Application Delivery Controller Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Application Delivery Controller Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

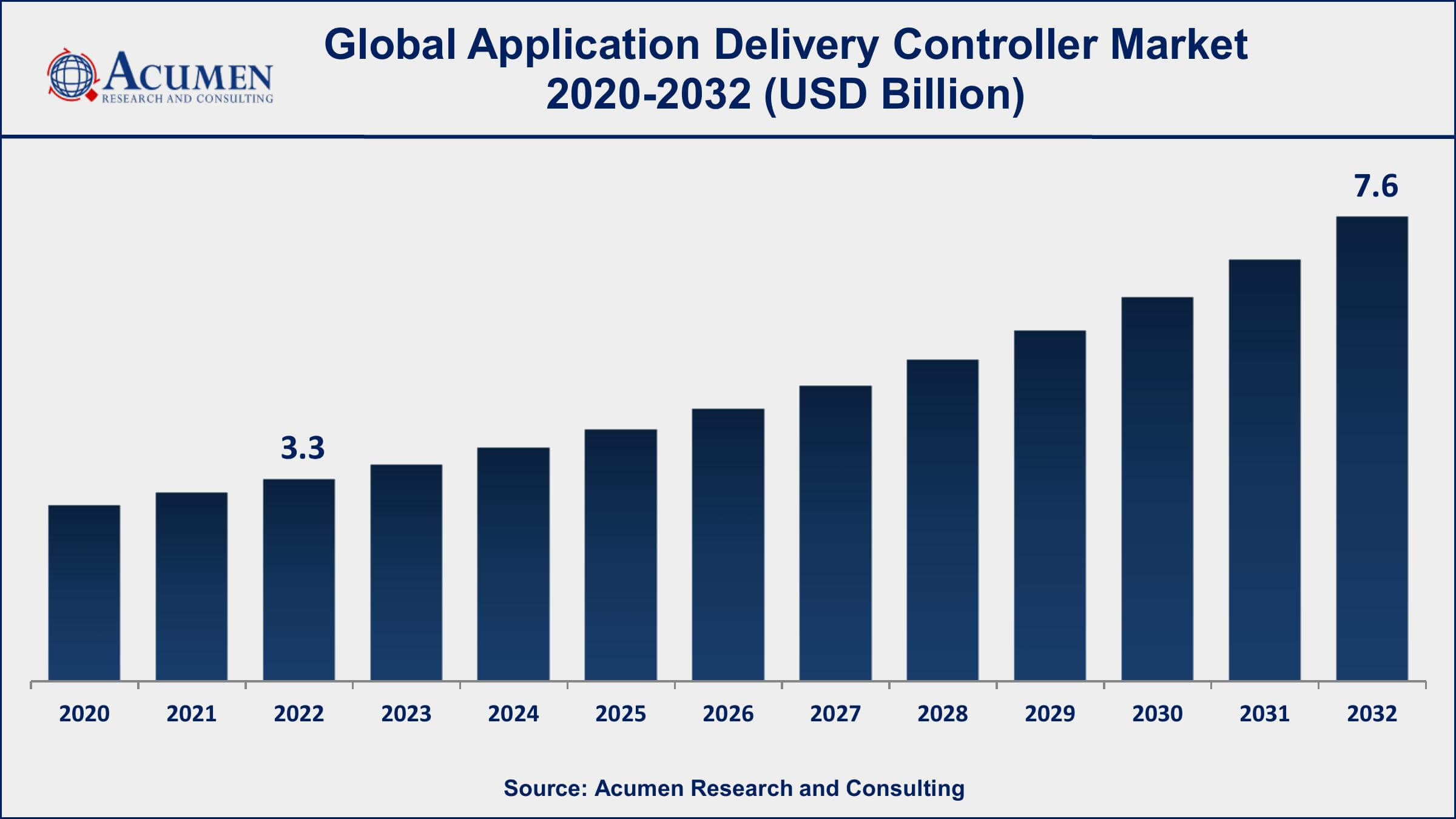

The Global Application Delivery Controller Market Size accounted for USD 3.3 Billion in 2022 and is projected to achieve a market size of USD 7.6 Billion by 2032 growing at a CAGR of 8.8% from 2023 to 2032.

Application Delivery Controller (ADC) Market Highlights

- Global Application Delivery Controller Market revenue is expected to increase by USD 7.6 Billion by 2032, with a 8.8% CAGR from 2023 to 2032

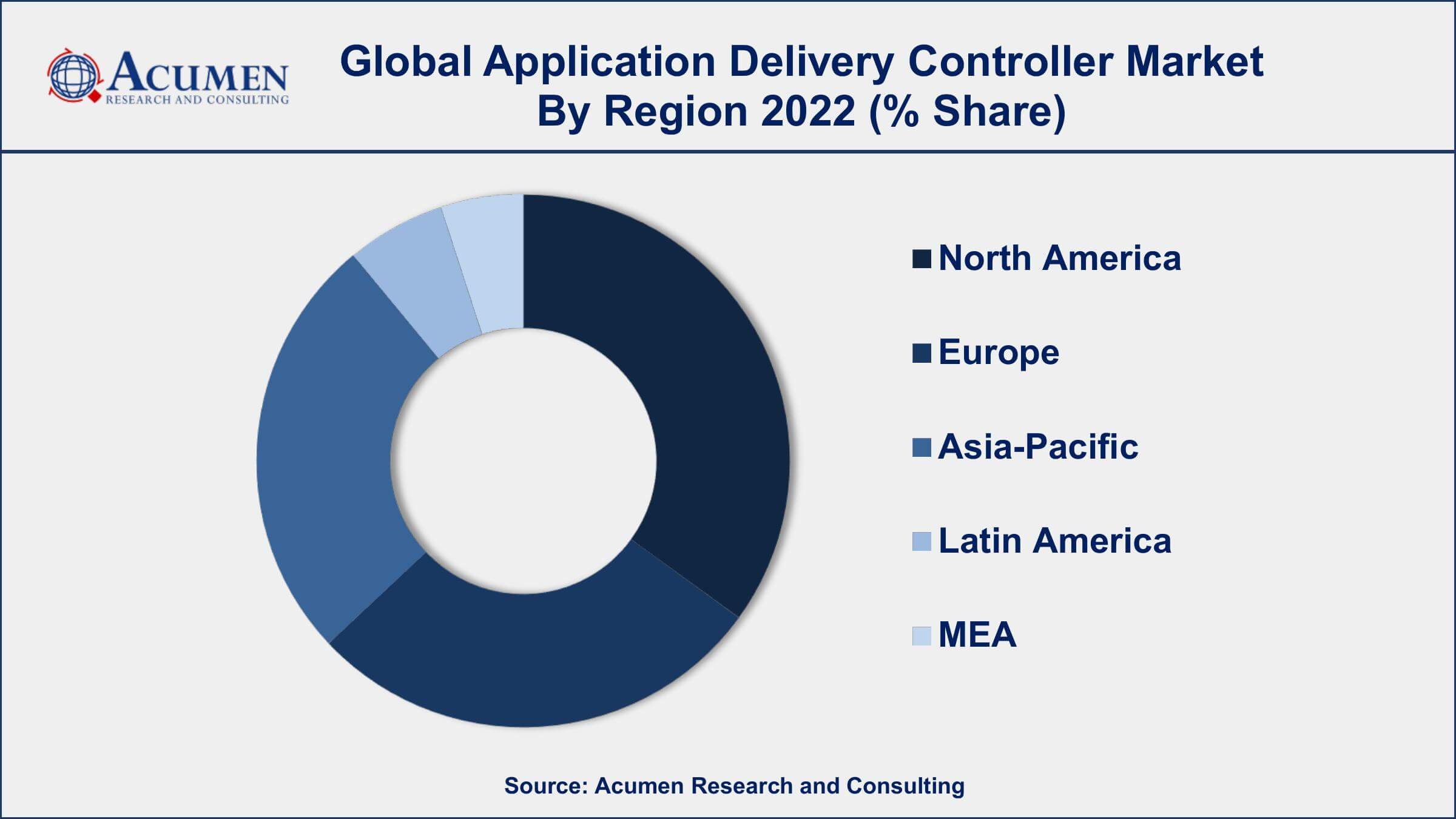

- North America region led with more than 41% of the Application Delivery Controller Market share in 2022

- Asia-Pacific Application Delivery Controller Market growth will record a CAGR of more than 10% from 2023 to 2032

- Based on deployment, the cloud sub-segment gathered around 64% share in 2022

- By end-user vertical, the BFSI segment is predicted to grow at the fastest CAGR of 9.7% between 2023 and 2032

- Increasing demand for high application performance and user experience, drives the Application Delivery Controller Market value

An Application Delivery Controller (ADC) is a networking device or software solution that plays a crucial role in optimizing the performance, security, and availability of applications in a network environment. ADCs are positioned between the client-side and server-side of a network to efficiently distribute and manage incoming application traffic. They perform functions such as load balancing, traffic management, SSL offloading, caching, compression, security enhancements, and application acceleration. By intelligently distributing user requests across multiple servers and optimizing data flow, ADCs ensure that applications run smoothly, with reduced latency and improved user experience.

The market for Application Delivery Controllers has witnessed steady growth over the years due to the increasing demand for efficient application delivery and management. As businesses continue to rely on digital applications for their operations, the need for reliable, secure, and high-performing application delivery has become paramount. The growth of cloud computing, the proliferation of mobile devices, and the rise of e-commerce and online services have contributed to the expansion of the ADC market. Organizations across various industries, including e-commerce, finance, healthcare, and more, invest in ADC solutions to ensure their applications are responsive, scalable, and secure, even during peak traffic periods. The market growth is also driven by the evolving security landscape, where ADCs play a role in providing security through features like Web Application Firewalls (WAFs) and Distributed Denial of Service (DDoS) protection.

Global Application Delivery Controller Market Trends

Market Drivers

- Increasing demand for high application performance and user experience

- Growth of cloud computing and hybrid environments

- Surge in mobile and web-based applications

- Emphasis on security enhancements and protection against cyber threats

- Need for scalable and flexible application delivery solutions

Market Restraints

- High initial deployment and operational costs.

- Complexity in managing multi-vendor environments

- Integration challenges with legacy systems

Market Opportunities

- Demand for AI-driven and analytics-powered ADC solutions

- Growth of edge computing and distributed application architecture

- Increasing need for microservices and container-based deployments

Application Delivery Controller Market Report Coverage

| Market | Application Delivery Controller Market |

| Application Delivery Controller Market Size 2022 | USD 3.3 Billion |

| Application Delivery Controller Market Forecast 2032 | USD 7.6 Billion |

| Application Delivery Controller Market CAGR During 2023 - 2032 | 8.8% |

| Application Delivery Controller Market Analysis Period | 2020 - 2032 |

| Application Delivery Controller Market Base Year | 2022 |

| Application Delivery Controller Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Deployment, By Enterprise Size, By End-user Vertical, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | F5 Networks, Citrix Systems, A10 Networks, Radware, Barracuda Networks, Kemp Technologies, Fortinet, Array Networks, Sangfor Technologies, HAProxy Technologies, Snapt, and Avi Networks |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

An Application Delivery Controller (ADC) is a critical networking component that optimizes the delivery and performance of applications over networks. It acts as a intermediary between clients (end-users) and servers, ensuring efficient, secure, and reliable distribution of application traffic. ADCs employ a range of techniques such as load balancing, caching, compression, SSL offloading, and application acceleration to enhance application responsiveness and user experience. By intelligently distributing incoming requests across multiple servers, ADCs help prevent server overloads, improve resource utilization, and ensure that applications are highly available even during traffic spikes. Additionally, ADCs contribute to security by inspecting incoming traffic for potential threats and vulnerabilities, thereby enhancing the overall security posture of the network.

The applications of ADCs are diverse and vital in today's digital landscape. They are extensively used in e-commerce websites to manage and optimize online transactions, providing seamless experiences even during peak shopping seasons. Enterprises rely on ADCs to deliver internal and external applications reliably to their employees, customers, and partners. ADCs are also crucial in content delivery networks (CDNs), accelerating the delivery of web content, videos, and other digital assets to users across the globe. In the realm of cloud computing, ADCs help balance the load among virtual machines and ensure applications perform optimally in dynamic cloud environments.

The Application Delivery Controller (ADC) market has experienced significant growth and transformation driven by the evolving demands of digital businesses. As organizations increasingly rely on digital applications to interact with customers, streamline operations, and enhance user experiences, the role of ADCs has become paramount. The market has witnessed a surge due to the need for efficient application delivery, scalability, security, and performance optimization. One of the primary drivers of ADC market growth is the rapid expansion of cloud computing and hybrid environments. As businesses migrate their applications to the cloud or adopt hybrid infrastructures, the complexity of managing and ensuring consistent performance across different environments has grown. ADCs address these challenges by intelligently distributing traffic, optimizing application delivery, and enhancing security, making them a crucial component in the cloud era.

Application Delivery Controller Market Segmentation

The global Application Delivery Controller Market segmentation is based on deployment, enterprise size, end-user vertical, and geography.

Application Delivery Controller Market By Deployment

- Cloud

- On-premise

According to the application delivery controller industry analysis, the cloud segment accounted for the largest market share in 2022. Cloud-based ADC solutions offer organizations greater flexibility, scalability, and agility in managing their application delivery needs while minimizing the complexity associated with traditional on-premises deployments. One of the key drivers of the cloud segment's growth is the increasing adoption of Infrastructure as a Service (IaaS) and Platform as a Service (PaaS) models. These cloud platforms enable businesses to deploy and manage their applications in a more dynamic and resource-efficient manner. Cloud-based ADCs complement this trend by providing on-demand scalability, automated provisioning, and global application delivery capabilities, allowing businesses to efficiently manage traffic spikes, optimize application performance, and ensure high availability across geographically dispersed users.

Application Delivery Controller Market By Enterprise Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

In terms of enterprise sizes, the small and medium enterprises (SMEs) segment is expected to witness significant growth in the coming years. In an era where digital interactions play a crucial role in business operations, SMEs are realizing the need for enhanced application performance, security, and availability to compete effectively and provide exceptional user experiences. One of the driving factors behind the growth of the SME segment is the availability of cost-effective and scaled-down ADC solutions tailored to the specific needs of smaller businesses. Traditional enterprise-grade ADCs can often be complex and expensive, which may not align with the budgets and IT resources of SMEs. As a result, ADC vendors are offering simplified, cloud-ready, and more affordable solutions that cater to the requirements of SMEs, enabling them to improve application responsiveness and user satisfaction without the burden of a significant investment.

Application Delivery Controller Market By End-user Vertical

- BFSI

- IT and Telecom

- Retail

- Government and Public Sector

- Media and Entertainment

- Healthcare and Life Sciences

- Energy and Utilities

- Manufacturing

- Others

According to the application delivery controller market forecast, the BFSI segment is expected to witness significant growth in the coming years. In the BFSI industry, where customer experience, data security, and regulatory compliance are paramount, ADCs play a crucial role in ensuring seamless application delivery while enhancing performance and security. The BFSI sector's growth within the ADC market is driven by several factors. Firstly, the rise of online banking, mobile apps, and digital payment platforms has elevated the importance of uninterrupted application availability and responsiveness. ADCs assist in load balancing and traffic management to ensure these critical applications can handle high transaction volumes and provide a seamless user experience even during peak demand periods.

Application Delivery Controller Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Application Delivery Controller Market Regional Analysis

North America's dominance in the Application Delivery Controller (ADC) market can be attributed to a combination of technological advancement, robust IT infrastructure, and a thriving business landscape. The region's early adoption of digital technologies, coupled with its mature and well-developed IT ecosystem, has positioned it as a leader in deploying ADC solutions to enhance application performance, security, and user experiences. One key factor is the presence of numerous technology-driven industries in North America, including finance, e-commerce, healthcare, and entertainment. These industries heavily rely on digital applications to interact with customers, process transactions, and manage operations. As a result, the demand for efficient application delivery solutions like ADCs is consistently high, driving market growth. Furthermore, North America's emphasis on innovation and early adoption of emerging technologies allows it to stay at the forefront of IT trends.

Application Delivery Controller Market Player

Some of the top application delivery controller market companies offered in the professional report include F5 Networks, Citrix Systems, A10 Networks, Radware, Barracuda Networks, Kemp Technologies, Fortinet, Array Networks, Sangfor Technologies, HAProxy Technologies, Snapt, and Avi Networks.

Frequently Asked Questions

What was the market size of the global application delivery controller in 2022?

The market size of application delivery controller was USD 3.3 Billion in 2022.

What is the CAGR of the global application delivery controller market from 2023 to 2032?

The CAGR of application delivery controller is 8.8% during the analysis period of 2023 to 2032.

Which are the key players in the application delivery controller market?

The key players operating in the global market are including F5 Networks, Citrix Systems, A10 Networks, Radware, Barracuda Networks, Kemp Technologies, Fortinet, Array Networks, Sangfor Technologies, HAProxy Technologies, Snapt, and Avi Networks.

Which region dominated the global application delivery controller (ADC) market share?

North America held the dominating position in application delivery controller industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of application delivery controller during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global application delivery controller industry?

The current trends and dynamics in the application delivery controller industry include increasing demand for high application performance and user experience, growth of cloud computing and hybrid environments, and surge in mobile and web-based applications.

Which enterprise size held the maximum share in 2022?

The large enterprises held the maximum share of the application delivery controller industry.