Anti-Obesity Drugs Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Anti-Obesity Drugs Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

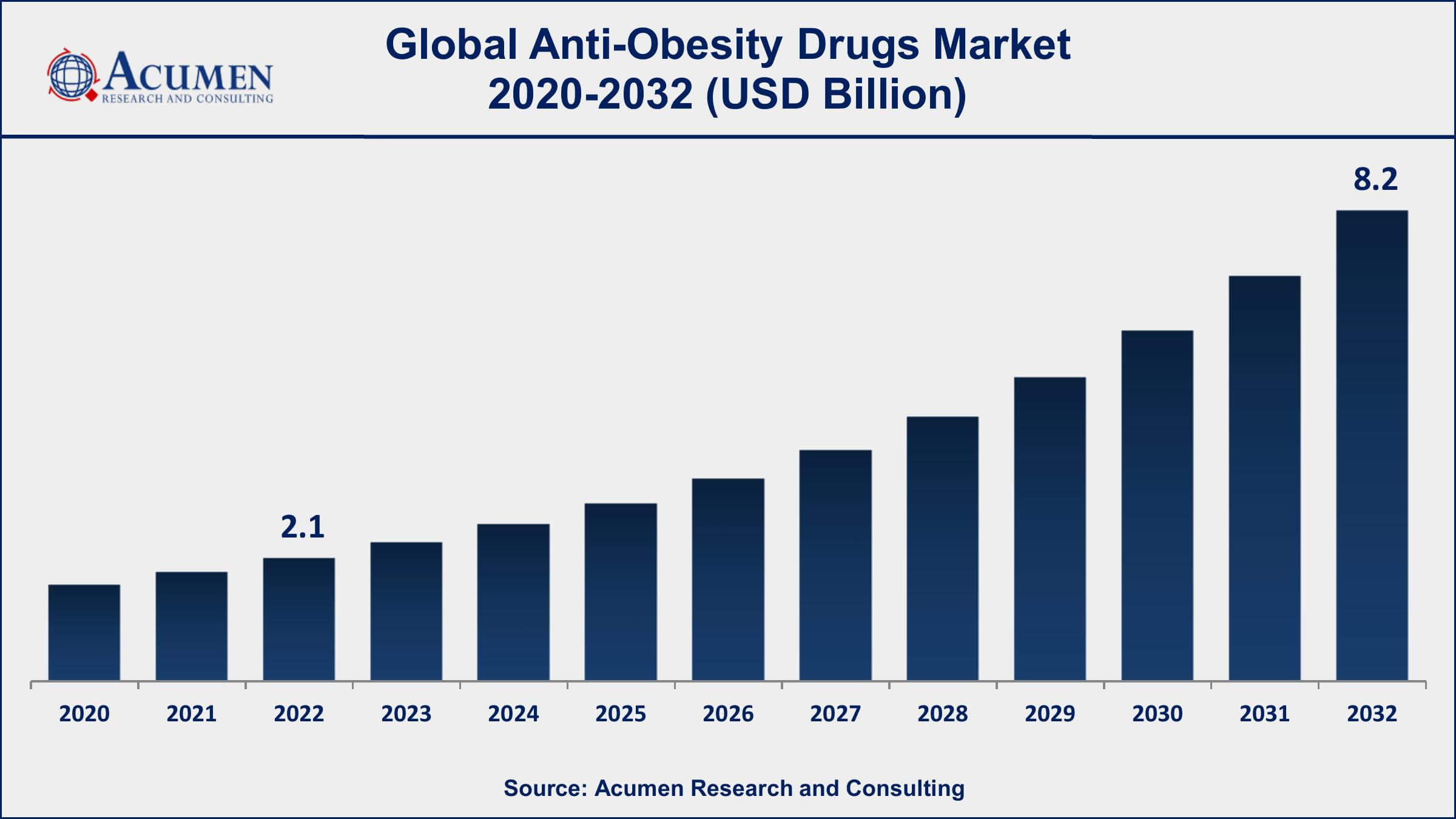

The Global Anti-Obesity Drugs Market Size accounted for USD 2.1 Billion in 2022 and is projected to achieve a market size of USD 8.2 Billion by 2032 growing at a CAGR of 14.6% from 2023 to 2032.

Anti-Obesity Drugs Market Highlights

- Global Anti-Obesity Drugs Market revenue is expected to increase by USD 8.2 Billion by 2032, with a 14.6% CAGR from 2023 to 2032

- North America region led with more than 68% of Anti-Obesity Drugs Market share in 2022

- According to a 2022 research study, 1 out of every 3 U.S. adults is obese

- According to World Heart Federation, 2.7 billion adults could be living with overweight or obesity by 2025

- Asia-Pacific Anti-Obesity Drugs Market growth will record a CAGR of around 15% from 2023 to 2032

- Increasing burden of obesity and related chronic diseases, drives the Anti-Obesity Drugs Market value

Anti-obesity drugs are pharmaceutical agents designed to help individuals manage and reduce their excess body weight, especially when lifestyle modifications like diet and exercise alone are not sufficient for achieving and maintaining a healthy weight. These drugs can work through various mechanisms, such as appetite suppression, interference with fat absorption, or altering metabolism. They are typically prescribed by healthcare professionals to patients who meet certain criteria, such as having a high body mass index (BMI) or obesity-related health conditions like type 2 diabetes.

The market for anti-obesity drugs has seen fluctuating growth over the years, influenced by factors such as changing societal attitudes towards weight management, the rise in obesity rates worldwide, and advancements in drug development. In recent years, there has been renewed interest in this market, driven by increasing awareness of the health risks associated with obesity and the demand for more effective and safe treatments. The market has witnessed the introduction of new medications, including combination therapies, which are being developed to enhance weight loss outcomes and minimize side effects. Additionally, healthcare providers are increasingly emphasizing a holistic approach to obesity management, which includes lifestyle changes, behavioral therapies, and pharmacological interventions.

Global Anti-Obesity Drugs Market Trends

Market Drivers

- Rising global obesity rates

- Growing awareness of obesity-related health risks

- Advances in drug development and research

- Increasing demand for effective weight management solutions

- High prevalence of comorbidities like diabetes

Market Restraints

- Stringent regulatory approvals and safety concerns

- Limited long-term efficacy data

- High development costs

Market Opportunities

- Development of novel combination therapies

- Personalized medicine approaches

- Telemedicine and digital health solutions

Anti-Obesity Drugs Market Report Coverage

| Market | Anti-Obesity Drugs Market |

| Anti-Obesity Drugs Market Size 2022 | USD 2.1 Billion |

| Anti-Obesity Drugs Market Forecast 2032 | USD 8.2 Billion |

| Anti-Obesity Drugs Market CAGR During 2023 - 2032 | 14.6% |

| Anti-Obesity Drugs Market Analysis Period | 2020 - 2032 |

| Anti-Obesity Drugs Market Base Year |

2022 |

| Anti-Obesity Drugs Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Drug Class, By Drug Type, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Novo Nordisk A/S, Arena Pharmaceuticals, Inc., VIVUS, Inc., Orexigen Therapeutics, Inc. (acquired by Nalpropion Pharmaceuticals), Eisai Co., Ltd., Takeda Pharmaceutical Company Limited, Rhythm Pharmaceuticals, Inc., Gelesis, Inc., Zafgen, Inc., Boehringer Ingelheim International GmbH, F. Hoffmann-La Roche Ltd., and AstraZeneca PLC. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Anti-obesity drugs are pharmaceutical medications specifically designed to combat obesity, which is a complex medical condition characterized by excessive accumulation of body fat. These drugs aim to assist individuals in achieving and maintaining a healthier body weight when lifestyle modifications, such as dietary changes and increased physical activity, alone are insufficient. They typically work through various mechanisms, including appetite suppression, altering metabolism, or interfering with the absorption of dietary fats. Anti-obesity drugs are typically prescribed to individuals who meet certain criteria, such as having a high body mass index (BMI) or obesity-related health issues like type 2 diabetes.

The applications of anti-obesity drugs are primarily focused on helping individuals manage their weight and reduce obesity-related health risks. These drugs can be beneficial for people who have struggled to lose weight through conventional methods and are at risk of developing serious health conditions associated with obesity, such as heart disease, hypertension, and sleep apnea. By aiding in weight loss or weight maintenance, anti-obesity drugs can contribute to improved overall health and quality of life for individuals struggling with obesity.

The anti-obesity drugs market has experienced a resurgence in recent years, driven by several key factors. One of the primary drivers is the alarming global rise in obesity rates, which has led to an increased awareness of the serious health risks associated with excess body weight. As a result, there is a growing demand for effective pharmaceutical interventions to help individuals manage their weight and reduce obesity-related health complications. Advancements in drug development and research have also contributed to market growth. Pharmaceutical companies are investing in innovative treatments that target various mechanisms involved in weight regulation, such as appetite control and metabolism. These developments have led to the introduction of new medications, some of which have shown promising results in clinical trials. Additionally, the aging population and the high prevalence of comorbidities like type 2 diabetes have created a significant patient pool seeking anti-obesity treatments.

Anti-Obesity Drugs Market Segmentation

The global Anti-Obesity Drugs Market segmentation is based on drug class, drug type, distribution channel, and geography.

Anti-Obesity Drugs Market By Drug Class

- Centrally Acting Drugs

- Peripherally Acting Drugs

According to the anti-obesity drugs industry analysis, the peripherally acting drugs segment accounted for the largest market share in 2022. Peripherally acting drugs target various physiological mechanisms involved in weight regulation, primarily affecting the digestive system's function, appetite, and energy balance. This segment has gained attention due to the need for effective and safe weight management options that have fewer central nervous system (CNS) side effects compared to older generations of anti-obesity medications. One of the key drivers of growth in the peripherally acting drugs segment is the increasing awareness of obesity-related health risks and the demand for pharmaceutical solutions. These drugs, such as GLP-1 receptor agonists and gut hormones like leptin, work by influencing the digestive processes, reducing appetite, and enhancing feelings of fullness. They have demonstrated efficacy in clinical trials and have been associated with moderate to substantial weight loss in patients with obesity or overweight conditions.

Anti-Obesity Drugs Market By Drug Type

- OTC Drugs

- Prescription Drugs

In terms of drug types, the prescription drugs segment is expected to witness significant growth in the coming years. Prescription drugs are a vital component of obesity management, especially for individuals who struggle to achieve and maintain a healthy weight through lifestyle modifications alone. This segment encompasses a range of pharmaceutical interventions, including appetite suppressants, fat absorption inhibitors, and peripherally acting drugs, among others, which are prescribed by healthcare professionals based on patients' specific needs and medical conditions. One of the key drivers of growth in the prescription drugs segment is the increasing prevalence of obesity and related health concerns. As obesity rates continue to rise globally, there is a growing demand for effective weight management solutions. Prescription drugs offer a medical approach to obesity treatment and can be particularly beneficial for individuals with severe obesity or obesity-related comorbidities like type 2 diabetes.

Anti-Obesity Drugs Market By Distribution Channel

- Hospital Pharmacy

- Online Pharmacy

- Retail Pharmacy

According to the anti-obesity drugs market forecast, the online pharmacy segment is expected to witness significant growth in the coming years. The advent of e-commerce and the increasing preference for online shopping have transformed the way people access healthcare products, including prescription medications. Online pharmacies provide a convenient and discreet way for individuals to purchase anti-obesity drugs and other prescription medications, eliminating the need for physical visits to brick-and-mortar pharmacies. One of the primary drivers of growth in the online pharmacy segment is the rising demand for anti-obesity drugs and weight management products. As the global obesity epidemic continues to escalate, more individuals are seeking effective solutions to manage their weight and improve their overall health.

Anti-Obesity Drugs Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Anti-Obesity Drugs Market Regional Analysis

North America has emerged as a dominant region in the anti-obesity drugs market in 2022. The United States, in particular, has one of the highest obesity rates globally, with a substantial portion of the population affected by overweight and obesity-related health issues. This high prevalence of obesity has led to a robust demand for effective anti-obesity treatments, driving market growth. Moreover, North America boasts a well-developed healthcare infrastructure, including advanced research and development capabilities, extensive clinical trial networks, and a strong pharmaceutical industry presence. This infrastructure facilitates the development and commercialization of new anti-obesity drugs, leading to a steady stream of innovative medications entering the market. Additionally, favorable reimbursement policies and insurance coverage for prescription anti-obesity drugs in North America have played a pivotal role in market dominance. Many healthcare plans in the region provide coverage for weight management interventions, making it more accessible and affordable for patients to seek medical help for their obesity. This financial support has contributed to increased adoption rates of anti-obesity drugs.

Anti-Obesity Drugs Market Player

Some of the top anti-obesity drugs market companies offered in the professional report include Novo Nordisk A/S, Arena Pharmaceuticals, Inc., VIVUS, Inc., Orexigen Therapeutics, Inc. (acquired by Nalpropion Pharmaceuticals), Eisai Co., Ltd., Takeda Pharmaceutical Company Limited, Rhythm Pharmaceuticals, Inc., Gelesis, Inc., Zafgen, Inc., Boehringer Ingelheim International GmbH, F. Hoffmann-La Roche Ltd., and AstraZeneca PLC.

Frequently Asked Questions

What was the market size of the global anti-obesity drugs in 2022?

The market size of anti-obesity drugs was USD 2.1 Billion in 2022.

What is the CAGR of the global anti-obesity drugs market from 2023 to 2032?

The CAGR of anti-obesity drugs is 14.6% during the analysis period of 2023 to 2032.

Which are the key players in the anti-obesity drugs market?

The key players operating in the global market are including Novo Nordisk A/S, Arena Pharmaceuticals, Inc., VIVUS, Inc., Orexigen Therapeutics, Inc. (acquired by Nalpropion Pharmaceuticals), Eisai Co., Ltd., Takeda Pharmaceutical Company Limited, Rhythm Pharmaceuticals, Inc., Gelesis, Inc., Zafgen, Inc., Boehringer Ingelheim International GmbH, F. Hoffmann-La Roche Ltd., and AstraZeneca PLC.

Which region dominated the global anti-obesity drugs market share?

North America held the dominating position in anti-obesity drugs industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of anti-obesity drugs during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global anti-obesity drugs industry?

The current trends and dynamics in the anti-obesity drugs industry include rising global obesity rates, growing awareness of obesity-related health risks, and advances in drug development and research.

Which drug type held the maximum share in 2022?

The prescription drug type held the maximum share of the anti-obesity drugs industry.