Automotive Brake Pads Market | Acumen Research and Consulting

Automotive Brake Pads Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

The Automotive Brake Pads Market Size accounted for USD 3.9 Billion in 2022 and is estimated to achieve a market size of USD 6.4 Billion by 2032 growing at a CAGR of 5.2% from 2023 to 2032.

Automotive Brake Pads Market Highlights

- Global automotive brake pads market revenue is poised to garner USD 6.4 billion by 2032 with a CAGR of 5.2% from 2023 to 2032

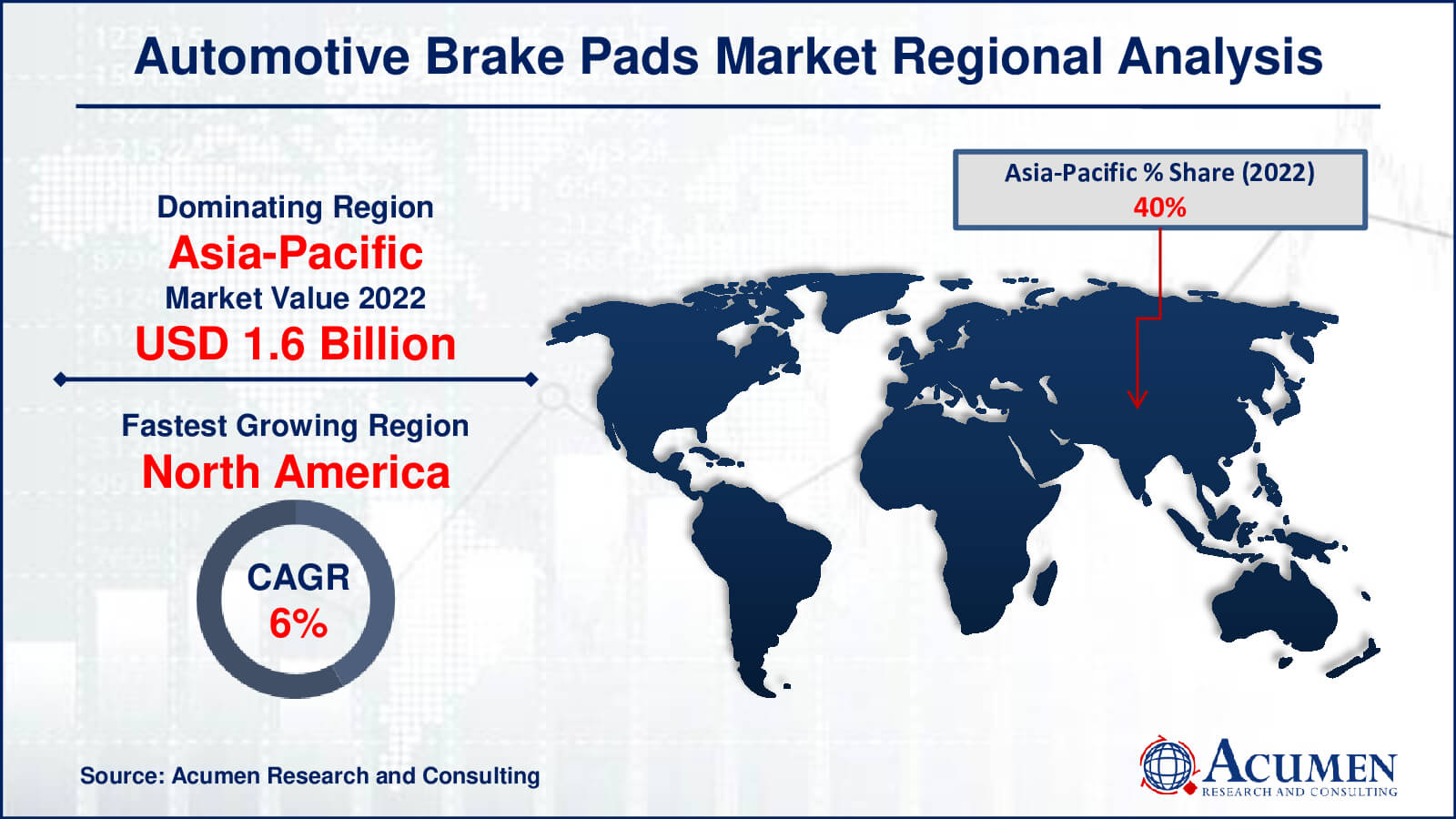

- Asia-Pacific automotive brake pads market value occupied around USD 1.6 billion in 2022

- North America automotive brake pads market growth will record a CAGR of more than 6% from 2023 to 2032

- Among vehicle, the passenger cars sub-segment generated over US$ 2.1 billion revenue in 2022

- Based on sales channel, the aftermarket sub-segment generated around 65% share in 2022

- Innovations in brake pad designs for autonomous vehicles and electric mobility is a popular automotive brake pads market trend that fuels the industry demand

As a supplier of essential parts for vehicle performance and safety, the automotive brake pads market is a significant sector of the automotive industry. These pads are essential to the vehicle's deceleration and stopping systems because they use friction to turn kinetic energy into heat, which slows or stops the car. The market is propelled by the ongoing rise in both global car sales and manufacturing. The growing need for fuel-efficient automobiles, the growing emphasis on vehicle safety, and technological developments in brake pad materials all contribute to the market's success. In addition, the development of more durable and effective brake pad solutions is fueled by the introduction of electric vehicles (EVs) and the incorporation of electronic systems into contemporary cars. All of these elements work together to highlight how important the automotive brake pad market is to maintaining effective and safe vehicle operation.

Global Automotive Brake Pads Market Dynamics

Market Drivers

- Increased emphasis on vehicle safety standards globally

- Technological advancements enhancing brake pad durability and performance

- Growing demand for fuel-efficient vehicles globally

- Expansion of electric vehicle (EV) adoption worldwide

Market Restraints

- Cost fluctuations in raw materials impacting brake pad manufacturing

- Regulatory challenges and compliance requirements in different regions

- Market saturation leading to intensified competition among brake pad manufacturers

Market Opportunities

- Rising demand for premium and high-performance brake pad variants

- Integration of advanced materials and nanotechnology in brake pad development

- Expansion into emerging markets with growing automotive sectors

Automotive Brake Pads Market Report Coverage

| Market | Automotive Brake Pads Market |

| Automotive Brake Pads Market Size 2022 | USD 3.9 Billion |

| Automotive Brake Pads Market Forecast 2032 | USD 6.4 Billion |

| Automotive Brake Pads Market CAGR During 2023 - 2032 | 5.2% |

| Automotive Brake Pads Market Analysis Period | 2020 - 2032 |

| Automotive Brake Pads Market Base Year |

2022 |

| Automotive Brake Pads Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Vehicle, By Material, By Sales Channel, By Position, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Brembo S.p.A, Continental AG, ZF Friedrichshafen AG, Nisshinbo Brake Inc., Brake Parts Inc., Akebono Brake Industry Co Ltd, ITT Inc., Robert Bosch GmbH, Tenneco Inc., ADVICS Co., Ltd., EBC Brakes, and Delphi Technologies (BorgWarner Inc.) |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automotive Brake Pads Market Insights

The global market is expected to surge due to rising worldwide vehicle sales projected for the automotive brake pads forecast period. Factors like heightened demand for fuel efficiency, increased integration of electronic systems in vehicles, and the widespread adoption of air conditioning systems contribute to this growth. Specifically, the expanding usage of electronic systems in modern vehicles significantly boosts the demand for automotive brake pads. Additionally, the burgeoning numbers of electric vehicles in developing nations will further stimulate the global automotive brake pads market.

However, the market faces a significant challenge posed by fluctuating raw material prices. It predominantly relies on commodities like metals, ceramics, and organic compounds, susceptible to volatile price changes due to global supply chain fluctuations. These variations directly impact production costs, potentially reducing brake pad manufacturers' profit margins. Adapting strategies such as inventory management and innovative material procurement becomes crucial to mitigate the impact on pricing and market competitiveness.

Amidst challenges, an attractive opportunity emerges in the rising demand for high-end, high-performance brake pad variants. As car owners increasingly seek improved safety, longevity, and braking performance, specialized brake pad solutions are gaining traction. Manufacturers can capitalize on this trend by innovating premium brake pads with enhanced heat dissipation, superior friction materials, and extended lifespan. Moreover, targeting specific vehicle segments, like sports cars or heavy-duty trucks, offers a promising route to differentiate and excel in this specialized segment of the automotive brake pads market.

Various marketing channels facilitate the distribution and sale of products, including direct selling, selling through intermediaries, dual distribution, and reverse channels. In the automotive brake pads market, the most prevalent channels are direct selling, selling through intermediaries, dual distribution, and e-commerce distribution.

Direct selling involves selling products directly to potential buyers, minimizing intermediary involvement and proving to be highly effective and profitable. Automotive brake pads manufacturers directly engage with customers and application industries through this method, establishing a significant presence in the market. Direct marketing, a widely utilized approach, facilitates direct communication between manufacturers and buyers through channels like email, calls, and text messaging, effectively targeting and acquiring new customers. Indirect marketing primarily focuses on retaining existing buyers, indirectly influencing them to maintain loyalty and attract new consumers. Advertising through catalogs, TV, and newspapers forms part of this strategy, aiming to enhance customer loyalty, retain existing consumers, and expand business reach.

Automotive Brake Pads Market Segmentation

The worldwide market for automotive brake pads is split based on vehicle, material, sales channel, position, and geography.

Automotive Brake Pads By Vehicles

- Two Wheelers

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

According to automotive brake pads industry analysis, The sector with the most share in the market is passenger cars. This dominance is a result of the widespread ownership and use of passenger vehicles around the world. As one of the most popular forms of transportation for both individuals and families, brake pads are in constant demand in this market. The segment's strong presence in the brake pads market can be attributed to its continuous production and broad consumer base.

Automotive Brake Pads By Materials

- Semi-Metallic

- Non-Asbestos Organic (NAO)

- Low-Metallic NAO

- Ceramic

The automobile brake pad market's non-asbestos organic (NAO) category has experienced notable growth due to its advantages for both the environment and performance. Reduced noise, improved stopping power, and less rotor wear are all benefits of using NAO pads. Furthermore, they comply with strict environmental laws due to its asbestos-free composition. This market segment's supremacy is a result of its ability to blend affordability, environmental friendliness, and performance, which has driven its widespread acceptability.

Automotive Brake Pads By Sales Channels

- OEM

- Aftermarket

The market for automotive brake pads is dominated by the aftermarket segment due to the high demand for upgrades and replacements. The constant necessity to replace the brake pads in current vehicles when the original equipment manufacturer's pads wear out is what drives this market. In the aftermarket, customers frequently look for a wide range of options, high-quality modifications, and affordable prices. The aftermarket segment has a significant lead over the brake pads market because to this demand, which is fueled by consumer preferences and the requirement for vehicle maintenance.

Automotive Brake Pads By Positions

- Front

- Front & Rear

The front & rear category leads the automotive brake pads market since it encompasses most vehicle braking systems. Even though front brake pads are necessary, having both front and rear pads available serves a larger market and guarantees full brake system upkeep. The reason this market segment is so popular is because customers prefer complete brake replacement sets since they provide ease and all-encompassing safety features for vehicle braking performance.

Automotive Brake Pads Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive Brake Pads Market Regional Analysis

The Asia-Pacific automotive brake pads market emerges as the largest region. China's continuously growing population drives increased vehicle production, boosting demand for automotive brake pads in both OEM and aftermarket segments. The region's high production and consumption nature further fuels the growth of the China automotive brake pads industry. Rising awareness about automotive brake pads and an increase in accidents in the region is expected to support the market growth during the forecast period 2023 to 2032.

The European automotive brake pads market ranks second globally. Germany, known for automotive technological advancements, drives the market's growth due to increased vehicle sales in recent years. The United Kingdom significantly contributes to the European market, particularly in the adoption of both rear and front automotive brake pads. The European automotive brake pads industry is expected to secure a notable share.

The North America automotive brake pads market emerges as the fastest-growing region of the global scenario due to widespread adoption of automotive vehicles in the region. Factors such as high disposable income and increased awareness regarding vehicle safety are expected to further propel market growth. Extreme climatic conditions in Canada and a rising demand for automotive vehicles also contribute to the anticipated escalation of the industry during the automotive brake pads market forecast period.

LAMEA holds the smallest share in the global automotive brake pads industry due to the region's poor economy, especially in Africa. Brazil's automotive brake pads industry is forecasted to claim a relatively lower to medium share due to insufficient awareness about automotive brake pads. Additionally, the absence of major players and lack of government support have contributed to sluggish market growth. However, this situation is expected to evolve in the coming years with rapid industrialization and a growing automotive sector in the region, unlocking untapped potential opportunities.

Automotive Brake Pads Market Players

Some of the top automotive brake pads companies offered in our report includes Brembo S.p.A, Continental AG, ZF Friedrichshafen AG, Nisshinbo Brake Inc., Brake Parts Inc., Akebono Brake Industry Co Ltd, ITT Inc., Robert Bosch GmbH, Tenneco Inc., ADVICS Co., Ltd., EBC Brakes, and Delphi Technologies (BorgWarner Inc.)

Frequently Asked Questions

How big is the automotive brake pads market?

The market size of automotive brake pads was USD 3.9 Billion in 2022.

What is the CAGR of the global automotive brake pads market from 2023 to 2032?

The CAGR of automotive brake pads is 5.2% during the analysis period of 2023 to 2032.

Which are the key players in the automotive brake pads market?

The key players operating in the global market are including Brembo S.p.A, Continental AG, ZF Friedrichshafen AG, Nisshinbo Brake Inc., Brake Parts Inc., Akebono Brake Industry Co Ltd, ITT Inc., Robert Bosch GmbH, Tenneco Inc., ADVICS Co., Ltd., EBC Brakes, and Delphi Technologies (BorgWarner Inc.)

Which region dominated the global automotive brake pads market share?

Asia-Pacific held the dominating position in automotive brake pads industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of automotive brake pads during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global automotive brake pads industry?

The current trends and dynamics in the automotive brake pads industry include increased emphasis on vehicle safety standards globally, technological advancements enhancing brake pad durability and performance, growing demand for fuel-efficient vehicles globally, and expansion of electric vehicle (EV) adoption worldwide.

Which vehicle held the maximum share in 2022?

The passenger cars vehicle held the maximum share of the automotive brake pads industry.

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date