API Security Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

API Security Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

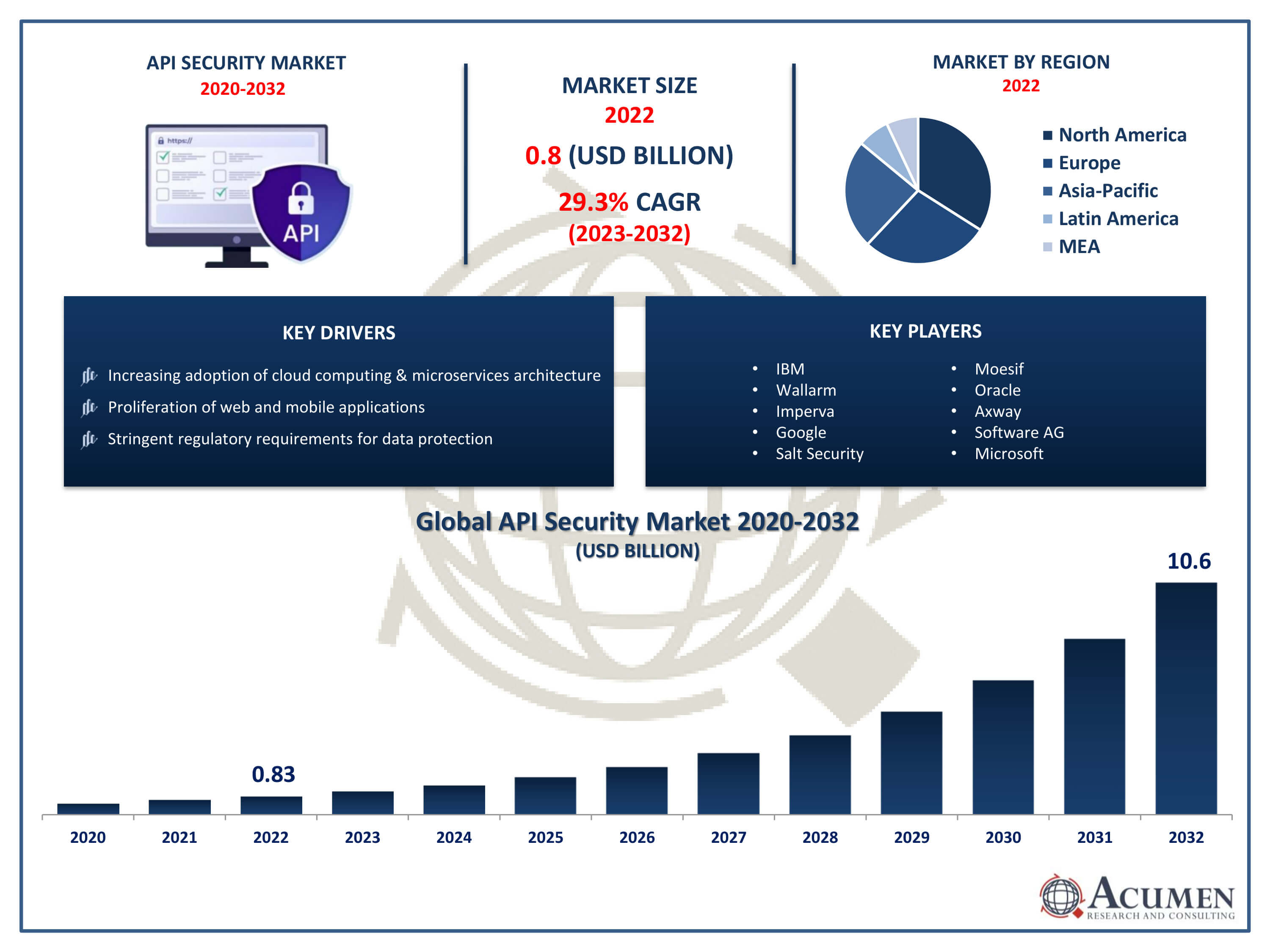

The API Security Market Size accounted for USD 0.8 Billion in 2022 and is projected to achieve a market size of USD 10.6 Billion by 2032 growing at a CAGR of 29.3% from 2023 to 2032.

API Security Market Highlights

- Global API Security Market revenue is expected to increase by USD 10.6 Billion by 2032, with a 29.3% CAGR from 2023 to 2032

- North America region led with more than 32% of API Security Market share in 2022

- Asia-Pacific API Security Market growth will record a CAGR of around 30.1% from 2023 to 2032

- By offering, the platform & solutions segment is the largest segment in the market, accounting for over 76% of the market share in 2022

- By vertical, the BFSI segment has recorded more than 21% of the revenue share in 2022

- Increasing adoption of cloud computing and microservices architecture, drives the API Security Market value

API (Application Programming Interface) security are practices and measures taken to protect APIs from unauthorized access, data breaches, and other security threats. APIs facilitate communication and data exchange between different software systems, allowing them to work together seamlessly. As a result, they play a crucial role in modern applications and services. API security involves securing the endpoints, managing access control, encrypting data in transit, and ensuring the integrity of the exchanged information. With the increasing adoption of APIs in various industries, the need for robust API security has become paramount to safeguard sensitive data and maintain the trust of users and stakeholders.

The market for API security has been experiencing significant growth in recent years and is expected to continue expanding. As organizations increasingly rely on APIs to enable digital transformation, the attack surface for potential security threats also grows. The rise of cloud computing market, mobile applications, and the Internet of Things (IoT) has further fueled the demand for API security solutions. Additionally, regulatory requirements and compliance standards, such as GDPR and HIPAA, emphasize the importance of securing data, further driving the adoption of API security measures. As a result, the API security market has seen the emergence of specialized solutions and services aimed at addressing the unique challenges posed by API vulnerabilities and ensuring the overall cybersecurity of interconnected systems.

Global API Security Market Trends

Market Drivers

- Increasing adoption of cloud computing and microservices architecture

- Proliferation of web and mobile applications

- Stringent regulatory requirements for data protection

- Rise in sophisticated cyber threats and attacks

Market Restraints

- Lack of standardized API security protocols

- Complexity of managing and securing diverse API ecosystems

Market Opportunities

- Growing demand for AI-driven API security solutions

- Integration of API security into DevOps processes

API Security Market Report Coverage

| Market | API Security Market |

| API Security Market Size 2022 | USD 0.8 Billion |

| API Security Market Forecast 2032 | USD 10.6 Billion |

| API Security Market CAGR During 2023 - 2032 | 29.3% |

| API Security Market Analysis Period | 2020 - 2032 |

| API Security Market Base Year |

2022 |

| API Security Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Offering, By Deployment Mode, By Organization Size, By Vertical, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | IBM, Wallarm, Imperva, Google, Salt Security, Moesif, Oracle, Axway, Software AG, Microsoft, MuleSoft, and Akana. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

API Security Market Dynamics

API security involves implementing strategies to authenticate and authorize users, encrypt data during transmission, and prevent common vulnerabilities such as SQL injection and cross-site scripting. By safeguarding APIs, organizations can maintain the confidentiality, integrity, and availability of the data exchanged between systems, protecting sensitive information and maintaining the overall cybersecurity posture. The applications of API security are diverse and span across various industries. In the realm of e-commerce, API security is crucial for safeguarding online transactions, payment gateways, and customer data. In the financial sector, APIs are employed for seamless integration between banking systems, and securing these interfaces is paramount to prevent unauthorized access to sensitive financial information. Additionally, in healthcare, APIs play a pivotal role in exchanging patient data between different healthcare systems and applications.

The API security market has witnessed robust growth in recent years, driven by the increasing reliance on APIs across diverse industries and the growing recognition of the critical need to secure these interfaces. As organizations continue to adopt digital technologies, cloud services, and mobile applications, the demand for efficient and comprehensive API security solutions has surged. The escalating frequency and sophistication of cyber threats targeting APIs have further propelled the market, prompting businesses to prioritize investments in robust security measures. The market growth is also fueled by regulatory requirements and compliance standards that mandate organizations to safeguard sensitive data exchanged through APIs. With the rise of privacy concerns and the enforcement of data protection regulations such as GDPR, companies are compelled to implement robust API security practices to ensure compliance and avoid legal repercussions.

API Security Market Segmentation

The global API Security Market segmentation is based on offering, deployment mode, organization size, vertical, and geography.

API Security Market By Offering

- Services

- Platform & Solutions

According to the API security industry analysis, the platform & solutions segment accounted for the largest market share in 2022. Organizations are increasingly adopting comprehensive API security platforms that offer a range of integrated solutions to address the evolving challenges in securing application interfaces. These platforms typically encompass features such as access control, encryption, threat detection, and monitoring tools, providing a holistic approach to API security. As businesses strive to streamline their operations and enhance customer experiences through digital channels, the demand for robust, all-encompassing solutions has intensified. One of the key drivers of growth in this segment is the recognition of the need for centralized API security management.

API Security Market By Deployment Mode

- On-Premises

- Hybrid

- Cloud

In terms of deployment modes, the cloud segment is expected to witness significant growth in the coming years. This growth is attributed to the widespread adoption of cloud computing services and the increasing reliance on cloud-native applications. As organizations migrate their applications and data to cloud environments, the need to secure API interactions within these distributed and dynamic architectures becomes paramount. Cloud-based API security solutions offer scalability, flexibility, and accessibility, aligning with the agile nature of cloud deployments. This has led to a surge in demand for cloud-centric API security solutions, catering to businesses of all sizes seeking to fortify their cloud infrastructure against potential threats. The scalability and elasticity of cloud platforms enable organizations to seamlessly integrate API security measures without the constraints of traditional on-premises solutions.

API Security Market By Organization Size

- Large Enterprise

- SMEs

According to the API security market forecast, the SMEs segment is expected to witness significant growth in the coming years. As SMEs embrace digital transformation to remain competitive and expand their market reach, they often integrate various applications and services, relying on APIs to facilitate seamless interactions. This heightened integration makes SMEs more susceptible to potential security threats, prompting a growing awareness of the need for robust API security measures. The growth in the SMEs segment can also be attributed to the availability of cost-effective and scalable API security solutions tailored to the specific needs and resource constraints of smaller businesses.

API Security Market By Vertical

- BFSI

- IT and ITeS

- Manufacturing

- Telecom

- Energy and Utilities

- Government

- Retail and eCommerce

- Healthcare

- Media and Entertainment

- Others

Based on the vertical, the BFSI segment is expected to continue its growth trajectory in the coming years. This growth is fueled by the sector's rapid digital transformation and the increasing reliance on APIs for streamlined financial services. As financial institutions strive to enhance customer experiences, introduce innovative services, and optimize internal processes, they increasingly leverage APIs to facilitate seamless data exchange and interoperability between diverse applications. However, the sensitive nature of financial data makes the BFSI sector a prime target for cyber threats, leading to a heightened focus on implementing robust API security measures. The growth in the BFSI segment is further driven by stringent regulatory requirements and compliance standards governing data protection and privacy. Regulations such as GDPR, PCI DSS, and regional financial regulations mandate financial institutions to ensure the security and confidentiality of customer information, making API security a critical component of their overall cybersecurity strategy.

API Security Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

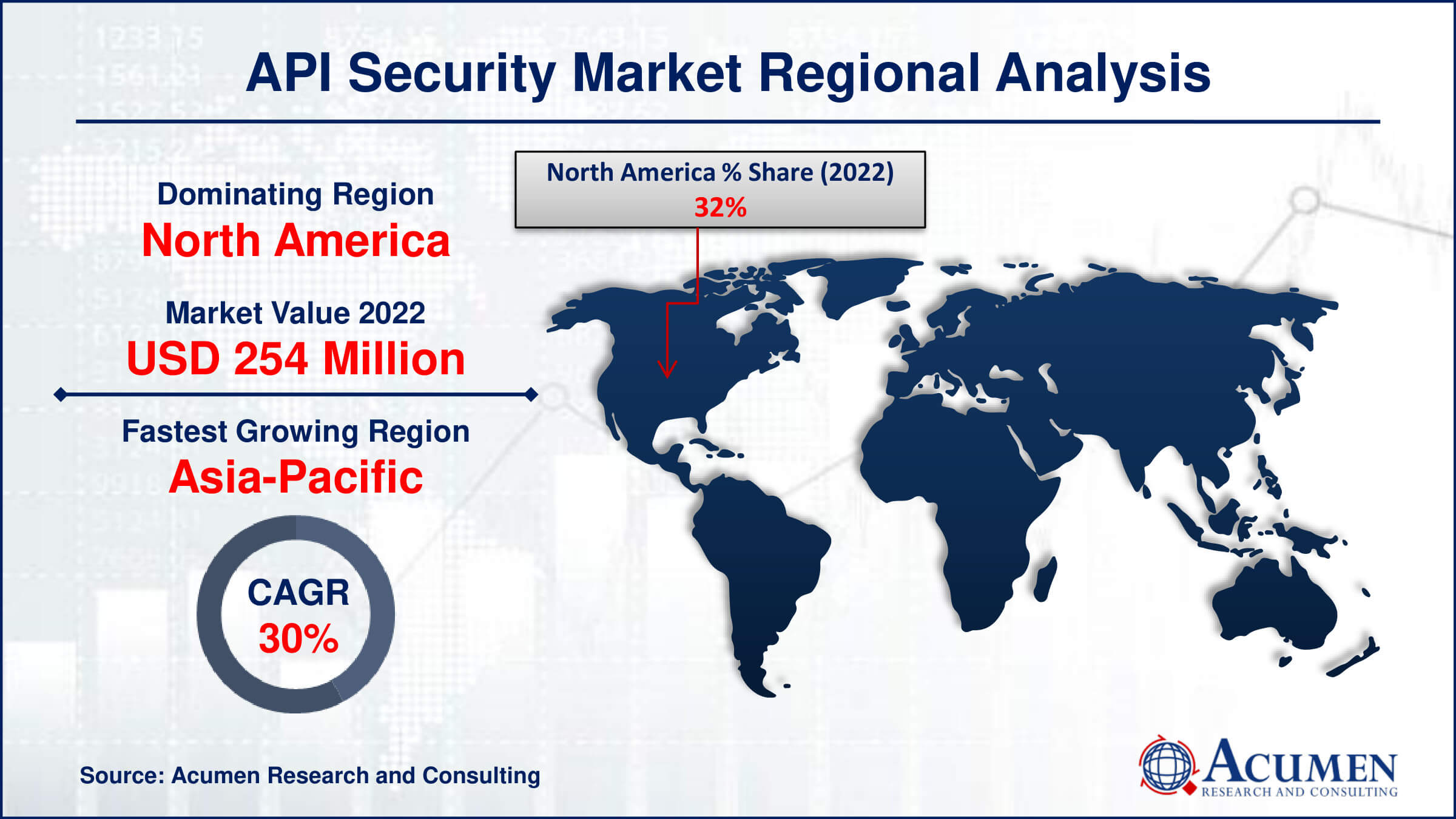

API Security Market Regional Analysis

North America stands out as the dominating region in the API security market, driven by a combination of factors that reflect the region's technological advancements, widespread digitalization, and the presence of a large number of major enterprises. The region is home to a significant concentration of leading technology companies, financial institutions, and businesses across diverse industries, which extensively utilize APIs to power their applications and services. The heightened adoption of cloud computing, mobile technologies, and IoT devices in North America has further accelerated the integration of APIs, creating a substantial demand for robust API security solutions to safeguard critical data and ensure the seamless functioning of interconnected systems. Moreover, North America's strong regulatory environment and the increasing focus on data protection and privacy have propelled the need for comprehensive API security measures. Stringent regulations such as GDPR in Europe and various data protection laws in the United States drive organizations to prioritize API security to avoid legal consequences and maintain the trust of consumers. The region's proactive approach toward cybersecurity, coupled with a high level of awareness regarding the potential risks associated with poorly secured APIs, has led to a robust market ecosystem comprising advanced API security platforms and solutions.

API Security Market Player

Some of the top API security market companies offered in the professional report include IBM, Wallarm, Imperva, Google, Salt Security, Moesif, Oracle, Axway, Software AG, Microsoft, MuleSoft, and Akana.

Frequently Asked Questions

How big is the API security market?

The market size of API security was USD 0.8 Billion in 2022.

What is the CAGR of the global API security market from 2023 to 2032?

The CAGR of API security is 29.3% during the analysis period of 2023 to 2032.

Which are the key players in the API security market?

The key players operating in the global market are including IBM, Wallarm, Imperva, Google, Salt Security, Moesif, Oracle, Axway, Software AG, Microsoft, MuleSoft, and Akana.

Which region dominated the global API security market share?

North America held the dominating position in API security industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of API security during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global API security industry?

The current trends and dynamics in the API security industry include increasing adoption of cloud computing and microservices architecture, proliferation of web and mobile applications, and stringent regulatory requirements for data protection.

Which offering held the maximum share in 2022?

The platform & solutions offering held the maximum share of the API security industry.