Anti-Money Laundering Software Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Anti-Money Laundering Software Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

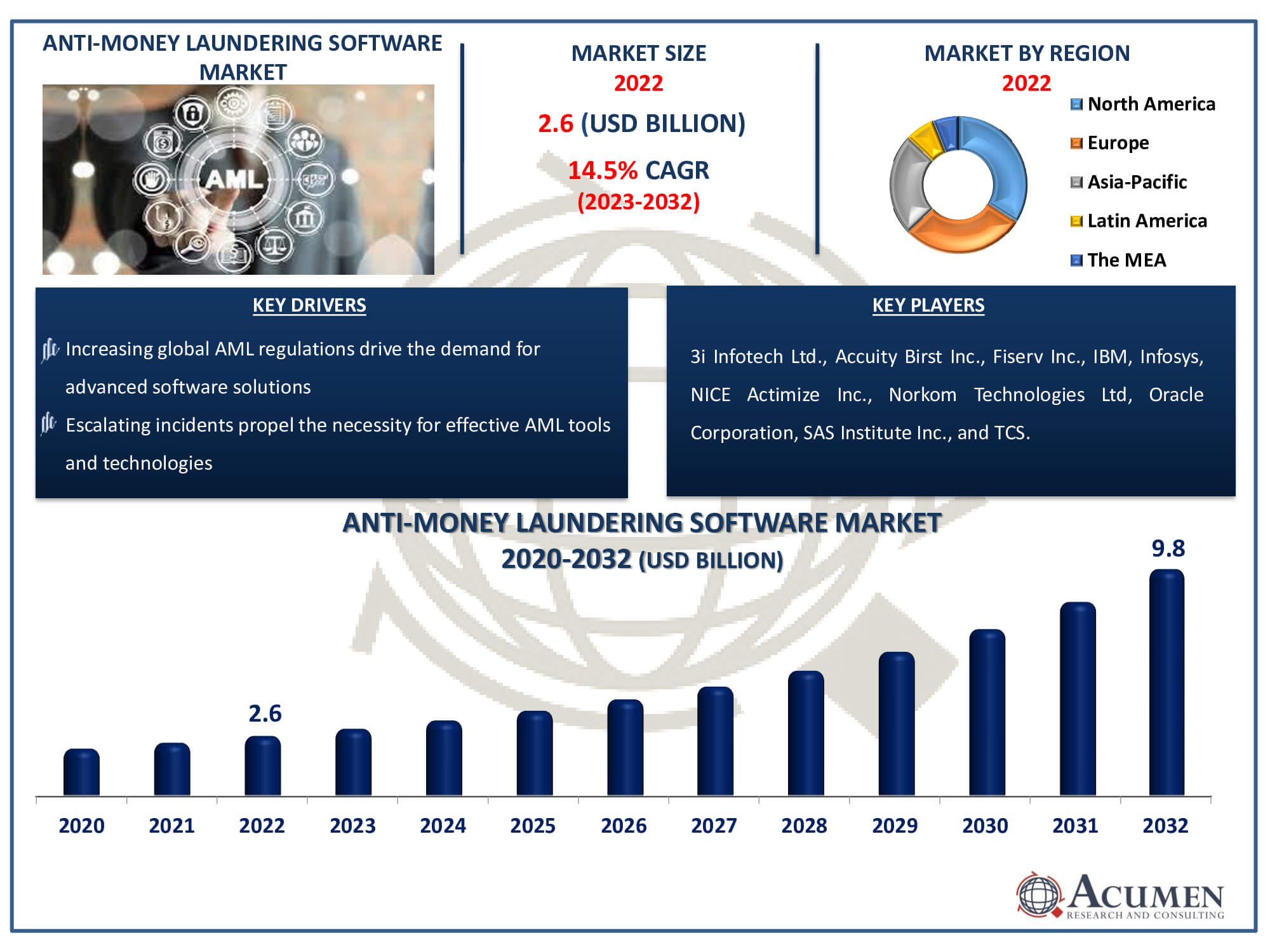

The Anti-Money Laundering Software Market Size accounted for USD 2.6 Billion in 2022 and is estimated to achieve a market size of USD 9.8 Billion by 2032 growing at a CAGR of 14.5% from 2023 to 2032.

Anti-Money Laundering Software Market Highlights

- Global anti-money laundering software market revenue is poised to garner USD 9.8 billion by 2032 with a CAGR of 14.5% from 2023 to 2032

- North America anti-money laundering (AML) software market value occupied around USD 884 million in 2022

- Asia-Pacific anti-money laundering software market growth will record a CAGR of more than 16% from 2023 to 2032

- Among component, the software sub-segment generated over US$ 1.5 billion revenue in 2022

- Based on product, the transaction monitoring sub-segment generated around 52% share in 2022

- Innovative features and improved AML software capabilities is a popular anti-money laundering software market trend that fuels the industry demand

Anti-money laundering (AML) software is a type of computer program used to analyze customer data and detect suspicious transactions. The system filters customer data, categorizing it based on the level of suspicion, and examines it for abnormalities. These abnormalities include a sudden and substantial increase in funds or a large withdrawal. Moreover, small transactions can also be flagged as suspicious because individuals attempting to avoid detection often deposit large amounts as multiple smaller sums within a short period.

This practice is termed structuring. Once the software mines the data and generates a report with flagged suspect transactions, compliance professionals use it to adhere to regulations such as the Bank Secrecy Act and corporate policies on financial fraud. Accountants and managers from various industry departments also benefit from evaluating new customers and suppliers. Additionally, banks and financial institutions use anti-money laundering software to detect suspicious and fraudulent activities.

Global Anti-Money Laundering Software Market Dynamics

Market Drivers

- Increasing global AML regulations drive the demand for advanced software solutions

- Escalating incidents propel the necessity for effective AML tools and technologies

- Increased investments, particularly in banks, contribute to the adoption of sophisticated AML software

- Growing cases of identity theft-based money laundering enhance the urgency for robust AML measures

Market Restraints

- Limited skilled workforce impedes efficient implementation and utilization of AML software

- Substantial upfront and ongoing expenses

- Navigating complex and evolving regulatory requirements

Market Opportunities

- Emerging artificial intelligence technology

- Increasing adoption of cloud-based deployment

- Collaborative efforts with technology providers and financial institutions

Anti-Money Laundering Software Market Report Coverage

| Market | Anti-Money Laundering Software Market |

| Anti-Money Laundering Software Market Size 2022 | USD 2.6 Billion |

| Anti-Money Laundering Software Market Forecast 2032 | USD 9.8 Billion |

| Anti-Money Laundering Software Market CAGR During 2023 - 2032 | 14.5% |

| Anti-Money Laundering Software Market Analysis Period | 2020 - 2032 |

| Anti-Money Laundering Software Market Base Year |

2022 |

| Anti-Money Laundering Software Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Product, By Deployment Type, By End-Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | 3i Infotech Ltd., Accuity Birst Inc., Fiserv Inc., IBM, Infosys, NICE Actimize Inc., Norkom Technologies Ltd, Oracle Corporation, SAS Institute Inc., and TCS. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Anti-Money Laundering Software Market Insights

The escalating anti-money laundering (AML) regulatory requirements, coupled with the increasing incidence of money laundering cases, are driving market growth. The surge in IT spending, particularly in banks, along with the rising occurrences of identity theft-based money laundering, is further accelerating the demand and usage of anti-money laundering software. Additionally, the emergence of artificial intelligence (AI) technology in AML deployment types, as well as the increasing adoption of cloud-based deployment, is expected to provide potential opportunities for anti-money laundering solutions market over the forecast period from 2023 to 2032.

The market for anti-money laundering (AML) software is hindered by the lack of qualified AML specialists and the high expenses associated with software deployment. One of the problems in making effective use of advanced software insights is the lack of specialists in AML techniques. In addition, adoption may be discouraged by the substantial cost outlays necessary for purchasing and maintaining AML software, especially for smaller businesses with tighter resources. Together, these two obstacles a lack of available labor and budgetary limitations hinder the market's ability to expand throughout the projected time frame and prevent the industry from implementing strong AML regulations in its entirety.

Anti-Money Laundering Software Market Segmentation

The worldwide market for anti-money laundering software is split based on component, product, deployment type, end-use industry, and geography.

Anti-Money Laundering AML Software Market By Component

- Software

- Service

According to anti-money laundering software industry analysis, the software segment is by far the largest in the market. This group includes advanced computer programmes made to carefully examine client data in order to spot and mark transactions that might be questionable. AML software uses sophisticated algorithms to filter, classify, and examine financial transactions, paying particular attention to irregularities such huge withdrawals, abrupt money growth, and structuring strategies. Automation of compliance procedures by the software guarantees adherence to legal frameworks such as the Bank Secrecy Act. AML software is a vital tool for financial institutions and regulatory compliance specialists due to its crucial role in identifying and stopping money laundering.

Anti-Money Laundering AML Software Market By Product

- Transaction Monitoring

- Currency Transaction Reporting

- Customer Identity Management

- Compliance Management

- Others (Sanction Screening Software and Case Management Software)

The market for anti-money laundering (AML) software is led by the transaction monitoring segment. This crucial group consists of advanced systems that monitor and examine financial transactions with great care, looking for trends and irregularities that might point to possible money laundering. Financial organisations use Transaction Monitoring software extensively to examine enormous volumes of data in real-time, making sure that suspicious activity is promptly identified and stopped. The importance of this section is found in its capacity to improve compliance, offer practical insights, and protect against illegal financial activity. Robust Transaction Monitoring systems are in high demand as regulatory scrutiny increases, and they constitute the foundation of AML software.

Anti-Money Laundering AML Software Market By Deployment Type

- Cloud

- On-Premise

In 2022, the on-premise segment led the market with the highest revenue share (%) as large organizations predominantly favored on-premise deployment, granting them full control. Moreover, the cloud deployment type is expected to experience the fastest growth during the anti-money laundering solution market forecast period, driven by the increasing preference among small and medium-scale enterprises (SMEs) for this model. Cloud deployment offers various advantages, such as organization-specific configurations with high security levels and control for private entities. Public organizations benefit from scalability, flexibility, bursting, cost-effectiveness, and ease of use associated with cloud deployment.

Anti-Money Laundering AML Software Market By End-Use Industries

- IT and Telecommunications

- Healthcare

- BFSI

- Transportation and Logistics

- Manufacturing

- Defense and Government

- Retail

- Energy and Utilities

- Others

In terms of anti-money laundering software market analysis, the end-use industry is led by the banking, financial services, and insurance (BFSI) sector. The BFSI industry, which is well-known for its intricate financial operations and strict legal requirements, mostly depends on AML software to identify and stop money laundering activity. The complex financial activities seen in the BFSI area are perfectly complemented by the advanced algorithms and real-time monitoring features of AML software. The financial services industry (BFSI) is the top end-use market for AML software, and this demand for strong AML solutions is a result of the increasing regulatory requirements placed on financial institutions.

Anti-Money Laundering Software Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Anti-Money Laundering Software Market Regional Analysis

In 2022, North America held the major share in terms of revenue, and the region is projected to maintain its dominance throughout the anti-money laundering software market forecast period from 2023 to 2032. The United States is the primary contributor to revenue in the regional market, benefiting from its advanced infrastructure across various industry verticals and the presence of major manufacturers. Furthermore, Asia-Pacific is anticipated to exhibit the fastest growth with a significant Compound Annual Growth Rate (CAGR%) over the forecast period. The rapidly developing economies of the region, including China and India, are major contributors to revenue. The increasing adoption of IT infrastructure across end-use industries in the region is bolstering the market value.

Anti-Money Laundering Software Market Players

Some of the top anti-money laundering software companies offered in our report includes 3i Infotech Ltd., Accuity Birst Inc., Fiserv Inc., IBM, Infosys, NICE Actimize Inc., Norkom Technologies Ltd, Oracle Corporation, SAS Institute Inc., and TCS.

Frequently Asked Questions

How big is the anti-money laundering software market?

The market size of anti-money laundering software was USD 2.6 billion in 2022.

What is the CAGR of the global anti-money laundering software market from 2023 to 2032?

The CAGR of anti-money laundering software is 14.5% during the analysis period of 2023 to 2032.

Which are the key players in the anti-money laundering software market?

The key players operating in the global market are including 3i Infotech Ltd., Accuity Birst Inc., Fiserv Inc., IBM, Infosys, NICE Actimize Inc., Norkom Technologies Ltd, Oracle Corporation, SAS Institute Inc., and TCS

Which region dominated the global anti-money laundering software market share?

North America held the dominating position in anti-money laundering software industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of anti-money laundering software during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global anti-money laundering software industry?

The current trends and dynamics in the anti-money laundering software industry include increasing global AML regulations drive the demand for advanced software solutions, escalating incidents propel the necessity for effective AML tools and technologies, increased investments, particularly in banks, contribute to the adoption of sophisticated AML software, and growing cases of identity theft-based money laundering enhance the urgency for robust AML measures

Which component held the maximum share in 2022?

The software component held the maximum share of the anti-money laundering software industry.