Anthocyanin Market | Acumen Research and Consulting

Anthocyanin Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

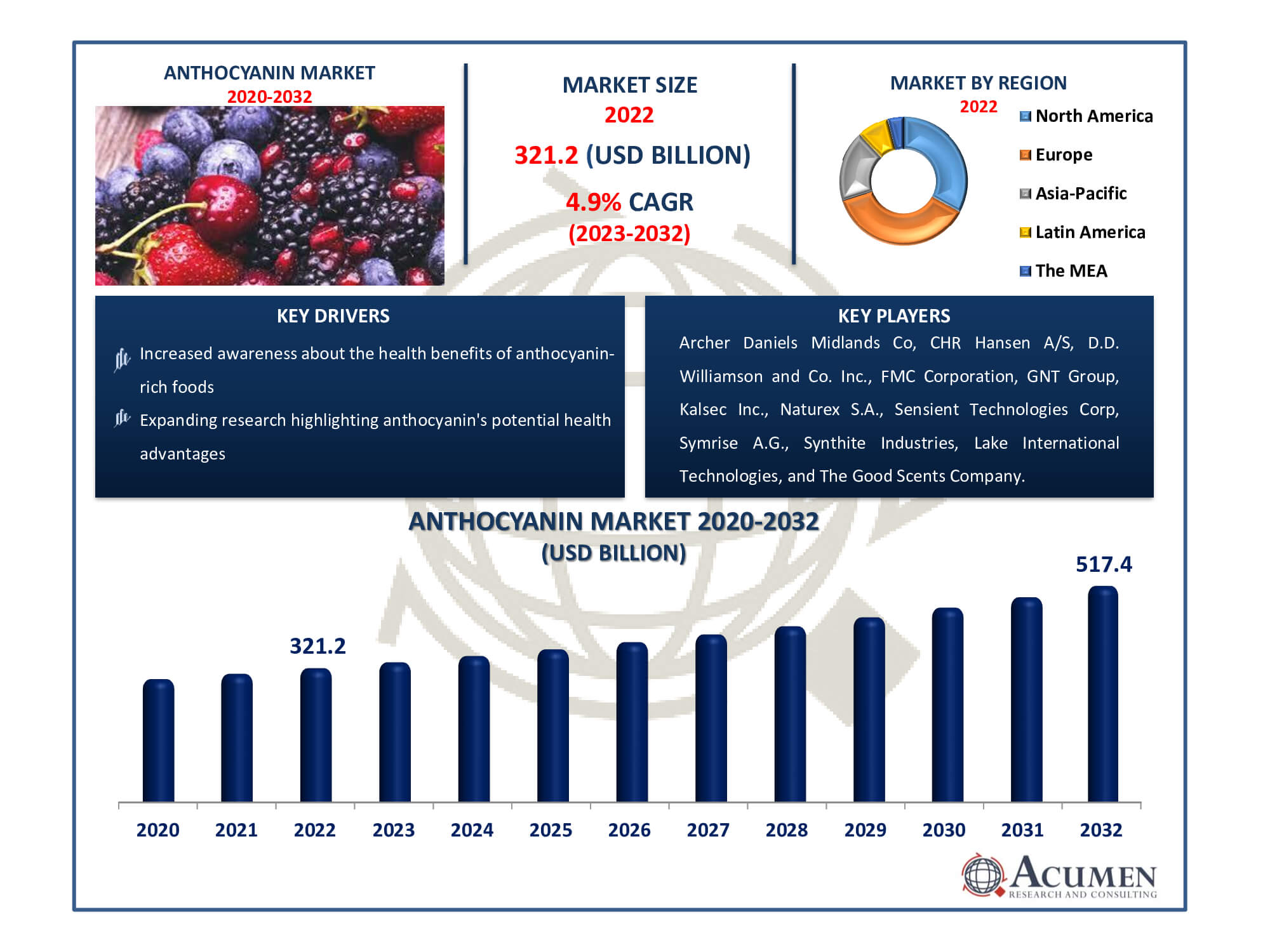

The Global Anthocyanin Market Size accounted for USD 321.2 Million in 2022 and is estimated to achieve a market size of USD 517.4 Million by 2032 growing at a CAGR of 4.9% from 2023 to 2032.

Anthocyanin Market Highlights

- Global anthocyanin market revenue is poised to garner USD 517.4 million by 2032 with a CAGR of 4.9% from 2023 to 2032

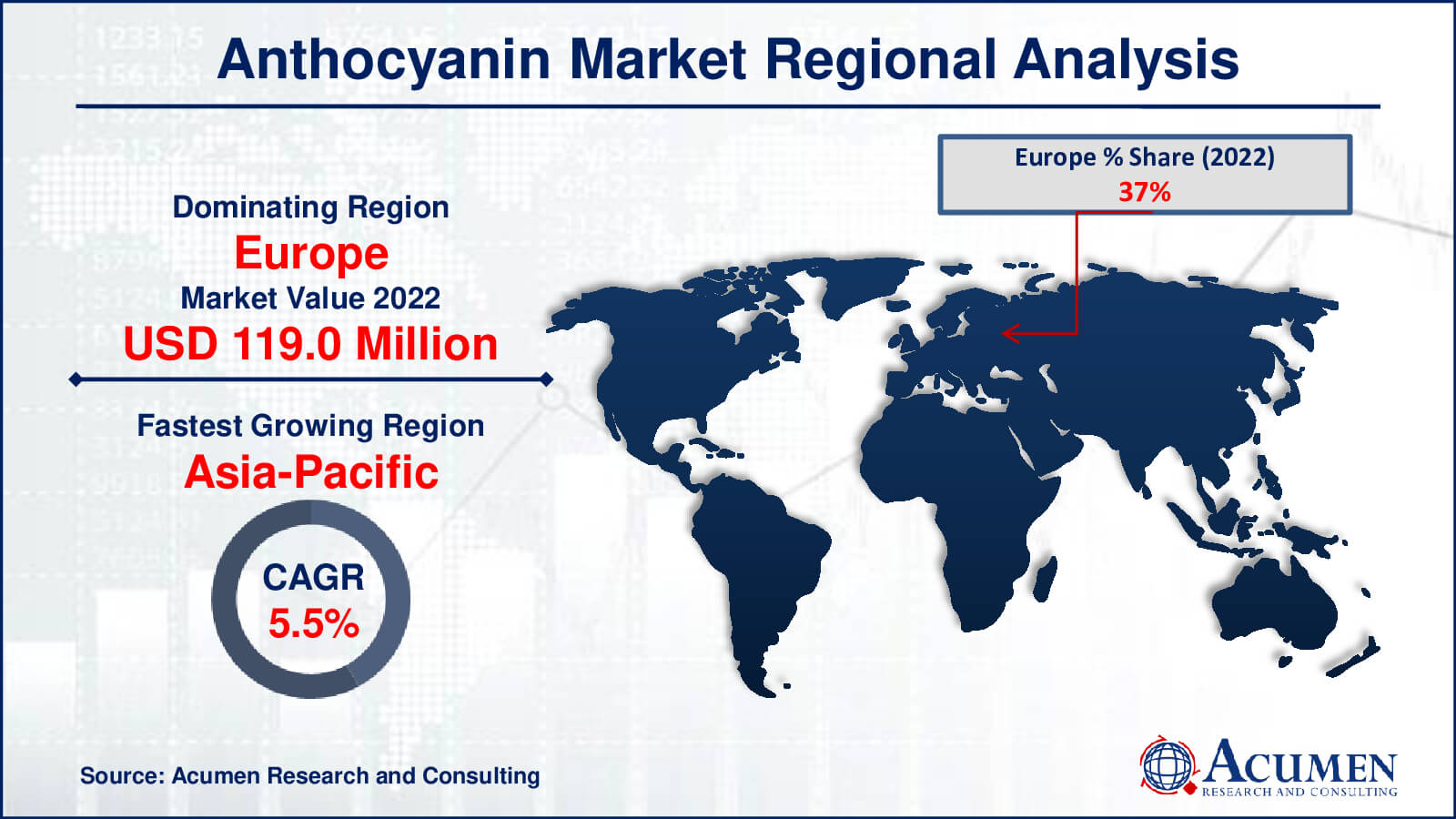

- Europe anthocyanin market value occupied around USD 119 million in 2022

- Asia-Pacific anthocyanin market growth will record a CAGR of more than 5.5% from 2023 to 2032

- Among product, the cyanidin sub-segment generated over US$ 96.3 million revenue in 2022

- Based on application, the food & beverage industry sub-segment generated around 25% share in 2022

- Innovations in packaging and formulations to enhance anthocyanin stability in products is a popular anthocyanin market trend that fuels the industry demand

Anthocyanin, a water-soluble phytochemical, imparts a regular red to blue hue. This flavorless and odorless flavonoid is commonly found in various fruits and vegetables, including berries, cabbage, purple grapes, and beets. Functioning as an antioxidant, anti-allergic, anti-inflammatory, antimicrobial agent, and microcirculation enhancer, anthocyanin plays a pivotal role in various industries, notably in food and beverages as a natural colorant.

Its multifaceted health benefits, encompassing anti-allergic, antimicrobial, anti-inflammatory, and antioxidant properties, position it as a crucial ingredient in numerous food products. The global demand for anthocyanin primarily stems from the increasing need for natural color additives in the food and beverage sector. As the demand for healthier food options rises, the usage of anthocyanin as a food colorant is expected to grow significantly. Its broad spectrum of health benefits suggests that it may become the preferred choice for colorants due to its extensive advantages compared to other alternatives.

Global Anthocyanin Market Dynamics

Market Drivers

- Growing consumer preference for natural and plant-based products

- Increased awareness about the health benefits of anthocyanin-rich foods

- Rising demand for natural colorants in the food and beverage industry

- Expanding research highlighting anthocyanin's potential health advantages

Market Restraints

- Limited availability and sourcing complexities of anthocyanin-rich sources

- Challenges related to stability and shelf life of anthocyanin in food applications

- Regulatory hurdles and standards for using natural colorants in various regions

Market Opportunities

- Expanding applications in pharmaceuticals and nutraceuticals due to health benefits

- Advancements in extraction techniques to improve anthocyanin yield and quality

- Growing market opportunities in developing regions for natural food colorants

Anthocyanin Market Report Coverage

| Market | Anthocyanin Market |

| Anthocyanin Market Size 2022 | USD 321.2 Million |

| Anthocyanin Market Forecast 2032 | USD 517.4 Million |

| Anthocyanin Market CAGR During 2023 - 2032 | 4.9% |

| Anthocyanin Market Analysis Period | 2020 - 2032 |

| Anthocyanin Market Base Year |

2022 |

| Anthocyanin Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Source, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Archer Daniels Midlands Co, CHR Hansen A/S, D.D. Williamson and Co. Inc., FMC Corporation, GNT Group, Kalsec Inc., Naturex S.A., Sensient Technologies Corp, Symrise A.G., Synthite Industries, Lake International Technologies, and The Good Scents Company. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Anthocyanin Market Insights

The global anthocyanin market has experienced significant growth in recent years due to increased awareness of the health benefits associated with anthocyanin and its expanding range of applications across various industries. The improved economic conditions in developing nations like India, China, Brazil, and Argentina, coupled with increased consumer purchasing power, have driven the consumption of anthocyanin-rich foods in these countries.

The rising utilization of anthocyanin-rich products is also attributed to shifting consumer lifestyles, fueled by growing health consciousness. Studies indicate that regular consumption of anthocyanin aids in reducing the risk of heart disease, respiratory disorders, and acts as an antioxidant, potentially preventing cancer and combating oxidative damage, among other benefits. Consumers seek food products that contribute to a healthy lifestyle, but many lack these health-promoting properties. Incorporating anthocyanin as a colorant not only enhances product appeal but also augments its health benefits, expanding its consumer base.

The anthocyanin market is projected to experience strengthened growth over the forecast period, primarily due to its expanding application scope in pharmaceuticals and specialty drugs. Its remarkable properties, such as microcirculation enhancement, antimicrobial, anti-inflammatory, and anti-allergic attributes, along with additional health benefits, are expected to drive market growth in this segment.

Anthocyanin has shown effectiveness in treating various ailments, including cancer, diabetes, cognitive decline, and several cardiovascular diseases. Factors like rapid urbanization, increasing disposable income, particularly in emerging economies like China, India, and Brazil, are anticipated to propel anthocyanin market growth. Moreover, changing consumption patterns and the rising demand for healthier food choices are additional factors expected to drive anthocyanin demand over the next seven years. Shifting consumer preferences towards healthier and visually appealing packaged food and beverage products are predicted to drive fruit extracts' growth.

Anthocyanin Market Segmentation

The worldwide market for anthocyanin is split based on product, source, application, end-user, and geography.

Anthocyanin Products

- Cyanidin

- Delphinidin

- Malvidin

- Pelargonidin

- Peonidin

- Petunidin

Cyanidin leads the anthocyanin market due to its ubiquitous prevalence in fruits and vegetables such as berries, apples, and grapes. Its prevalence contributes to its dominance among anthocyanin subclasses. Cyanidin's abundance in nature, combined with its particular antioxidant qualities, places it as a market favourite. Its adaptability in numerous food and beverage applications, as well as its recognised health benefits, reinforce its position as the key category, commanding a significant portion of the anthocyanin market.

Anthocyanin Sources

- Cereals

- Flowers

- Fruits

- Legumes

- Vegetables

Among the various sources in the anthocyanin market, fruits stand out as the leading segment. Fruits like berries, grapes, cherries, and pomegranates boast rich concentrations of Anthocyanin, contributing vibrant colors and potential health benefits. These fruits are not only highly accessible but also widely consumed, driving the significant presence of Anthocyanin in this segment. The versatile nature of Anthocyanin in fruits makes it a favored choice for various applications in food, beverages, and nutraceuticals, solidifying its leadership in the market.

Anthocyanin Applications

- Food & Beverage Industry

- Personal Care

- Animal Feed

- Cosmetics

- Nutraceutical Industry

- Pharmaceutical Industry

According to the anthocyanin industry analysis, among various application, the food and beverages industry held a leading position in the market and is anticipated to maintain this dominance throughout the foreseeable future. It contributed significantly to the global market revenues in the previous period and is expected to sustain its prominence. Anthocyanin finds extensive applications in a wide array of food and beverage products, surpassing its use in other key industries.

Moreover, owing to the therapeutic effects of anthocyanin, attributed to its anti-oxidative, neuroprotective, and anti-cancer properties, its application in pharmaceutical products has surged. This surge in demand has positioned the pharmaceutical sector as a significant contributor to the growth of the global anthocyanin market. Consequently, the pharmaceutical segment is considered the most attractive application sector, expected to exhibit promising growth in the anthocyanin market forecast years.

Anthocyanin Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Anthocyanin Market Regional Analysis

Europe emerges as the largest region in the anthocyanin market due to the strong demand for natural colourants in the food and beverage industries. With a strong emphasis on healthy product formulations, European customers drive the significant use of anthocyanin in a variety of applications, further cementing the region's supremacy.

North America ranks second in the anthocyanin market, owing to the increasing use of natural components in food products. The region's preference for functional foods and beverages, combined with rising health consciousness, drives the utilization of anthocyanin-rich sources.

Asia-Pacific is the fastest-growing region in the anthocyanin market, owing to rising consumer awareness of health advantages and increased demand for natural colourants. Rapid urbanization, lifestyle changes, and a growing middle class all contribute to the region's rapid development in anthocyanin usage across a variety of industries.

Anthocyanin Market Players

Some of the top anthocyanin companies offered in our report includes Archer Daniels Midlands Co, CHR Hansen A/S, D.D. Williamson and Co. Inc., FMC Corporation, GNT Group, Kalsec Inc., Naturex S.A., Sensient Technologies Corp, Symrise A.G., Synthite Industries, Lake International Technologies, and The Good Scents Company.

Frequently Asked Questions

How is the anthocyanin market?

The market size of anthocyanin was USD 321.2 million in 2022.

What is the CAGR of the global anthocyanin market from 2023 to 2032?

The CAGR of anthocyanin is 4.9% during the analysis period of 2023 to 2032.

Which are the key players in the anthocyanin market?

The key players operating in the global market are including Archer Daniels Midlands Co, CHR Hansen A/S, D.D. Williamson and Co. Inc., FMC Corporation, GNT Group, Kalsec Inc., Naturex S.A., Sensient Technologies Corp, Symrise A.G., Synthite Industries, Lake International Technologies, and The Good Scents Company.

Which region dominated the global anthocyanin market share?

Europe held the dominating position in anthocyanin industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of Anthocyanin during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global anthocyanin industry?

The current trends and dynamics in the anthocyanin industry include growing consumer preference for natural and plant-based products, increased awareness about the health benefits of anthocyanin-rich foods, rising demand for natural colorants in the food and beverage industry, and expanding research highlighting anthocyanin's potential health advantages.

Which product held the maximum share in 2022?

The cyanidin product held the maximum share of the anthocyanin industry.