Automotive Power Electronics Market | Acumen Research and Consulting

Automotive Power Electronics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format : ![]()

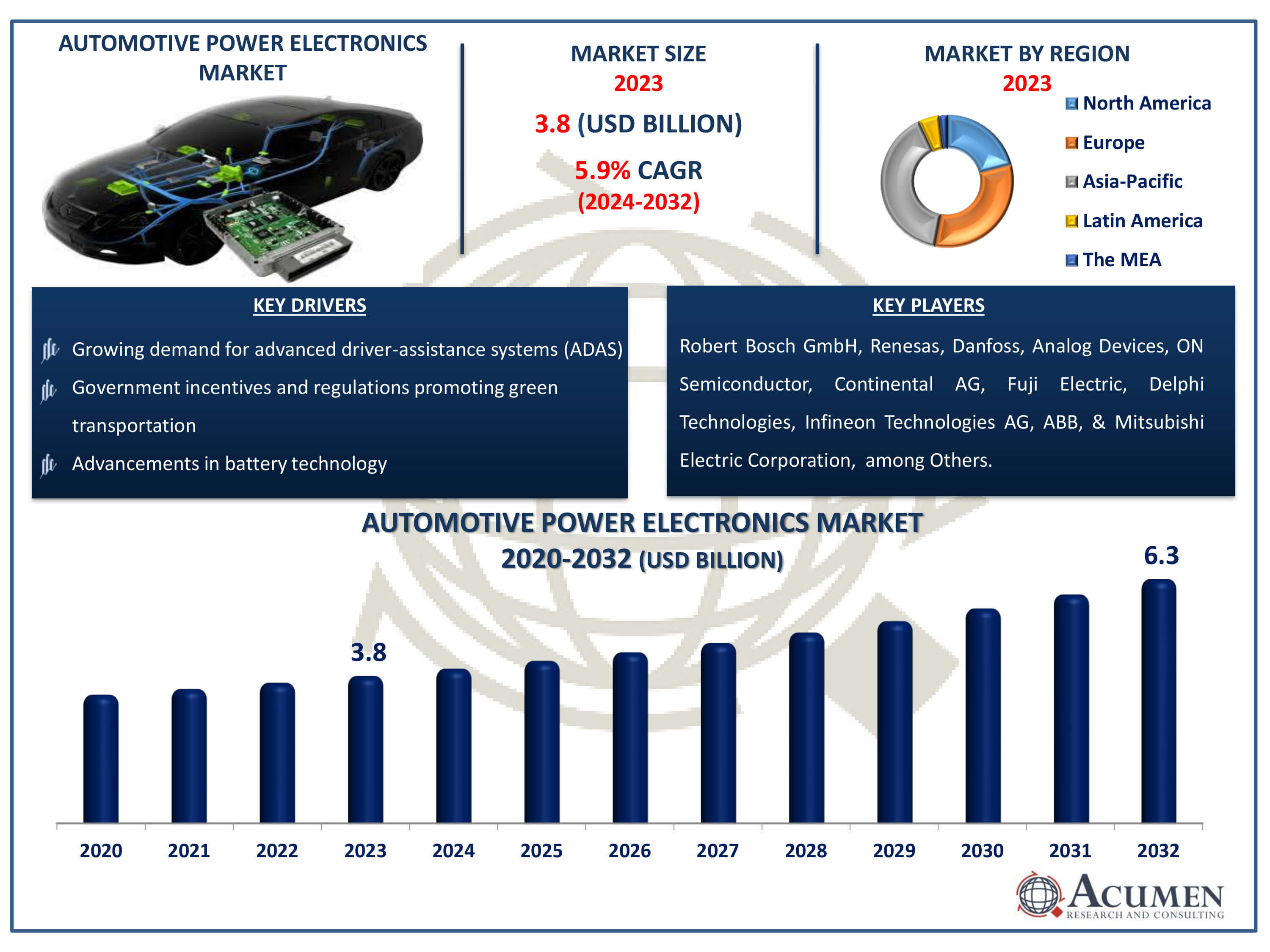

The Automotive Power Electronics Market Size accounted for USD 3.8 Billion in 2023 and is estimated to achieve a market size of USD 6.3 Billion by 2032 growing at a CAGR of 5.9% from 2024 to 2032.

Automotive Power Electronics Market Highlights

- Global automotive power electronics market revenue is poised to garner USD 6.3 billion by 2032 with a CAGR of 5.9% from 2024 to 2032

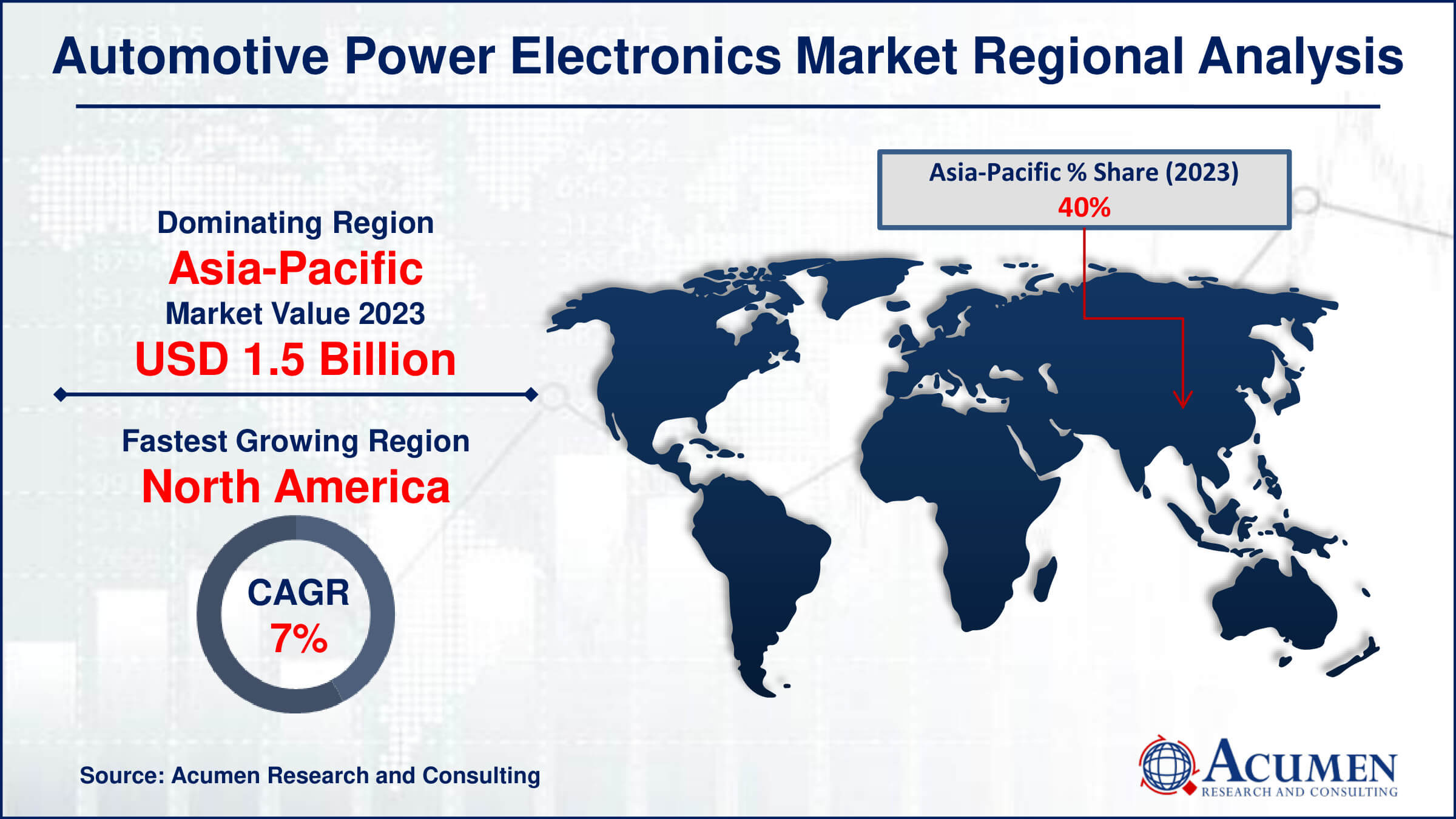

- Asia-Pacific automotive power electronics market value occupied around USD 1.5 billion in 2023

- North America automotive power electronics market growth will record a CAGR of more than 7% from 2024 to 2032

- Among component, the microcontroller sub-segment generated noteworthy revenue in 2023

- Based on device, the power IC sub-segment generated around 75% automotive power electronics market share in 2023

- Growing market for hybrid electric vehicles (HEVs) is a popular automotive power electronics market trend that fuels the industry demand

Power electronics refers to a wide range of solid-state devices used to manage and convert electric power, such as diodes, silicon-controlled rectifiers (SCR), thyristors, gate turn-off thyristors, and power MOSFETs, among others. These gadgets play an important role in the automotive sector by controlling the electronics. Automotive electronics, which arise from power electronic devices, are required in modern automobiles for advanced systems such as electric power steering, brake systems, seat control, HEV main inverters, and central body control units. The use of power electronics in these applications improves vehicle efficiency, safety, and performance, making them a critical component in the progress of automotive technology.

Global Automotive Power Electronics Market Dynamics

Market Drivers

- Increasing adoption of electric vehicles (EVs)

- Advancements in battery technology

- Growing demand for advanced driver-assistance systems (ADAS)

- Government incentives and regulations promoting green transportation

Market Restraints

- High cost of power electronic components

- Technical challenges in integrating power electronics in vehicles

- Limited charging infrastructure for electric vehicles

Market Opportunities

- Development of smart and autonomous vehicles

- Expansion of fast-charging infrastructure

- Innovations in power electronic materials and components

Automotive Power Electronics Market Report Coverage

| Market | Automotive Power Electronics Market |

| Automotive Power Electronics Market Size 2022 | USD 3.8 Billion |

| Automotive Power Electronics Market Forecast 2032 | USD 6.3 Billion |

| Automotive Power Electronics Market CAGR During 2023 - 2032 | 5.9% |

| Automotive Power Electronics Market Analysis Period | 2020 - 2032 |

| Automotive Power Electronics Market Base Year |

2022 |

| Automotive Power Electronics Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Device, By Vehicle Type, By Electric Vehicle Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Robert Bosch GmbH, Renesas, Danfoss, Analog Devices, ON Semiconductor, Continental AG, Fuji Electric, Delphi Technologies, Infineon Technologies AG, ABB, Maxim Integrated, Mitsubishi Electric Corporation, and NXP Semiconductor. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automotive Power Electronics Market Insights

The automotive power electronics market is now expanding rapidly, driven primarily by two primary factors: increased use of electric vehicles (EVs) and a growing trend toward lightweight vehicle designs. Electric vehicles have received a lot of attention because of their environmental benefits and reduced reliance on fossil fuels. Power electronics are critical in EVs, controlling power flow and increasing energy efficiency, hence promoting mainstream adoption. Another important driver is the automobile industry's transition to lightweight vehicles. These vehicles are intended to enhance fuel efficiency and minimize emissions, in line with global legislative initiatives to mitigate environmental impact. Power electronics enable lightweight vehicle designs by allowing the use of lighter materials and more efficient electronic components.

In addition to these factors, the ongoing growth in worldwide automotive sales has greatly increased demand for automotive power electronics. With vehicle sales surpassing and continuing to expand, there is a matching increase in the adoption of advanced power electronic systems throughout the automotive production sector. Looking ahead, numerous significant developments are influencing market dynamics. Developing countries are progressively adopting electric vehicles, owing to urbanization and government measures supporting sustainable transportation alternatives. Furthermore, severe rules requiring lightweight vehicles to fulfill pollution standards drive market expansion by needing improved power electronic solutions in vehicle production.

Opportunities abound in this changing landscape. The automotive power electronics market will benefit greatly from the global expansion of the automobile sector. Government subsidies and laws that promote electric and lightweight automobiles offer a favorable climate for industry expansion. Furthermore, continued technological breakthroughs in power electronics, such as improvements in battery management systems and power converters, promise improved performance and efficiency, which will drive innovation and market expansion.

Automotive Power Electronics Market Segmentation

The worldwide automotive power electronics market is split based on component, device, vehicle type, electric vehicle type, applications, and geography.

Automotive Power Electronics Market By Components

- Sensors

- Microcontroller

According to automotive power electronics industry analysis, the microcontroller segment is prominent. Microcontrollers are essential for managing and controlling a variety of activities in automobiles, including engine management, safety systems, infotainment, and more. These small integrated circuits are critical for processing and executing commands from sensors and other components, which improves vehicle performance and efficiency. The demand for microcontrollers is increasing as automotive electronics become more complicated, with the integration of advanced driver assistance systems (ADAS) and electric car technologies. Their capacity to handle real-time data processing, assure dependable operation, and enable connection features makes them important in modern vehicle applications, contributing to their dominance in the vehicle power electronics market.

Automotive Power Electronics Market By Devices

- Power IC

- Module/Discrete

The power IC sector is the largest and it is expected to grow continue during the automotive power electronics industry forecast period, owing to its vital role in power distribution and conversion within automobiles. Power integrated circuits combine numerous functions like voltage regulation, power switching, and protection circuits into small, efficient packages. This integration increases dependability, decreases size and weight, and boosts overall system efficiency in automotive applications. As vehicles incorporate more complex technologies such as electric power steering, hybrid electric vehicles (HEVs), and electric vehicles (EVs), the requirement for sophisticated power management solutions from power ICs grows. Power ICs' capacity to manage high-power requirements while maintaining maximum performance makes them crucial for current car electronics, strengthening their dominance in the car power electronics market.

Automotive Power Electronics Market By Vehicle Types

- Passenger Vehicle

- Commercial Vehicle

Several significant factors contribute to the passenger vehicle segment dominance in the automotive power electronics market. Passenger vehicles come in a variety of forms, including sedans, SUVs, and hatchbacks, all of which are increasingly equipped with complex electrical systems. These include electric power steering, infotainment systems, advanced driving assistance systems (ADAS), and, more recently, electric and hybrid powertrains. For effective energy management and control, the integration of these technologies necessitates the use of advanced power electronics. Moreover, increased customer demand for comfort, safety, and connection features in passenger vehicles accelerates the use of innovative electronic systems. As automotive manufacturers work to improve vehicle performance, efficiency, and environmental sustainability, the passenger vehicle segment continues to lead in the adoption and growth of automotive power electronics, demonstrating its critical role in influencing the market landscape.

Automotive Power Electronics Market By Electric Vehicle Types

- Plug-in Electric Vehicle

- Battery Electric Vehicle

- Hybrid Electric Vehicle

The hybrid electric vehicle (HEV) sector is the largest in the automotive power electronics market, owing to its extensive acceptance across many vehicle types. HEVs combine internal combustion engines with electric propulsion systems, using power electronics to efficiently regulate energy flow. This dual-power technology enables HEVs to increase fuel efficiency, lower emissions, and improve overall vehicle performance. Power electronics in HEVs govern the interaction between the internal combustion engine, electric motor, and battery pack, guaranteeing smooth operation and power source transitions. As governments around the world prioritize environmental rules and fuel economy standards, HEVs offer a feasible answer for lowering carbon footprints without sacrificing driving range or performance. Continuous developments in power electronics technology strengthen the appeal and market dominance of HEVs, cementing their position as a key driver in the automotive power electronics market.

Automotive Power Electronics Market By Applications

- Body Electronics

- Infotainment & Telematics

- Safety & Security

- Chassis & Powertrain

- Others

The body electronics section is expected to lead throughout the automotive power electronics market forecast period due to its vital function in modern automobiles. Body electronics include a variety of systems, including as central locking, power windows, and exterior lighting controls. These systems improve user convenience and vehicle functionality, demonstrating the increased desire for comfort and user-friendly features in automobiles. Furthermore, advances in sensor technology and connectivity with vehicle networks highlight the importance of body electronics. As vehicle design trends prioritize user experience and connection, the Body Electronics market is projected to remain prominent. This rise is being driven by ongoing innovation in interface technology and the integration of smart features into car interiors, which respond to consumer desires for increased comfort and convenience.

Automotive Power Electronics Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive Power Electronics Market Regional Analysis

In terms of automotive power electronics market analysis, the Asia-Pacific area is expected to largest region in the future years. This development might be ascribed to the growing adoption of electric vehicles, particularly in China and Japan. Government attempts to promote sustainable mobility, together with rising consumer awareness of environmental issues, are increasing demand for vehicle power electronics in Asia-Pacific. Furthermore, the region's huge population and rising middle class help to fuel the burgeoning demand for electric and hybrid vehicles, creating a favorable environment for automotive power electronics development and implementation.

North America is predicted to fastest growing region in the automotive power electronics market forecast period, followed by Europe, owing to the established automotive industry and rising use of electric cars (EVs) in these areas. The North American market benefits from solid infrastructure, technical developments, and a devoted consumer base interested in automobile innovation. Similarly, Europe's market growth is being pushed by severe environmental legislation that encourages EVs and large investments in automotive R&D.

Automotive Power Electronics Market Players

Some of the top automotive power electronics market companies offered in our report includes Robert Bosch GmbH, Renesas, Danfoss, Analog Devices, ON Semiconductor, Continental AG, Fuji Electric, Delphi Technologies, Infineon Technologies AG, ABB, Maxim Integrated, Mitsubishi Electric Corporation, and NXP Semiconductor.

Frequently Asked Questions

How big is the automotive power electronics market?

The automotive power electronics market size was valued at USD 3.8 billion in 2023.

What is the CAGR of the global automotive power electronics market from 2024 to 2032?

The CAGR of automotive power electronics is 5.9% during the analysis period of 2024 to 2032.

Which are the key players in the automotive power electronics market?

The key players operating in the global market are including Abbott, Agilent Technologies, Inc., Applied Spectral Imaging, Bio-Rad Laboratories, Inc., CytoTest Inc., Empire Genomics, Inc., Leica Biosystems Nussloch GmbH, MetaSystems, PerkinElmer Inc., Sartorius AG, SciGene Corporation, and Thermo Fisher Scientific Inc.

Which region dominated the global automotive power electronics market share?

Asia-Pacific held the dominating position in automotive power electronics industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of automotive power electronics during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global automotive power electronics industry?

The current trends and dynamics in the automotive power electronics industry include increasing adoption of electric vehicles (EVs), advancements in battery technology, growing demand for advanced driver-assistance systems (ADAS), and government incentives and regulations promoting green transportation.

Which component held the maximum share in 2023?

The microcontroller held the significant share of the automotive power electronics industry.