Armored Car Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Armored Car Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

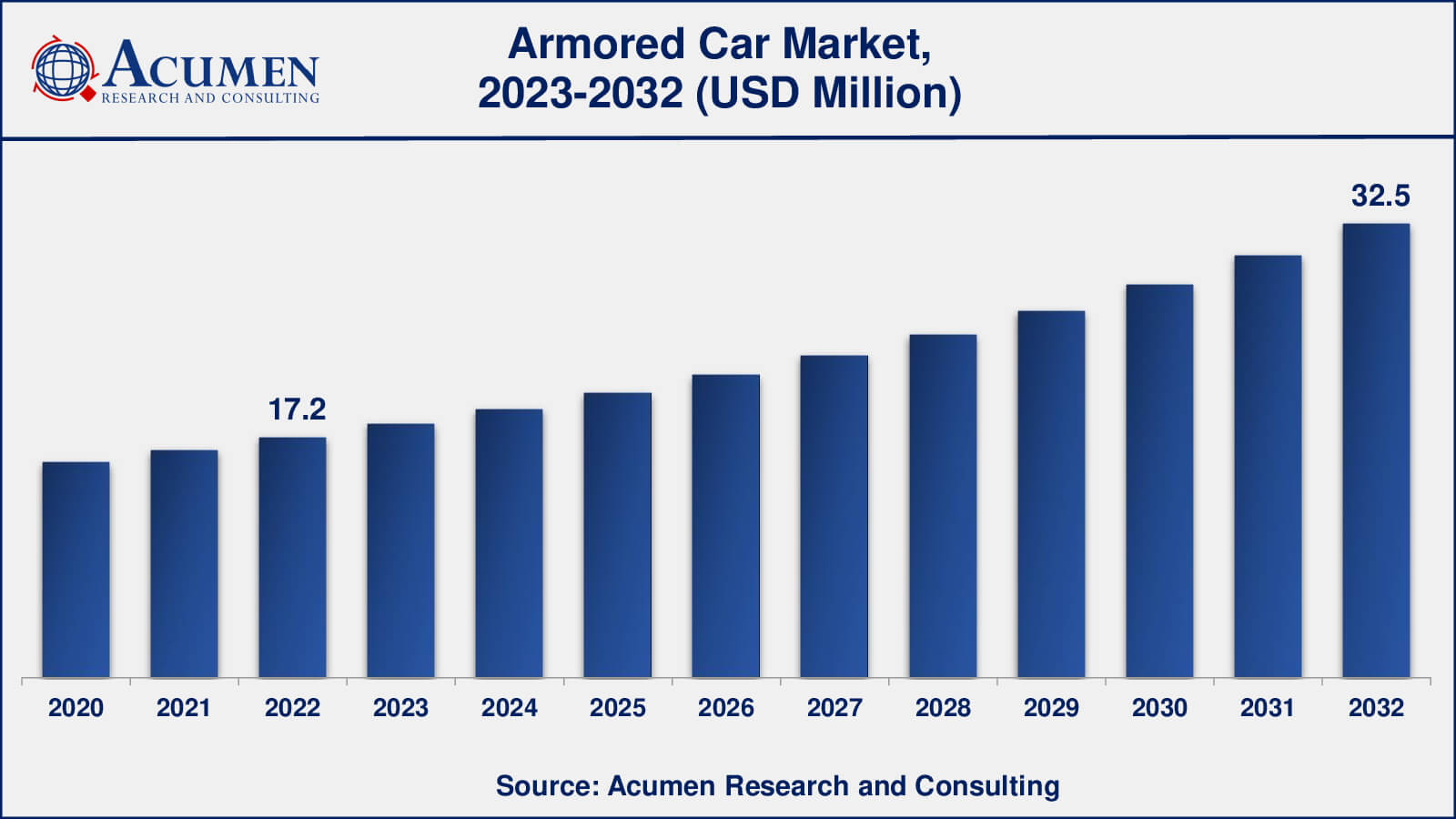

The global Armored Car Market size was valued at USD 17.2 Billion in 2022 and is projected to attain USD 32.5 Billion by 2032 mounting at a CAGR of 6.7% from 2023 to 2032.

Armored Car Market Highlights

- Global armored car market revenue is poised to garner USD 32.5 billion by 2032 with a CAGR of 6.7% from 2023 to 2032

- North America armored car market value occupied around USD 6.2 billion in 2022

- Asia-Pacific armored car market growth will record a CAGR of more than 7% from 2023 to 2032

- Among vehicle type, the cash-in-transit (CIT) vehicles sub-segment occupied over US$ 6 billion revenue in 2022

- Based on ownership, the government-owned sub-segment gathered around 60% share in 2022

- Growth in electric vehicle technology is a popular armored car market trend that drives the industry demand

An armored car is a specifically adapted vehicle meant to give superior protection against various dangers such as ballistic strikes, explosives, and physical assaults. These vehicles are frequently employed for various purposes, primarily to ensure the protection and safety of passengers and precious goods while in transit. Armored cars are built by retrofitting or custom-building ordinary cars with modern armor materials, strengthening the body and windows to withstand assaults, and frequently integrating extra security elements.

The primary function of an armored automobile is to protect its people and belongings, making it extremely resistant to external assaults. Armored cars are used in a variety of industries, including security businesses, financial institutions, law enforcement, government agencies, and for personal protection. They serve a variety of purposes, including safely moving cash and valuables, providing secure transportation for high-profile persons, and meeting tactical and security needs for military and law enforcement organizations.

Armored vehicles include armored SUVs, sedans, lorries, vans, and specialized vehicles such as cash-in-transit (CIT) vehicles. Armor protection can range from light armor, which protects against pistols and small arms, to heavy armor, which can withstand massive weapons and explosives. The choice of an armored car is determined by the customer's individual security demands and preferences, and these vehicles serve a key role in protecting lives and assets in circumstances where security is important

Global Armored Car Market Dynamics

Market Drivers

- Rising concerns about personal and asset security

- Growth in cash-intensive industries

- Global unrest and conflict drive demand for military and police armored cars

- Innovations in armor materials and vehicle technology enhance protection and performance

Market Restraints

- High expense of manufacturing and maintaining armored vehicles

- Stringent regulations and certifications

- Armored vehicles may have higher emissions and environmental impacts

Market Opportunities

- Expanding security needs in emerging economies

- Increasing demand for customized armored vehicles tailored to specific needs

- Development of lighter, more effective armor materials for improved mobility

Armored Car Market Report Coverage

| Market | Armored Car Market |

| Armored Car Market Size 2022 | USD 17.2 Billion |

| Armored Car Market Forecast 2032 | USD 32.5 Billion |

| Armored Car Market CAGR During 2023 - 2032 | 6.7% |

| Armored Car Market Analysis Period | 2020 - 2032 |

| Armored Car Market Base Year |

2022 |

| Armored Car Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Ownership, By End-Users, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | INKAS Group of Companies, BAE Systems, Lenco Armored Vehicles, Ford Motor Company, Oshkosh Defense, General Dynamics Land Systems, Bullrich, Streit Group, MSPV (Military and Security Vehicle), and Iveco Defence Vehicles. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Armored Car Market Insights

Various dynamic elements drive the growth and evolution of the armored car industry. The growing concern for security and safety in an increasingly unpredictable environment is a primary driver of this industry. The surge in criminal activity, terrorism, and geopolitical instability has increased demand for armored vehicles. Institutions, corporations, and people want to know that their assets, cash, and staff will be safe throughout transportation, which contributes to consistent market demand.

Concurrently, the global economy has a significant impact on the armored car industry. Economic expansion, particularly in emerging nations, can boost cash transactions and the requirement for safe cash-in-transit (CIT) services, creating demand for CIT vehicles. Economic downturns, on the other hand, may have a temporary impact on market dynamics as budgets for security-related expenditures are scrutinized more thoroughly.

Another important component impacting this industry is geopolitical considerations. Countries suffering insecurity or war frequently have a greater need for armored military vehicles, such as armored personnel carriers (APCs) and supporting equipment. Furthermore, the global weapons trade may have a considerable influence on the armored car industry, as governments invest in military vehicles for defense and security.

Technological advances in armor materials and vehicle technology have resulted in greater protection and performance. These advancements have boosted the survivability of armored vehicles while also broadening their potential uses, such as the creation of lighter and more adaptable armored systems.

Despite these drivers, the armored car industry is constrained by several factors. High production and maintenance costs are a major concern, especially for small-scale producers and operators. Strict regulatory requirements and certifications can be costly, increasing the total cost and complexity of armored vehicle manufacture. Furthermore, the weight of armor might hinder vehicle movement and fuel economy, particularly in metropolitan areas.

The market also provides prospects for expansion and innovation. Emerging markets with changing security requirements provide a viable route for growth. The need for customized armored vehicles that are suited to individual security and transportation requirements is increasing. Furthermore, as the world becomes more digital, there is an increased need for armored vehicles with enhanced cybersecurity technologies to guard against cyber-attacks while in transit. Furthermore, the research of electric-powered armored vehicles and the development of lightweight armor materials add to the sector's potential for long-term growth.

In conclusion, the armored car industry is impacted by a complex interplay of elements such as security concerns, economic conditions, geopolitical stability, technical advances, and regulatory restraints. Businesses and organizations in this field must be tuned in to these dynamics to adapt and prosper in an ever-changing world.

Armored Car Market Segmentation

The worldwide market for armored car is split based on type, ownership, end-users, and geography.

Armored Car Types

- Cash-in-Transit (CIT) Vehicles

- Armored Personnel Carriers (APCs)

- Armored SUVs

- Armored Sedans

- Others

According to the armored car industry analysis, the cash-in-transit (CIT) vehicles segment accounted for a significant market share in 2022. CIT vehicles are armored vehicles developed specifically for the safe movement of cash and valuables. They are extremely important in the security and logistics industries, notably in the banking and financial sectors. Currency, coins, and other precious objects must be transported between banks, ATMs, and companies using CIT vehicles. CIT vehicles have been a key category in the armored automobile industry because of their vital purpose.

Armored personnel carriers are mostly employed by the military and law enforcement. They are intended to carry soldiers and defend them in battle scenarios. Armored SUVs and sedans are frequently employed in corporate and executive protection, as well as VIP transportation. High-profile persons, diplomats, government officials, and business leaders frequently use these cars for personal protection and safe transportation. Armored SUVs and sedans have grown in popularity in areas where security is a major issue. Other categories of armored vehicles may include armored vans, buses, ambulances, and customized security vehicles. The dominance of this category would be determined by market needs and applications.

Armored Car Ownerships

- Government-Owned

- Private-Owned

Government-owned and privately owned armored cars both play important roles in the armored car industry. Armored vehicles are regularly purchased by government organizations such as the military, law enforcement agencies, and government officials for a variety of purposes including defense, law enforcement, and official transportation. Armored vehicles owned by the government may be more common in locations with high-security hazards or current hostilities.

Armored vehicle ownership is widespread in both the commercial and civilian sectors. Businesses, executives, high-net-worth individuals, and security agencies acquire private armored cars for personal protection, secure transportation, and cash-in-transit (CIT) services. Demand for privately owned armored vehicles can be influenced by both economic and personal security concerns.

Armored Car End-Users

- Financial Institutions

- Government and Law Enforcement

- Corporate

- VIPs and Celebrities

- Military

- Others

As per the armored car market forecast, the government and law enforcement will be a significant drivers of the industry from 2023 to 2032. Government and law enforcement organizations are major users of armored vehicles, especially for security and tactical objectives. Police agencies, military groups, and government officials that require armored vehicles for a variety of purposes such as crowd control, border security, and VIP transportation fall into this category.

Financial institutions, such as banks, credit unions, and cash management firms, have historically been heavy users of armored cars. They rely on armored vehicles to move cash, coins, and other important items safely. The banking sector has long been a major user of armored vehicles, notably cash-in-transit (CIT) trucks.

Armored Car Market Regional Segmentation

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Armored Car Market Regional Analysis

North America, notably the United States, is an important market for armored vehicles. Security concerns, financial logistics, and the necessity for executive protection all fuel demand in this market. Financial organizations, security corporations, and private people are among the region's major users. Canada has a burgeoning armored car business within North America, with a special emphasis on cash-in-transit (CIT) services and VIP protection.

The armored car market has grown significantly in the Asia-Pacific region, including China and India. China's economic boom has increased demand for armored SUVs, notably for corporate clients and VIPs. In India, on the other hand, the industry is expanding, owing mostly to security concerns and the need for CIT services. Furthermore, armored vehicles are in high demand throughout the Middle East, notably for VIP transportation and government protection.

Armored Car Market Players

Some of the top armored car companies offered in our report include INKAS Group of Companies, BAE Systems, Lenco Armored Vehicles, Ford Motor Company, Oshkosh Defense, General Dynamics Land Systems, Bullrich, Streit Group, MSPV (Military and Security Vehicle), and Iveco Defence Vehicles.

Frequently Asked Questions

What was the size of the global armored car market in 2022?

The size of armored car market was USD 17.2 billion in 2022.

What is the armored car market CAGR from 2023 to 2032?

The armored car market CAGR during the analysis period of 2023 to 2032 is 6.7%.

Which are the key players in the armored car market?

The key players operating in the global armored car market are INKAS Group of Companies, BAE Systems, Lenco Armored Vehicles, Ford Motor Company, Oshkosh Defense, General Dynamics Land Systems, Bullrich, Streit Group, MSPV (Military and Security Vehicle), and Iveco Defence Vehicles.

Which region dominated the global armored car market share?

North America region held the dominating position in armored car industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of armored car during the analysis period of 2023 to 2032.

What are the current trends in the global armored car industry?

The current trends and dynamics in the armored car industry include rising concerns about personal and asset security, growth in cash-intensive industries, and global unrest and conflict drive demand for military and police armored cars

Which type held the maximum share in 2022?

The cash-in-transit (CIT) vehicles held the maximum share of the armored car industry.