Adipic Acid Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Adipic Acid Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

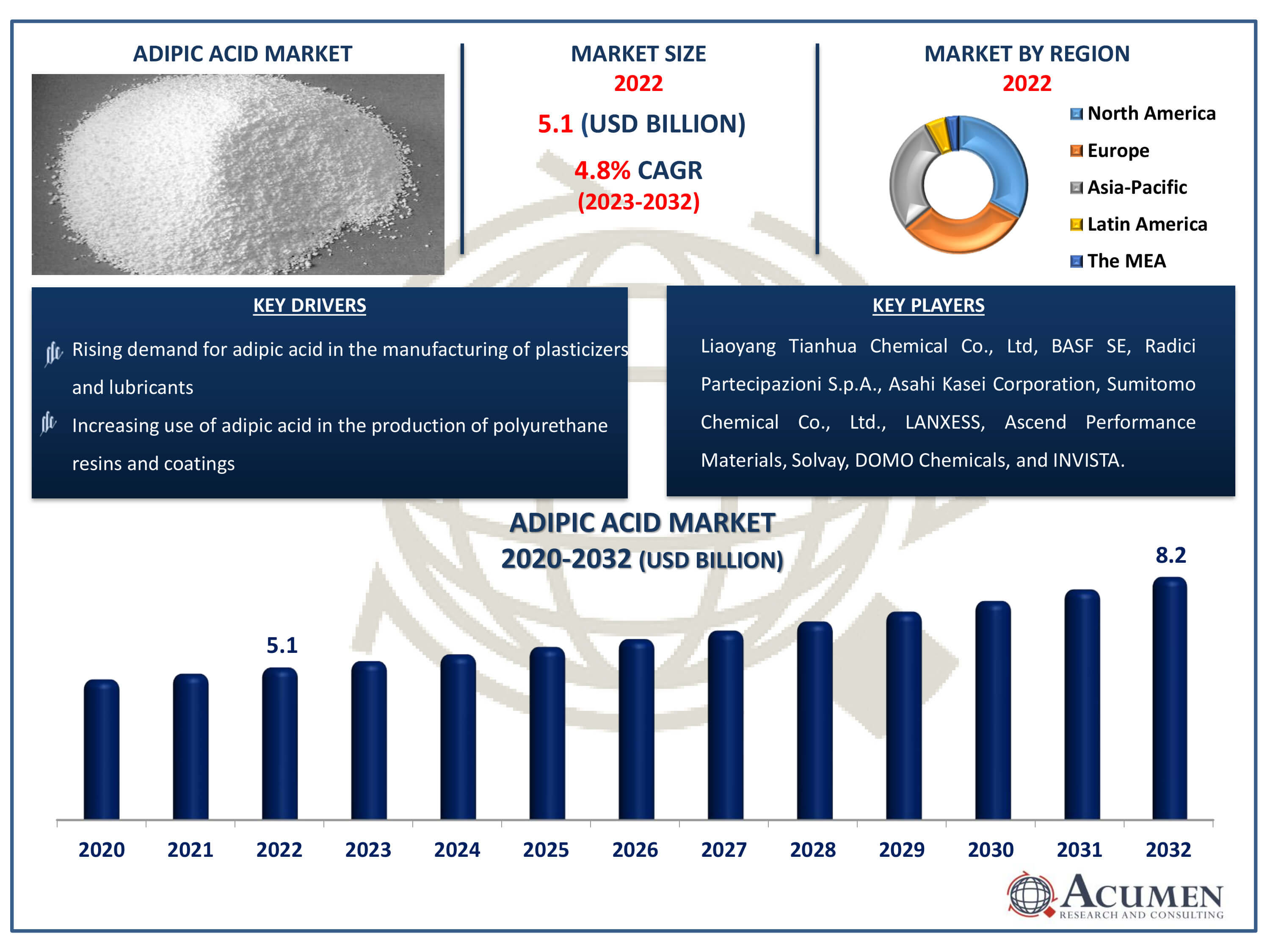

The Adipic Acid Market Size accounted for USD 5.1 Billion in 2022 and is estimated to achieve a market size of USD 8.2 Billion by 2032 growing at a CAGR of 4.8% from 2023 to 2032.

Adipic Acid Market Highlights

- Global adipic acid market revenue is poised to garner USD 8.2 billion by 2032 with a CAGR of 4.8% from 2023 to 2032

- North America adipic acid market value occupied around USD 1.7 billion in 2022

- Asia-Pacific adipic acid market growth will record a CAGR of more than 6% from 2023 to 2032

- Among application, the nylon 6, 6 fiber sub-segment generated more than USD 2.7 billion revenue in 2022

- Based on end-use industry, the textiles sub-segment generated significant market share in 2022

- Expansion into emerging economies with growing industrial sectors and demand for adipic acid-based products is a popular adipic acid market trend that fuels the industry demand

Adipic acid is a dicarboxylic acid that has the chemical formula C6H10O4. It is a white, crystalline substance that has a slightly acidic flavor and dissolves in water. Adipic acid is largely utilized as a precursor in the manufacturing of nylon 6,6, a synthetic polymer often used in textiles, carpets, and industrial plastics. It reacts with hexamethylenediamine to form a crucial intermediate in the manufacture of nylon. Additionally, adipic acid is used in the production of polyurethane resins, plasticizers, and other industrial compounds. Adipic acid is an important component in the chemical industry due to its flexibility and use in the creation of synthetic fibers and polymers.

Global Adipic Acid Market Dynamics

Market Drivers

- Growing demand for nylon 6,6 in various industries, such as textiles and automotive

- Increasing use of adipic acid in the production of polyurethane resins and coatings

- Rising demand for adipic acid in the manufacturing of plasticizers and lubricants

- Expansion of adipic acid production capacity to meet market demand

Market Restraints

- Fluctuations in raw material prices, particularly in the petrochemical industry

- Environmental concerns regarding adipic acid production processes and waste management

- Stringent regulations governing chemical manufacturing and emissions control

Market Opportunities

- Development of bio-based processes for adipic acid production, reducing reliance on fossil fuels

- Exploration of new applications and markets for adipic acid, such as in food additives and pharmaceuticals

- Collaboration with research institutions to enhance adipic acid production efficiency and sustainability

Adipic Acid Market Report Coverage

| Market | Adipic Acid Market |

| Adipic Acid Market Size 2022 | USD 5.1 Billion |

| Adipic Acid Market Forecast 2032 |

USD 8.2 Billion |

| Adipic Acid Market CAGR During 2023 - 2032 | 4.8% |

| Adipic Acid Market Analysis Period | 2020 - 2032 |

| Adipic Acid Market Base Year |

2022 |

| Adipic Acid Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Raw Material, By Application, By End-Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Liaoyang Tianhua Chemical Co., Ltd, BASF SE, Radici Partecipazioni S.p.A., Asahi Kasei Corporation, Sumitomo Chemical Co., Ltd., LANXESS, Ascend Performance Materials, Solvay, INVISTA, and DOMO Chemicals. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Adipic Acid Market Insights

The adipic acid market is gaining prominence due to its expanded demand across various verticals, particularly in the automotive sector. The increasing need for lightweight vehicles in automotive manufacturing is a primary driver propelling market growth. Furthermore, the development of the nylon 66 market in India is expected to have a positive impact on the demand for adipic acid, as nylon 66 represents a significant portion of adipic acid's overall demand. Additionally, the rapidly growing consumer electronics industry in Asia is another key factor contributing to the market's expansion.

Adipic acid serves as a crucial monomer in the production of nylon 6,6, with approximately 70% to 80% of adipic acid used for this purpose. Other applications of adipic acid include its utilization in polyurethanes and adipic acid esters, such as Di-2-Ethylhexyl Adipate (DOA), which serve as plasticizers for Polyvinyl Chloride (PVC) resins. The polyurethane (PU) segment is expected to be the second fastest-growing segment in the adipic acid market, accounting for 15.98% of the market share. The demand for innovative PU foams, both rigid and flexible, is rising across several end-use industries due to their durability, flexibility, cost-effectiveness, and high functionality.

Adipic Acid Market Segmentation

The worldwide market for adipic acid is split based on raw material, application, end-use industry, and geography.

Adipic Acid Raw Materials

- Cyclohexanol

- Cyclohexanone

According to Adipic Acid industry analysis, cyclohexanol is expected to the leading raw material segment due to a number of factors. Cyclohexanol is an important precursor in the synthesis of adipic acid, accounting for a major share of global output. Typically, adipic acid is produced by oxidising cyclohexanol or its derivative cyclohexanone. This process is efficient and scalable, hence cyclohexanol is a popular choice among adipic acid makers. Moreover, cyclohexanol can easily obtained from a variety of sources, including petroleum refining and biomass conversion processes, ensuring a consistent supply chain for adipic acid synthesis. Furthermore, advances in cyclohexanol manufacturing technology, along with its lower cost than cyclohexanone, lead to its dominance as the main raw material segment in the adipic acid industry.

Adipic Acid Applications

- Nylon 6, 6 Fiber

- Nylon 6, 6 Resin

- Polyurethane

- Adipate Esters

- Others

Nylon 6,6 fibre emerges as the largest sector in the adipic acid market due to a number of major considerations. Nylon 6,6 fibre is widely used in a variety of applications, including textiles, carpets, and industrial fabrics, due to its remarkable strength, durability, and abrasion resistance. As a result, there is a steady need for adipic acid in the manufacture of nylon 6,6 fibre. Furthermore, the textile and carpet sectors, which are key users of nylon 6,6 fibre, continue to see consistent expansion internationally, fuelling demand for adipic acid. Furthermore, technical advances in fibre manufacturing techniques and rising consumer demand for high-performance textiles contribute to nylon 6,6 fiber's continued dominance as the leading application category in the adipic acid industry.

Adipic Acid End-Use Industries

- Automotive

- Personal Care

- Pharmaceuticals

- Electrical & Electronics

- Food and Beverage

- Home Appliances

- Textiles

- FMCG

The textile sector expected to dominate the adipic acid market's end-use industry category. Adipic acid finds extensive utilization in textile applications, particularly in the production of nylon fibers such as nylon 6,6. These fibers are frequently used in textile manufacturing for apparel, carpets, upholstery, and industrial textiles because to their outstanding strength, durability, and abrasion resistance. The textile industry's high demand for adipic acid is driven by a growing worldwide population, rising disposable incomes, and shifting fashion trends. Furthermore, technical advances in textile production methods, as well as a growing preference for high-performance fabrics, are driving up demand for adipic acid. Furthermore, the adaptability of nylon fibers makes them appropriate for a wide range of textile applications, confirming the textile industry's dominance as the largest user of adipic acid.

Adipic Acid Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Adipic Acid Market Regional Analysis

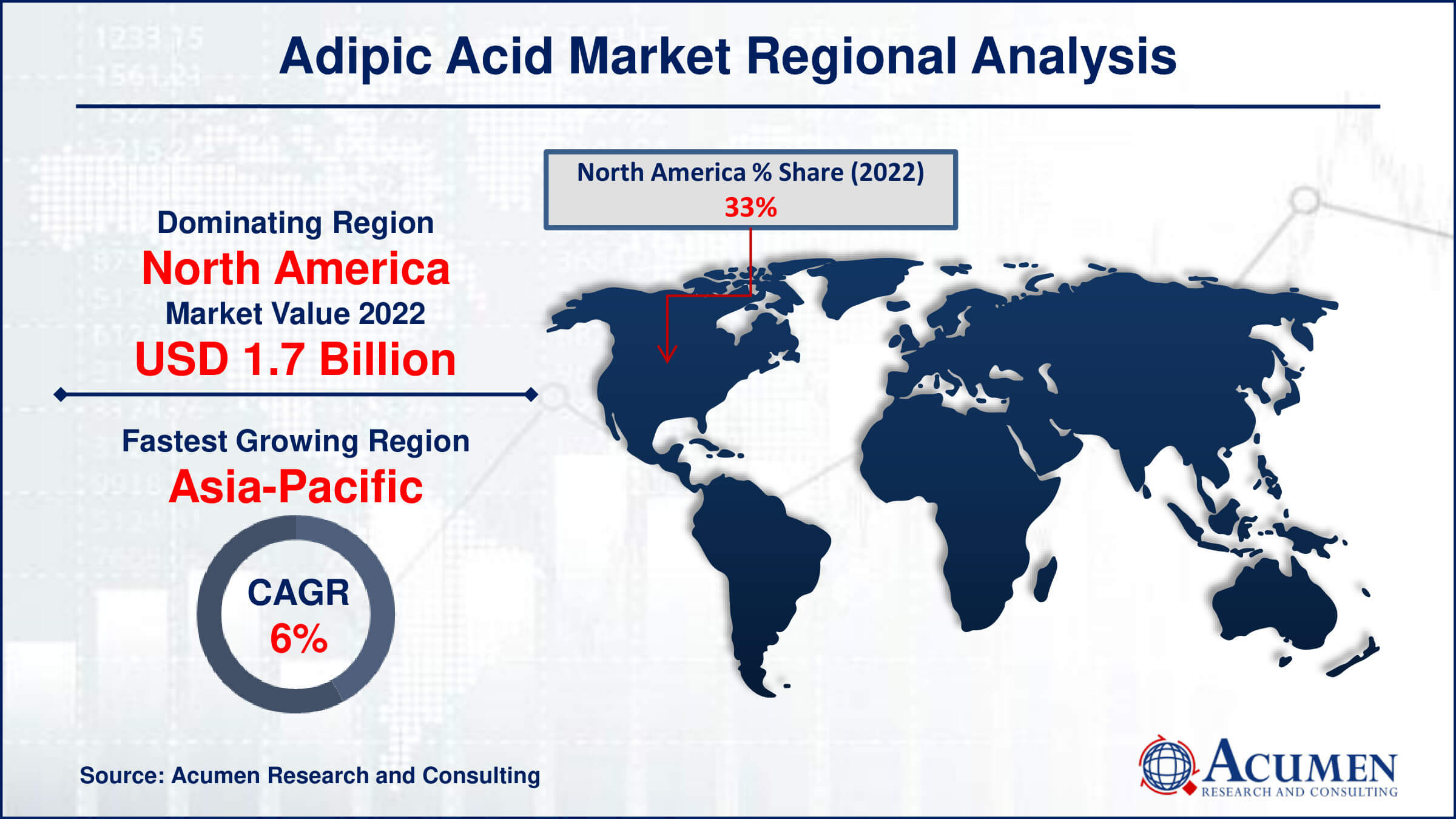

North America stands out as a significant supply center for engineered polymers, making it a potential destination for adipic acid. The region's demand for adipic acid was estimated to be around 858.6 kilo tons in 2015 and is projected to grow further at a rate of 2.6% over the adipic acid market forecast year.

The burgeoning automotive industry in North America is expected to be a central factor driving market growth. Additionally, the Asia Pacific market is exhibiting significant potential for adipic acid producers to establish a presence in the region, thanks to its business-friendly environment. Demand for the product in this region is anticipated to reach 1,551.8 kilo tons by the end of the adipic acid industry forecast period.

Adipic acid manufacturers are currently strategizing to position themselves strategically between raw material supply hubs and end-use industries to achieve optimal growth and profitability. A notable trend in the industry is the relocation of adhesive and sealant manufacturers to be closer to adipic acid supply hubs, aimed at enhancing supply efficiency.

Adipic Acid Market Players

Some of the top adipic acid companies offered in our report includes Liaoyang Tianhua Chemical Co., Ltd, BASF SE, Radici Partecipazioni S.p.A., Asahi Kasei Corporation, Sumitomo Chemical Co., Ltd., LANXESS, Ascend Performance Materials, Solvay, INVISTA, and DOMO Chemicals.

Frequently Asked Questions

How big is the adipic acid market?

The adipic acid market size was valued at USD 5.1 billion in 2022.

What is the CAGR of the global adipic acid market from 2023 to 2032?

The CAGR of adipic acid is 4.8% during the analysis period of 2023 to 2032.

Which are the key players in the adipic acid market?

The key players operating in the global market are including Liaoyang Tianhua Chemical Co., Ltd, BASF SE, Radici Partecipazioni S.p.A., Asahi Kasei Corporation, Sumitomo Chemical Co., Ltd., LANXESS, Ascend Performance Materials, Solvay, DOMO Chemicals, and INVISTA.

Which region dominated the global adipic acid market share?

North America held the dominating position in adipic acid industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of adipic acid during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global adipic acid industry?

The current trends and dynamics in the adipic acid industry include growing demand for nylon 6,6 in various industries, such as textiles and automotive, increasing use of adipic acid in the production of polyurethane resins and coatings, rising demand for adipic acid in the manufacturing of plasticizers and lubricants, and expansion of adipic acid production capacity to meet market demand.

Which application held the maximum share in 2022?

The nylon 6, 6 fiber application held the maximum share of the adipic acid industry.