January 2025

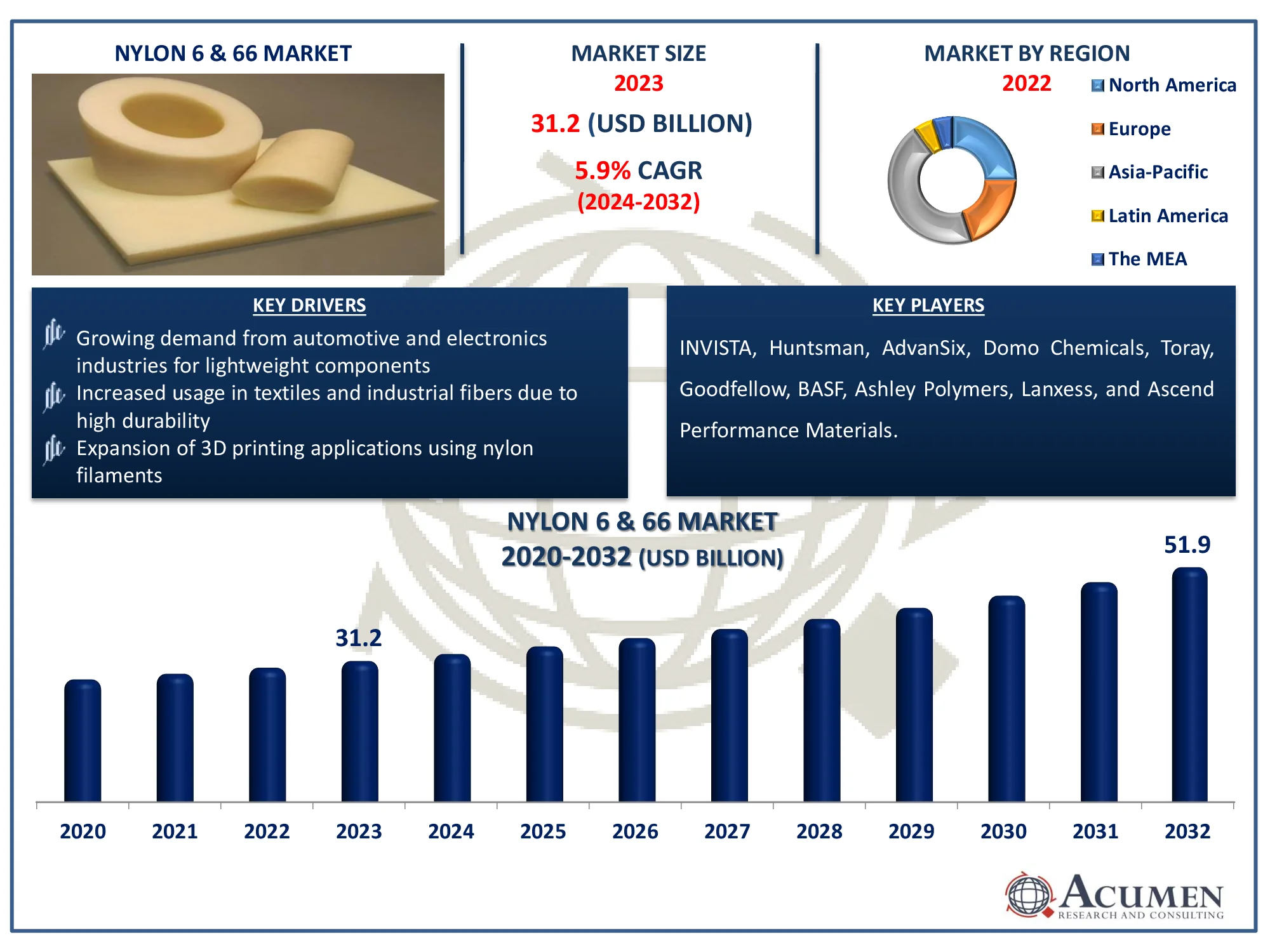

The Global Nylon 6 & 66 Market, valued at USD 31.2 Billion in 2023, is set to reach USD 51.9 Billion by 2032, growing at a 5.9% CAGR. This growth is driven by increased demand across multiple industries, enhancing the market's potential.

The Global Nylon 6 & 66 Market Size accounted for USD 31.2 Billion in 2023 and is estimated to achieve a market size of USD 51.9 Billion by 2032 growing at a CAGR of 5.9% from 2024 to 2032.

Nylon 6 & 66 Market (By Product: Nylon 66, and Nylon 6; By Application: Automobile, Engineering Plastics, Electronics & Electrical, Textile, and Others and By Region: North America, Europe, Asia-Pacific, Latin America, and MEA)

Nylon 6 & 66 Market Highlights

Nylon is a lightweight, strong synthetic polymer with a chemical structure that can be molded, filamented, or formed into sheets. It is a thermoplastic, silky material that, after melting, may be turned into films, fibers, and shapes. Nylons 6 and 66 are two synthetic polymers that are polyamides and are utilized in the automotive, plastic, and textile industries. Nylons 6, 6 have a melting point of 265 degrees Celsius for a high synthetic fiber, as well as tensile and flexural strengths of up to 36,000 and 50,000 psi, respectively. The use of nylon 6 & 66 in automobile spares and parts is predicted to increase worldwide due to its high tensile strength, flexibility, and exceptional resilience. It is utilized in medicine, textiles, and fishing due to its low elongation, improved handling, smoother and more elastic properties, and biodegradability. Thus, the worldwide nylon 6 & 66 market is predicted to stall due to a close substitute product and a lower competitive price with good properties.

Global Nylon 6 & 66 Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Nylon 6 & 66 Market Report Coverage

| Market | Nylon 6 & 66 Market |

| Nylon 6 & 66 Market Size 2022 |

USD 31.2 Billion |

| Nylon 6 & 66 Market Forecast 2032 | USD 51.9 Billion |

| Nylon 6 & 66 Market CAGR During 2023 - 2032 | 5.9% |

| Nylon 6 & 66 Market Analysis Period | 2020 - 2032 |

| Nylon 6 & 66 Market Base Year |

2022 |

| Nylon 6 & 66 Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | INVISTA, Huntsman, AdvanSix, Domo Chemicals, Toray, Goodfellow, BASF, Ashley Polymers, Lanxess, and Ascend Performance Materials. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Nylon 6 & 66 Market Insights

Nylon 6 and 66 are becoming increasingly used in textiles and industrial fibers due to their superior durability, abrasion resistance, and strength. These qualities make them perfect for generating high-performance fabrics for applications such as garments, home furnishings, and technical textiles. Furthermore, the material's capacity to withstand hard conditions and wear makes it ideal for industrial applications such as ropes, conveyor belts, and tire cords. This increased demand across multiple sectors greatly accelerates market expansion.

Environmental concerns about the non-biodegradability of nylon 6 and 66 have a substantial impact on market growth, as these materials take hundreds of years to degrade in landfills. The accumulation of nylon trash contributes to plastic pollution, causing environmental concerns. With growing worldwide awareness and regulatory pressures for eco-friendly options, producers must strike a balance between material durability and environmental responsibility. This has resulted in increased demand for more sustainable materials, limiting the growth of traditional nylon products.

The development of bio-based nylon compounds addresses environmental issues, providing a huge potential opportunity for the nylon 6 & 66 market. Bio-based nylons, made from renewable resources such as castor oil, offer the same durability and performance as traditional nylon while lowering carbon footprints. As companies promote sustainability, environmentally friendly alternatives are gaining favor in industries such as automotive, textiles, and electronics. This shift toward greener alternatives creates new market sectors and fosters innovation in nylon production.

Nylon 6 & 66 Market Segmentation

The worldwide market for nylon 6 & 66 is split based on product, application, and geography.

Nylon 6 and Nylon 66 Market By Product

According to the nylon 6 & 66 industry analysis, enhanced nylon 66 properties are a primary driver of demand for nylon 6, the market's largest product. Nylon 66 is the favored class of polyamides due to its high dielectric resistance in thermally and mechanically stressed mouldings. Polymer technological advancements have expanded the range of applications for nylon 66. Nylon 66 has high dimensional stability and excellent wear resistance. High heat, water, and other electromechanical resistance are required for electrical protection devices to function properly. Furthermore, the connection is shorter and stronger, and the structure is denser and more compact than nylon 6.

Nylon 6 and Nylon 66 Market By Application

According to the nylon 6 & 66 market forecast, the automotive industry dominates the market because of the material's lightweight, high strength, and great resistance to wear and chemicals. Nylon 6 and 66 are commonly used in automobile components like engine covers, air intake manifolds, and fuel system elements to reduce vehicle weight and enhance fuel efficiency. The growing trend toward electric vehicles and higher emission rules drive up demand for nylon in automotive applications, making it the market's largest category.

Nylon 6 & 66 Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Nylon 6 & 66 Market Regional Analysis

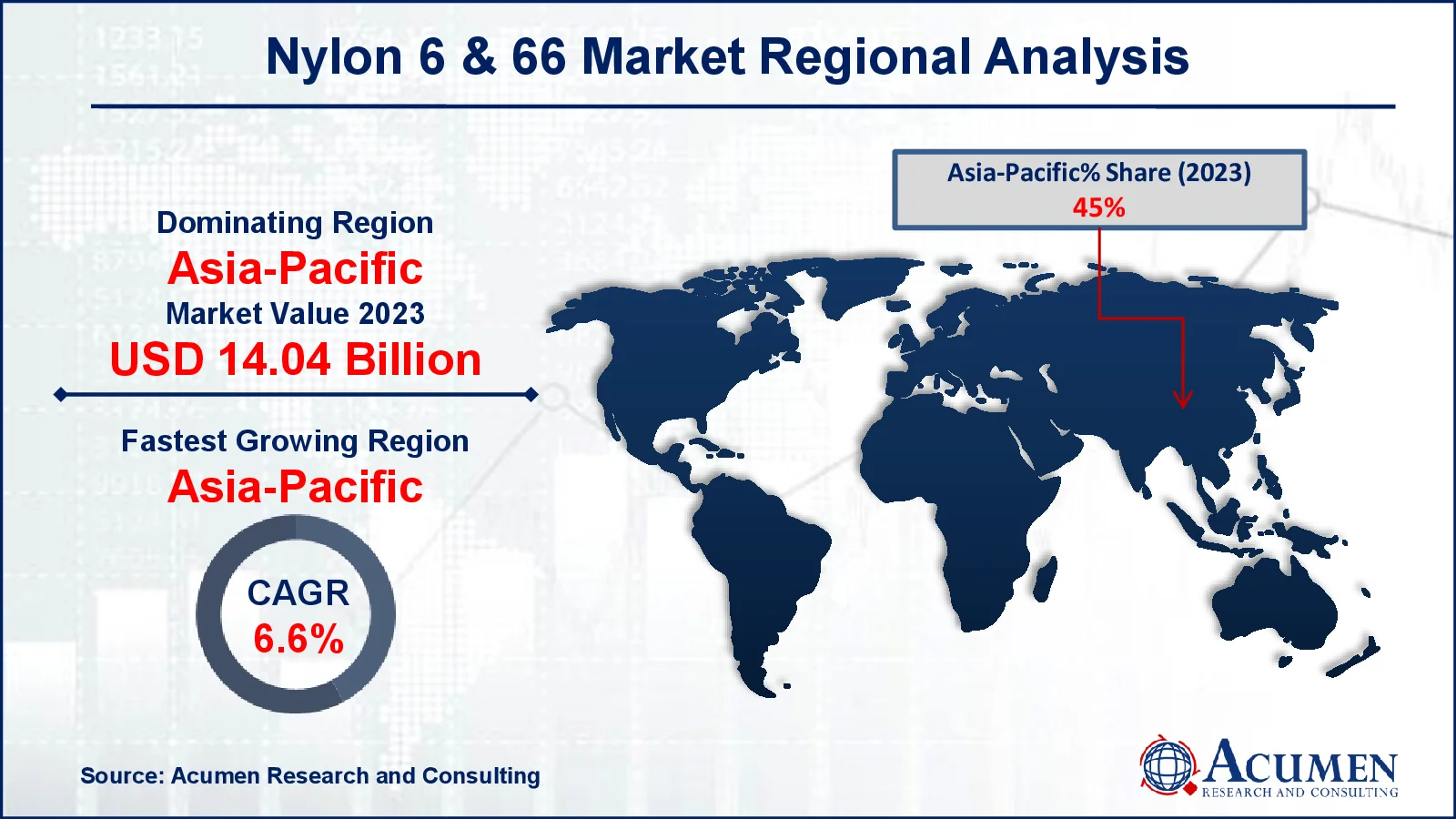

For several reasons, Asia-Pacific’s dominance, owing to increasing demands from the automotive, aerospace, and electronics industries. The region's emphasis on sophisticated manufacturing and lightweight materials, particularly for fuel efficiency and vehicle sustainability, encourages nylon use. Furthermore, technical advancements and increased investments in R&D are promoting market expansion.

Asia-Pacific is predicted to create more revenue in the nylon 6 & 66 market in 2023 and it’s a fastest growing region because to rapid industrialization, particularly in the automotive, electronics, and textile sectors. Countries such as China, India, and Japan are seeing a surge in demand for lightweight, durable materials in manufacturing, due to rising consumer demand and expanded production capacity. Furthermore, the presence of significant manufacturers contributes to revenue growth in this region.

Nylon 6 & 66 Market Players

Some of the top nylon 6 & 66 companies offered in our report include INVISTA, Huntsman, AdvanSix, Domo Chemicals, Toray, Goodfellow, BASF, Ashley Polymers, Lanxess, and Ascend Performance Materials.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

January 2025

January 2021

November 2024

September 2023