Marine Diesel Engine Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Marine Diesel Engine Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

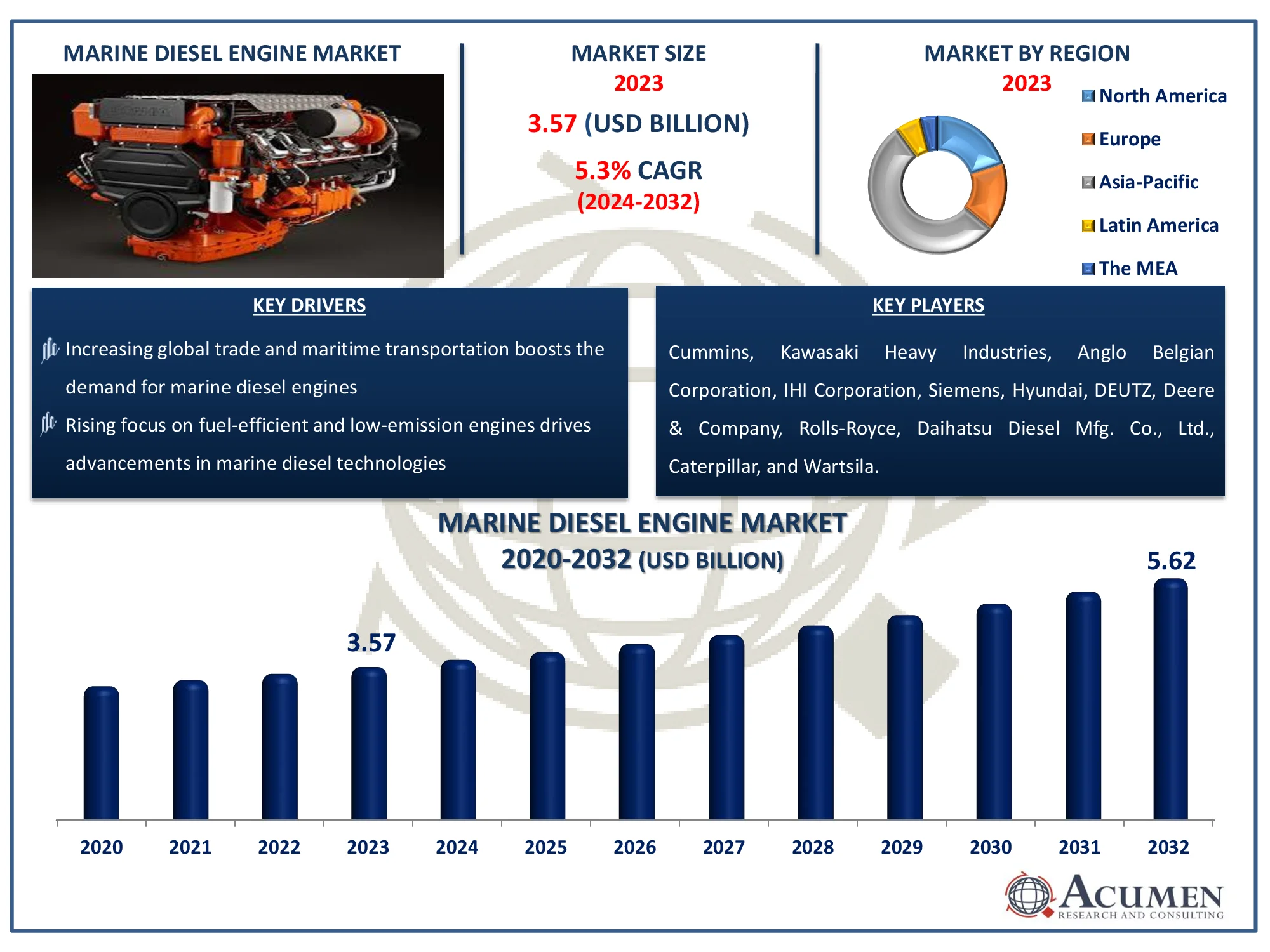

The Global Marine Diesel Engine Market Size accounted for USD 3.57 Billion in 2023 and is estimated to achieve a market size of USD 5.62 Billion by 2032 growing at a CAGR of 5.3% from 2024 to 2032.

Marine Diesel Engine Market Highlights

- Global marine diesel engine market revenue is poised to garner USD 5.62 billion by 2032 with a CAGR of 5.3% from 2024 to 2032

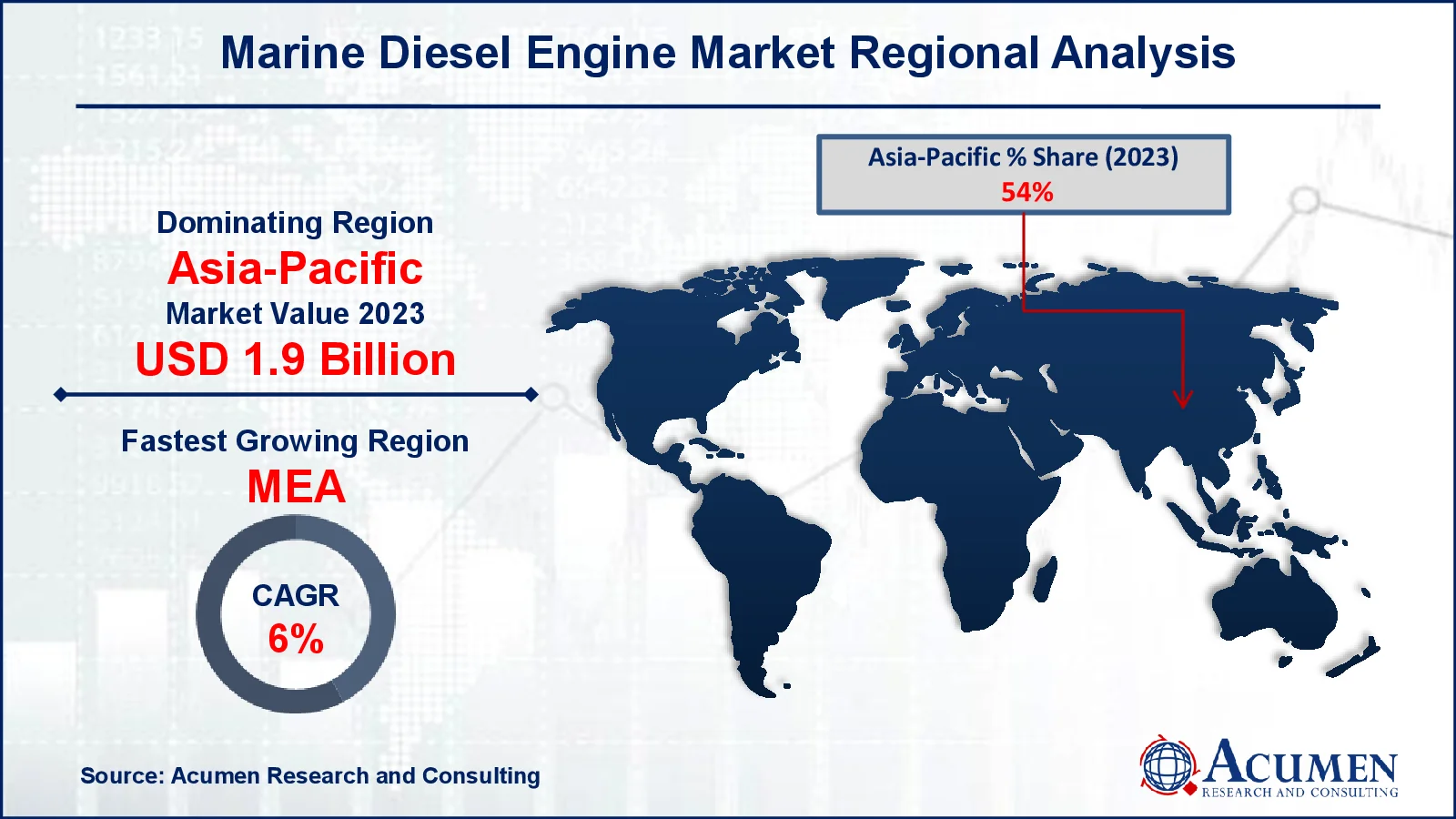

- Asia-Pacific marine diesel engine market value occupied around USD 1.9 billion in 2023

- The Middle East and Africa marine diesel engine market growth will record a CAGR of more than 6% from 2024 to 2032

- Among technology, the low speed sub-segment generated USD 2.3 billion revenue in 2023

- Based on capacity, the more than 5001 Hp sub-segment generated significant marine diesel engine market share in 2023

- Advancements in digital technologies, such as engine monitoring systems, improve operational efficiency is a popular marine diesel engine market trend that fuels the industry demand

A marine diesel engine is a highly efficient internal combustion engine that powers ships, boats, and submarines. It runs on diesel fuel, which is known for its great energy density and cost effectiveness. Marine diesel engines are chosen for their durability, fuel efficiency, and ability to work consistently in difficult maritime environments. These engines are available in a variety of forms, including two-stroke and four-stroke, and are normally classified according to speed range: low, medium, or high. The most common applications include propulsion systems for cargo ships, passenger vessels, and fishing boats, as well as supplementary power for on-board equipment. Their durability and versatility make them suitable for business and recreational water transportation.

Global Marine Diesel Engine Market Dynamics

Market Drivers

- Increasing global trade and maritime transportation boosts the demand for marine diesel engines

- Rising focus on fuel-efficient and low-emission engines drives advancements in marine diesel technologies

- Growth in offshore oil and gas exploration activities spurs demand for robust marine propulsion systems

- Expansion of naval fleets and modernization of defense marine vessels supports market growth

Market Restraints

- Stringent environmental regulations on emissions limit the adoption of conventional diesel engines

- High initial investment costs deter small-scale operators from upgrading their fleets

- Fluctuating fuel prices create uncertainty in operational costs, impacting engine sales

Market Opportunities

- Development of hybrid and dual-fuel marine diesel engines to meet environmental compliance

- Increasing focus on LNG as an alternative fuel in maritime transport opens new engine design opportunities

- Growing investments in shipbuilding industries in emerging economies

Marine Diesel Engine Market Report Coverage

| Market | Marine Diesel Engine Market |

| Marine Diesel Engine Market Size 2022 |

USD 3.57 Billion |

| Marine Diesel Engine Market Forecast 2032 | USD 5.62 Billion |

| Marine Diesel Engine Market CAGR During 2023 - 2032 | 5.3% |

| Marine Diesel Engine Market Analysis Period | 2020 - 2032 |

| Marine Diesel Engine Market Base Year |

2023 |

| Marine Diesel Engine Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Ship Type, By Technology, By Capacity, By Propulsion System, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Cummins, Kawasaki Heavy Industries, Anglo Belgian Corporation, IHI Corporation, Siemens, Hyundai, DEUTZ, Deere & Company, Rolls-Royce, Daihatsu Diesel Mfg. Co., Ltd., Caterpillar, and Wartsila. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Marine Diesel Engine Market Insights

Growing worldwide seaborne trade mainly across emerging countries along with favorable shipping prospects will boost market demand for marine diesel engines. According to the UN Conference on Trade & Development, the worldwide transport sector covers 80% of world trade by quantity and 70% by income. Easy accessibility along with small diesel costs makes shipowners' implementation feasible over other alternative fuels.

The implementation of marine pollution reduction legislation across ECAs has encouraged demand for low-emission motors. To satisfy highlighted standards, sector competitors have altered their product lines with sophisticated motors, including motors with catalytic inhibitors and scrubbers. Technological advances to produce sophisticated motors due to variables including higher effectiveness and decreased operating costs will boost company development. Furthermore, favourable financial developments from emerging economies, coupled with a rise in retrofitting operations to attain greater operating norms, are expected to increase the business landscape of marine diesel engines.

High-speed systems are mostly mounted in yachts, tiny ships, ferry boats, and fishing vessels. They are small, using high-quality marine diesel fuel to enhance engine performance and effectiveness. Innovations, sophisticated product design, and advances in diesel engines resulting in advantages including low fuel consumption and operating costs will complement product acceptance. For instance, Wärtsilä launched its high-speed motor intended to meet reduced capital expenditure demands, restricted room & weight, and meet the continuing worldwide emission laws.

Rising seaborne trade across emerging economies along with increasing demand for economically feasible motors due to advantages including durability, reliability, and fuel efficiency will boost marine diesel engine market growth. The swift change from residual fuel motors to diesel engines along with shifting shipping industry focus is laid to drive consumer penetration. Key advantages, including easy accessibility and small diesel costs, make shipowners' acceptance viable over other alternative fuels. Technological advances and advances in product design leading to small operating costs will further increase the landscape.

Declining crude oil prices, combined with rising seaborne passenger traffic, are laid to encourage item acceptance. Implementing public measures to reduce marine pollution mainly across emission control fields increased the demand for low-emission motors. Major sector competitors have changed their product lines to motors fitted with scrubbers and catalytic reactors which, in turn, will enhance manufacturing implementation.

Marine Diesel Engine Market Segmentation

The worldwide market for marine diesel engine is split based on ship type, technology, capacity, propulsion system, applications, and geography.

Marine Diesel Engines Market By Market Ship Type

- General Cargo Ship

- Bulk Carriers

- Container Ship

- Oil Tankers

- Ferries and Passenger Ships

- Others

Bulk carriers are likely to be the greatest contributors to the marine diesel engine market, owing to their critical role in moving vast quantities of raw materials such as coal, cereals, and ores across worldwide trade routes. The rising need for bulk commodities, spurred by industrial growth and energy production, has resulted in a surge in the construction of bulk carriers outfitted with sophisticated diesel engines that are both efficient and dependable. Furthermore, bulk carriers' operational cost-effectiveness for long-haul shipments increases their desirability. With increased international trade, particularly in emerging economies, the category maintains its marine diesel engine market dominance, aided by engine design advances to meet tough environmental laws.

Marine Diesel Engines Market By Technology

- Medium Speed

- Low Speed

- High Speed

According to marine diesel engine industry analysis, low-speed technology sector dominated in 2023. Key factors, including enhancing long-distance travel traffic, using low-cost petrol and adopting motors in merchant ships, including cargo, tankers and bulk carriers, will increase the business landscape. Reduced expenses, lower polluting emissions, and enhanced heat & oxidation resistance features are among the parameters that enhance business perspective.

Medium speed is expected to expand due to increased marine tourism and increased demand for recreational ships including cruises, ferries, yachts and passenger vessels. Increasing worldwide imports and exports of countless commodities including ores, merchandise, and minerals will favorably affect item assembly. Moreover, multiple cruise ship businesses including Costa Asia, Royal Caribbean and Star Cruise are increasing their portfolio by including fresh, state-of-the-art cruise boats that are more luxurious and can provide stronger passenger experience. Increased consumption of crude oil and other liquid products favors consumer requirement. Extending choke points along with increasing container traffic will further drive demand from container vessels. Improving living standards along with increasing disposable income in emerging countries will encourage consumer acceptance.

Marine Diesel Engines Market By Capacity

- 300 To 500 Hp

- 500 To 1000 Hp

- 1001 To 2000 Hp

- 2001 To 5000 Hp

- More Than 5001 Hp

The more than 5001 HP sector accounts for a sizable portion of the marine diesel engine market since it can power large vessels such as cargo ships, tankers, and cruise ships. These engines are engineered for peak performance, allowing for efficient long-distance operations with little downtime. Their rugged structure provides dependability in harsh marine settings, while modern technologies improve fuel efficiency and reduce emissions. The segment benefits from rising international trade, which drives demand for large ships. Furthermore, increased investments in fleet modernization to fulfill severe environmental standards contribute to the employment of engines of more than 5001 horsepower. This trait is critical for heavy-duty applications, and it contributes significantly to the marine diesel engine market total growth.

Marine Diesel Engines Market By Propulsion System

- Four Stroke

- Two Stroke

The two-stroke segment of the marine diesel engine market is expanding rapidly due to improved efficiency, power density, fuel flexibility, and technical developments. These engines have improved thermal efficiency, reduced fuel consumption, and may use a wider variety of fuels. Their compact size and great power output make them suited for larger vessels. Continuous advances in engine design and emission control technologies improve their performance and environmental friendliness. While four-stroke engines have their uses, the two-stroke segment's inherent advantages position it for future expansion in the marine diesel engine market.

Marine Diesel Engine Market By Application

- Off-Shore

- Merchant

- Cruise & Ferry

- Navy

- Others

In the marine diesel engine market, offshore development is expected due to favorable perspective for profound water exploration operations coupled with solid exploration and production (E&P) operations leading to increased demand for gas carriers, petroleum tankers and drill vessels, among others. Implementing public laws to decrease marine pollution will fuel OSV brand acceptance. Moreover, reviving the oil & gas sector will further boost demand for offshore ships worldwide.

Marine Diesel Engine Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Marine Diesel Engine Market Regional Analysis

The Asia-Pacific region dominates the marine diesel engine market as the main contributor, owing to its considerable marine trade, shipbuilding activity, and coastal economies. China, South Korea, and Japan are world leaders in ship production, accounting for a sizable proportion of commercial and navy vessels. China, in particular, holds a leading position because to its strong export-import trade and large investments in shipbuilding infrastructure. Furthermore, the presence of major corporations and access to low-cost raw materials strengthen the region's leadership. The region's proactive adoption of eco-friendly engine technologies, combined with rising demand for container ships, tankers, and bulk carriers, solidifies its position as an industry leader.

Meanwhile, the Middle East and Africa (MEA) region is developing as the fastest-growing marine diesel engine market, owing to its strategic location along major global shipping routes and rising investment in maritime infrastructure. Gulf countries, particularly the UAE and Saudi Arabia, are investing in marine infrastructure, such as ports and shipping fleets, in order to increase energy exports and diversify commerce. Furthermore, the region's burgeoning offshore oil and gas exploration activities drives up demand for large marine diesel engines. The region's need to modernize its fleets and comply with international emission laws is also driving the MEA's rapid marine diesel engine market expansion.

Marine Diesel Engine Market Players

Some of the top marine diesel engine market companies offered in our report includes Cummins, Kawasaki Heavy Industries, Anglo Belgian Corporation, IHI Corporation, Siemens, Hyundai, DEUTZ, Deere & Company, Rolls-Royce, Daihatsu Diesel Mfg. Co., Ltd., Caterpillar, and Wartsila.

Frequently Asked Questions

How big is the marine diesel engine market?

The marine diesel engine market size was valued at USD 3.57 billion in 2023.

What is the CAGR of the global marine diesel engine market from 2024 to 2032?

The CAGR of marine diesel engine is 5.3% during the analysis period of 2024 to 2032.

Which are the key players in the marine diesel engine market?

The key players operating in the global market are including Cummins, Kawasaki Heavy Industries, Anglo Belgian Corporation, IHI Corporation, Siemens, Hyundai, DEUTZ, Deere & Company, Rolls-Royce, Daihatsu Diesel Mfg. Co., Ltd., Caterpillar, and Wartsila.

Which region dominated the global marine diesel engine market share?

Asia-Pacific held the dominating position in marine diesel engine industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

The MEA region exhibited fastest growing CAGR for market of marine diesel engine during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global marine diesel engine industry?

The current trends and dynamics in the marine diesel engine industry include increasing awareness and acceptance of prenatal testing for detecting chromosomal abnormalities, ongoing developments in genetic research, and increasing prevalence of genetic disorders globally.

Which ship type held the maximum share in 2023?

The bulk carriers ship type held the maximum share of the marine diesel engine industry.