Automotive Filter Market | Acumen Research and Consulting

Automotive Filter Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

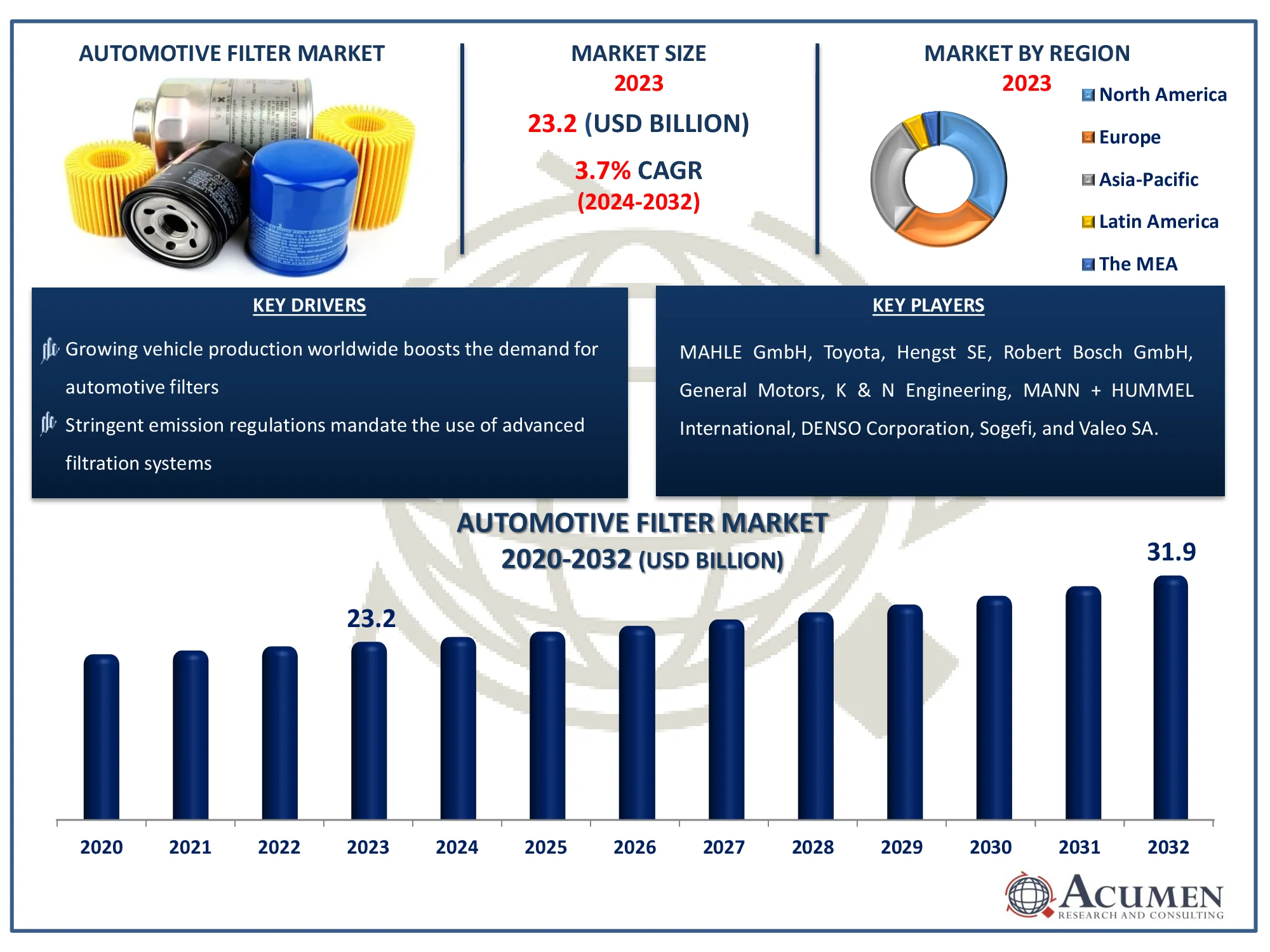

The Global Automotive Filter Market Size accounted for USD 23.2 Billion in 2023 and is estimated to achieve a market size of USD 31.9 Billion by 2032 growing at a CAGR of 3.7% from 2024 to 2032.

Automotive Filter Market Highlights

- Global automotive filter market revenue is poised to garner USD 31.9 billion by 2032 with a CAGR of 3.7% from 2024 to 2032

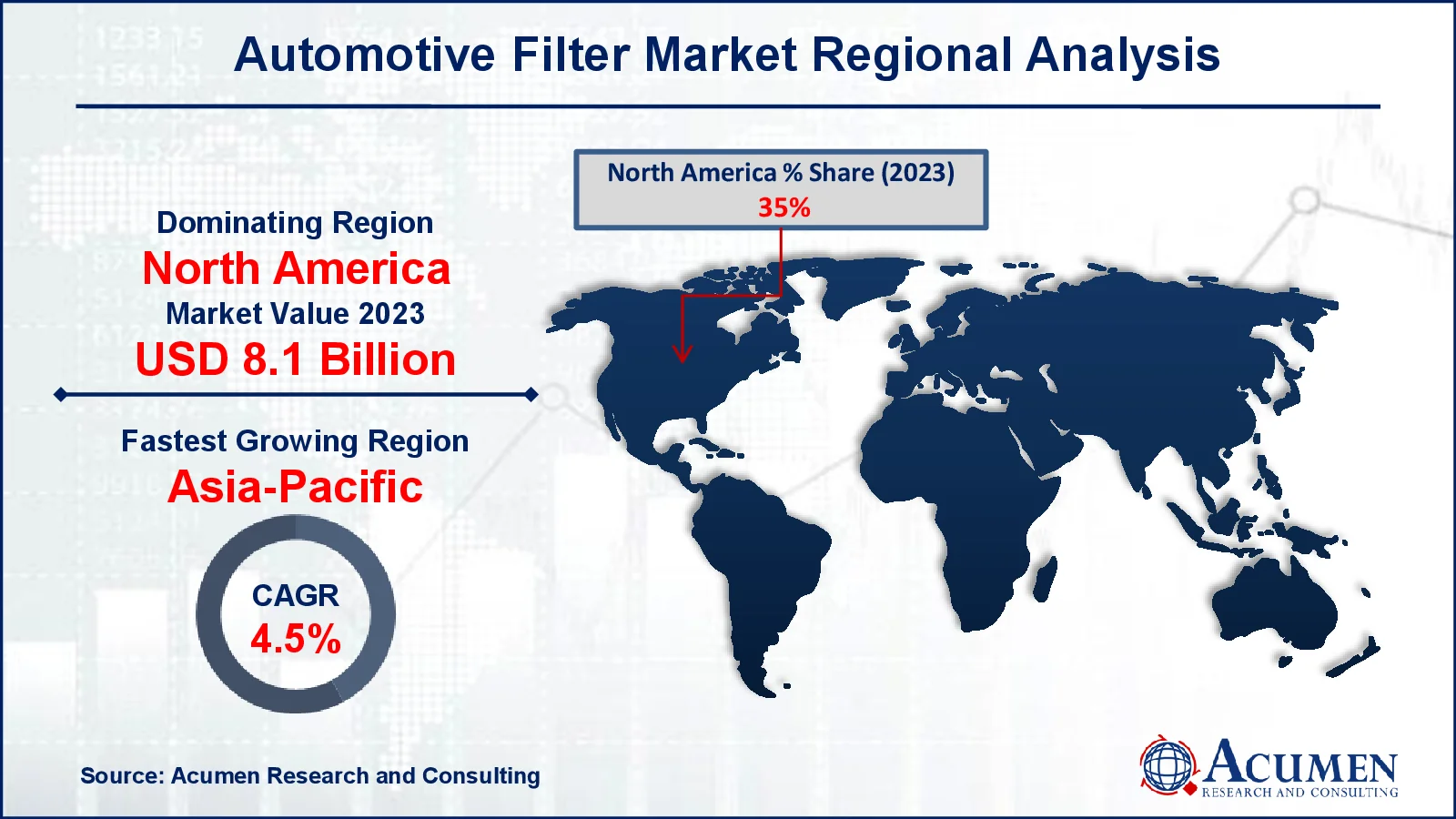

- North America automotive filter market value occupied around USD 8.1 billion in 2023

- Asia-Pacific automotive filter market growth will record a CAGR of more than 4.5% from 2024 to 2032

- Among sales channel, the aftermarket sub-segment generated significant revenue in 2023

- Based on application, the 2-wheeler sub-segment generated notable automotive filter market share in 2023

- Rising adoption of hybrid vehicles generates demand for multi-functional filters is a popular automotive filter market trend that fuels the industry demand

An automotive filter is a critical component in vehicles that removes pollutants and impurities from various systems, assuring peak performance and durability. These filters are employed in a variety of applications, including the engine, fuel system, air intake, and cabin. Common types include oil filters, air filters, gasoline filters, and cabin air filters. They prevent debris, filth, and hazardous particles from accessing sensitive components such as the engine, fuel injectors, or the interior environment, hence increasing efficiency and minimizing wear. Automotive filters help to improve engine performance, fuel efficiency, and cabin air quality by keeping systems clean. Regular replacement is required to ensure that the filters function properly, as clogged filters can impair efficiency and cause damage to vehicle systems.

Global Automotive Filter Market Dynamics

Market Drivers

- Growing vehicle production worldwide boosts the demand for automotive filters

- Stringent emission regulations mandate the use of advanced filtration systems

- Rising consumer awareness about air quality enhances cabin filter adoption

- Increased adoption of electric vehicles spurs the demand for specialized filters

Market Restraints

- High maintenance costs of premium filters limit their adoption in budget vehicles

- The shift toward electric vehicles reduces the need for certain traditional filters

- Availability of low-cost counterfeit filters

Market Opportunities

- Technological advancements in filtration materials offer innovative solutions

- Expanding aftermarket services in emerging economies drive filter sales

- Integration of smart filtration systems in connected vehicles creates new avenues

Automotive Filter Market Report Coverage

| Market | Automotive Filter Market |

| Automotive Filter Market Size 2022 |

USD 23.2 Billion |

| Automotive Filter Market Forecast 2032 | USD 31.9 Billion |

| Automotive Filter Market CAGR During 2023 - 2032 | 3.7% |

| Automotive Filter Market Analysis Period | 2020 - 2032 |

| Automotive Filter Market Base Year |

2023 |

| Automotive Filter Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Type, By Sales Channel, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | MAHLE GmbH, Toyota, Hengst SE, Robert Bosch GmbH, General Motors, K & N Engineering, MANN + HUMMEL International, DENSO Corporation, Sogefi, and Valeo SA. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automotive Filter Market Insights

The growing emphasis on environmental sustainability and severe emission standards is dramatically increasing demand for car filters. Global regulatory agencies are setting higher emission regulations to reduce vehicle pollution, mandating the use of high-performance filters in automobiles. These filters are critical in decreasing harmful pollutants like nitrogen oxides and particulate matter while also maintaining compliance with regulations such as Euro 6 and Bharat Stage VI. The increased public awareness of the detrimental environmental and health consequences of automobile emissions encourages the use of better filtering equipment.

The rapid use of electric vehicles (EVs) places a tremendous strain on the automotive filter sector. EVs, which lack internal combustion engines, do not require components such as oil or fuel filters, reducing the requirement for conventional automotive filters. As governments and automakers promote cleaner and more sustainable mobility options, demand for conventional filters is likely to gradually fall.

The expanding trend of vehicle electrification opens up potential for the development of specialized filtration systems. To ensure passenger comfort and safety, EVs require cabin air filters as well as enhanced particulate filters. The growing emphasis on improving indoor air quality in vehicles provides a lucrative opportunity for manufacturers to develop and cater to the changing needs of the automotive sector, hence expanding their market share.

Automotive Filter Market Segmentation

The worldwide market for automotive filter is split based on type, sales channel, application, and geography.

Automotive Filter Types

- Air Filter

- Fuel Filter

- Oil Filter

- Cabin Air Filter

According to automotive filter industry analysis, the cabin air filter category is driving the market due to customers' growing awareness of air quality and health issues. Cabin air filters improve the quality of air inside automobiles by collecting dust, pollen, allergies, and other contaminants, resulting in a healthier atmosphere for passengers. The rising prevalence of respiratory disorders and allergies has increased the need for effective cabin filtration systems. Stringent air quality rules and increased urbanization, which expose commuters to higher levels of pollution, also drive this market. Automakers are progressively fitting vehicles with improved cabin filters, particularly those capable of filtering ultrafine particles, to improve passenger comfort and safety. This trend places the cabin air filter segment as a significant growth driver.

Automotive Filter Sales Channels

- OEM

- Aftermarket

The vehicle filter industry is growing rapidly due to the aftermarket segment. Because of their low cost and availability, aftermarket filters are increasingly being used by car owners to maintain or improve the performance of their vehicles. Aftermarket filters come in a variety of sizes and shapes to fit various vehicle models and types. These filters frequently provide competitive quality and performance when compared to OEM filters, making them a popular choice for consumers looking to extend the life of their vehicle without incurring excessive costs. Furthermore, the rise of online sales platforms and expanding distribution networks has fueled demand for aftermarket automotive filters by providing customers with convenient purchasing options around the world.

Automotive Filter Applications

- LCV

- Passenger Vehicle (PV)

- HCV

- 2-wheeler

On the basis of application, the automotive filter market is segmented into LCV, passenger vehicle (PV), HCV, 2-wheeler. 2-wheeler holds the major share in automotive filter in terms of volume. Presence of huge number of vehicles across the globe coupled with increasing demand for the 2-wheeler vehicles have boosted the market for the automotive filter for 2-wheeler application across the globe.

Automotive Filter Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive Filter Market Regional Analysis

North America dominates the global automotive filter market owing to the growing adoption of automotive vehicles and increased investment in the countries such as the U.S. and Mexico are driving the automotive filter market growth in North America. Growing interest in digital technology and innovative mobility has increased the adoption of automotive, thereby driving the global automotive filter market. Additionally, Mexico accounted notable of total North America production. Increased focus on improving fuel efficiency is compelling the manufacturers to meet the consumers’ demand that makes the vehicle lighter automotive filter and safe is fueling the automotive filter market growth further.

Asia-Pacific holds the fastest growth in the automotive filter market forecast period owing to the presence of huge manufacturing companies. Low labor cost for manufacturing, and availability of huge raw material have driven the market of automotive filter in Asia-Pacific region. On the other hand, LAMEA holds the lease share in the market.

Automotive Filter Market Players

Some of the top automotive filter companies offered in our report includes MAHLE GmbH, Toyota, Hengst SE, Robert Bosch GmbH, General Motors, K & N Engineering, MANN + HUMMEL International, DENSO Corporation, Sogefi, and Valeo SA.

Frequently Asked Questions

How big is the automotive filter market?

The Automotive Filter market size was valued at USD 23.2 billion in 2023.

What is the CAGR of the global automotive filter market from 2024 to 2032?

The CAGR of automotive filter is 3.7% during the analysis period of 2024 to 2032.

Which are the key players in the automotive filter market?

The key players operating in the global market are including MAHLE GmbH, Toyota, Hengst SE, Robert Bosch GmbH, General Motors, K & N Engineering, MANN + HUMMEL International, DENSO Corporation, Sogefi, and Valeo SA.

Which region dominated the global automotive filter market share?

North America held the dominating position in automotive filter industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of automotive filter during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global automotive filter industry?

The current trends and dynamics in the automotive filter industry include growing vehicle production worldwide boosts the demand for automotive filters, and stringent emission regulations mandate the use of advanced filtration systems.

Which sales channel held the maximum share in 2023?

The aftermarket sales channel held the significant share of the automotive filter industry.