base with growing disposable income in the region captures to high need for automotive wiring harness market.

Asia-Pacific represented over 51% of the general market in 2021. This can be licensed to growing road infrastructure activities, combined with developing automotive manufacturing, particularly in creating economies, for example, China and India. Besides, rising interest for upgraded well being and accommodation includes in mid-portion vehicles and low work costs are in charge of expanding deals.

The Europe market is anticipated to display a CAGR surpassing 6% over the forthcoming years. Developing car generation, advancement as far as drive advances, and multiplying selection of electric vehicles are foreseen to drive request in Europe. Growing need for better automotive infrastructure is a pivotal factor impelling the growth of the regional market.

Automotive Wiring Harness Market Players

Market companies are concentrating on implementing new strategies for instance regional expansion, partnerships, mergers and acquisitions, new product launches, and distribution agreements to surge their revenue share. The major players associated with the Robert Furukawa Electric Co., Ltd., Aptiva PLC, Samvardhana Motherson Group, YURA Tech Corporation, Nexans, Lear Corporation, Sumitomo Electric Industries, Ltd., Leoni AG, and Yazidi Corporation.

Frequently Asked Questions

What is the size of global automotive wiring harness market in 2021?

The market size of automotive wiring harness market in 2021 was accounted to be USD 47.3 Billion.

What is the CAGR of global automotive wiring harness market during forecast period of 2022 to 2030?

The projected CAGR of automotive wiring harness market during the analysis period of 2022 to 2030 is 5.5%.

Which are the key players operating in the market?

The prominent players of the global automotive wiring harness market include Robert Furukawa Electric Co., Ltd., Aptiva PLC, Samvardhana Motherson Group, YURA Tech Corporation, Nexans, Lear Corporation, Sumitomo Electric Industries, Ltd., Leoni AG, and Yazidi Corporation.

Which region held the dominating position in the global automotive wiring harness market?

Asia-Pacific held the dominating automotive wiring harness during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Europe region exhibited fastest growing CAGR for automotive wiring harness during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global automotive wiring harness market?

Growth in electric vehicles throughout the globe, favorable government support, and surging electrification of vehicles drives the growth of global automotive wiring harness market.

Which material held the maximum share in 2021?

Based on material, copper segment is expected to hold the maximum share of the automotive wiring harness market.

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date