Agriculture Adjuvant Market (By Function: Activator Adjuvant, Utility Adjuvant; By Application: Herbicides, Insecticides, Fungicides, Others; By Formulation: Suspension Concentrate, Emulsifiable Concentrate; By Adoption Stage: Tank-Mix, In-Formulation; By Crop Type: Cereals and Grains, Fruits and Vegetables, Oilseeds and Pulses, Others) - Global Industry Analysis, Market Size, Opportunities and Forecast 2021 - 2028

Published :

Report ID:

Pages :

Format :

Agriculture Adjuvant Market (By Function: Activator Adjuvant, Utility Adjuvant; By Application: Herbicides, Insecticides, Fungicides, Others; By Formulation: Suspension Concentrate, Emulsifiable Concentrate; By Adoption Stage: Tank-Mix, In-Formulation; By Crop Type: Cereals and Grains, Fruits and Vegetables, Oilseeds and Pulses, Others) - Global Industry Analysis, Market Size, Opportunities and Forecast 2021 - 2028

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

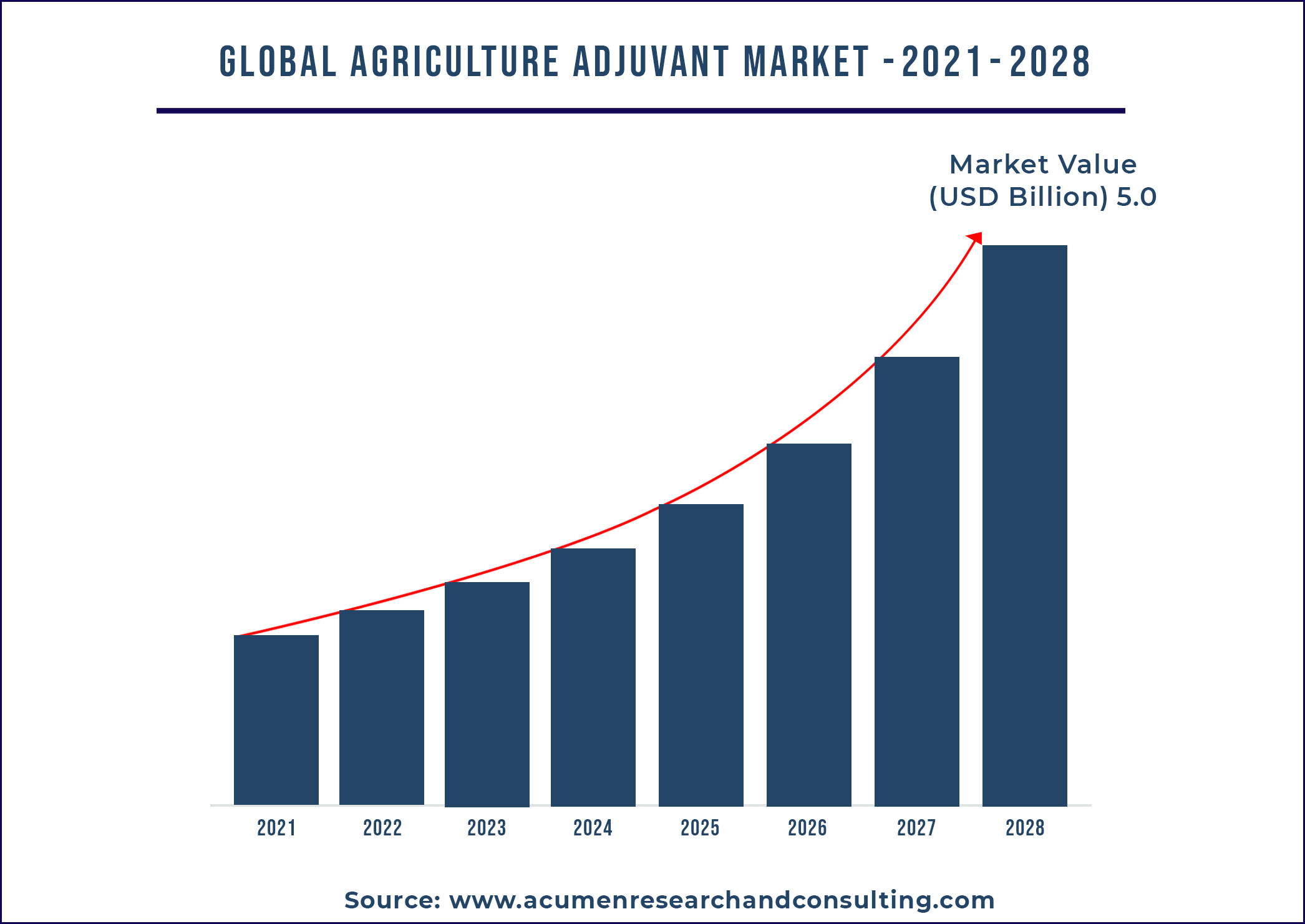

The global agriculture adjuvant market is expected to grow at a CAGR of around 5.9% from 2021 to 2028 and expected to reach the market value of around US$ 5.0 Bn by 2028.

Agricultural adjuvant are surfactants that are added in to agrochemicals to improve the biological effectiveness of foliar sprays by improving spray wetting behavior and/or active ingredient penetration into leaf tissues. Furthermore, adjuvant is added to crop protection products to improve the overall performance and increase the effectiveness of the pesticide, insecticide, or herbicide. Drift control, stickers, wetting agents, water conditioners, and penetrants are examples of additives.

Report coverage

| Market | Agriculture Adjuvant Market |

| Analysis Period | 2017 - 2028 |

| Base Year | 2020 |

| Forecast Data | 2021 - 2028 |

| Segments Covered | By Function, By Application, By Formulation, By Adoption Stage, By Crop Type, and By Region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Clariant AG, AlzChem Group AG, DuPont de Nemours, Inc., Wilbur-Ellis Company Inc., Brandt Consolidated, Inc., BASF SE, Huntsman Corporation, and among others |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope | 10 hrs of free customization and expert consultation |

Market Drivers

Government support enhances the growth of global agricultural adjuvant market

Because pesticide active ingredients are widely available, several different types of formulations have been developed, based primarily on the physico-chemical properties of the active ingredients. Currently, the majority of government and regulatory bodies are demanding formulations that pose no safety risks and are used cleaner and safer for the utility, have a low environmental impact, and can be applied at the lowest dose rate. Furthermore, there is a growing demand from government agencies and consumer groups to use safer formulation additives and adjuvant, as well as to reduce pesticide residues on food crops after spraying. All of the aforementioned factors are putting significant strain on the development of improved formulation and adjuvant technologies.

Stringent regulations fuel the growth of global agricultural adjuvant market

According to a report published in 2003 by The Nature Conservancy's Weed Control Methods Handbook, regulatory agencies in the United States used to pay little attention to the regulation of adjuvant for herbicides. Because of the lack of consistent labeling laws, thousands of different adjuvant formulations and brands were marketed and sold without a consistent ingredient list or proper scientific trials. Because of such factors as state-level regulations concerning product quality and government proposals requiring full disclosure of ingredients, the adjuvant industry has begun to self-regulate. Currently, the Chemical Producers and Distributor Association (CDPA) are pushing for a certification process based on 17 labeling and manufacturing standards. Furthermore, these adjuvant manufacturers intend to conduct properly designed experimental trials and make the results available to both herbicide companies and consumers.

Developments of bio-adjuvant for commercial and organic farming bolster the growth of overall market

There is currently an ongoing study comparing traditional organosilicone surfactant and a variety of bio-adjuvant on the leaf surface using methods to study droplet behaviors. The results show that droplet drying time typically increased with droplet volume, but this response varied depending on the adjuvant. Adjuvant made with various pesticides (e.g., fungicide, insecticide, and biofungicide) had a significant impact on the droplet lifetime behavior of different adjuvant when used alone with water. When high moisture retention or good coverage is required for a given pesticide, these factors direct growers to the best bio-adjuvant to use. Furthermore, field free trials will aid in the screening of adjuvant that may be compatible with biopesticides and the assessment of biocontrol effects. These aforementioned factors will ultimately drive the growth of the agricultural adjuvant market as a whole.

Market Segmentation

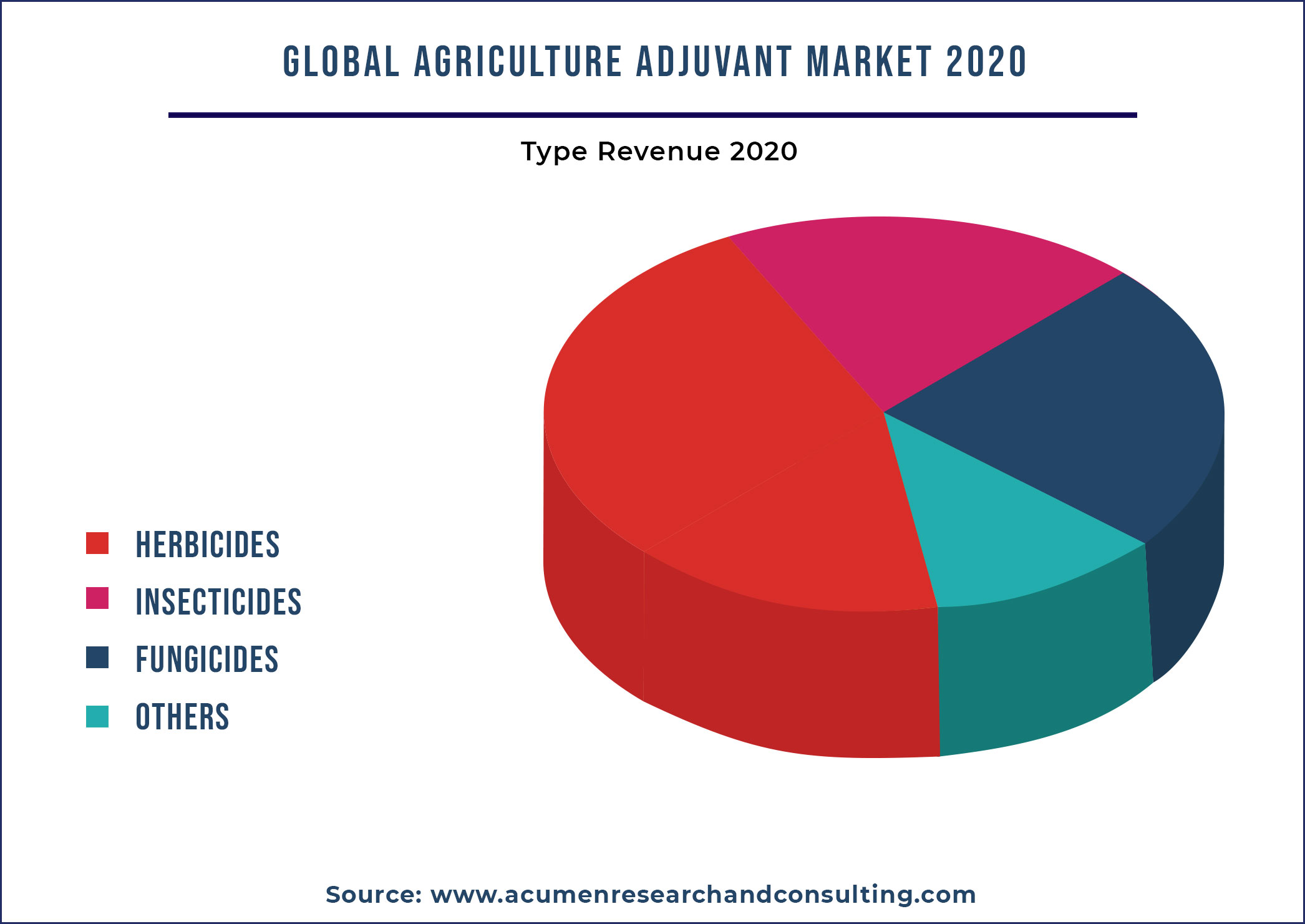

The global agricultural adjuvant market is segmented based on function, application, formulation, adoption stage, and crop type. Based on function, the market is segmented as activator adjuvant and utility adjuvant. Based on activator adjuvant, the market is sub segmented as surfactants and oil adjuvant. By utility adjuvant, it is further segmented as compatibility agents, buffers/acidifiers, antifoam agents, water conditioning agents, drift control agents, and others. Furthermore, application segment is segregated as herbicides, insecticides, fungicides, and among others. By formulation, the market is classified into suspension concentrate and emulsifiable concentrate. Adoption stage is bifurcated into tank-mix and in-formulation. Crop-type is segmented as cereals and grains, fruits and vegetables, oilseeds and pulses, and other crops.

According to the function segment, activator adjuvant is expected to dominate the agricultural adjuvant market in the coming years, accounting for a significant share. According to a JSTOR report, activator adjuvant for herbicides increases herbicide activity by incorporating a wide range of surfactant chemistry. Furthermore, the manufacturer incorporates it into the product formulation or the herbicide applicator tank-mixes it. Activator adjuvant efficiency is determined not only by the adjutant’s function, but also by the herbicide, the specific weed species, and environmental conditions. Such factors have a positive impact on segmental growth, which in turn contributes to market growth overall.

Herbicides, based on application, will provide lucrative opportunities for segmental growth, contributing to market growth overall. Herbicides, according to a USEPA report, are chemicals that have evolved to manipulate or control undesirable vegetation. Because herbicides' potential effects are strongly influenced by their toxic mode of action and method of application, predicting the molecular site of action is difficult, but modes of action are well-established. Such factors are to blame for the overall positive growth of the agricultural adjuvant market.

Suspension concentrate, based on formulation, commands significant attention in the global market, contributing to overall growth. Suspension concentrates, which are essentially water dispersible granules, are useful for pre-mixing and are a very popular formulation used for the majority of pesticides. Such factors have boosted the use of suspension concentrates in the global agricultural adjuvant market.

Regional Landscape

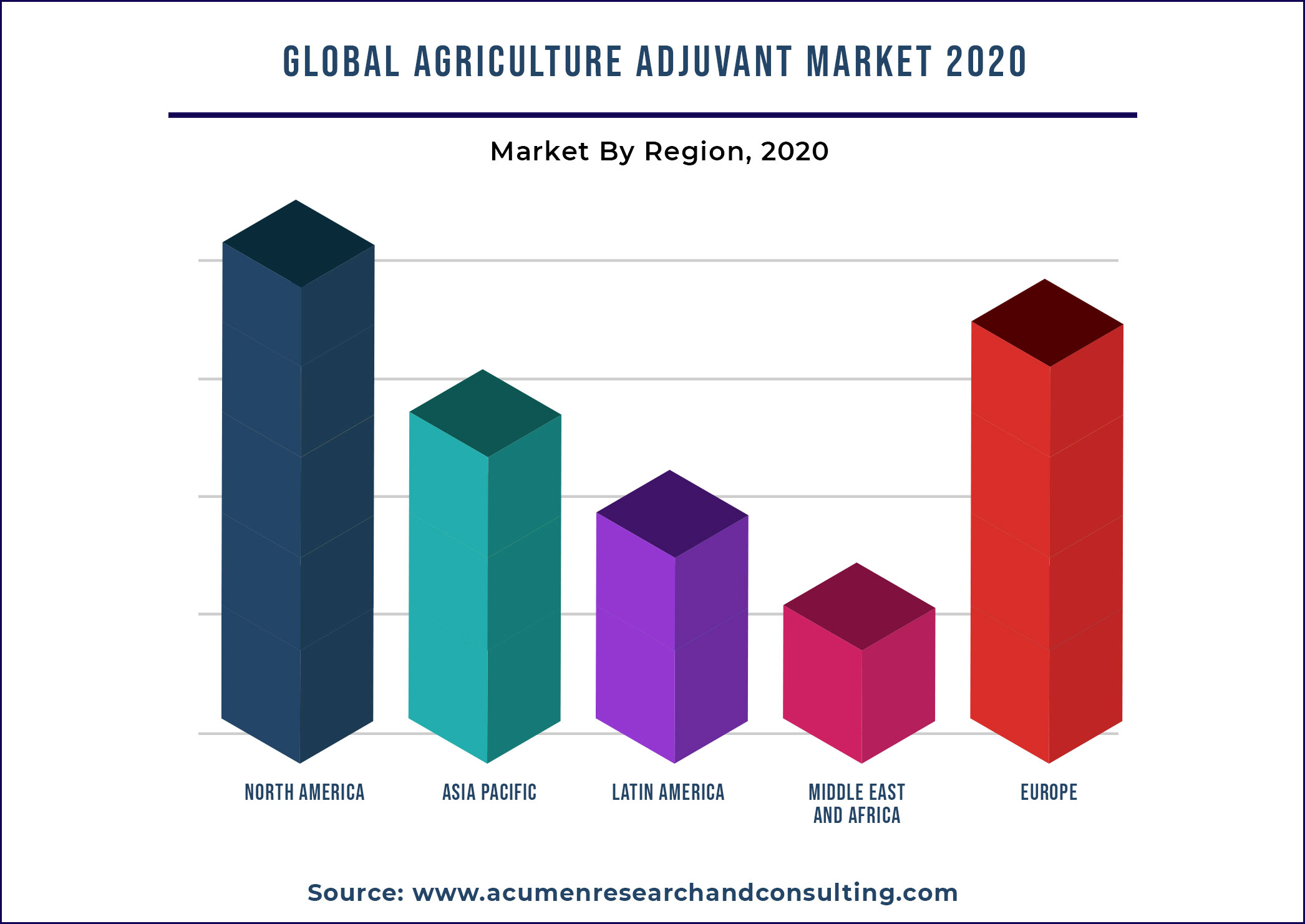

North America dominates agricultural adjuvant market by recording dominant share; Asia Pacific will record fastest growing CAGR in the coming years

North America has dominated the agricultural adjuvant market since 2020 and will continue to do so throughout the forecast period, owing to a large consumer base for agrochemicals, which are primarily used as adjuvant. Canada is the fastest growing country in North America, contributing to the overall growth of the agricultural adjuvant market in this region.

Competitive Landscape

The prominent players of the global agricultural adjuvant market involve Clariant AG, AlzChem Group AG, DuPont de Nemours, Inc., Wilbur-Ellis Company Inc., Brandt Consolidated, Inc., BASF SE, Huntsman Corporation, and among others

Market Segmentation

Market By Function

Activator Adjuvant

- Surfactants

- Oil Adjuvant

Utility Adjuvant

- Compatibility Agents

- Buffers/Acidifiers

- Antifoam Agents

- Water Conditioning Agents

- Drift Control Agents

- Others

Market By Application

Herbicides

Insecticides

Fungicides

Others

Market By Formulation

Suspension Concentrate

Emulsifiable Concentrate

Market By Adoption Stage

Tank-Mix

In-Formulation

Market By Crop Type

Cereals and Grains

Fruits and Vegetables

Oilseeds and Pulses

Other Crops

Market By Geography

North America

• U.S.

• Canada

Europe

• U.K.

• Germany

• France

• Spain

• Rest of Europe

Asia-Pacific

• China

• Japan

• India

• Australia

• South Korea

• Rest of Asia-Pacific

Latin America

• Brazil

• Mexico

• Rest of Latin America

Middle East & Africa

• GCC

• South Africa

• Rest of Middle East & Africa

Frequently Asked Questions

What will be the market value of the agriculture adjuvant market?

Agriculture adjuvant market is expected to reach a market value of around US$ 5.0 Bn by 2028.

At what CAGR, the agriculture adjuvant market is expected to grow during the forecast period (2021-2028)?

The agriculture adjuvant market is expected to grow at a CAGR of around 5.9% from 2021 to 2028.

Which is the leading segment in the agriculture adjuvant market?

Based on function, activator adjuvant segment is the leading segment in the overall market.

What are the key drivers of the agriculture adjuvant market?

High government support is one of the prominent factors that drive the demand for agriculture adjuvant market.

Which are the prominent players in the agriculture adjuvant market?

Clariant AG, AlzChem Group AG, DuPont de Nemours, Inc., Wilbur-Ellis Company Inc., Brandt Consolidated, Inc., BASF SE, Huntsman Corporation, and among others.

Which region held the highest market share in the agriculture adjuvant market?

North America is anticipated to grab the highest market share in the regional market

Which region is expected to be the fastest growing market over the forecast period?

Asia Pacific is expected to be the fastest growing market in the forthcoming years