Antacids Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Antacids Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

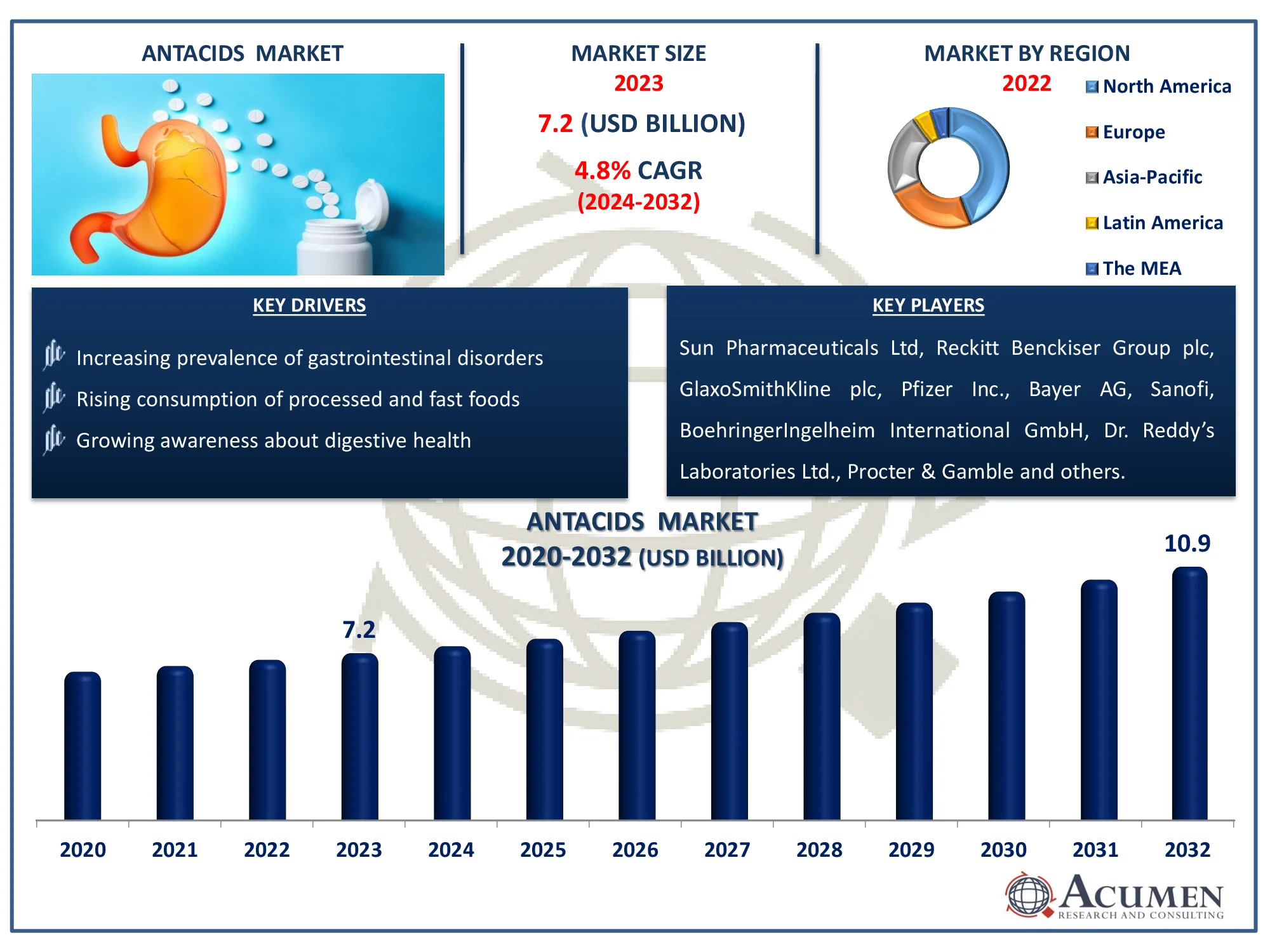

The Global Antacids Market Size accounted for USD 7.2 Billion in 2023 and is estimated to achieve a market size of USD 10.9 Billion by 2032 growing at a CAGR of 4.8% from 2024 to 2032.

Antacids Market (By Drug Class: Proton Pump Inhibitors, H2-Receptor Antagonists, and Acid Neutralizers; By Formulation Type: Tablet, Liquid, Powder, and Others; By Distribution Channel: Retail Pharmacy, Hospital Pharmacy, and Online Pharmacy; and By Region: North America, Europe, Asia-Pacific, Latin America, and the MEA)

Antacids Market Highlights

- The global antacids market revenue is projected to reach USD 10.9 billion by 2032, with a CAGR of 4.8% from 2024 to 2032

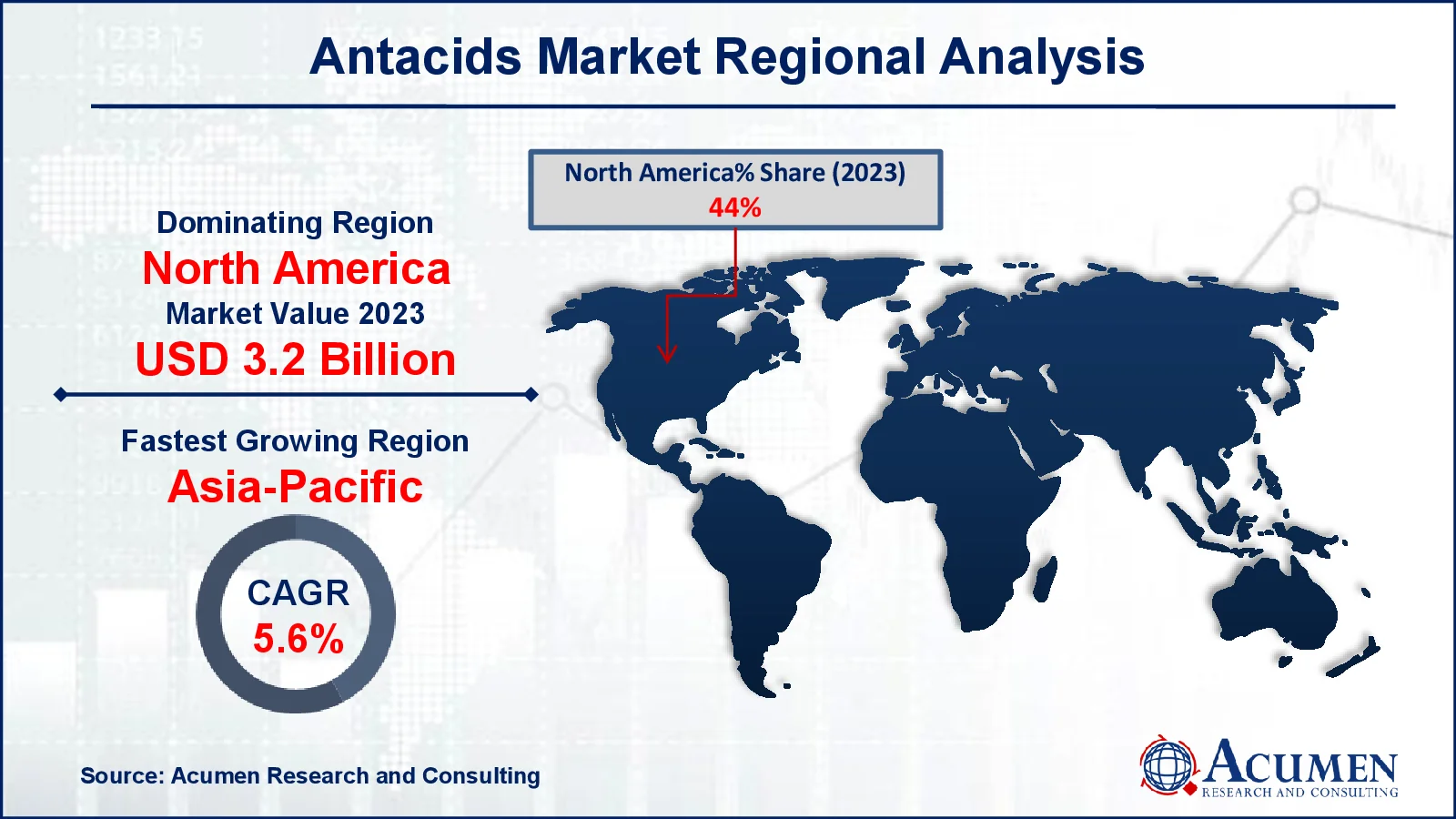

- The North America antacids market was valued at approximately USD 3.2 billion in 2023

- The Asia Pacific antacids market is expected to grow at a CAGR of over 5.6% from 2024 to 2032

- In 2023, the proton pump inhibitors sub-segment held a significant market share among drug classes

- The tablet formulation sub-segment also accounted for a notable market share in 2023

- Increasing awareness about digestive health and self-medication is the antacids market trend that fuels the industry demand

Changing dietary preferences are projected to fuel market expansion in the future years. Furthermore, inconsistent eating and sleeping patterns are anticipated to contribute to increasing acidity in the population, hence accelerating market expansion. The increased prevalence of Gastroesophageal Reflux Disease (GERD) is expected to have a considerable market impact in the forecast year. For instance, according to National Institute of Health, GERD is a prevalent gastrointestinal illness that affects approximately 20% of individuals in Western countries. The incidence in the United States ranges from 18.1% to 27.8%, with men having a slightly higher rate.

Global Antacids Market Dynamics

Market Drivers

- Increasing prevalence of gastrointestinal disorders

- Rising consumption of processed and fast foods

- Growing awareness about digestive health

Market Restraints

- Side effects and long-term health risks of antacid use

- Growing popularity of alternative therapies and natural remedies

- Stringent regulatory standards and potential for market saturation

Market Opportunities

- Innovations in antacid formulations and delivery systems

- Expanding markets in developing regions with rising healthcare access

- Increasing demand for over-the-counter medications and self-medication

Antacids Market Report Coverage

| Market | Antacids Market |

| Antacids Market Size 2022 |

USD 7.2 Billion |

| Antacids Market Forecast 2032 | USD 10.9 Billion |

| Antacids Market CAGR During 2023 - 2032 | 4.8% |

| Antacids Market Analysis Period | 2020 - 2032 |

| Antacids Market Base Year |

2022 |

| Antacids Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Drug Class, By Formulation Type, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Sun Pharmaceuticals Ltd, Reckitt Benckiser Group plc, GGlaxoSmithKline plc, Pfizer Inc., Bayer AG, Sanofi, BoehringerIngelheim International GmbH, Dr. Reddy’s Laboratories Ltd., Procter & Gamble and Takeda Pharmaceutical Company Limited. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Antacids Market Insights

The rising use of processed and fast foods, which are generally high in fats and carbohydrates, has resulted in an increase in gastrointestinal problems such acid reflux and heartburn. For instance, according to Indian Council for Research on International Economic Relations (ICRIER), the value of ultra-processed retail sales climbed rapidly, from 14% in 2011 to 18% in 2020 and 19% in 2021. The growing rate of processed and necessary foods outpaces that of GDP. Ultra processed foods are expected to grow faster than essential foods. The increasing prevalence of digestive discomfort is driving up demand for antacids, which neutralize stomach acid and provide relief. As eating patterns continue to emphasize convenience and indulgence above balanced nutrition, the antacids industry is expanding significantly.

The increased popularity of alternative medicines and natural remedies is limiting the antacids business. For instance, the World Health Organization (WHO) is hosting the Traditional Medicine Global Summit on August 17-18, 2023 in Gandhinagar, Gujarat, India to promote progress in global health and sustainability. To cure acid-related diseases, consumers are increasingly turning to natural remedies such as herbal supplements and dietary adjustments. As a result, traditional antacids are losing popularity as more people seek towards other remedies.

The rising trend in self-medication and the growing demand for over-the-counter (OTC) medications are creating significant opportunities for the antacids market. For instance, Wonderbelly, an Austin-based firm, was launched in June 2022 with over-the-counter (OTC) chewable antacid tablets in flavors like strawberry milkshake, watermelon mint, and fruity cereal. Consumers increasingly prefer OTC solutions for managing common digestive issues, driving the need for more accessible and effective antacid products. This shift towards self-care is fueled by the desire for convenience and cost-effectiveness, which further boosts market growth.

Antacids Market Segmentation

The worldwide market for antacids is split based on drug class, formulation type, distribution channel, and geography.

Antacid Market By Drug Class

- Proton Pump Inhibitors

- H2-Receptor Antagonists

- Acid Neutralizers

According to the antacids industry analysis, proton pump inhibitors (PPIs) dominate the market because they are more effective in reducing stomach acid production than other antacids. They provide long-term treatment from illnesses such as gastroesophageal reflux disease (GERD) and peptic ulcers by targeting acid-producing pumps in the stomach lining. Furthermore, their demonstrated effectiveness and extended duration of action have solidified their market leadership.

Antacid Market By Formulation Type

- Tablet

- Liquid

- Powder

- Others

The tablet segment is the largest formulation type category in the antacids market and it is expected to increase over the industry. The availability of chewable tablets in various flavors enhances patient adherence to medication, which is expected to contribute to the segment's growth. Tablets provide precise dosing compared to other forms and are easy to store, factors that will likely drive segment growth in the coming years. Additionally, the introduction of new products by major players is expected to further boost the segment.

Antacid Market By Distribution Channel

- Retail Pharmacy

- Hospital Pharmacy

- Online Pharmacy

According to the antacids market forecast, retail pharmacies are expected to lead the market throughout 2024 to 2032 because they are widely accessible and convenient, providing consumers with simple access to over-the-counter (OTC) drugs. They frequently offer a wide range of brands and formulations to meet the interests and demands of specific customers. Furthermore, retail pharmacies benefit from high client trust and the opportunity to offer individualized advice. Because of their accessibility and range, they are a better option for purchasing antacids than other distribution methods.

Antacids Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Antacids Market Regional Analysis

For several reasons, North America dominates antacids market, owing to the increasing frequency of digestive diseases and consumer awareness of antacid products. The region's strengthening healthcare system, as well as increased investments by industry players, is projected to help drive growth. For instance, according to American Medical Association, in 2022, health-care spending in the United States rose by 4.1% to $4.5 trillion, or $13,493 per person. This growth rate is comparable to the pre-pandemic rate (4.1% in 2019). Furthermore, the presence of developed economies in the region promotes growth.

The Asia-Pacific region is projected to be the fastest-growing segment in the forecast years, owing to significant unmet clinical requirements, the availability of effective treatment modalities, and higher consumer awareness of these products. Furthermore, the presence of prominent companies such as Pfizer Inc., GGlaxoSmithKline plc., and Abbott is expected to propel market growth in the future years. For instance, in 2022, Zydus Lifesciences received FDA approval to market Famotidine tablets, a histamine H2 receptor blocker that greatly lowers stomach acid production.

Antacids Market Players

Some of the top antacids companies offered in our report include Bayer AG, BoehringerIngelheim International GmbH, Sun Pharmaceuticals Ltd, Reckitt Benckiser Group plc, GlaxoSmithKline plc, Pfizer Inc., Sanofi, Dr. Reddy’s Laboratories Ltd., Procter & Gamble and Takeda Pharmaceutical Company Limited.

Frequently Asked Questions

How big is the antacids market?

The Antacids market size was valued at USD 7.2 billion in 2023.

What is the CAGR of the global antacids market from 2024 to 2032?

The CAGR of Antacids is 4.8% during the analysis period of 2024 to 2032.

Which are the key players in the antacids market?

The key players operating in the global market are including Sun Pharmaceuticals Ltd, Reckitt Benckiser Group plc, GlaxoSmithKline plc, Pfizer Inc., Bayer AG, Sanofi, BoehringerIngelheim International GmbH, Dr. Reddy’s Laboratories Ltd., Procter & Gamble and Takeda Pharmaceutical Company Limited

Which region dominated the global antacids market share?

North America held the dominating position in Antacids industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of Antacids during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global antacids industry?

The current trends and dynamics in the antacids industry include increasing prevalence of gastrointestinal disorders, rising consumption of processed and fast foods, and growing awareness about digestive health.

Which Drug Class held the maximum share in 2023?

The proton pump inhibitors drug class held the maximum share of the antacids industry.