Automotive Embedded Telematics Market | Acumen Research and Consulting

Automotive Embedded Telematics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

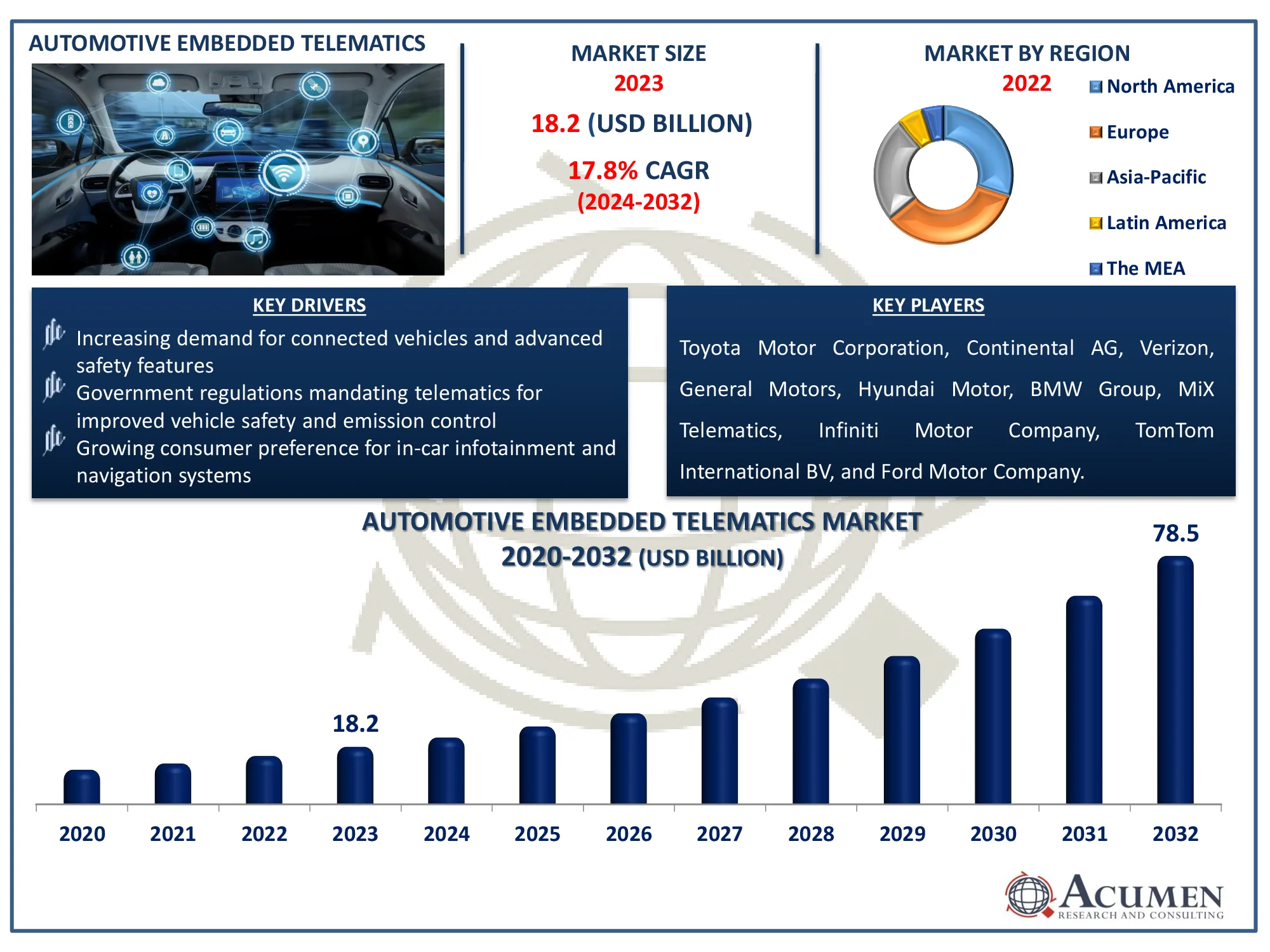

The Global Automotive Embedded Telematics Market Size accounted for USD 18.2 Billion in 2023 and is estimated to achieve a market size of USD 78.5 Billion by 2032 growing at a CAGR of 17.8% from 2024 to 2032.

Automotive Embedded Telematics Market Highlights

- Global automotive embedded telematics market revenue is poised to garner USD 78.5 billion by 2032 with a CAGR of 17.8% from 2024 to 2032

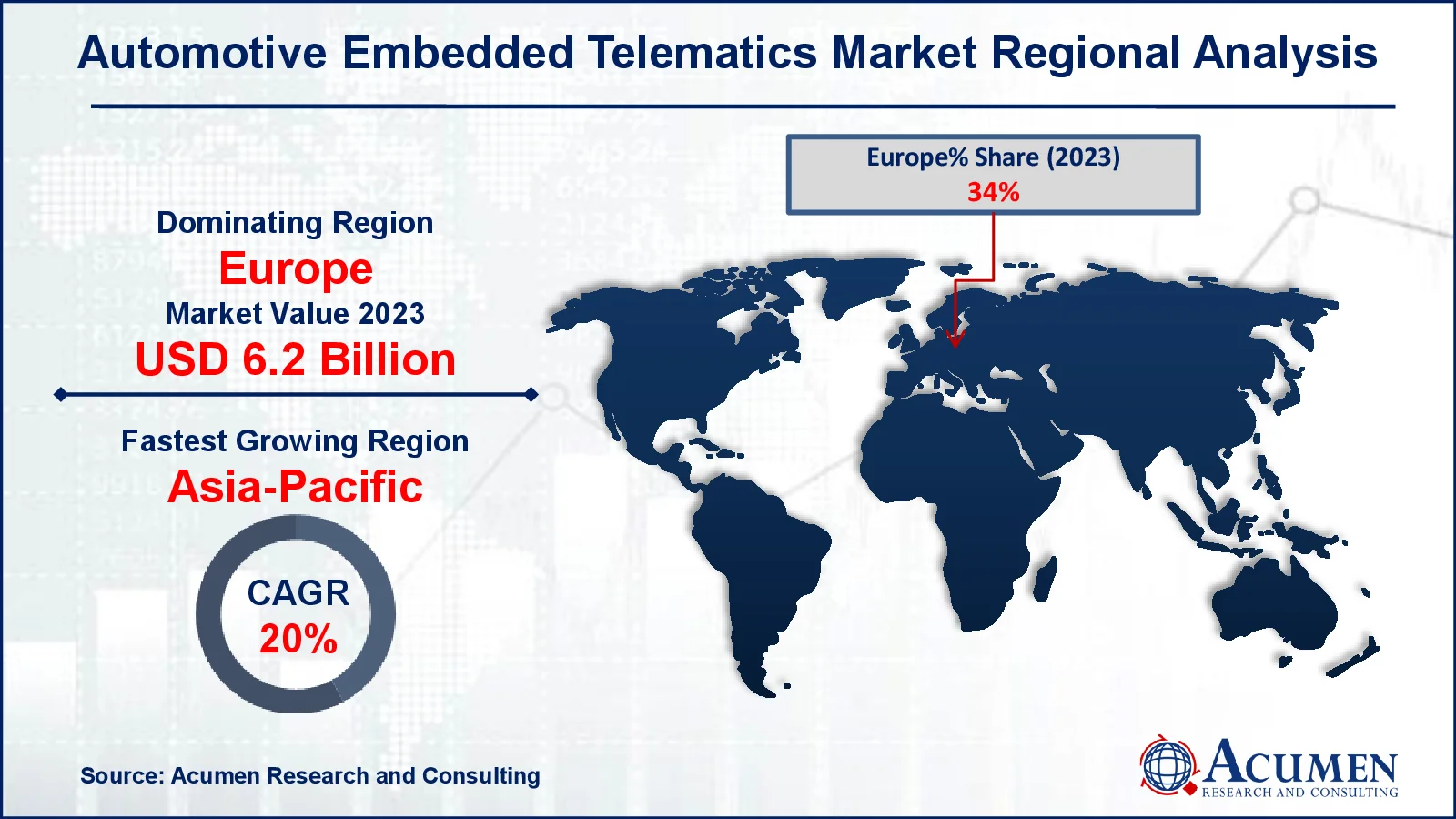

- Europe automotive embedded telematics market value occupied around USD 6.2 billion in 2023

- Asia-Pacific automotive embedded telematics market growth will record a CAGR of more than 20% from 2024 to 2032

- Among component, the services sub-segment generated 52% of the market share in 2023

- Based on solution, the safety & security sub-segment accounted 48% of market share in 2023

- Growing integration of AI and machine learning for enhanced driver assistance and predictive maintenance is the automotive embedded telematics market trend that fuels the industry demand

Automotive embedded telematics refers to integrated systems in vehicles that enable communication and data exchange. These systems typically utilize GPS, cellular networks, and onboard diagnostics to provide services like navigation, vehicle tracking, remote diagnostics, and emergency assistance. Applications include real-time monitoring of vehicle performance, enabling predictive maintenance, enhancing fleet management efficiency, and improving driver safety through features like collision detection and emergency response coordination. Embedded telematics also supports connectivity for infotainment systems, allowing drivers to access multimedia content and smartphone integration seamlessly. Overall, it enhances the driving experience by providing valuable data insights and connectivity options.

Global Automotive Embedded Telematics Market Dynamics

Market Drivers

- Increasing demand for connected vehicles and advanced safety features

- Government regulations mandating telematics for improved vehicle safety and emission control

- Growing consumer preference for in-car infotainment and navigation systems

Market Restraints

- High installation and maintenance costs of telematics systems

- Privacy and cybersecurity concerns related to data transmission

- Limited network coverage and connectivity issues in rural and remote areas

Market Opportunities

- Advancements in 5G technology enabling faster and more reliable telematics services

- Rising adoption of electric and autonomous vehicles incorporating advanced telematics

- Growing aftermarket services and fleet management solutions leveraging telematics

Automotive Embedded Telematics Market Report Coverage

| Market | Automotive Embedded Telematics Market |

| Automotive Embedded Telematics Market Size 2022 |

USD 18.2 Billion |

| Automotive Embedded Telematics Market Forecast 2032 | USD 78.5 Billion |

| Automotive Embedded Telematics Market CAGR During 2023 - 2032 | 17.8% |

| Automotive Embedded Telematics Market Analysis Period | 2020 - 2032 |

| Automotive Embedded Telematics Market Base Year |

2022 |

| Automotive Embedded Telematics Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Component, By Solution, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Toyota Motor Corporation, Continental AG, Verizon, General Motors, Hyundai Motor Company, BMW Group, MiX Telematics, Infiniti Motor Company, TomTom International BV, and Ford Motor Company. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automotive Embedded Telematics Market Insights

The growing demand for connected vehicles and advanced safety features is propelling the automotive embedded telematics market. For instance, In July 2021, Magna International Inc. acquired Veoneer to enhance their advanced driver assistance systems (ADAS). This acquisition aimed to bolster Magna's offerings in stereo vision sensors and lane warning systems, expand their customer base, and increase their global presence through Veoneer's technology and geographic reach. These systems enhance vehicle connectivity, offering real-time data exchange for improved navigation, remote diagnostics, and emergency assistance. They also support advanced driver assistance systems (ADAS), which enhance safety by providing features like collision avoidance and lane departure warnings. As consumers and regulators increasingly prioritize vehicle safety and connectivity, the adoption of embedded telematics systems is on the rise.

Privacy and cybersecurity concerns pose significant restraints for the automotive embedded telematics market as they heighten the risk of unauthorized data access and breaches. The transmission of sensitive information, such as location and personal data, makes vehicles vulnerable to cyber-attacks. This vulnerability necessitates stringent security measures, increasing costs and complexity for manufacturers. Additionally, consumer apprehensions about data privacy may deter the adoption of these advanced telematics systems.

The growing adoption of electric and autonomous vehicles is driving demand for advanced telematics systems, enhancing vehicle connectivity, safety, and efficiency. For instance, according to The International Council of Clean Transportation, in 2023, sales of new electric light-duty vehicles in the United States increased to approximately 1.4 million, compared to nearly 1 million in 2022, achieving a market share of about 9%. These embedded telematics systems enable real-time data exchange, remote diagnostics, and improved navigation. As a result, the automotive embedded telematics market is poised for significant growth, capitalizing on the trend towards smarter and more connected vehicles.

Automotive Embedded Telematics Market Segmentation

The worldwide market for automotive embedded telematics is split based on component, solution, application, and geography.

Automotive Embedded Telematics Component

- Hardware

- Service

- Connectivity

According to the automotive embedded telematics industry analysis, the service component dominates the market due to the increasing demand for connected services, such as real-time navigation, remote diagnostics, and infotainment. These services enhance the driving experience, improve vehicle safety, and provide valuable data for vehicle manufacturers and fleet operators. Additionally, advancements in cloud computing and data analytics enable seamless integration of these services, making them indispensable. As a result, service offerings are driving market growth and adoption in the automotive industry.

Automotive Embedded Telematics Solution

- Safety & Security

- Information & Navigation

- Entertainment

- Remote Diagnostics

The safety & security segment is the largest solution category in the automotive embedded telematics market and it is expected to increase over the industry. These systems offer real-time vehicle tracking, emergency response, and theft prevention, enhancing overall vehicle safety and user peace of mind. Additionally, regulatory mandates and consumer preferences for safer vehicles drive the adoption of telematics technologies. As a result, safety and security solutions shaping its growth and innovation trajectory.

Automotive Embedded Telematics Application

- Passenger Cars

- Commercial Vehicles

According to the automotive embedded telematics market forecast, passenger cars dominate the market due to their high production volumes and widespread adoption of advanced safety and convenience features. For instance, according to data from the China Passenger Car Association, 21.7 million passenger cars were sold in 2023, marking a 5.6 percent increase compared to the previous year. These vehicles benefit from embedded telematics for real-time navigation, vehicle diagnostics, and emergency assistance, enhancing driver experience and safety. The growing consumer demand for connected car services and stringent government regulations on vehicle safety further drive the adoption of telematics in passenger cars.

Automotive Embedded Telematics Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive Embedded Telematics Market Regional Analysis

For several reasons, Europe leads the automotive embedded telematics market due to its strong regulatory framework promoting vehicle safety and connectivity standards. The region's advanced automotive industry, combined with high consumer demand for connected cars, drives market growth. European governments also support technological advancements through policies and funding for smart transportation initiatives. For instance, in May 2021, the European Road Safety Action Programme (ERSAP) introduced a regulation requiring the integration of eCall technology for driver assistance in all new vehicles. Major automakers and technology firms headquartered in Europe further bolster the market's dominance.

The Asia-Pacific region is the fastest-growing market for automotive embedded telematics due to rising vehicle production, increased demand for advanced safety and navigation systems, and supportive government regulations. For instance, according to the Press Information Bureau, in the Indian automobile market, two-wheelers and passenger cars represented 77% and 18% of the market share, respectively, for the fiscal year 2021-22. India aims to double the size of its auto industry to Rs. 15 lakh crores by the end of 2024. Key markets such as China, Japan, and India are driving growth with their significant investments in automotive technology and smart infrastructure.

Automotive Embedded Telematics Market Players

Some of the top automotive embedded telematics companies offered in our report include Toyota Motor Corporation, Continental AG, Verizon, General Motors, Hyundai Motor Company, BMW Group, MiX Telematics, Infiniti Motor Company, TomTom International BV, and Ford Motor Company.

Frequently Asked Questions

How big is the automotive embedded telematics market?

The automotive embedded telematics market size was valued at USD 18.2 billion in 2023.

What is the CAGR of the global automotive embedded telematics market from 2024 to 2032?

The CAGR of automotive embedded telematics is 17.8% during the analysis period of 2024 to 2032.

Which are the key players in the automotive embedded telematics market?

The key players operating in the global market are including Toyota Motor Corporation, Continental AG, Verizon, General Motors, Hyundai Motor Company, BMW Group, MiX Telematics, Infiniti Motor Company, TomTom International BV, and Ford Motor Company.

Which region dominated the global automotive embedded telematics market share?

Europe held the dominating position in automotive embedded telematics industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of automotive embedded telematics during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global automotive embedded telematics industry?

The current trends and dynamics in the automotive embedded telematics industry include increasing demand for connected vehicles and advanced safety features, government regulations mandating telematics for improved vehicle safety and emission control, and growing consumer preference for in-car infotainment and navigation systems.

Which component held the maximum share in 2023?

The services component held the maximum share of the automotive embedded telematics industry.