Automotive Airbag Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Automotive Airbag Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

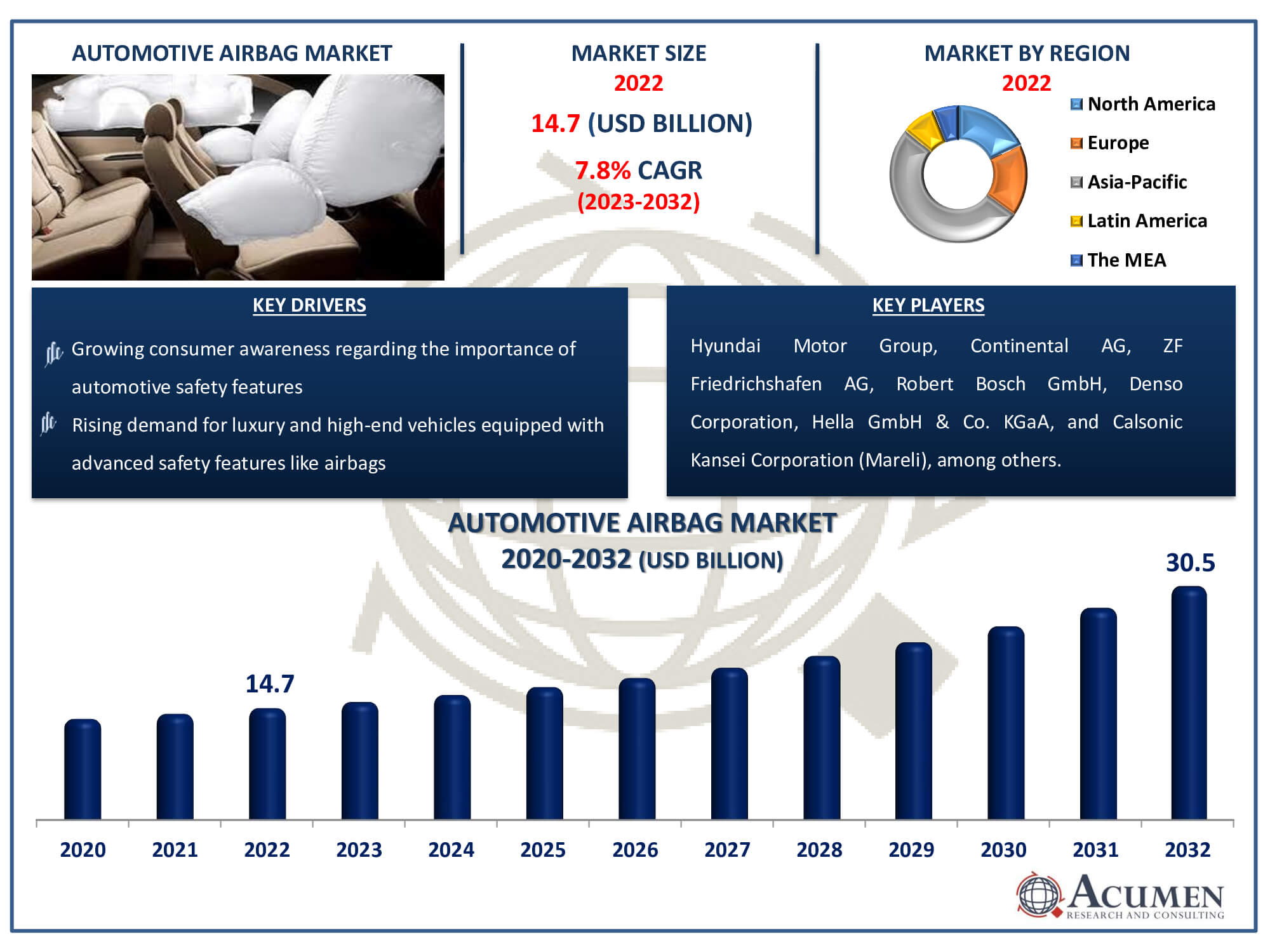

The Automotive Airbag Market Size accounted for USD 14.7 Billion in 2022 and is estimated to achieve a market size of USD 30.5 Billion by 2032 growing at a CAGR of 7.8% from 2023 to 2032.

Automotive Airbag Market Highlights

- Global automotive airbag market revenue is poised to garner USD 30.5 billion by 2032 with a CAGR of 7.8% from 2023 to 2032

- Asia-Pacific automotive airbag market value occupied around USD 7.5 billion in 2022

- Europe automotive airbag market growth will record a CAGR of more than 8.5% from 2023 to 2032

- Among position, the frontal sub-segment generated more than USD 6.6 billion revenue in 2022

- Based on vehicle, the passenger vehicles sub-segment generated around 80% market share in 2022

- Increasing adoption of electric and autonomous vehicles, creating new avenues for airbag system development is a popular automotive airbag market trend that fuels the industry demand

The car safety device known as an airbag consists of a flexible fabric coil or cushion designed to inflate during a vehicle collision. Its primary purpose is to protect the car's occupants by cushioning them against internal objects, such as the steering wheel or window, in the event of a crash. Modern vehicles are equipped with multiple airbags positioned in various front and side locations to provide comprehensive protection. These airbags are activated by sensors that assess the type and severity of the collision. The airbag control unit, a component of contemporary vehicles, monitors various parameters such as vehicle speed, door positions, and brake pressure.

Global Automotive Airbag Market Dynamics

Market Drivers

- Increasing focus on vehicle safety regulations globally

- Growing consumer awareness regarding the importance of automotive safety features

- Technological advancements leading to more effective and versatile airbag systems

- Rising demand for luxury and high-end vehicles equipped with advanced safety features like airbags

Market Restraints

- Cost constraints for airbag implementation, particularly in budget vehicle segments

- Complexities associated with retrofitting older vehicles with airbag systems

- Potential challenges in ensuring consistent quality and reliability across airbag manufacturing processes

Market Opportunities

- Expansion of the automotive market in emerging economies, driving demand for safety features

- Integration of artificial intelligence and machine learning in airbag technology for enhanced performance

- Collaboration opportunities between automotive manufacturers and technology firms to develop innovative airbag solutions

Automotive Airbag Market Report Coverage

| Market | Automotive Airbag Market |

| Automotive Airbag Market Size 2022 | USD 14.7 Billion |

| Automotive Airbag Market Forecast 2032 | USD 30.5 Billion |

| Automotive Airbag Market CAGR During 2023 - 2032 | 7.8% |

| Automotive Airbag Market Analysis Period | 2020 - 2032 |

| Automotive Airbag Market Base Year |

2022 |

| Automotive Airbag Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Position, By Component, By Fabric, By Vehicle, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Hyundai Motor Group, Continental AG, ZF Friedrichshafen AG, Robert Bosch GmbH, Denso Corporation, Hella GmbH & Co. KGaA, Toyoda Gosei, Calsonic Kansei Corporation (Mareli), Nihon Plastic Company Co. Ltd, Delphi Automotive, and Takata Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automotive Airbag Market Insights

Shifting consumer inclination towards increased vehicle safety features, providing front and roll-over protection for occupants, offers significant growth opportunities in the automotive airbag market forecast period. The adoption of enhanced safety features is thus increasing the size of the industry, positively influencing available incomes, and raising consumer awareness. In emerging countries, the proliferation of automotive production will boost product demand. The in-depth demand for vehicle safety systems accelerates due to the increasing number of vehicle crashes and road accidents. For instance, in 2016, there were more than 5.5% more fatal crashes than in 2015. In conjunction with supporting regulatory standards, improved road safety standards drive the market share of car airbags over the automotive airbag industry forecast period.

The increasing importance of vehicle safety requirements and crash tests significantly contributes to increased airbag penetration during the study period. Within the context of the Global New Car Assessment Program (NCAP), the adoption of safety restriction systems to reduce road deaths and serious injuries is effectively promoted. The market will be driven by increased consumer awareness of safety standards and the characteristic features of tested cars.

The automobile airbags market has a positive outlook over the projected timeframe due to strict demands on full frontal impact, offset frontal impact, and side impact testing. Government bodies are developing legislation and regulations for compulsory occupational safety systems. For example, in 2017, the Indian Government announced that as of October 2019, at least one airbag would be compulsory in all passenger cars.

Rapid advances in technology in airbags significantly contribute to improved passenger safety and adaptive performance for various occupant sizes. The shift to affordable passive safety systems shows potential growth prospects for the market size of automotive airbag systems. Additionally, the development of cost-effective frontal and side-impact security airbag technologies is gaining greater visibility.

Automotive Airbag Market Segmentation

The worldwide market for automotive airbag is split based on position, component, fabric, vehicle, distribution channels, and geography.

Automotive Airbag Positions

- Frontal

- Side Curtain

- Side

- Rear

- Knee

According to the analysis of the automotive airbag industry, the frontal sector leads the market as the largest segment due to its vital function in preserving occupant safety during frontal collisions, which are one of the most frequent kinds of accidents. By protecting occupants from front impact forces, frontal airbags lower the risk of head and chest injuries by deploying from the dashboard and steering wheel. Market expansion is also fueled by strict safety laws requiring frontal airbag installations in cars. Furthermore, the efficiency and dependability of frontal airbags are constantly being improved by developments in sensor technology and deployment mechanisms, solidifying their status as essential safety equipment in contemporary automobiles.

The market share is bolstered by side curtain airbags, which provide effective protection against side impacts and rollovers over the automotive airbag industry forecast period. The market's growth is driven by increased product installations by car and truck manufacturers. For instance, Scania introduced side curtain airbags in August 2019 to protect passengers from truck rollover crashes.

New product penetration offers the potential for lightweight and flexible airbags. For example, ZF Friedrichshafen AG developed a new knee airbag fabric module with smaller and more flexible packaging features in March 2018. The increased preference for knee airbags in cars further enhances the market share over the automotive airbag market forecast period.

Automotive Airbag Components

- Airbag Inflator

- Impact Sensors

- Indicator Lamp

- Others

In the automotive airbag market, the airbag inflator component usually holds the highest market share among its sub-segments. Because they enable the airbags to deploy quickly in the event of an accident, airbag inflators are essential to passenger safety. The need for efficient airbag inflators has increased due to changes in safety standards and growing awareness of vehicle safety. This sub-segment is dominated in part by technology advancements that attempt to improve the effectiveness and dependability of airbag deployment. Since airbags are essential to maintaining passenger safety in cars, the airbag inflator sub-segment continues to have a sizable market share.

Automotive Airbag Fabrics

- Non-coated

- Coated

Coated automated airbags are anticipated to rise at a compound annual growth rate (CAGR) of more than 8% because of their quick deployment in driver, side, and knee airbags. This will improve the product penetration rate over the forecast period, attributed to minimal heat transfer and uniform application of airbags. The use of silicon-coated airbags is positively influenced by increasing vehicle safety and crash standards.

With increased deployment in passenger airbags, the uncoated airbag segment is expected to achieve significant revenue in 2022. Longer inflation time and cooler gas availability are among the features offered by non-coated airbags. The growing demand for occupant protection from frontal crashes will further bolster the market size for automotive airbags.

Automotive Airbag Vehicles

- Commercial Vehicles

- Passenger Vehicles

The automotive airbags market is projected to dominate passenger vehicles by 2032. This dominance can be attributed to several governmental laws mandating the deployment of airbags. Industry participants are launching new airbag products that deploy faster and enhance safety. For instance, Toyoda Gosei Co., Ltd. introduced a new 3-bag lateral airbag in July 2017, designed to ensure immediate deployment in high-speed crashes.

The business segment is expected to experience significant growth due to the increasing sales of commercial vehicles worldwide. According to the International Motor Vehicle Organization (OICA), heavy commercial vehicle (HCV) sales grew by approximately 3.5 percent in 2018 compared to 2017. The expansion of the commercial vehicle fleet is supported by the proliferating logistics industry. LCV manufacturers are incorporating airbags and other safety devices, including AEB systems, into new models, thereby increasing segment penetration. For example, Peugeot launched three new commercial vehicles in the Australian market.

Automotive Airbag Distribution Channels

- OEM

- Aftermarket

Due to the growing demand for new generation cars, original equipment manufacturers (OEMs) account for a significant proportion of the market. In order to increase their market share, industry participants often enter into strategic mergers and acquisitions. For example, Joyson Safety Systems completed the acquisition of Takata Corporation's global operations, expanding its reach in providing security solutions.

The aftermarket segment significantly contributes to the increase in vehicle deaths and accidents over the study period. This segment's share is expected to increase significantly due to compulsory requirements to replace airbag modules following a vehicle collision.

Automotive Airbag Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive Airbag Market Regional Analysis

Due to growing car sales in the region, Asia Pacific dominates the market share. The increasing number of vehicle sales is driven by rising disposable incomes, easy access to finances, and frequent launches of new models. Additionally, industry participants are investing in the region to start new production facilities in order to support demand in the domestic vehicle industry. For example, Toyoda announced in May 2017 its investment of USD 10.54 million in the development of a new airbag factory.

As a result of compulsory airbag regulations, Europe's car airbags market is expected to experience significant growth. Regional growth will be supported by increasing safety concerns for cars alongside technological advances in airbag design. In February 2019, for instance, ZF announced the development of external airbag systems aimed at reducing the severity of occupants' injuries by up to 40%.

Automotive Airbag Market Players

Some of the top automotive airbag companies offered in our report includes Hyundai Motor Group, Continental AG, ZF Friedrichshafen AG, Robert Bosch GmbH, Toyoda Gosei, Denso Corporation, Hella GmbH & Co. KGaA, Calsonic Kansei Corporation (Mareli), Nihon Plastic Company Co. Ltd, Delphi Automotive, and Takata Corporation.

Frequently Asked Questions

How big is the automotive airbag market?

The automotive airbag market size was valued at USD 14.7 billion in 2022.

What is the CAGR of the global automotive airbag market from 2023 to 2032?

The CAGR of automotive airbag is 7.8% during the analysis period of 2023 to 2032.

Which are the key players in the automotive airbag market?

The key players operating in the global market are including Hyundai Motor Group, Continental AG, ZF Friedrichshafen AG, Robert Bosch GmbH, Denso Corporation, Hella GmbH & Co. KGaA, Calsonic Kansei Corporation (Mareli), Nihon Plastic Company Co. Ltd, Delphi Automotive, and Takata Corporation.

Which region dominated the global automotive airbag market share?

Asia-Pacific held the dominating position in automotive airbag industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Europe region exhibited fastest growing CAGR for market of automotive airbag during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global automotive airbag industry?

The current trends and dynamics in the automotive airbag industry include increasing focus on vehicle safety regulations globally, growing consumer awareness regarding the importance of automotive safety features, technological advancements leading to more effective and versatile airbag systems, and rising demand for luxury and high-end vehicles equipped with advanced safety features like airbags.

Which position held the maximum share in 2022?

The frontal position held the maximum share of the automotive airbag industry.