5G Base Station Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

5G Base Station Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

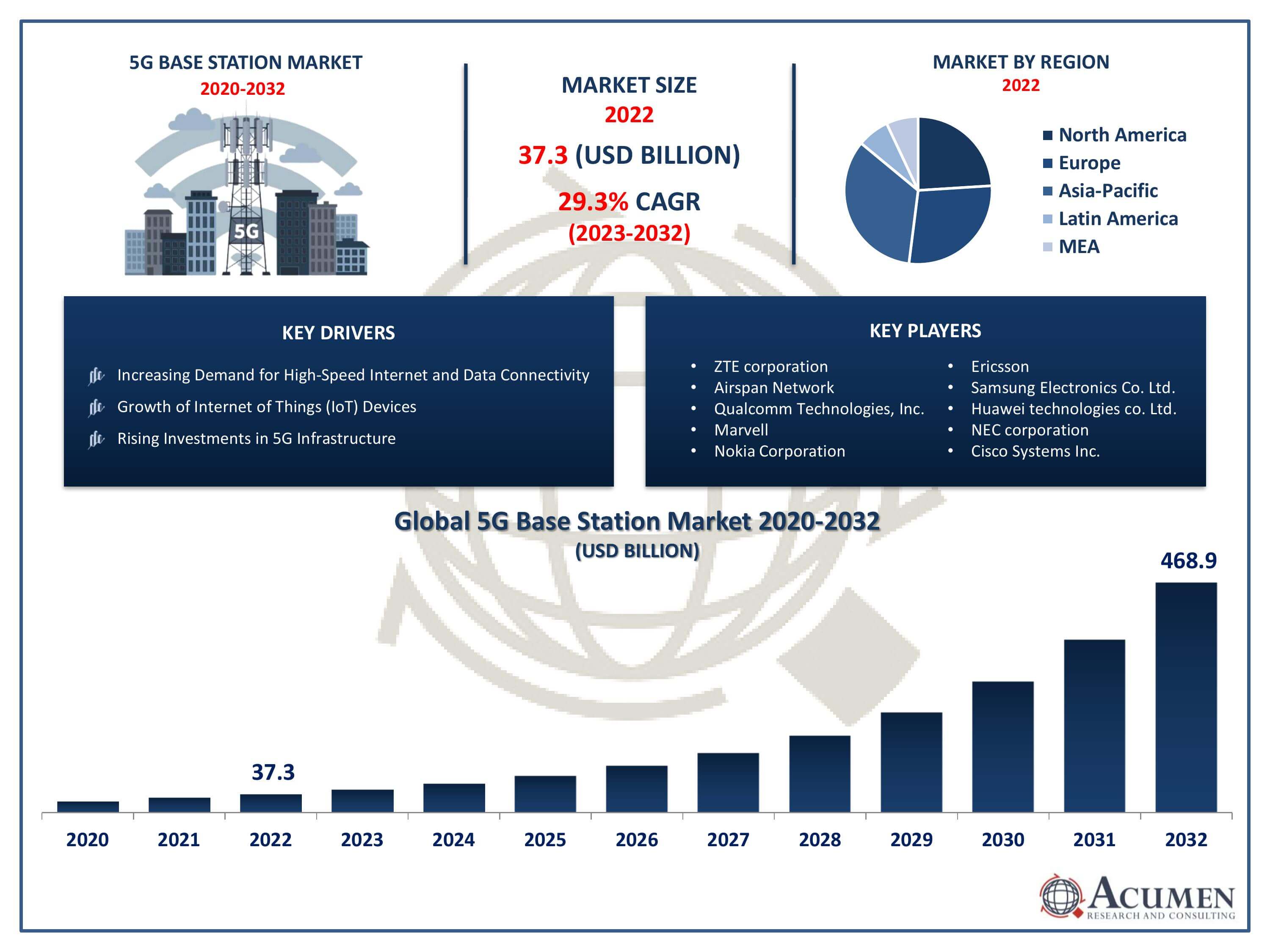

Request Sample Report

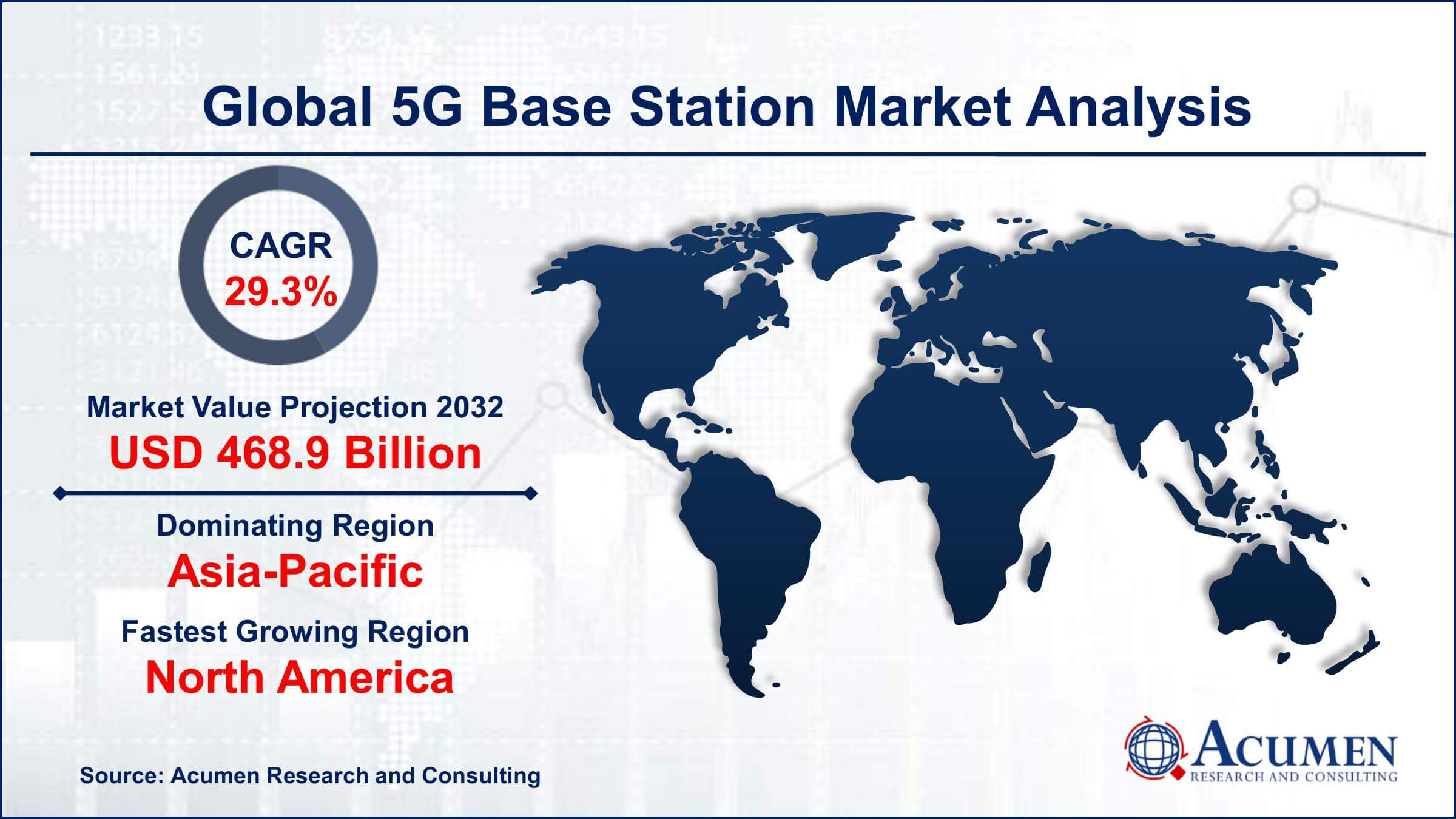

The 5G Base Station Market Size accounted for USD 37.3 Billion in 2022 and is projected to achieve a market size of USD 468.9 Billion by 2032 growing at a CAGR of 29.3% from 2023 to 2032.

5G Base Station Market Highlights

- Global 5G base station market revenue is expected to increase by USD 468.9 Billion by 2032, with a 29.3% CAGR from 2023 to 2032

- Asia-Pacific region led with more than 41% of 5G Base Station Market share in 2022

- North America 5G Base Station Market growth will record a CAGR of around 30.7% from 2023 to 2032

- By network architecture, the 5G non-standalone segment contributed over 53% of revenue share in 2022

- By end user, the commercial segment is expected to expand at a noteworthy CAGR of 30% between 2023 and 2032

- Increasing demand for high-speed internet and data connectivity, drives the 5G Base Station Market value

A 5G base station, also known as a cell site or cell tower, is a crucial component of the 5G network infrastructure. It facilitates wireless communication between devices and the core network, enabling high-speed data transfer, low latency, and support for a massive number of connected devices simultaneously. Unlike previous generations of mobile networks, 5G base stations use advanced technologies such as beamforming and massive MIMO (Multiple Input Multiple Output) to enhance signal strength and coverage. These stations are typically equipped with antennas and transceivers that communicate with 5G-enabled devices, ensuring seamless connectivity and enabling various applications like autonomous vehicles, smart cities, and the Internet of Things (IoT).

The market growth of 5G base stations has been substantial in recent years. With the rapid adoption of 5G technology worldwide, the demand for 5G base stations has surged. Telecom operators, businesses, and governments are investing heavily in deploying 5G infrastructure to meet the growing data demands of consumers and to enable innovative applications. The market is driven by the need for faster and more reliable internet connectivity, especially with the rise of bandwidth-intensive applications like 4K video streaming, online gaming, and virtual reality. Additionally, industries such as healthcare, manufacturing, and transportation are leveraging 5G networks to enhance operational efficiency and explore new possibilities, further fueling the market growth of 5G base stations.

Global 5G Base Station Market Trends

Market Drivers

- Increasing demand for high-speed internet and data connectivity

- Growth of internet of things (IoT) devices

- Rising investments in 5g infrastructure

- Technological advancements like massive MIMO and beamforming

- Industry adoption for mission-critical applications

Market Restraints

- High initial deployment costs

- Regulatory challenges and spectrum allocation issues

Market Opportunities

- Development of 5G-enabled smart cities and IoT applications

- Expansion of 5G networks in rural and underserved areas

- Integration of 5G in industrial automation and manufacturing

5G Base Station Market Report Coverage

| Market | 5G Base Station Market |

| 5G Base Station Market Size 2022 | USD 37.3 Billion |

| 5G Base Station Market Forecast 2032 | USD 468.9 Billion |

| 5G Base Station Market CAGR During 2023 - 2032 | 29.3% |

| 5G Base Station Market Analysis Period | 2020 - 2032 |

| Base Year |

2022 |

| Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Network Architecture, By Core Network, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | ZTE Corporation, CommScope Holding Company, Inc., Airspan Network, Telefonaktiebolaget LM Ericsson, Qualcomm Technologies, Inc., Marvell, Nokia Corporation, Ericsson, Samsung Electronics Co. Ltd., Huawei technologies co. Ltd., NEC Corporation, and Cisco Systems Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

5G base stations are equipped with antennas and transceivers that communicate with 5G-enabled devices, ensuring seamless connectivity and enabling a wide range of applications. The applications of 5G base stations are diverse and transformative. One of the most significant applications is in enhancing mobile broadband, allowing users to experience faster download and upload speeds, and making activities like streaming high-definition videos and online gaming smoother and more enjoyable. 5G technology is also instrumental in enabling the Internet of Things (IoT). With its ability to handle a vast number of connected devices in a small area, 5G facilitates the proliferation of smart devices in various sectors such as healthcare, transportation, agriculture, and manufacturing. For instance, in healthcare, 5G-enabled devices can transmit real-time patient data to healthcare professionals, enabling faster and more accurate diagnoses.

The 5G base station market has witnessed remarkable growth in recent years, driven by the global demand for faster, more reliable, and low-latency wireless communication. With the advent of 5G technology, telecommunications companies around the world have been investing significantly in upgrading their network infrastructures. The market growth is primarily attributed to the proliferation of smartphones and other connected devices, which require robust 5G networks to support bandwidth-intensive applications such as high-definition video streaming, online gaming, and augmented reality. Additionally, the increasing adoption of IoT devices across various industries, including healthcare, automotive, and manufacturing, has further propelled the demand for 5G base stations. Furthermore, the growing 5G infrastructure market will also drive the 5G base station market in the coming years.The market expansion is also spurred by advancements in technologies like massive MIMO (Multiple Input, Multiple Output) and beamforming, which enhance the efficiency and coverage of 5G base stations. Moreover, industries are embracing 5G to revolutionize their operations, driving the need for reliable and high-performance 5G networks.

5G Base Station Market Segmentation

The global 5G Base Station Market segmentation is based on type, network architecture, core network, end user, and geography.

5G Base Station Market By Type

- Small Cells

- Microcells

- Femtocells

- Picocells

- Macro cells

According to the 5G base station industry analysis, the small cells segment accounted for the largest market share in 2022. Small cells are low-powered radio access nodes that operate in licensed and unlicensed spectrum bands. They are a critical component of 5G networks, especially in urban areas and high-density environments where large macro base stations may face challenges in providing consistent coverage and capacity. Small cells enhance network capacity and improve the user experience by offloading traffic from macro cells, reducing congestion, and ensuring better indoor coverage, which is crucial for applications like voice over LTE (VoLTE) and video calling. One of the primary drivers of the small cells market is the increasing demand for high-quality mobile broadband services.

5G Base Station Market By Network Architecture

- 5G non-Standalone

- 5G Standalone

In terms of network architectures, the 5G standalone segment is expected to witness significant growth in the coming years. Unlike non-standalone (NSA) 5G, which relies on existing 4G infrastructure for certain functions, 5G standalone operates independently, offering enhanced performance and capabilities. The adoption of 5G standalone architecture has gained momentum due to its ability to provide lower latency, higher data rates, and improved overall network efficiency. This is particularly important for applications that require real-time data processing, such as autonomous vehicles, remote healthcare services, and augmented reality experiences. With the deployment of 5G standalone networks, operators can unlock the full potential of 5G technology, enabling innovative use cases and transforming various industries. One of the key drivers fueling the growth of the 5G standalone market is the demand for advanced services and applications that require ultra-reliable and low-latency communication (URLLC).

5G Base Station Market By Core Network

- Software Defined Networking

- Network Function Virtualization

According to the 5G base station market forecast, the network function virtualization (NFV) segment is expected to witness significant growth in the coming years. NFV involves decoupling network functions, traditionally performed by dedicated hardware, and running them as software on general-purpose servers. In the context of 5G base stations, NFV enables greater flexibility, scalability, and cost-efficiency. With the complexity of 5G networks and the demand for diverse services, NFV allows operators to deploy and manage network functions dynamically, responding to changing requirements in real-time. This flexibility is particularly valuable in the 5G landscape, where the network needs to adapt swiftly to support various applications, from massive IoT deployments to ultra-low latency services like autonomous vehicles and augmented reality. One of the primary drivers behind the growth of the NFV segment is the need for efficient resource utilization.

5G Base Station Market By End User

- Commercial

- Industrial

- Residential

- Smart City

- Government

- Others

Based on the end user, the commercial segment is expected to continue its growth trajectory in the coming years. This growth is due to the increasing demand for high-speed and reliable wireless communication services in various industries. Commercial deployments of 5G base stations cater to businesses, enterprises, and public spaces, delivering enhanced connectivity that fuels productivity and innovation. Industries such as retail, healthcare, manufacturing, and hospitality are adopting 5G technology to transform their operations. Retailers are leveraging 5G networks to enhance customer experiences through augmented reality shopping and personalized marketing initiatives. In healthcare, 5G enables remote patient monitoring, telemedicine services, and quick access to medical data, improving patient care and healthcare efficiency. Manufacturing companies are embracing 5G for automation and robotics, optimizing production processes and increasing operational efficiency. Additionally, the hospitality sector utilizes 5G to provide seamless connectivity for guests, enhancing guest satisfaction and loyalty.

5G Base Station Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

5G Base Station Market Regional Analysis

Asia-Pacific has emerged as the dominating region in the 5G base station market due to several key factors driving its rapid growth and adoption of 5G technology. One of the primary reasons is the region's sheer population size and the increasing penetration of smartphones and other connected devices. Countries like China, South Korea, and Japan have witnessed extensive 5G infrastructure deployment, supported by massive investments from both governments and private enterprises. The dense populations in urban areas create a strong demand for high-speed internet and data services, making 5G networks a necessity to meet the burgeoning data needs of millions of users. Additionally, the rapid economic development in Asia-Pacific has led to a thriving digital economy, further fueling the demand for advanced communication technologies like 5G. Furthermore, several Asian countries are at the forefront of technological innovation, with companies in nations like China and South Korea leading the way in 5G research and development. Additionally, supportive regulatory policies and initiatives by governments in the Asia-Pacific region have facilitated the smooth rollout of 5G networks. Many countries have allocated ample spectrum for 5G services and provided incentives to telecom operators for investing in 5G infrastructure.

5G Base Station Market Player

Some of the top 5G base station market companies offered in the professional report include ZTE corporation, CommScope Holding Company, Inc., Airspan Network, Telefonaktiebolaget LM Ericsson, Qualcomm Technologies, Inc., Marvell, Nokia Corporation, Ericsson, Samsung Electronics Co. Ltd., Huawei technologies co. Ltd., NEC corporation, and Cisco Systems Inc.

Frequently Asked Questions

How big is the 5G base station market?

The market size of 5G base station was USD 37.3 Billion in 2022.

What is the CAGR of the global 5G base station market from 2023 to 2032?

The CAGR of 5G base station is 29.3% during the analysis period of 2023 to 2032.

Which are the key players in the 5G base station market?

The key players operating in the global market are including ZTE corporation, CommScope Holding Company, Inc., Airspan Network, Telefonaktiebolaget LM Ericsson, Qualcomm Technologies, Inc., Marvell, Nokia Corporation, Ericsson, Samsung Electronics Co. Ltd., Huawei technologies co. Ltd., NEC corporation, and Cisco Systems Inc.

Which region dominated the global 5G base station market share?

Asia-Pacific held the dominating position in 5G base station industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of 5G base station during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global 5G base station industry?

The current trends and dynamics in the 5G base station industry include increasing demand for high-speed internet and data connectivity, growth of internet of things (IoT) devices, and rising investments in 5g infrastructure.

Which network architecture held the maximum share in 2022?

The 5G non-standalone network architecture held the maximum share of the 5G base station industry.