Advanced Data Center Infrastructure Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Advanced Data Center Infrastructure Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

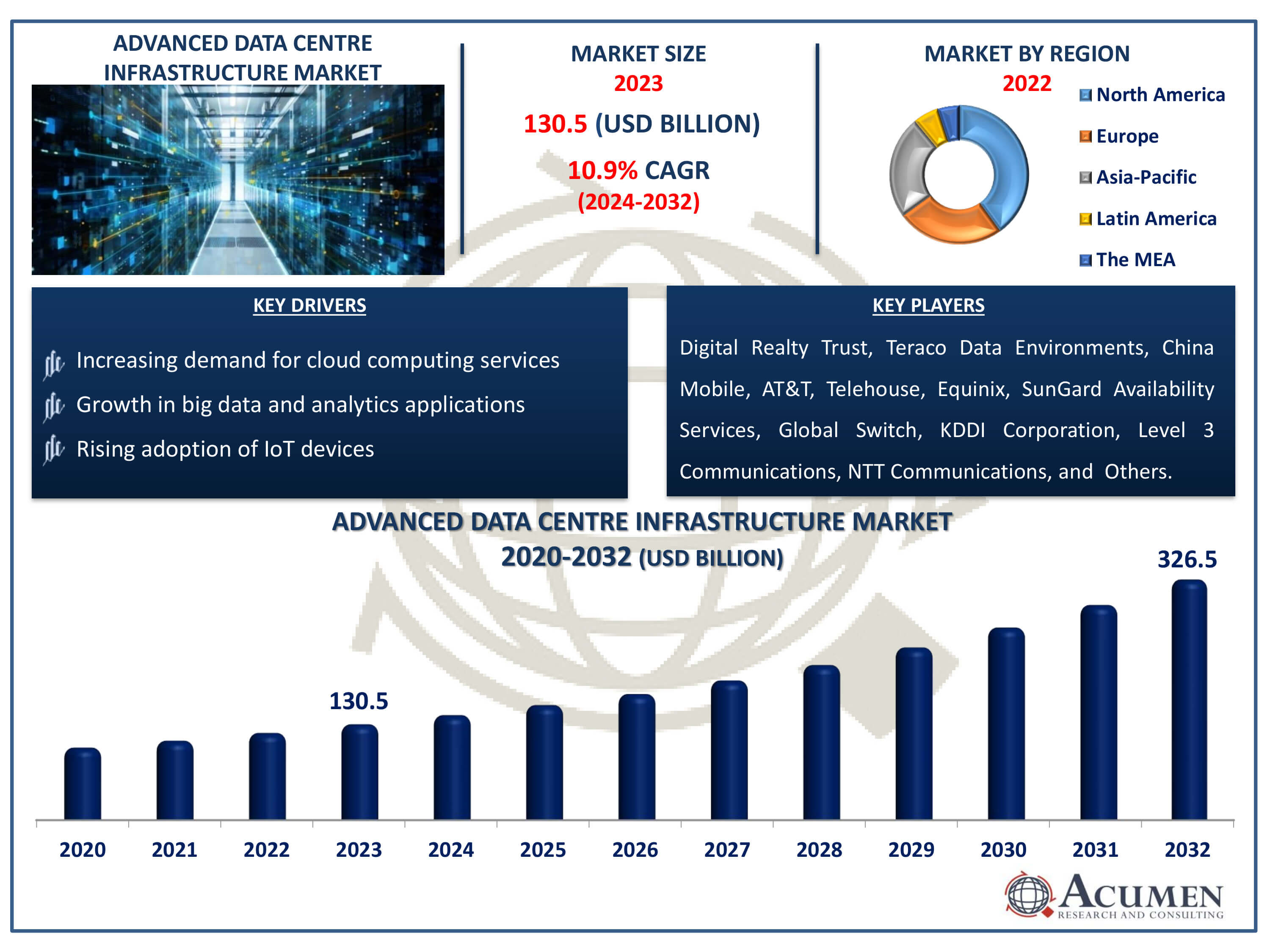

The Advanced Data Center Infrastructure Market Size accounted for USD 130.5 Billion in 2023 and is estimated to achieve a market size of USD 326.5 Billion by 2032 growing at a CAGR of 10.9% from 2024 to 2032.

Advanced Data Center Infrastructure Market Highlights

- Global advanced data center infrastructure market revenue is poised to reach USD 326.5 billion by 2032, with a CAGR of 10.9% from 2024 to 2032

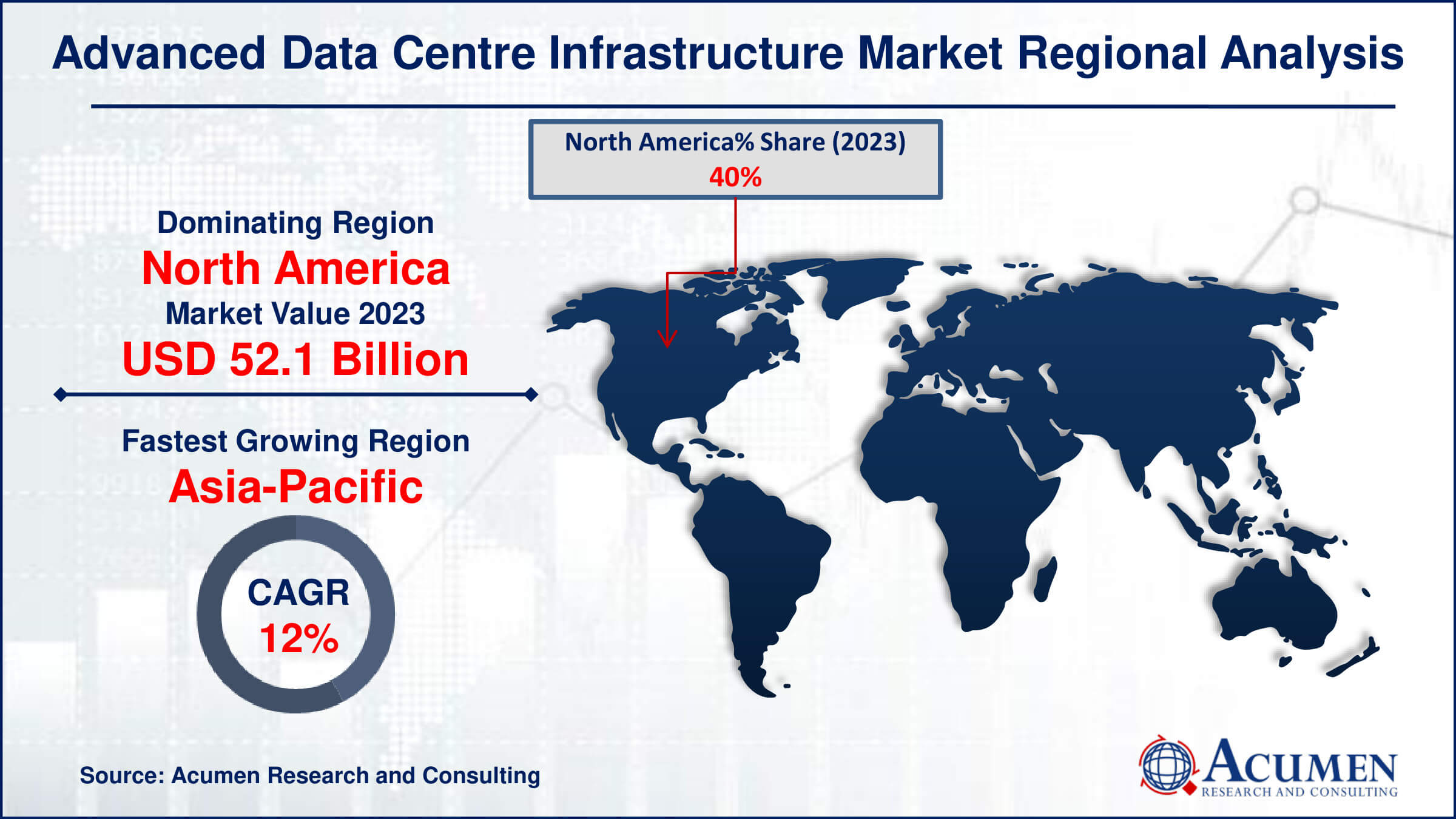

- The North America advanced data center infrastructure market was valued at around USD 52.1 billion in 2023

- The Asia-Pacific advanced data center infrastructure market is expected to grow at a CAGR of more than 12% from 2024 to 2032

- Among data center types, the enterprise data centers sub-segment accounted for 40% of the share in 2023

- Based on deployment mode, the on-premises sub-segment held 62% of the advanced data center infrastructure market share in 2023

- In terms of organization size, large enterprises held 72% of the advanced data center infrastructure market share in 2023

- Among industry verticals, the IT and Telecom sub-segment captured 36% of the market share in the advanced data center infrastructure market

- The growing implementation of AI-driven analytics and automation to optimize data center operations and resource management is a prominent trend in the advanced data center infrastructure market, fueling industry demand

Advanced data center infrastructure refers to the cutting-edge technologies and architecture designed to support the storage, processing, and dissemination of vast amounts of data in a highly efficient and reliable manner. It includes state-of-the-art hardware such as high-performance servers, storage systems, networking equipment, and virtualization technologies that optimize resource utilization and enhance scalability. Advanced data center infrastructure plays a crucial role in modern IT ecosystems by enabling seamless cloud computing services, big data analytics, artificial intelligence, and machine learning applications. Its robust security measures ensure data integrity and confidentiality, critical for businesses handling sensitive information.

Moreover, through innovations like software-defined networking (SDN) and hyper-converged infrastructure (HCI), it facilitates agile and cost-effective IT operations, accelerating digital transformation efforts across industries. Overall, Advanced Data center Infrastructure represents the backbone of today's digital economy, supporting the rapid growth and innovation in technology-driven businesses and services.

Global Advanced Data Center Infrastructure Market Dynamics

Market Drivers

- Increasing demand for cloud computing services

- Growth in big data and analytics applications

- Rising adoption of IoT devices

Market Restraints

- High initial investment costs

- Data security and privacy concerns

- Complexity in integrating diverse technologies

Market Opportunities

- Expansion of edge computing capabilities

- Advancements in renewable energy integration

- Demand for efficient cooling solutions

Advanced Data Center Infrastructure Market Report Coverage

| Market | Advanced Data Center Infrastructure Market |

| Advanced Data Center Infrastructure Market Size 2022 | USD 130.5 Billion |

| Advanced Data Center Infrastructure Market Forecast 2032 | USD 326.5 Billion |

| Advanced Data Center Infrastructure Market CAGR During 2023 - 2032 | 10.9% |

| Advanced Data Center Infrastructure Market Analysis Period | 2020 - 2032 |

| Advanced Data Center Infrastructure Market Base Year |

2022 |

| Advanced Data Center Infrastructure Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Data Center Type, By Deployment Mode, By Organization Size, By Industry Vertical, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Digital Realty Trust, Advanced Datacenter Systems, Teraco Data Environments, Equinix, Datacom Group Ltd, China Mobile, AT&T, Telehouse, SunGard Availability Services, Global Switch, Analogue Holdings Limited, KDDI Corporation, Level 3 Communications, NTT Communications, BT Group, Interxion, CenturyLink, Siemon, Colt Technology Services, China Unicom, Verizon Communications, CyrusOne, and CoreSite Realty Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Advanced Data Center Infrastructure Market Insights

The increasing demand for cloud computing services is propelling significant growth in the advanced data center infrastructure management market. For instance, according to Cloudscene, the U.S. has over 2,694 data centers and 2,980 service providers nationwide. While Northern California hosts numerous data-heavy companies like Facebook, Google, Twitter, Uber, and Yelp, Dallas currently boasts the most data centers, with a total of 152. As businesses hold digital transformation, the need for scalable and efficient data storage and processing solutions has surged. Advanced data centers offer enhanced capabilities such as higher computing power, improved energy efficiency, and robust security measures, meeting the evolving demands of modern enterprises. This expansion is driven by trends like IoT, AI, and big data analytics, which require robust infrastructure to manage vast amounts of data in real-time. Consequently, investments in advanced data center infrastructure are crucial for supporting the rapid expansion of digital services globally.

Data security and privacy concerns pose significant barriers to the growth of the advanced data center infrastructure market. Companies and organizations are increasingly cautious about storing and processing sensitive information due to the risk of data breaches and regulatory non-compliance. This cautious approach can slow down investments in advanced data center technologies like cloud computing and AI-driven analytics, which require robust security measures. Addressing these concerns, innovative products launched for data security by Lenovo Data Center. For instance, in December 2020, Lenovo Data Center Group introduced a new range of products designed to facilitate comprehensive data management for businesses and enhance data security. These new offerings feature Lenovo’s data security fiber channel switch and the ThinkSystem all-flash storage array.

The increasing demand for efficient cooling solutions within the advanced data center infrastructure management market presents a significant opportunity for growth and innovation. As data centers expand to meet the rising needs of cloud computing and big data analytics, the requirement for energy-efficient cooling systems becomes critical. This demand drives investment and development in advanced cooling technologies such as liquid cooling, AI-driven HVAC systems, and innovative airflow management solutions. Companies focusing on these technologies stand to capitalize on a burgeoning market driven by sustainability concerns and operational cost efficiencies. For instance, in January 2022, Siemens, the largest and most energy-efficient data center in the Baltic region, adopted comprehensive software for integrated data center management. This includes software for optimizing white space cooling (WSCO), managing energy and power (EPS), and overseeing building operations (BMS). These technologies are crucial in green data centers to regulate energy consumption, uphold thermal safety, and ensure the dependable functioning of essential infrastructure. Overall, the shift towards efficient cooling solutions not only enhances environmental sustainability but also fosters data center industry.

Advanced Data Center Infrastructure Market Segmentation

The worldwide market for advanced data center infrastructure is split based on component, data center type, deployment mode, organization size, industry vertical, and geography.

Advanced Data Center Infrastructure Components

- Hardware

- Software

- Services

According to advanced data center infrastructure industry analysis, the hardware component expected to dominate the advanced data center infrastructure market is the server. Servers are crucial for data processing, storage, and management, forming the backbone of data center operations. With the growing demand for cloud services, artificial intelligence, and big data analytics, the need for high-performance, scalable, and energy-efficient servers is increasing. Innovations in server technology, such as advanced processors and improved connectivity, further bolster their dominance in this sector.

Advanced Data Center Infrastructure Data Center Types

- Enterprise Data Centers

- Colocation Data Centers

- Cloud Data Centers

- Edge Data Centers

Enterprise data centers has long been a market leader in the advanced data center infrastructure industry due to their robust capacity to handle extensive data storage, processing, and management needs. These centers offer high reliability, scalability, and security features, essential for large organizations. Their advanced infrastructure supports critical business applications and big data analytics, driving market dominance. Additionally, continuous innovations and integration of cutting-edge technologies keep enterprise data centers at the forefront of the industry.

Advanced Data Center Infrastructure Deployment Mode

- On-Premises

- Cloud-Based

In the advanced data center infrastructure industry, on-premises solutions are anticipated to dominate the advanced data center infrastructure market due to their superior control over data security, customization capabilities, and compliance with regulatory standards. Organizations prefer on-premises setups to ensure data control and to tailor infrastructure to their specific needs, which is often more challenging with cloud-based alternatives. Additionally, the increasing complexity and scale of enterprise operations necessitate robust, localized infrastructure that on-premises systems are better equipped to provide. As a result, businesses are investing heavily in advanced on-premises data centers to maintain competitive advantage and operational efficiency.

Advanced Data Center Infrastructure Organization Sizes

- Small and Medium Enterprises (SMEs)

- Large Enterprises

Historically, large enterprises dominate the advanced data center infrastructure business due to their substantial financial resources, which allow them to invest in cutting-edge technology and infrastructure. Their global reach and vast customer base provide the scale needed to optimize operations and drive efficiency.Furthermore, their expertise in managing complex IT environments and ensuring high levels of security and compliance attracts top clients. This dominance also enables them to continuously innovate, maintaining a competitive edge in the rapidly evolving industry.

Advanced Data Center Infrastructure Industry Verticals

- IT and Telecom

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- Retail

- Government and Defense

- Energy and Utilities

- Manufacturing

- Others (e.g., Education, Media & Entertainment)

In the advanced data center infrastructure market, the IT and telecom sectors are anticipated to lead the advanced data center infrastructure market due to their escalating demand for high-speed data processing and storage solutions. These industries are investing heavily in innovative technologies to enhance data management efficiency and ensure seamless connectivity. The rise of cloud computing, 5G networks, and IoT applications further fuels this growth, necessitating robust and scalable data center infrastructures. Consequently, IT and telecom's dominance is driving significant advancements and investments in the data center sector.

Advanced Data Center Infrastructure Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Advanced Data Center Infrastructure Market Regional Analysis

The market in North America dominates advanced data center infrastructure market, driven by its robust technological advancements and significant investment in IT infrastructure. For instance, in October 2021, Sunbird, a provider of data center infrastructure management (DCIM) software, unveiled the newest iteration of dcTrack. This updated version boasts improved scalability, accommodating even the largest organizations with support for up to 300,000 cabinets and numerous sites within a unified system. Additionally, Sunbird has broadened the functionality of its web service APIs and business rules, empowering enhanced automation capabilities. Moreover, the region benefits from a high concentration of major tech companies and data centers, facilitating cutting-edge developments. Strong economic conditions and a focus on digital transformation further bolster growth. Additionally, the regulatory environment supports innovation and expansion in data center capabilities. For instance, in February 2021, Databox, well-known for its distribution channels, entered a partnership with Delta to provide energy-efficient uninterruptible power supplies and data center infrastructure solutions across Portugal. Through this collaboration, Databox aims to support its resellers and system integrators with Delta's offerings. Overall, this dominance ensures North America remains at the forefront of global data infrastructure advancements.

The Asia-Pacific region is the fastest-growing market for advanced data center infrastructure, driven by rapid digital transformation, increasing demand for cloud services, and significant investments in technology by governments and enterprises. Additionally, strong presence of Software Company and their innovations in facilities further contributes to region’s growth. For instance, in September 2021, Trend Micro Incorporated, a global cybersecurity software company, inaugurated its regional data center named Cloud One in India. This facility was established to uphold data privacy and sovereignty within the nation.This growth is fueled by the region's expanding internet user base, e-commerce boom, and the rise of emerging technologies like AI and IoT. As a result, Asia-Pacific is becoming a critical hub for global data center development and innovation.

Advanced Data Center Infrastructure Market Players

Some of the top advanced data center infrastructure companies offered in our report includes Digital Realty Trust, Advanced Datacenter Systems, Teraco Data Environments, Equinix, Datacom Group Ltd, China Mobile, AT&T, Telehouse, SunGard Availability Services, Global Switch, Analogue Holdings Limited, KDDI Corporation, Level 3 Communications, NTT Communications, BT Group, Interxion, CenturyLink, Siemon, Colt Technology Services, China Unicom, Verizon Communications, CyrusOne, and CoreSite Realty Corporation.

Frequently Asked Questions

How big is the advanced data center infrastructure market?

The advanced data center infrastructure management market size was valued at USD 130.5 Billion in 2023.

What is the CAGR of the global advanced data center infrastructure market from 2024 to 2032?

The CAGR of advanced data center infrastructure is 10.9% during the analysis period of 2024 to 2032.

Which are the key players in the advanced data center infrastructure market?

The key players operating in the global market are including Digital Realty Trust, Advanced Datacenter Systems, Teraco Data Environments, Equinix, Datacom Group Ltd, China Mobile, AT&T, Telehouse, SunGard Availability Services, Global Switch, Analogue Holdings Limited, KDDI Corporation, Level 3 Communications, NTT Communications, BT Group, Interxion, CenturyLink, Siemon, Colt Technology Services, China Unicom, Verizon Communications, CyrusOne, and CoreSite Realty Corporation.

Which region dominated the global advanced data center infrastructure market share?

North America held the dominating position in advanced data center infrastructure industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of advanced data center infrastructure during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global advanced data center infrastructure industry?

The current trends and dynamics in the advanced data center infrastructure industry include increasing demand for cloud computing services, growth in big data and analytics applications, and rising adoption of IoT devices.

Which data center type held the maximum share in 2023?

The enterprise data center held the maximum share of the advanced data center infrastructure industry.?