Automotive VVT System Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Automotive VVT System Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

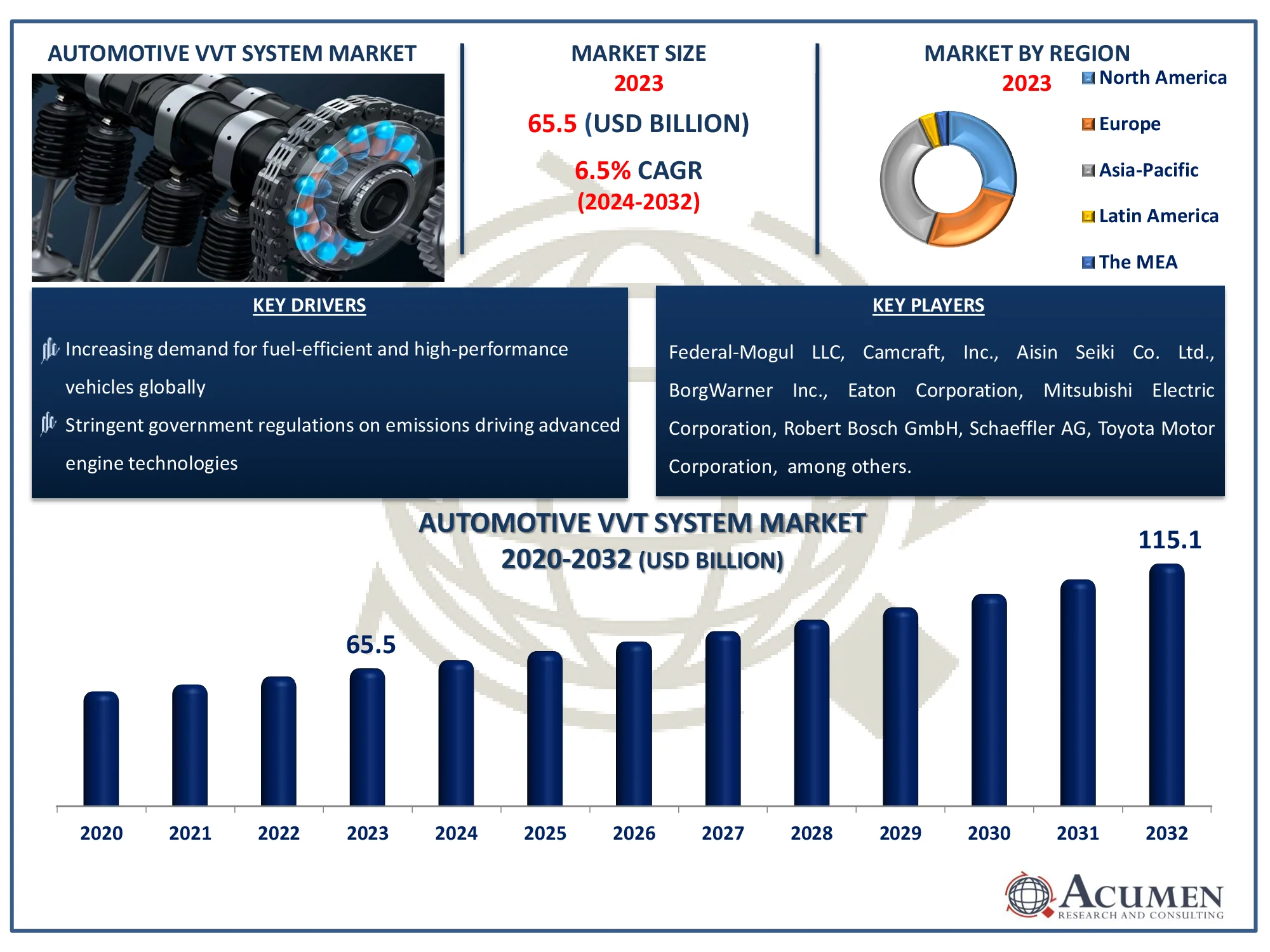

The Global Automotive VVT System Market Size accounted for USD 65.5 Billion in 2023 and is estimated to achieve a market size of USD 115.1 Billion by 2032 growing at a CAGR of 6.5% from 2024 to 2032.

Automotive VVT System Market Highlights

- Global automotive VVT system market revenue is poised to garner USD 115.1 billion by 2032 with a CAGR of 6.5% from 2024 to 2032

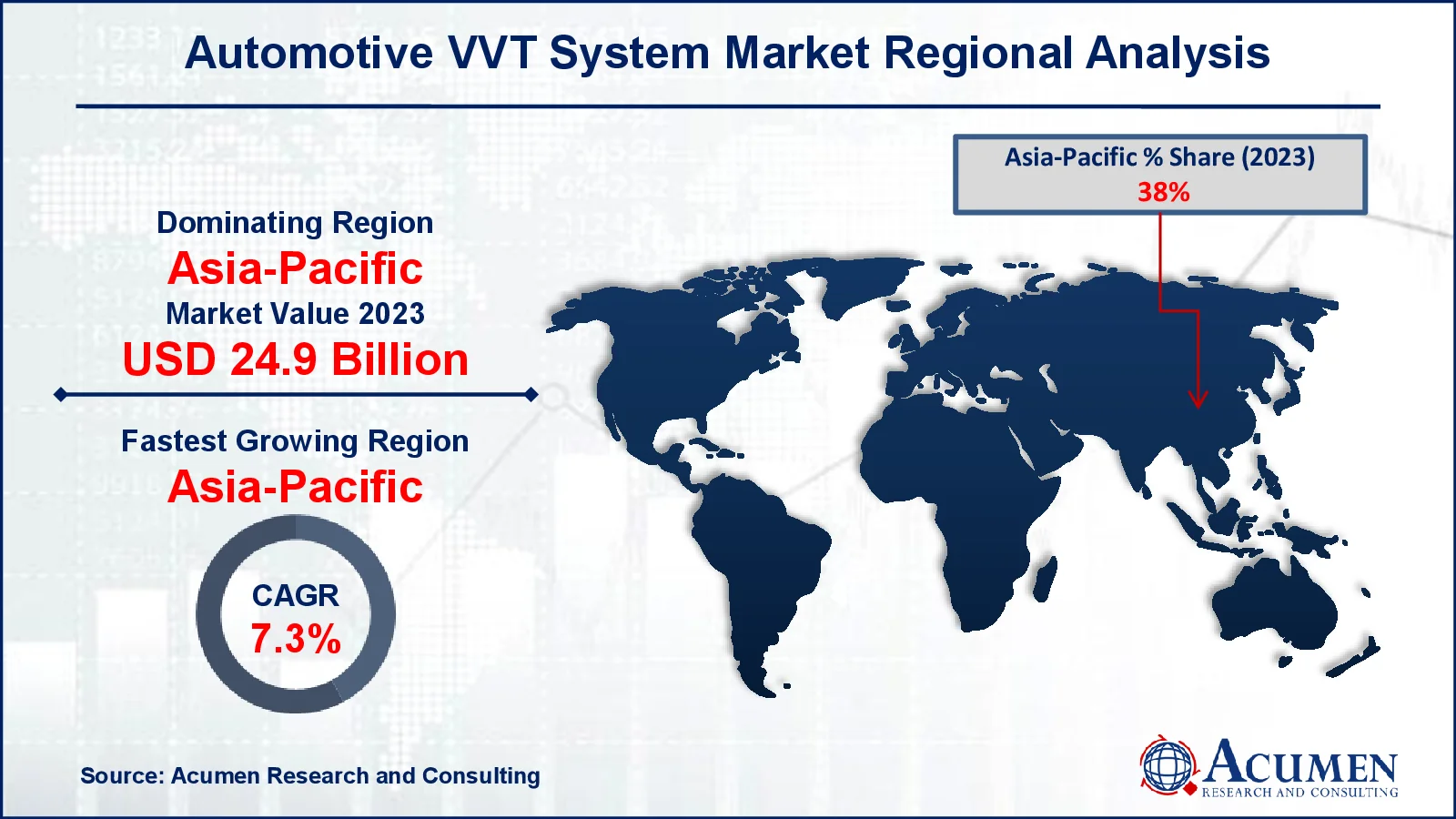

- Asia-Pacific automotive VVT system market value occupied around USD 24.9 billion in 2023

- Asia-Pacific automotive VVT system market growth will record a CAGR of more than 7.3% from 2024 to 2032

- Among product type, the continuous VVT sub-segment generated notable revenue in 2023

- Based on application, the passenger vehicle sub-segment generated around 62% automotive VVT system market share in 2023

- Rising demand for lightweight and compact engines is a popular automotive VVT system market trend that fuels the industry demand

Automotive industry is experiencing a drastic change across the globe. Rising government regulation related to pollution, carbon footprints, and developing transportation sector is shifting manufacturers focus on development of advanced emission control system. Variable Valve Timing and Lift Electronic Control is an electronic and mechanical system that is able to increase the performance of the vehicle with improved engine efficiency. With VVT, it is possible to have the timing altered to match the engine speed, torque requirements, and valve overlap.

Global Automotive VVT System Market Dynamics

Market Drivers

- Increasing demand for fuel-efficient and high-performance vehicles globally

- Stringent government regulations on emissions driving advanced engine technologies

- Growing adoption of hybrid and electric vehicles with integrated VVT systems

- Rising consumer preference for eco-friendly vehicles with improved powertrain efficiency

Market Restraints

- High cost of VVT system integration in entry-level vehicles

- Complexities in VVT system design and maintenance challenges

- Limited adoption in regions with low vehicle electrification and emission norms

Market Opportunities

- Expansion of the automotive sector in emerging economies creating new VVT adoption avenues

- Increasing R&D investments in innovative VVT technologies for hybrid engines

- Collaboration between automakers and technology providers to lower VVT system costs

Automotive VVT System Market Report Coverage

| Market | Automotive VVT System Market |

| Automotive VVT System Market Size 2022 |

USD 65.5 Billion |

| Automotive VVT System Market Forecast 2032 | USD 115.1 Billion |

| Automotive VVT System Market CAGR During 2023 - 2032 | 6.5% |

| Automotive VVT System Market Analysis Period | 2020 - 2032 |

| Automotive VVT System Market Base Year |

2023 |

| Automotive VVT System Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Product Type, By Fuel Type, By Method, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Federal-Mogul LLC, Camcraft, Inc., Aisin Seiki Co. Ltd., BorgWarner Inc., Eaton Corporation, Mitsubishi Electric Corporation, DENSO Corporation, Robert Bosch GmbH, Schaeffler AG, Toyota Motor Corporation, Honda Motor Co., Ltd., and Johnson Controls, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automotive VVT System Market Insights

Major factors expected to drive the growth of the global automotive VVT systems market are increasing automotive regulatory standards across the globe and manufacturer’s approach towards increasing the performance of the vehicle. Automotive industry flourishing across the globe and is witnessing a reasonable change in order to reduce the air pollution through vehicles. Manufacturers are focused on development of advanced technology that helps to achieve high power with low carbon emission.

In addition, increasing regulation related to environment pollution, governments initiatives to reduce carbon footprints from transportation sector is resulting in demand for VVT systems that aid in low fuel consumption and provide high output this another factor expected to further boost the growth of the target market.

Moreover, increasing passenger car production across the globe, coupled with deployment of VVT systems in passenger vehicles is expected to further support the growth of the target market.

However, high complexity and production cost associated to VVT system is a major factor expected to hamper the growth of the global automotive VVT systems market. In addition, high maintenance cost and low adoption of diesel engine vehicles is expected to further challenge the growth go the automotive VVT system market.

Technological advancements by major players and development of low cost product, along with rising diesel engine product sale are factors expected to create new revenue opportunities for players operating in the target market over the automotive VVT system market forecast period. In addition, increasing merger and acquisition activities in order to increase customer base and product portfolio is expected to further revenue support the growth of the target market.

Automotive VVT System Market Segmentation

The worldwide market for automotive VVT system is split based on product type, fuel type, methods, application, and geography.

Automotive VVT System Market By Product Type

- Continuous VVT

- Non-Continuous VVT

According to automotive VVT system industry analysis, the product type segment is bifurcated into continuous VVT and non-continuous VVT. The continuous VVT segment is expected to account for moderate revenue share. The application segment is bifurcated in to passenger vehicle, light commercial vehicle, and heavy commercial vehicle. The passenger vehicle is expected to witness significant revenue growth due to increasing passenger vehicle sale in developing countries, coupled with demand of improved fuel efficiency with high power and torque.

Automotive VVT System Market By Fuel Type

- Diesel

- Gasoline

In the automotive variable valve timing system market, the gasoline category is the largest by fuel type. Gasoline engines dominate the worldwide automotive landscape because they are widely used in passenger cars and light trucks. VVT systems assist these engines greatly by increasing fuel efficiency, improving engine performance, and lowering emissions—all of which are top priorities for automakers and regulators. The growing popularity of hybrid and plug-in hybrid vehicles, which are mostly powered by gasoline, adds to the segment's strength. Additionally, gasoline engines are more compatible with newer technologies such as turbocharging and direct injection, which work well with VVT systems. As consumer preferences evolve toward environmentally friendly and fuel-efficient automobiles, the gasoline segment continues to dominate the industry, aided by ongoing technological developments.

Automotive VVT System Market By Method

- Cam Phasing

- Variable Valve

- Cam Changing

- Cam Phasing & Changing

Cam phasing is the most significant segment in the automotive variable valve timing (VVT) system market in terms of method. Cam phasing is frequently used since it is simple, inexpensive, and can improve engine efficiency and performance. This approach adjusts the camshaft timing to optimize valve performance based on engine speed and load circumstances, thereby increasing fuel efficiency and lowering emissions. Its compatibility with both gasoline and diesel engines makes it adaptable, which contributes to its extensive use across vehicle types. Cam phasing is preferred by automakers because it is proved to be reliable and less complex than other approaches such as cam changing. With rising demand for fuel-efficient and environmentally friendly automobiles, cam phasing is projected to remain dominant in the industry.

Automotive VVT System Market By Application

- Passenger Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

The passenger vehicle segment accounts for the majority of the automotive VVT system market by application. This dominance is due to the enormous global production and sales volume of passenger vehicles, particularly in developing and developed markets. Passenger vehicles prioritize fuel efficiency, pollution reduction, and improved performance all of which are important benefits of VVT systems. Furthermore, rising consumer demand for technologically innovative and environmentally friendly automobiles, such as hybrids, has hastened the adoption of VVT systems in this category. Regulatory restrictions for tougher pollution norms propel adoption even further, since VVT technology meets compliance criteria. The growth in urbanization and rising disposable incomes, which leads to higher car ownership rates, reinforces the passenger vehicle segment's dominance in the VVT market.

Automotive VVT System Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive VVT System Market Regional Analysis

The automotive VVT system market in Asia-Pacific is expected to witness largest and fastest growth this can be attributed to increasing passenger Product sale in developing economies. In addition, increasing spending capacity among consumers, along with demand for passenger vehicles with advanced features and system that are fuel efficient is expected to increase demand for VVT systems thus driving the growth of the automotive VVT system market in this region.

The market in North America is expected to account for notable revenue share in the automotive VVT system market owing to increasing government regulations related to pollution control, and presence of major manufacturers operating in the country in this region. Government is implementing various regulations in order to control the pollution through vehicles and reduce environmental impact. Manufacturers are developing various component and systems in order to reduce the rising pollution through transportation sector.

Automotive VVT System Market Players

Some of the top automotive VVT system companies offered in our report includes Federal-Mogul LLC, Camcraft, Inc., Aisin Seiki Co. Ltd., BorgWarner Inc., Eaton Corporation, Mitsubishi Electric Corporation, DENSO Corporation, Robert Bosch GmbH, Schaeffler AG, Toyota Motor Corporation, Honda Motor Co., Ltd., and Johnson Controls, Inc.

Frequently Asked Questions

How big is the automotive VVT system market?

The automotive VVT system market size was valued at USD 65.5 Billion in 2023.

What is the CAGR of the global automotive VVT system market from 2024 to 2032?

The CAGR of automotive VVT system is 6.5% during the analysis period of 2024 to 2032.

Which are the key players in the automotive VVT system market?

The key players operating in the global market are including Federal-Mogul LLC, Camcraft, Inc., Aisin Seiki Co. Ltd., BorgWarner Inc., Eaton Corporation, Mitsubishi Electric Corporation, DENSO Corporation, Robert Bosch GmbH, Schaeffler AG, Toyota Motor Corporation, Honda Motor Co., Ltd., and Johnson Controls, Inc.

Which region dominated the global automotive VVT system market share?

Asia-Pacific held the dominating position in automotive VVT system industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of automotive VVT system during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global automotive VVT system industry?

The current trends and dynamics in the automotive VVT system industry include increasing demand for fuel-efficient and high-performance vehicles globally, and stringent government regulations on emissions driving advanced engine technologies.

Which fuel type held the maximum share in 2023?

The gasoline fuel type held the notable share of the automotive VVT system industry.