Automotive Endpoint Authentication Market | Acumen Research and Consulting

Automotive Endpoint Authentication Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

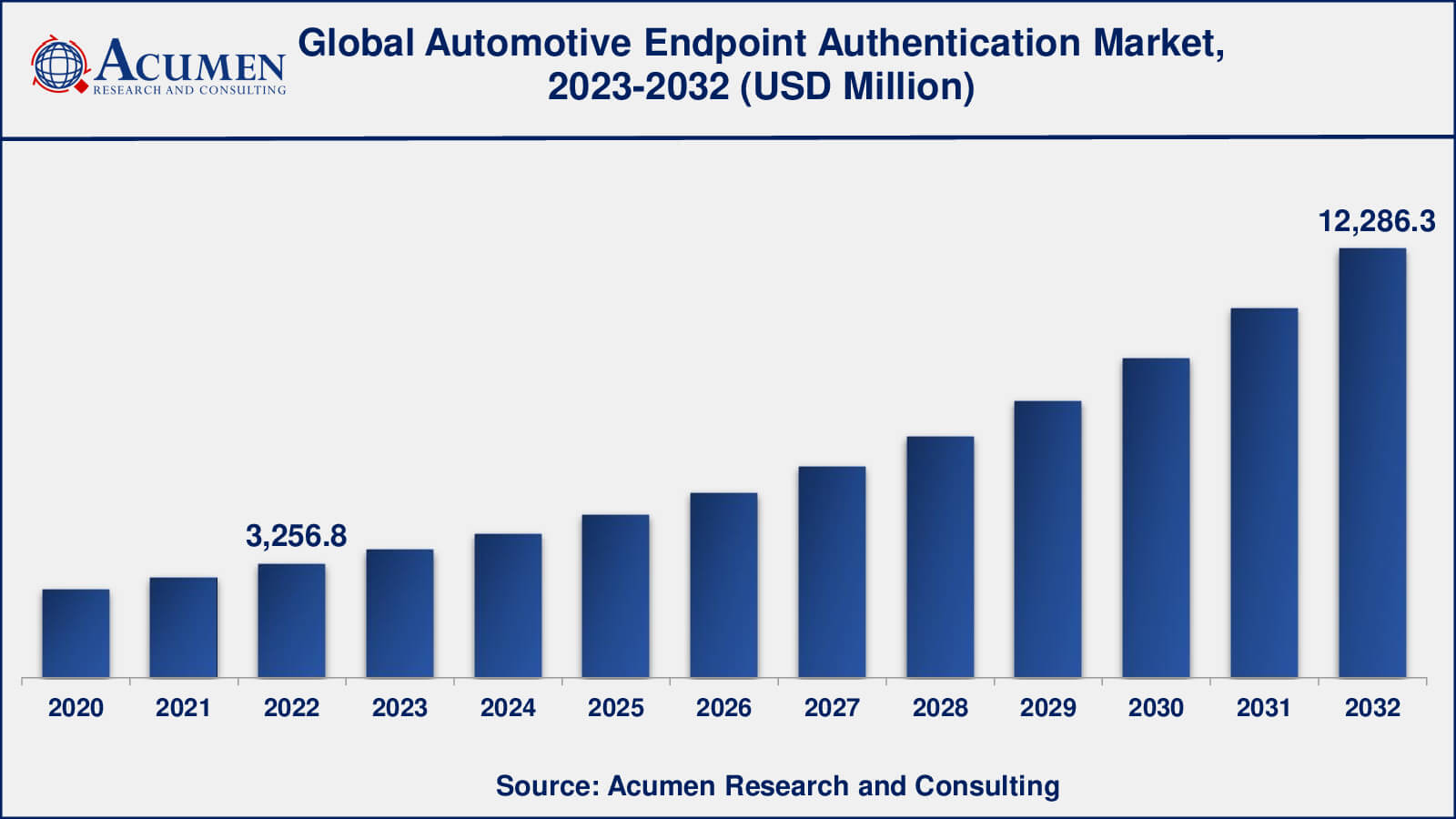

The Global Automotive Endpoint Authentication Market Size accounted for USD 3,256.8 Million in 2022 and is estimated to achieve a market size of USD 12,286.3 Million by 2032 growing at a CAGR of 14.4% from 2023 to 2032.

Automotive Endpoint Authentication Market Highlights

- Global automotive endpoint authentication market revenue is poised to garner USD 12,286.3 million by 2032 with a CAGR of 14.4% from 2023 to 2032

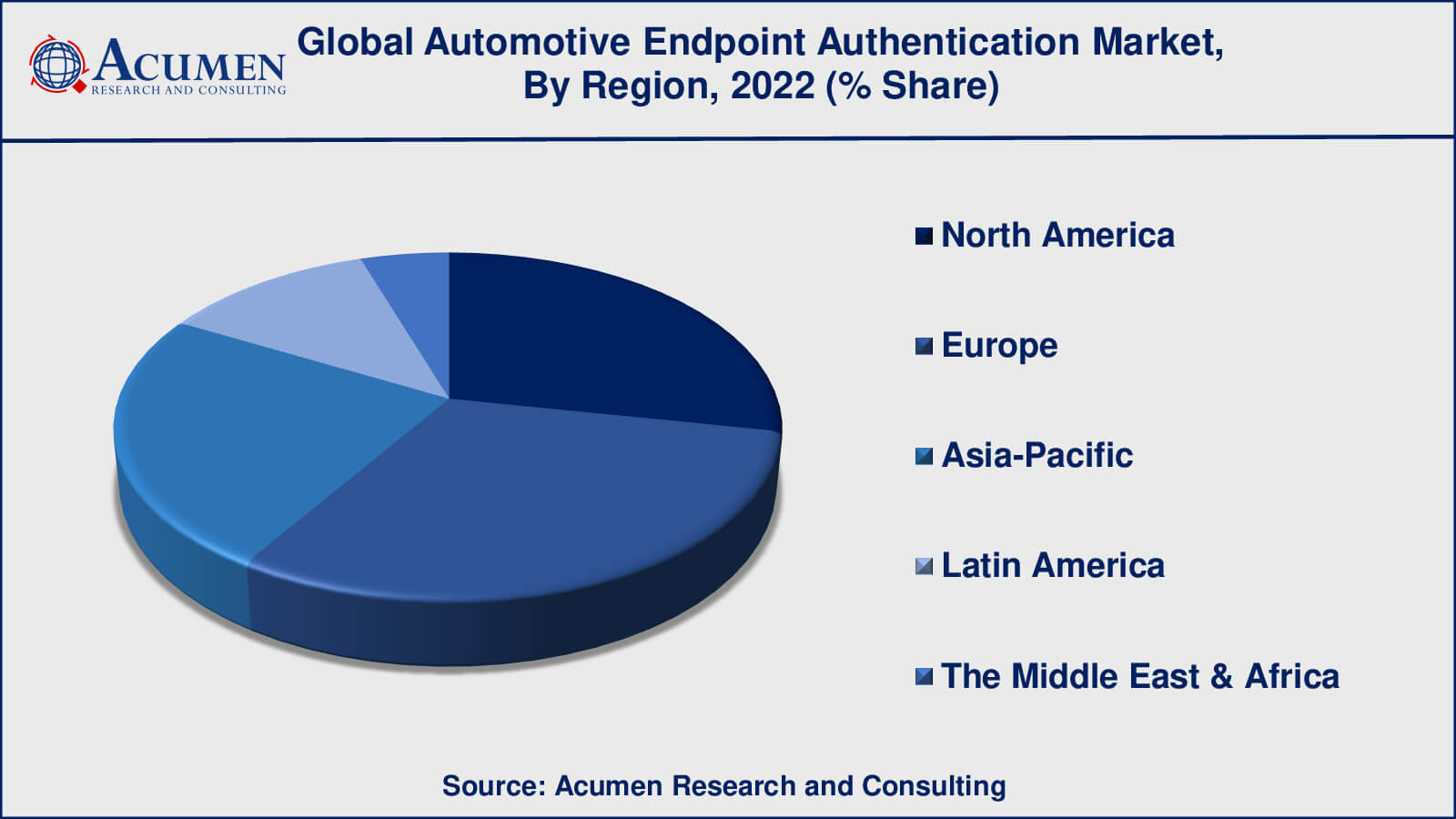

- Europe automotive endpoint authentication market value occupied around USD 1.01 billion in 2022

- Asia-Pacific automotive endpoint authentication market growth will record a CAGR of more than 15% from 2023 to 2032

- Among product, the passenger vehicle sub-segment generated over US$ 2.2 million in revenue in 2022

- Based on peripheral connectivity, the Bluetooth sub-segment generated around 41% share in 2022

- Increasing benefits from insurance companies for vehicles installed with biometric system market trend that fuels the industry demand

Authentication of endpoints is vitally important for networks that have a flurry of remote users. It is used to verify and track the identity of external devices connected to a network, thereby ensuring that only allowed endpoint devices are linked. An endpoint authentication mechanism is employed to substantiate the identification of external devices connected to the network, securing connectivity for authorized endpoint devices. This mechanism is implemented through an endpoint authentication system, which not only verifies users but also monitors incoming connections of the endpoint device.

The global automotive endpoint authentication market is segmented based on products, vehicles, peripheral connectivity, and geography. Products are classified into wearables, smartphone apps, and biometric vehicle access. Vehicles are categorized as electric vehicles and passenger cars. Peripheral connectivity is divided into Bluetooth, Wi-Fi, and mobile phone networks. The major driving factors behind the market's growth are increasing cyber attacks and the rising demand for security. Another contributing factor to the growth of the automotive endpoint authentication market is the increase in disposable income in developing countries.

Global Automotive Endpoint Authentication Market Dynamics

Market Drivers

- Increasing benefits from insurance companies for vehicles installed with biometric system

- Rising in cyber attacks intrusion and the ever increasing demand for security

- The growing demand for connected cars

Market Restraints

- High cost of automotive endpoint authentication devices

- Rising connectivity would induce the risk of cyber attacks

Market Opportunities

- Rising demand for safety and convenience features

- Advent of connected cars and electric vehicles in the automotive industry

Automotive Endpoint Authentication Market Report Coverage

| Market | Automotive Endpoint Authentication Market |

| Automotive Endpoint Authentication Market Size 2022 | USD 3,256.8 Million |

| Automotive Endpoint Authentication Market Forecast 2032 | USD 12,286.3 Million |

| Automotive Endpoint Authentication Market CAGR During 2023 - 2032 | 14.4% |

| Automotive Endpoint Authentication Market Analysis Period | 2020 - 2032 |

| Automotive Endpoint Authentication Market Base Year | 2022 |

| Automotive Endpoint Authentication Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Vehicle, By Peripheral Connectivity, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Continental AG, DENSO Corporation, Fitbit Inc., Fujitsu Ltd., Garmin Ltd., Harman International Industries, Inc., HID Global Corporation, Hitachi Ltd., NXP Semiconductors N.V., Robert Bosch GmbH, Samsung Electronics Co. Ltd., Symantec Corporation, Synaptics Incorporated, and Voxx International Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automotive Endpoint Authentication Market Insights

Growing penetration of cyber attacks and ever-increasing demand for encryption propel the global authentication market for endpoint automotive. Growth in vehicle safety laws and additional benefits for cars equipped with endpoint security is fueling market growth among insurance companies. High prices and possible product part loss could constrain market growth.

Cars are currently wired to Bluetooth and WIFI making them vulnerable to cyber-attacks. Investing in a security system, which can avoid malfunctions and unauthorized access, has thus become important. This can be done by implementing an authentication system for an automobile endpoint that avoids cyber-attacks and unauthorized access to the car or its peripherals.

Moreover, the rise in demand for the market for mobile apps also increases market growth for endpoint authentication in the automotive industry. Moreover, in the automotive sector, the Biometric Peripheral Connectivity Programming Interface (BioAPI) will improve endpoint authentication market growth.

Automotive Endpoint Authentication Market Segmentation

The worldwide market for automotive endpoint authentication is split based on product, vehicle, peripheral connectivity, and geography.

Automotive Endpoint Authentication Products

- Wearable

- Smartphone App

- Biometric Vehicle Access

According to the automotive endpoint authentication industry analysis, biometric vehicle access has held the largest portion within the Product segment in the past years. The biometric vehicle access segment in the automotive endpoint authentication market is expected to continue expanding with significant momentum by 2032, and it is projected to capture the highest market shares during the forecast period. The biometric system helps to identify consumers and authenticate people based on their ingrained physical or behavioral attributes. Additionally, biometrics in vehicles offer advantages for passenger vehicles, facilitating cross-checking of locking systems and helping to reduce cyber attacks. Many premium car producers are now incorporating biometric technology to enhance car security

Automotive Endpoint Authentication Vehicles

- Electric Vehicle

- Passenger Car

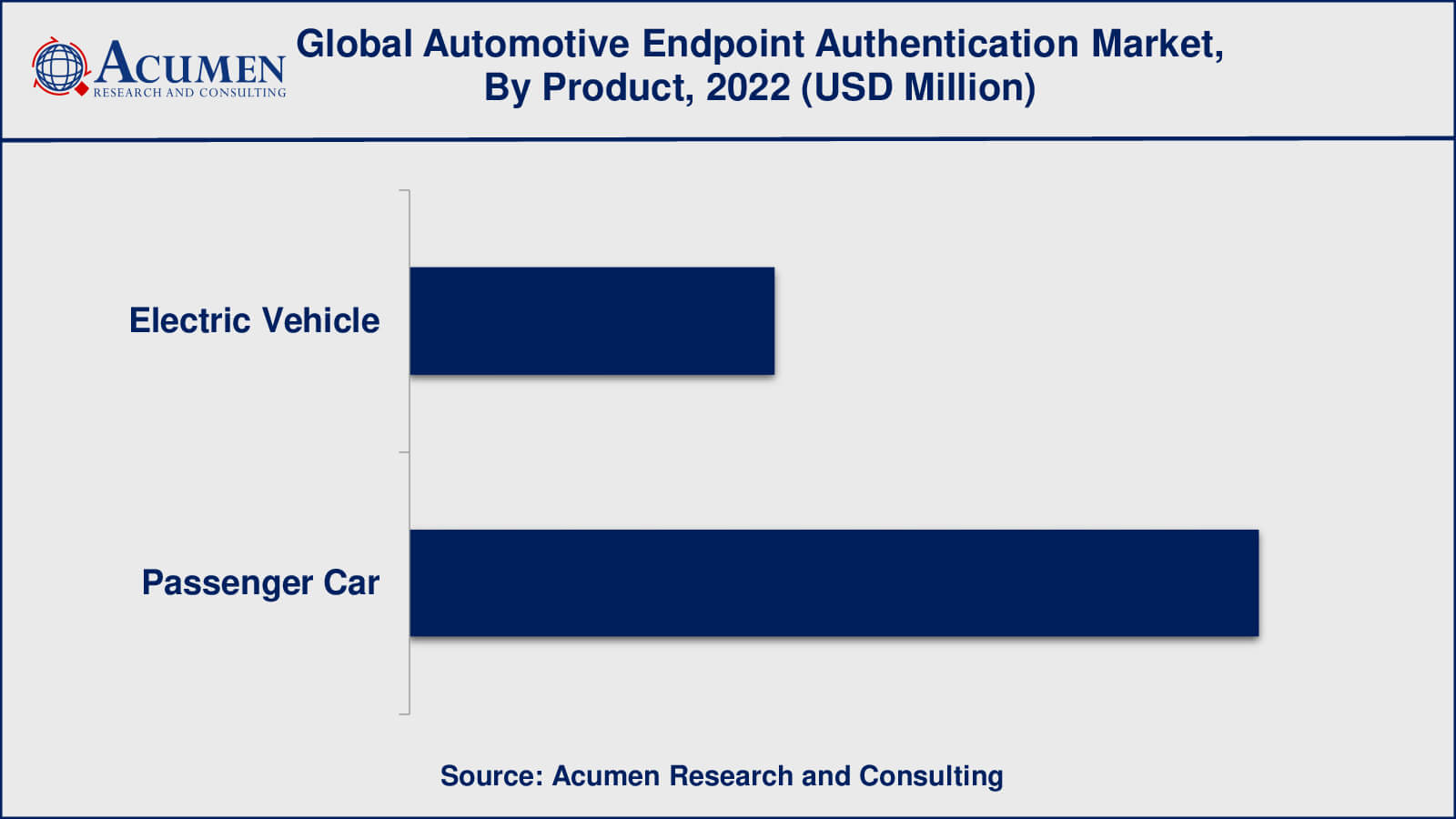

Based on the automotive endpoint authentication market, the passenger car segment is poised to procure remarkable revenues from 2023 to 2032. The passenger vehicle segment is expected to witness the highest market shares in the global automotive endpoint authentication market. Industry revenue will be activated by the sharp increase in demand and sales of cars and utility vehicles. After the Covid-19 pandemic, there was a boost in the purchase of private vehicles as people sought to prevent the spread of infection. Automotive endpoint authentication, which helps with locking systems, proves extremely helpful for families, offering added security and protection against attacks.

The appearance of connected technologies such as IoT in high-end luxury passenger vehicles has exposed them to several unlawful sources. Consequently, the risks linked with data security have increased, leading to a higher demand for endpoint authentication systems in these vehicles. This trend further promotes business development in the automotive endpoint authentication market."

Automotive Endpoint Authentication Peripheral Connectivity

- Bluetooth

- WIFI

- Mobile Phone Networks

The Bluetooth segment is expected to witness the highest market shares in the global automotive endpoint authentication market throughout the forecast period from 2023 to 2032. Bluetooth permits consumers to connect their smartphones, facilitating an enhanced consumer experience. It was introduced in the early 2010s, allowing the implementation of authentication systems. The Wi-Fi segment is also expected to experience rapid growth between 2023 and 2030. Wi-Fi aids in searching for devices and permits the installation of GPS systems. Additionally, it does not occupy too much space and helps prevent cyber attacks.

Automotive Endpoint Authentication Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive Endpoint Authentication Market Regional Analysis

Europe represents a key automotive endpoint security market as the demand for wired and autonomous vehicles continues to grow. The German government is taking major steps toward the introduction of wired automobiles. For example, the City introduced the Action Plan for automated driving technologies in August 2017, and the Ethics Commission issued recommendations for the introduction of automated driving systems at the Federal Ministry of Transport and Digital Infrastructure. This government initiative aims to rapidly and efficiently implement automated driving in Germany.

In Asia Pacific, with the rise of smart city initiatives and increased demand for passenger vehicles in developing countries like China and India, it has become a lucrative area for the automotive endpoint authentication industry. The increasing internet penetration in the region enables portable networks to be more commonly used, but it also increases the chances of cyber threats to wired and autonomous vehicles, thereby contributing to a growing need for secure endpoint security solutions in the automotive industry. Another aspect fueling the market's growth in this region is the rising concern about vehicle safety due to the growing cases of vehicle theft.

Automotive Endpoint Authentication Market Players

Some of the top automotive endpoint authentication companies offered in our report includes Continental AG, DENSO Corporation, Fitbit Inc., Fujitsu Ltd., Garmin Ltd., Harman International Industries, Inc., HID Global Corporation, Hitachi Ltd., NXP Semiconductors N.V., Robert Bosch, GmbH Samsung Electronics Co. Ltd., Symantec Corporation, Synaptics Incorporated, and Voxx International Corporation.

Frequently Asked Questions

What was the market size of the global automotive endpoint authentication in 2022?

The market size of automotive endpoint authentication was USD 3,256.8 million in 2022.

What is the CAGR of the global automotive endpoint authentication market from 2023 to 2032?

The CAGR of automotive endpoint authentication is 14.4% during the analysis period of 2023 to 2032.

Which are the key players in the automotive endpoint authentication market?

The key players operating in the global market are including Continental AG, DENSO Corporation, Fitbit Inc., Fujitsu Ltd., Garmin Ltd., Harman International Industries, Inc., HID Global Corporation, Hitachi Ltd., NXP Semiconductors N.V., Robert Bosch GmbH, Samsung Electronics Co. Ltd., Symantec Corporation, Synaptics Incorporated, and Voxx International Corporation.

Which region dominated the global automotive endpoint authentication market share?

Europe held the dominating position in automotive endpoint authentication industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of automotive endpoint authentication during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global automotive endpoint authentication industry?

The current trends and dynamics in the automotive endpoint authentication industry include increasing benefits from insurance companies for vehicles installed with biometric system, rising in cyber attacks intrusion and the ever increasing demand for security, and the growing demand for connected cars

Which vehicle held the maximum share in 2022?

The passenger vehicles held the maximum share of the automotive endpoint authentication industry.