Agritech Platform Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Agritech Platform Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

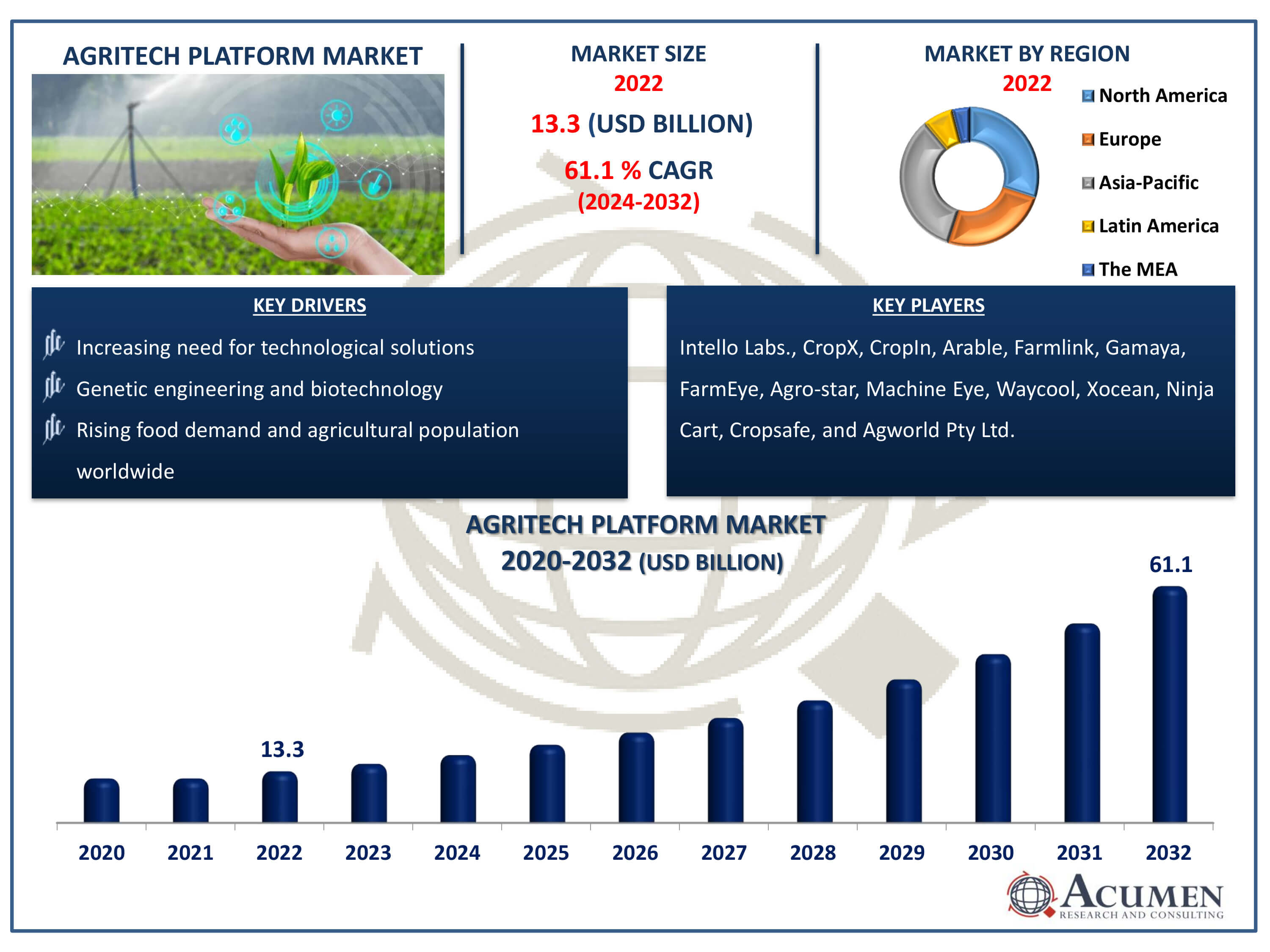

The Agritech Platform Market Size accounted for USD 13.3 Billion in 2022 and is estimated to achieve a market size of USD 61.1 Billion by 2032 growing at a CAGR of 16.9% from 2024 to 2032.

Agritech Platform Market Highlights

- Global agritech platform market revenue is poised to garner USD 61.1 billion by 2032 with a CAGR of 16.9% from 2024 to 2032

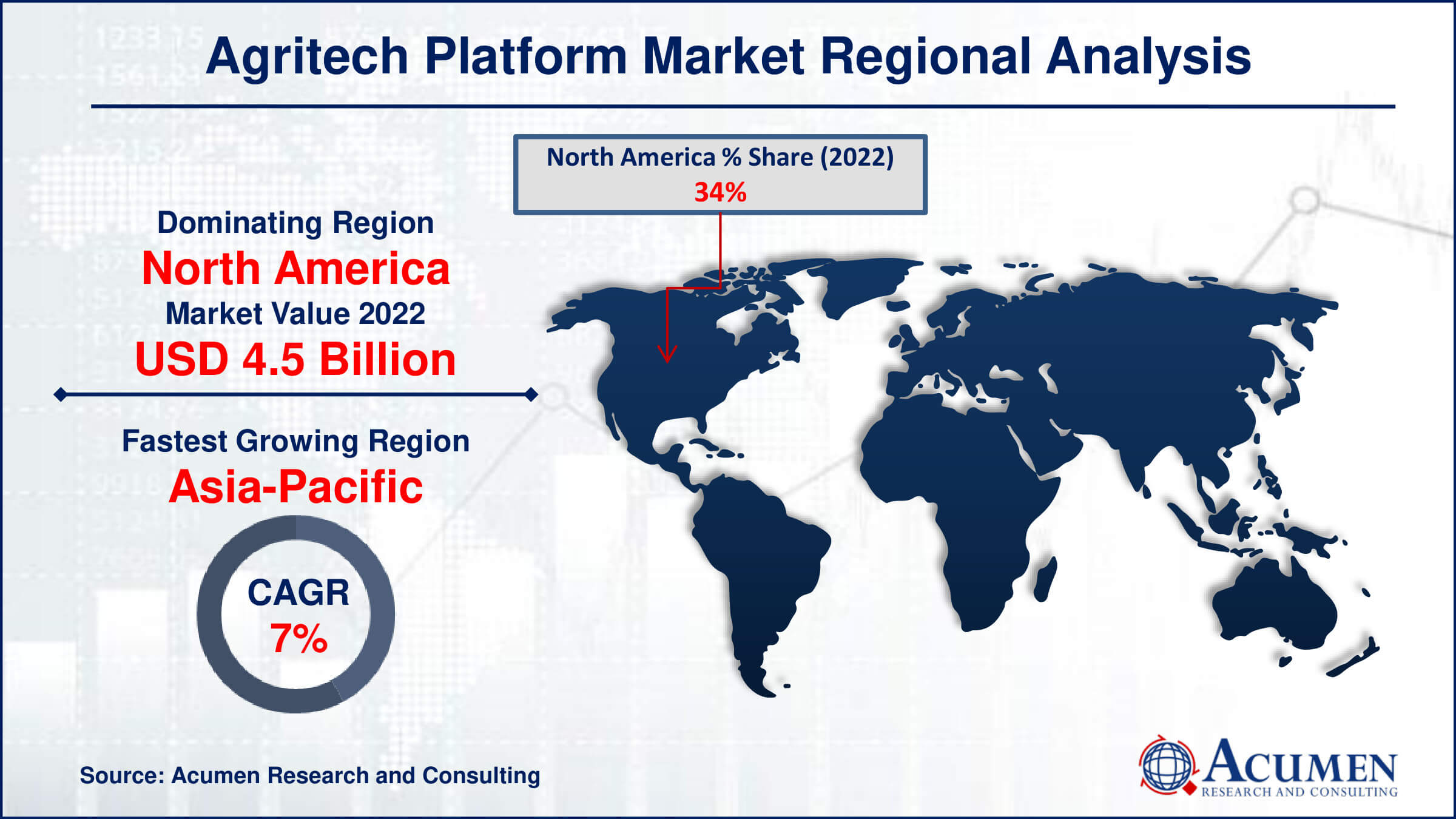

- North America agritech platform market value occupied around USD 4.5 billion in 2022

- Asia-Pacific agritech platform market growth will record a CAGR of more than 7% from 2024 to 2032

- Among sector, the precision farming sub-segment generated 33% of share in 2022

- Based on application, the supply chain sub-segment generated around 30% market share in 2022

- Increasing adoption of precision agriculture is a popular agritech platform market trend that fuels the industry demand

An agritech platform is a digital tool or system that leverages technology to enhance various aspects of agriculture, including production, management, and distribution. These platforms often integrate data analytics, IoT (Internet of Things), AI (Artificial Intelligence), and other emerging technologies to provide farmers with valuable insights, optimize resource usage, improve crop yields, and operations. They facilitate tasks such as crop monitoring, soil analysis, weather forecasting, and supply chain management. Agritech platforms allow farmers to make informed decisions, increase efficiency, and ultimately contribute to sustainable agricultural practices and food security.

Global Agritech Platform Market Dynamics

Market Drivers

- Increasing need for technological solutions

- Genetic engineering and biotechnology

- Rising food demand and agricultural population worldwide

Market Restraints

- Lack of data challenges

- High startup operating cost

Market Opportunities

- Rising adoption of smart farming technology

- Technological advancements

- Governmental initiatives on farming

Agritech Platform Market Report Coverage

| Market | Agritech Platform Market |

| Agritech Platform Market Size 2022 | USD 13.3 Billion |

| Agritech Platform Market Forecast 2032 |

USD 61.1 Billion |

| Agritech Platform Market CAGR During 2024 - 2032 | 16.9% |

| Agritech Platform Market Analysis Period | 2020 - 2032 |

| Agritech Platform Market Base Year |

2022 |

| Agritech Platform Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Type, By Sector, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Intello Labs., CropX, CropIn, Arable, Farmlink, Gamaya, FarmEye, Agro-star, Machine Eye, Waycool, Xocean, Ninja Cart, Cropsafe, and Agworld Pty Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Agritech Platform Market Insights

The agritech platform market is experiencing significant growth in the forecast year due to rising food demand and agricultural population. As the world's population increases, the food industry automatically grows. With new inventions, people can now trade agricultural products through online platforms, including machinery, crop seeds, crop byproducts, and others. This increases efficiency and provides easy access to production for farmers. For instance, the world's population is expected to rise by 2 billion people in the next 30 years, increasing from 8 billion in 2023 to 9.7 billion by 2050. As a result, the rise in population demand for the food industry automatically increases, leading to growth in the agritech platform market. Additionally, advancements in genetic engineering, biotechnology, and the increasing need for technological solutions further boost demand for agritech platforms in the forecast year.

However, challenges related to data impede the growth of the agritech platform market in the coming years. Issues such as data security and privacy concerns worry farmers. Firstly, data produced by their operations, such as resource utilization, crop yield, and soil farming, may be shared and utilized without farmers' consent, posing privacy issues. Additionally, the high startup operating costs of agritech platforms further become obstacles for market growth."

The rising adoption of smart farming technologies creates an opportunity for the agritech platform market in the forecast year. Technologies such as the Internet of Things (IoT) and artificial intelligence enhance the overall performance of agritech platforms. As key players focus on new inventions and advancements in farming and technologies for improved farming, the market will automatically grow in the coming years. For instance, in Abu Dhabi, UAE, AeroFarms plans to construct the world's largest indoor vertical farm, spanning 90,000 square feet in 2020. The Abu Dhabi Investment Office (ADIO) invested $100 million in AeroFarms to construct facilities in Abu Dhabi.

Agritech Platform Market Segmentation

The worldwide market for agritech platform is split based on type, sector, application, and geography.

Agritech Platform Types

- Biotechnology and Biochemical

- Big Data and Analytics

- Sensor and Connected Devices

- Mobility

- Others

According to the agritech platform industry forecast, the biotechnology and biochemical segment is expected to dominate in the forecast year. This segment encompasses diverse biochemical and biotechnological tools utilized in agritech platforms. These tools, such as RNA interference, biochips, next-generation DNA sequencing, genome editing tools, and synthetic biological tools, play a crucial role in increasing crop yields. As a result of the rising demand for technologies that enhance crop productivity, the biotechnology and biochemical segment is experiencing significant dominance in the agritech platform market.

Agritech Platform Sectors

- Agriculture

- Smart Agriculture

- Precision Farming

- Agrochemicals

- Biotechnology

- Indoor farming

- Others

The precision farming segment is the largest sector category in the agritech platform market and it is expected to increase over the industry agritech platform forecast period. Leveraging cutting-edge technologies such as GPS, IoT sensors, and data analytics, precision farming optimizes crop yields, minimizes resource usage, and enhances overall efficiency in agricultural practices. By providing farmers with real-time data on soil conditions, weather patterns, and crop health, precision farming enables informed decision-making and precise interventions, leading to improved productivity and sustainability across the agricultural value chain.

Agritech Platform Applications

- Irrigation

- Production and Maintenance

- Supply chain

- Marketplace

- Others

The supply chain category maintains the highest proportion in the agritech platform industry. This category continues to expand its portfolio due to the increasing focus on supply chain optimization, supply chain analytics, and improved visibility across the supply chain. Additionally, companies offer supply chain platforms for better management of practices and production processes.

Agritech Platform Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Agritech Platform Market Regional Analysis

For several reasons, North America stands as the largest region in the agritech platform market. The increasing investments in agricultural platforms in countries like the U.S., Canada, and Mexico further boost the demand for agritech platforms in the forecast year. For example, agricultural land is highly valuable in the U.S. and is attractive to foreign investors. There has been substantial growth in agricultural investment, reaching 43.4 million acres in 2022. Additionally, the rising demand for food in this region presents an opportunity for significant growth in the agritech platform market. U.S. households influence the types of crops grown by American farmers. Furthermore, genetic engineering and biotechnology in this region maintain their dominance in the market. The robust presence of key players and growing innovations and new technologies in North America showcase strong growth in the agritech market. For instance, in 2020, AgBiome announced the issuance of a new patent in the U.S. for the Connate product line, enhancing the company's intellectual property protection for innovative product offerings. As a result, the region maintains its dominance in the agritech platform market in the coming years.

Asia-Pacific emerges as the fastest-growing region in the agritech platform market. This growth is fueled by factors including the increasing adoption of digital technologies in agriculture, rising demand for advanced farming practices, and government initiatives. With a burgeoning population and a strong agricultural sector, countries in the Asia-Pacific region are investing heavily in agritech solutions to enhance productivity. This trend is driving a surge in the development and adoption of agritech platforms, positioning Asia-Pacific as a key player in the global agritech landscape. For instance, Mahindra acquired all of AgriTech M.I.T.R.A.'s shares, with Omnivore's stake in the startup MITRA, backed by that business, also being acquired by M&M as part of the arrangement. MITRA, backed by that business, plans to expand its network and scale its product portfolio in India and other foreign countries.

Agritech Platform Market Players

Some of the top agritech platform companies offered in our report includes Intello Labs., CropX, CropIn, Arable, Farmlink, Gamaya, FarmEye, Agro-star, Machine Eye, Waycool, Xocean, Ninja Cart, Cropsafe, and Agworld Pty Ltd.

Frequently Asked Questions

How big is the agritech platform market?

The agritech platform market size was valued at USD 13.3 billion in 2022.

What is the CAGR of the global agritech platform market from 2024 to 2032?

The CAGR of agritech platform is 16.9% during the analysis period of 2024 to 2032.

Which are the key players in the agritech platform market?

The key players operating in the global market are including Intello Labs., CropX, CropIn, Arable, Farmlink, Gamaya, FarmEye, Agro-star, Machine Eye, Waycool, Xocean, Ninja Cart, Cropsafe, and Agworld Pty Ltd.

Which region dominated the global agritech platform market share?

North America Asia-Pacific held the dominating position in agritech platform industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of agritech platform during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global agritech platform industry?

The current trends and dynamics in the agritech platform industry include increasing need for technological solutions, genetic engineering and biotechnology, and rising food demand and agricultural population worldwide.

Which sector held the maximum share in 2022?

The precision farming sector held the maximum share of the agritech platform industry.