Abrasives Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Abrasives Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

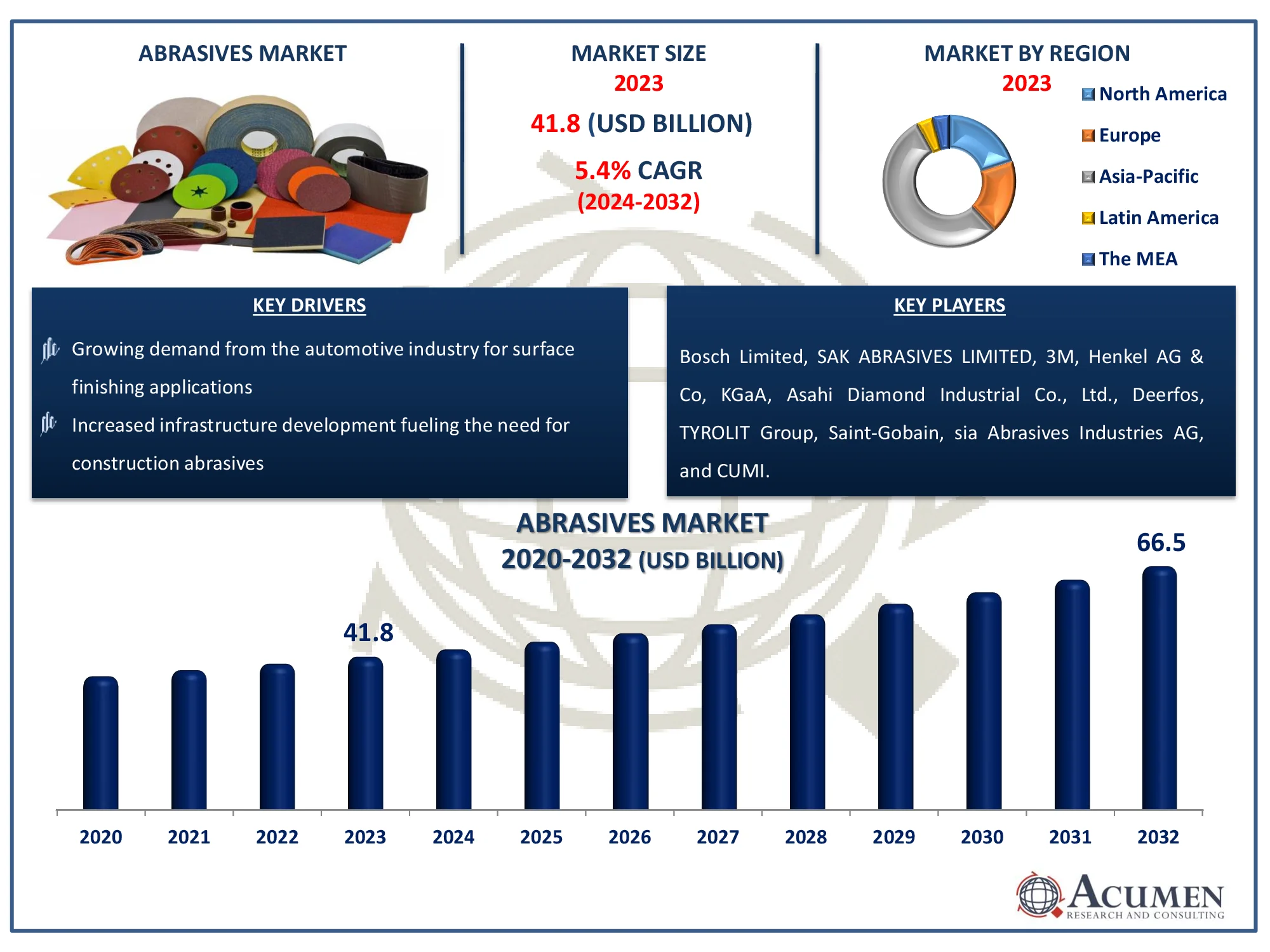

The Global Abrasives Market Size accounted for USD 41.8 Billion in 2023 and is estimated to achieve a market size of USD 66.5 Billion by 2032 growing at a CAGR of 5.4% from 2024 to 2032.

Abrasives Market Highlights

- Global abrasives market revenue is poised to garner USD 66.5 billion by 2032 with a CAGR of 5.4% from 2024 to 2032

- Asia-Pacific abrasives market value occupied around USD 22.6 billion in 2023

- North America abrasives market growth will record a CAGR of more than 6% from 2024 to 2032

- Among product type, the bonded sub-segment generated more than USD 18 billion revenue in 2023

- Based on end use, the automotive & transportation sub-segment generated around 36% market share in 2023

- Increasing use of super abrasives in precision machining driving market growth is a popular abrasives market trend that fuels the industry demand

Abrasives are categorized as difficult plastics that are used for the finishing and scratch-off of other softer materials with comprehensive rubbing. They are used in the form of shaved wheels, sandpapers, sandstroke, stone shaping and other mass media. Sandpaper, emery, sand, and pumice are common types of abrasives. These are used in countless end-use applications such as equipment, cars, electrical, electronics etc. In Asia Pacific, there is a strong demand for tied ceramic abrasives due to the existence of a big player in the area.

Global Abrasives Market Dynamics

Market Drivers

- Growing demand from the automotive industry for surface finishing applications

- Increased infrastructure development fueling the need for construction abrasives

- Advancements in manufacturing technology enhancing abrasive product efficiency

- Expanding use of abrasives in electronics for precision cutting and polishing

Market Restraints

- High cost of raw materials affecting the overall production cost of abrasives

- Stringent environmental regulations limiting the use of certain abrasive materials

- Availability of alternative technologies like laser cutting reducing abrasive demand

Market Opportunities

- Rising demand for abrasives in renewable energy projects, particularly wind and solar

- Growing adoption of abrasives in the aerospace industry for maintenance and repair operations

- Expansion of abrasive applications in 3D printing for post-processing of parts

Abrasives Market Report Coverage

| Market | Abrasives Market |

| Abrasives Market Size 2022 |

USD 41.8 Billion |

| Abrasives Market Forecast 2032 | USD 66.5 Billion |

| Abrasives Market CAGR During 2023 - 2032 | 5.4% |

| Abrasives Market Analysis Period | 2020 - 2032 |

| Abrasives Market Base Year |

2022 |

| Abrasives Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Material, By Product Type, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Bosch Limited, SAK ABRASIVES LIMITED, 3M, Henkel AG & Co, KGaA, Asahi Diamond Industrial Co., Ltd., Deerfos, TYROLIT Group, Saint-Gobain, sia Abrasives Industries AG, and CUMI. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Abrasives Market Insights

The development is motivated mainly by the growing popularity of superabrasives and the growing manufacturing of cars. Due to the increasing demand for the item in finishing and polishing apps in the fields of automotive, electronic and electro (E&E) equipment, metal production and machinery, the sector is expected to see important development. The increasing demand for automotive abrasives is the main driver for increasing product demand. Abrasives are essential for automotive parts to be manufactured by changing operating parameters such as noise reduction and carbon dioxide emission reduction of high performance motors and component machining.

Building industry expansion globally is also anticipated to boost demand development for abrasives, particularly superabrasives. The evolution of the productive sector has allowed improved precision instruments, which in turn increase the consumption of abrasives that are used in the process, and are helpful for producing smaller parts with higher precision. Nevertheless, strict regulations and costs for raw materials are anticipated to limit product demand. The production method of the item may cause obstruction in production. There is some limitation. Abrasive manufacturing needs high quantities of raw materials and raw material concentration is expected to impact distribution policies and extra expenses including the cost of transport and fuel in a restricted amount of countries.

Abrasives Market Segmentation

The worldwide market for abrasives is split based on material, product type end use, and geography.

Abrasives Market By Material

- Synthetic

- Natural

According to abrasives industry analysis, the natural sector accounted maximum share in 2023, due to the high price of manufacturing and lower accessibility the tiny share of the segment. U.S. is a major natural materials market because of grenet production in the region. Over the forecast period, the Sector of synthetic materials will record a CAGR of more than 6 percent in terms of revenue. A significant reason for segment development is the high demand for fused aluminum oxide and silicone carbide abrasives. In 2023, ceramic grain abrasives accounts for one-fourth of the income section of synthetic products. The section of ceramics can also be separated to covered and bonded ceramics. Bonded is a greater proportion than the version covered.

Abrasives Market By Product Type

- Coated

- Bonded

- Super Abrasives

Bonded represented the biggest sector with a 43% revenue share. Bonded abrasives are accessible in various forms, such as wheels and discs, and are precisely and roughly grinded. Automotive sector growth over the forecast period is expected to increase segment growth. Coated abrasives consist of a thin layer of grain connected with the aid of adhesives such as a sandpaper to a substrate such as paper or cloth. These are available, among other things, as rolls, disks, bands and sheets. Product development is due to the increasing demand from the Asia-Pacific region, particularly in China and India, where these materials can be used in applications such as grinding, polishing and sanding, including leather, rubber, wood, pottery, etc. In the next seven years, the sector for superabrasives is projected to grow in terms of income at the estimated CAGR of more than 6%. These are used to produce high-quality surface finishes for difficult metals. Growth in the production industry worldwide is expected to increase product usage over the abrasives market forecast period.

Abrasives Market By End Use

- Metal Fabrication

- Automotive & Transportation

- Electrical & Electronics Equipment

- Heavy Machinery

- Others

Automotive had more than 36% of its biggest share of sales. Abrasives are used in various uses such as rough sanding, lacquer sanding, repair sanding and polishing. For grinding and polishing, superabrasives in the form of diamond disks are preferred. Increased automotive production over the abrasives market forecast period is anticipated to increase abrasive consumption. The second biggest market share for machinery was in 2023. There is projected to be a promising development in demand for sophisticated abrasives for special applications such as machining of metal matrix composites and sophisticated ceramy. Robust growth is anticipated to drive development in Asia Pacific machinery sector over the coming years. In terms of income over the forecast era, metal manufacturing is expected to be the largest CAGR. The growth segment is motivated by increased usage of manufactured components for the aerospace, automotive, shipbuilding and different other industries.

Abrasives Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

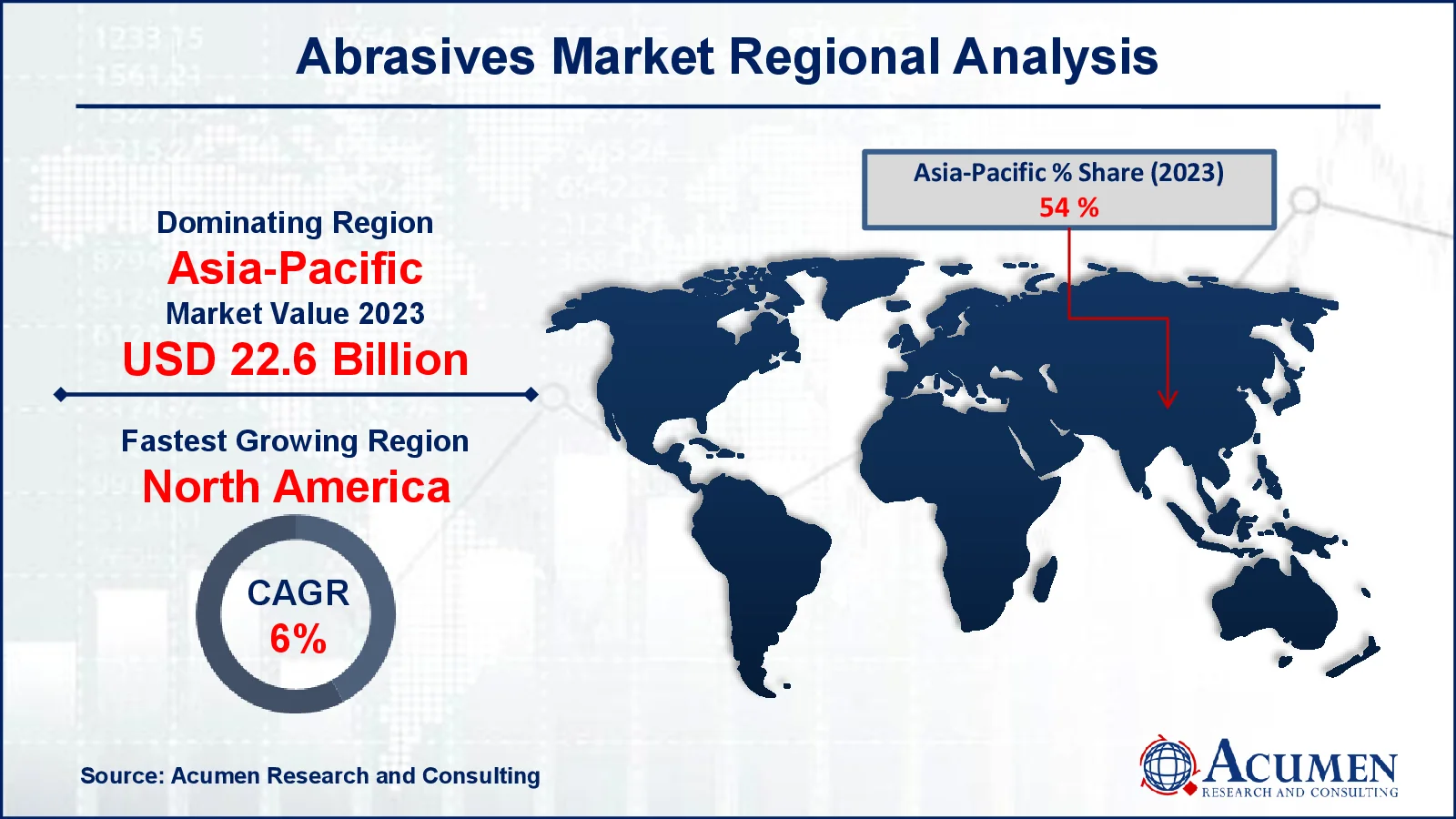

Abrasives Market Regional Analysis

Asia-Pacific was the biggest regional segment and represented more than 54% of the worldwide market in 2023. Due to the rise in building and production, the demand for abrasives is projected to be constant. High-end technology for the production of customs abrasives, which is anticipated to be acquired by developing markets in the area, will also increase market growth. China had the biggest Asia-Pacific share, representing an major volume share in 2023. The Chinese market is mature with a large number of non-organizing players and a large supply of raw material.

According to U.S. study China was one of the world's biggest manufacturers of fused aluminum oxide and silicon carbide geological survey. Over the abrasives market forecast period, North America is expected to increase its sales at the CAGR by approximately 6%. Regional demand is driven by the United States, whose market share over the forecast period will likely significantly increase. In the coming years, precision tooling and elaborate machine parts production units are expected to develop in North America to encourage the growth of the abrasives market.

Abrasives Market Players

Some of the top abrasives companies offered in our report include Bosch Limited, SAK ABRASIVES LIMITED, 3M, Henkel AG & Co, KGaA, Asahi Diamond Industrial Co., Ltd., Deerfos, TYROLIT Group, Saint-Gobain, sia Abrasives Industries AG, and CUMI.

Frequently Asked Questions

How big is the abrasives market?

The abrasives market size was valued at USD 41.8 billion in 2023.

What is the CAGR of the global abrasives market from 2024 to 2032?

The CAGR of abrasives is 5.4% during the analysis period of 2024 to 2032.

Which are the key players in the abrasives market?

The key players operating in the global market are including Bosch Limited, SAK ABRASIVES LIMITED, 3M, Henkel AG & Co, KGaA, Asahi Diamond Industrial Co., Ltd., Deerfos, TYROLIT Group, Saint-Gobain, sia Abrasives Industries AG, and CUMI.

Which region dominated the global abrasives market share?

Asia-Pacific held the dominating position in abrasives industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of abrasives during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global abrasives industry?

The current trends and dynamics in the abrasives industry include growing demand from the automotive industry for surface finishing applications, increased infrastructure development fueling the need for construction abrasives, advancements in manufacturing technology enhancing abrasive product efficiency, and expanding use of abrasives in electronics for precision cutting and polishing.

Which product type held the maximum share in 2023?

The bonded product type held the maximum share of the abrasives industry.