Amaranth Market | Acumen Research and Consulting

Amaranth Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

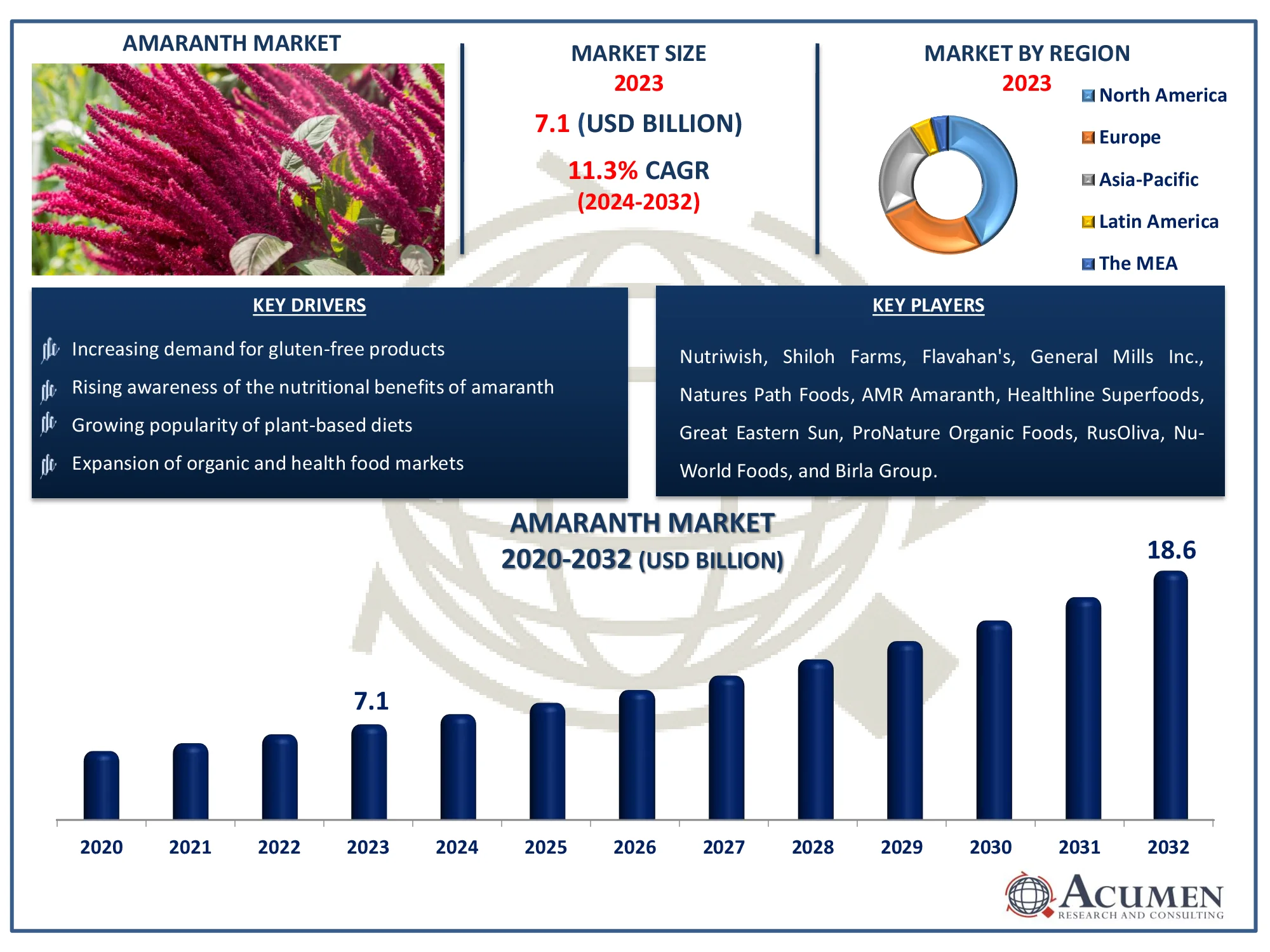

The Amaranth Market Size accounted for USD 7.1 Billion in 2023 and is estimated to achieve a market size of USD 18.6 Billion by 2032 growing at a CAGR of 11.3% from 2024 to 2032.

Amaranth Market Highlights

- Global amaranth market revenue is poised to garner USD 18.6 billion by 2032 with a CAGR of 11.3% from 2024 to 2032

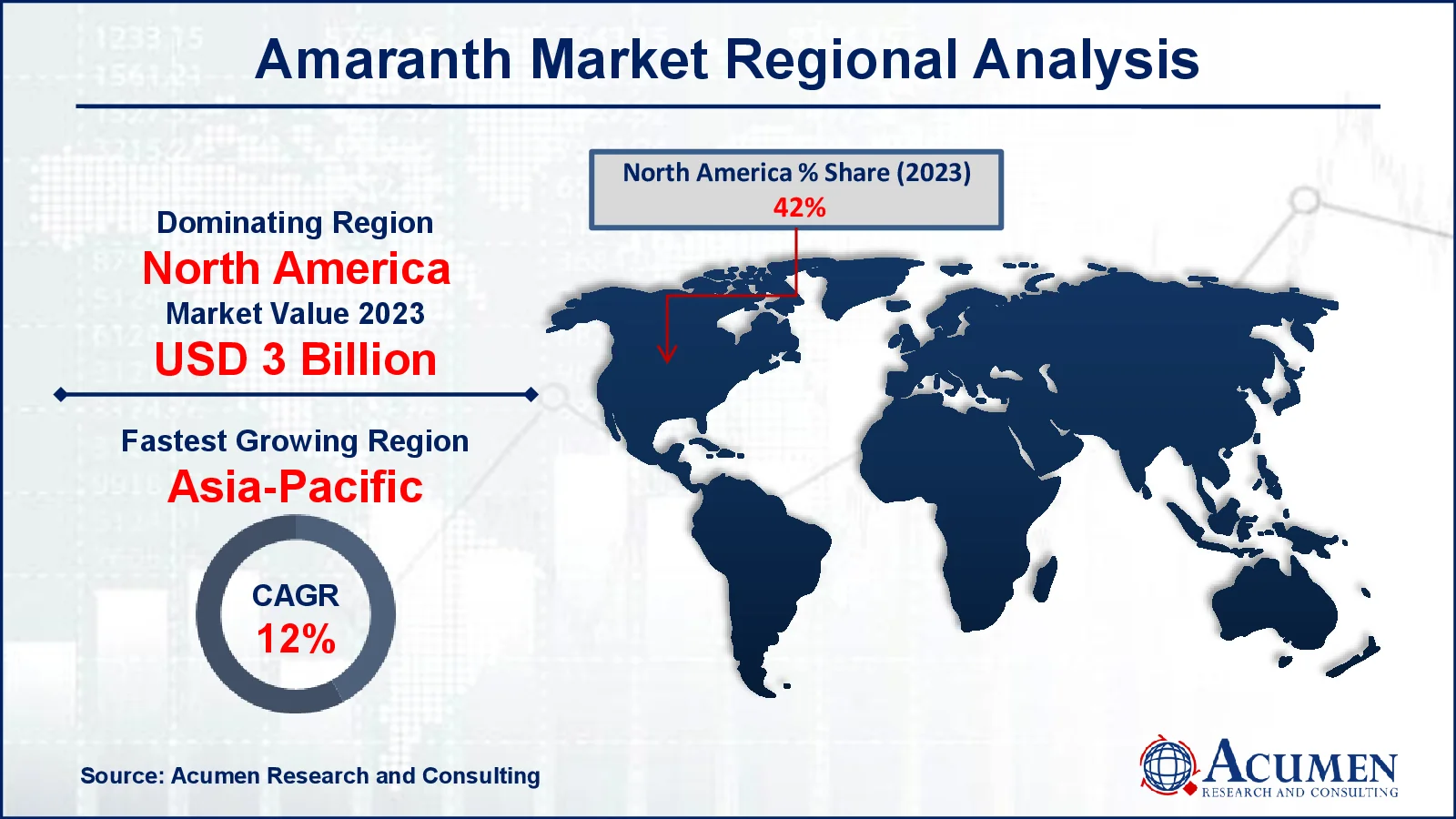

- North America amaranth market value occupied around USD 3 billion in 2023

- Asia-Pacific amaranth market growth will record a CAGR of more than 12% from 2024 to 2032

- Among product, the amaranth seed sub-segment generated more than USD 2.8 billion revenue in 2023

- Based on application, the personal care sub-segment generated around 50% market share in 2023

- Increasing demand in the gluten-free and specialty diet sectors is a popular amaranth market trend that fuels the industry demand

Amaranth is a genus of about 60 grains known for their nutritional value and versatility. Amaranth, like quinoa, is considered a pseudocereal rather than a cereal. It is high in protein, fiber, and essential amino acids, particularly lysine, which is commonly deficient in other grains. Amaranth is also gluten-free, making it suitable for those with gluten intolerance or celiac disease. It is rich in vitamins and minerals like as calcium, magnesium, iron, and phosphorus. Amaranth, a traditional Aztec staple, can be cooked as rice, popped like popcorn, or ground into flour for baking. Its nutritional qualities and adaptability have made it a popular element in health foods and specialty diets.

Global Amaranth Market Dynamics

Market Drivers

- Increasing demand for gluten-free products

- Rising awareness of the nutritional benefits of amaranth

- Growing popularity of plant-based diets

- Expansion of organic and health food markets

Market Restraints

- Limited consumer awareness in some regions

- High production costs compared to traditional grains

- Challenges in supply chain and distribution

Market Opportunities

- Development of new amaranth-based products

- Expansion into emerging markets with rising health awareness

- Potential for organic and non-GMO labeling

Amaranth Market Report Coverage

| Market | Amaranth Market |

| Amaranth Market Size 2022 |

USD 7.1 Billion |

| Amaranth Market Forecast 2032 | USD 18.6 Billion |

| Amaranth Market CAGR During 2023 - 2032 | 11.3% |

| Amaranth Market Analysis Period | 2020 - 2032 |

| Amaranth Market Base Year |

2022 |

| Amaranth Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Category, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Nutriwish, Shiloh Farms, Flavahan's, General Mills Inc., Natures Path Foods, AMR Amaranth, Healthline Superfoods, Great Eastern Sun, ProNature Organic Foods, RusOliva, Nu-World Foods, and Birla Group. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Amaranth Market Insights

Presence of uncommon components, for example, stearic acid, squalene, oleic acid, and tocopherols, which aid in increasing bone strength, fixing tissues, reducing inflammation, while giving various other medical advantages, is anticipated to play a vital factor in powering the demand for amaranth over the forthcoming years. Amaranth by-product are used in various applications in different businesses, for example, cosmetics, pharmaceuticals, dietary supplements, and food additives. Developing geriatric populace, for which the item is helpful in a few medicinal conditions, is ready to work up the need for amaranth in the pharmaceutical division over the amaranth market forecast period.

Amaranth contains a high level of proteins, which upgrade post-exercise recuperation procedure of muscles. Latest trend, for example, tumultuous and urban ways of living life, growing the adoption of in a hurry suppers, and expanding mindfulness with respect to wellness among working populace, are probably going to help the demand for minimal effort protein sustenance over the coming years. Amaranth oil additionally has anti-inflammatory properties, which help forestall risks of sensitivities.

Amaranth seeds have been a share piece of indigenous culture in Mexico and Central America because of their high centralization of vitamins, minerals, and protein. Despite the fact that the utilization of plant is tied down fundamentally in Central America, in the course of recent years, the need for the products has seen a noteworthy development in different regions, for example, North America, Europe, and Asia Pacific.

Growing consumer interest for seeking after sound way of healthy lifestyle and emerging penetration of essential oils in the cosmetic business are evaluated to support the development of the market throughout the following couple of years. Developing utilization of basic oils in the sustenance and drink industry is additionally pushing the market over the gauge time frame. Purchasing behaviour of shoppers towards organic foods is to a great extent affected by elements, for example, specific food attributes, personality traits, natural features that the food preserves, place of manufacture, and vegetarian issues.

Amaranth Market Segmentation

The worldwide market for amaranth is split based on product, category, application, and geography.

Amaranth Products

- Amaranth Seed

- Amaranth Oil

- Amaranth Leaf

- Amaranth Flour

According to amaranth industry analysis, amaranth seed is the most important sector within the product category because of its adaptability and wide variety of applications in food goods. Amaranth seed is popular among health-conscious consumers due to its high nutritional content, which includes protein, fiber, and vital amino acids. It is widely used as a whole grain in cooking, much like rice or quinoa, and can be popped, toasted, or crushed into flour for baking. The seed's gluten-free status boosts its popularity among persons with gluten intolerance or celiac disease. Furthermore, the growing popularity of plant-based and organic diets has increased the demand for amaranth seeds as a nutritious and sustainable food alternative, contributing to their market dominance.

Amaranth Categories

- Organic

- Conventional

The organic segment has emerged as the leading category in the amaranth market forecast period, owing to rising customer demand for natural and chemical-free products. As people become more aware of the benefits of organic farming and food products, they seek for organic solutions that are free of synthetic pesticides, fertilizers, and genetically modified organisms (GMOs). Organic amaranth is especially appealing to health-conscious consumers and those who follow specific dietary regimens, such as vegan, gluten-free, or clean eating. The growing concern about the environment, as well as the need for sustainable farming practices, are driving up demand for organic products. This trend is bolstered by the growth of organic food distribution channels, such as specialized stores, online platforms, and supermarkets, which make organic amaranth more available to a wider audience.

Amaranth Applications

- Food & Beverages

- Personal care

- Pharmaceuticals

- Others

The personal care category is emerging as a key application area in the amaranth market, owing to rising demand for natural and plant-based components in skincare and cosmetic products. Amaranth oil, in particular, is prized for its high concentration of squalene, an emollient that hydrates and protects the skin, making it a popular ingredient in moisturizers, anti-aging lotions, and serums. Furthermore, the presence of important fatty acids and antioxidants in amaranth makes it appealing for use in hair care products such shampoos and conditioners that nourish and strengthen the hair. As customers seek for personal care products that are devoid of synthetic chemicals and environmentally friendly, the use of amaranth in this area is expected to grow, cementing its market position.

Amaranth Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Amaranth Market Regional Analysis

North America region is the largest in amaranth market, owing to the region's established health food sector and high consumer awareness of amaranth's nutritional value. Amaranth seeds, flour, and oil are becoming increasingly popular in the United States and Canada due to the demand for gluten-free, organic, and plant-based cuisine. The region's well-developed retail infrastructure, which includes supermarkets, health food stores, and internet platforms, guarantees that amaranth goods are widely available, cementing its market domination. Furthermore, the presence of major health food companies and rising product innovations, such as amaranth-based snacks and supplements, has propelled its expansion in North America.

However, the Asia-Pacific region is the fastest-growing during the amaranth industry forecast period. This expansion is being driven by expanding health awareness, rising disposable incomes, and a preference for more healthy and natural food options. Traditional use of amaranth in countries such as India and Nepal, along with a rising middle class and urbanization, has increased demand for amaranth products. The rising food processing industry, as well as the rapid expansion of organic farming in countries like as China and India, contributes to the region's dynamic growth, establishing Asia-Pacific as a vital emerging market for amaranth.

Amaranth Market Players

Some of the top amaranth companies offered in our report includes Nutriwish, Shiloh Farms, Flavahan's, General Mills Inc., Natures Path Foods, AMR Amaranth, Healthline Superfoods, Great Eastern Sun, ProNature Organic Foods, RusOliva, Nu-World Foods, and Birla Group.

Frequently Asked Questions

How big is the amaranth market?

The amaranth market size was valued at USD 7.1 billion in 2023.

What is the CAGR of the global amaranth market from 2024 to 2032?

The CAGR of amaranth is 11.3% during the analysis period of 2024 to 2032.

Which are the key players in the amaranth market?

The key players operating in the global market are including Nutriwish, Shiloh Farms, Flavahan's, General Mills Inc., Natures Path Foods, AMR Amaranth, Healthline Superfoods, Great Eastern Sun, ProNature Organic Foods, RusOliva, Nu-World Foods, and Birla Group.

Which region dominated the global amaranth market share?

North America held the dominating position in amaranth industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of amaranth during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global amaranth industry?

The current trends and dynamics in the amaranth industry include increasing demand for gluten-free products, rising awareness of the nutritional benefits of amaranth, growing popularity of plant-based diets, and expansion of organic and health food markets.

Which application held the maximum share in 2023?

The personal care application held the maximum share of the amaranth industry.

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date