3D ICs Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

3D ICs Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

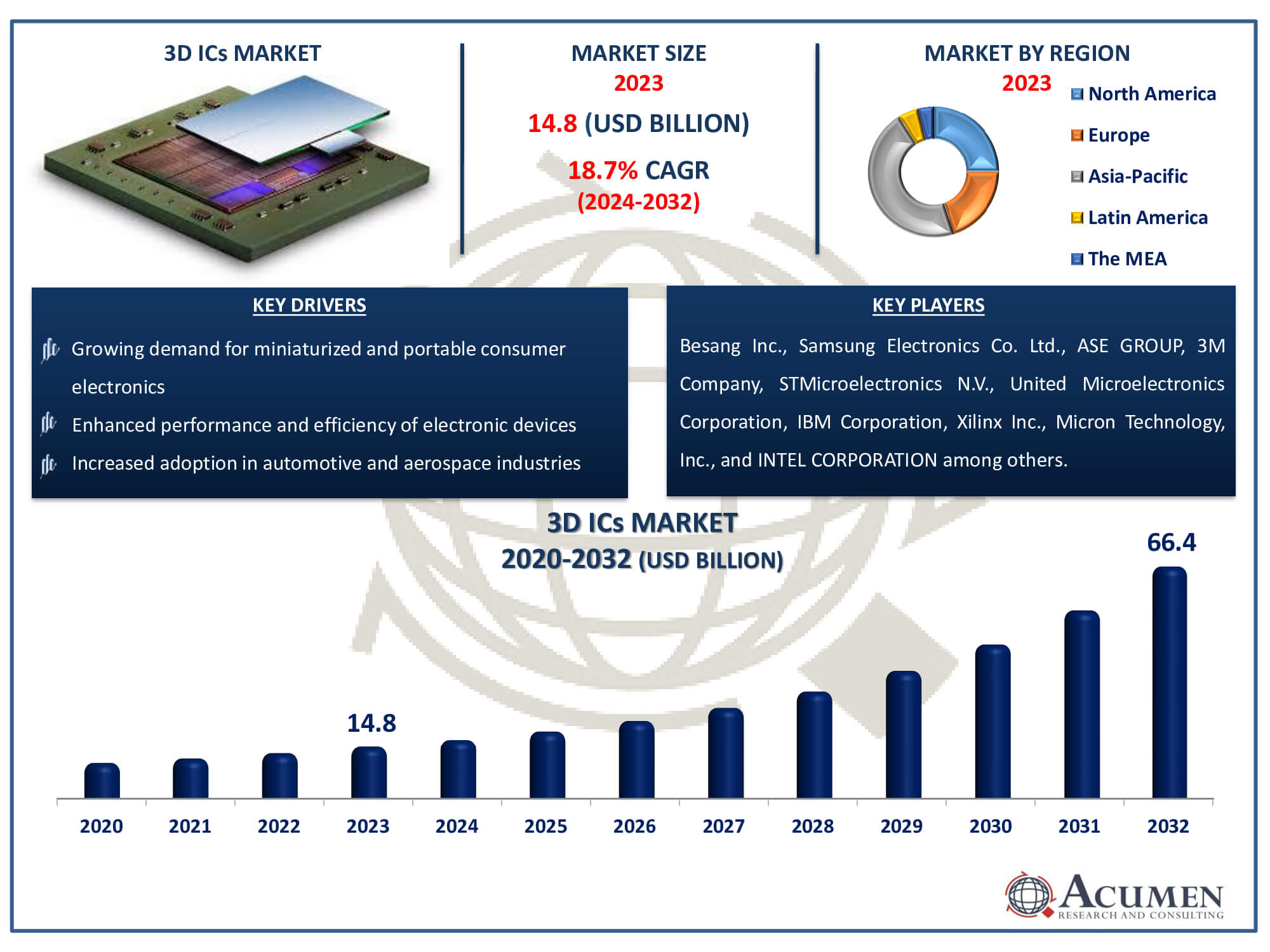

The 3D ICs Market Size accounted for USD 14.8 Billion in 2023 and is estimated to achieve a market size of USD 66.4 Billion by 2032 growing at a CAGR of 18.7% from 2024 to 2032.

3D ICs Market Highlights

- Global 3D ICs market revenue is poised to garner USD 66.4 billion by 2032 with a CAGR of 18.7% from 2024 to 2032

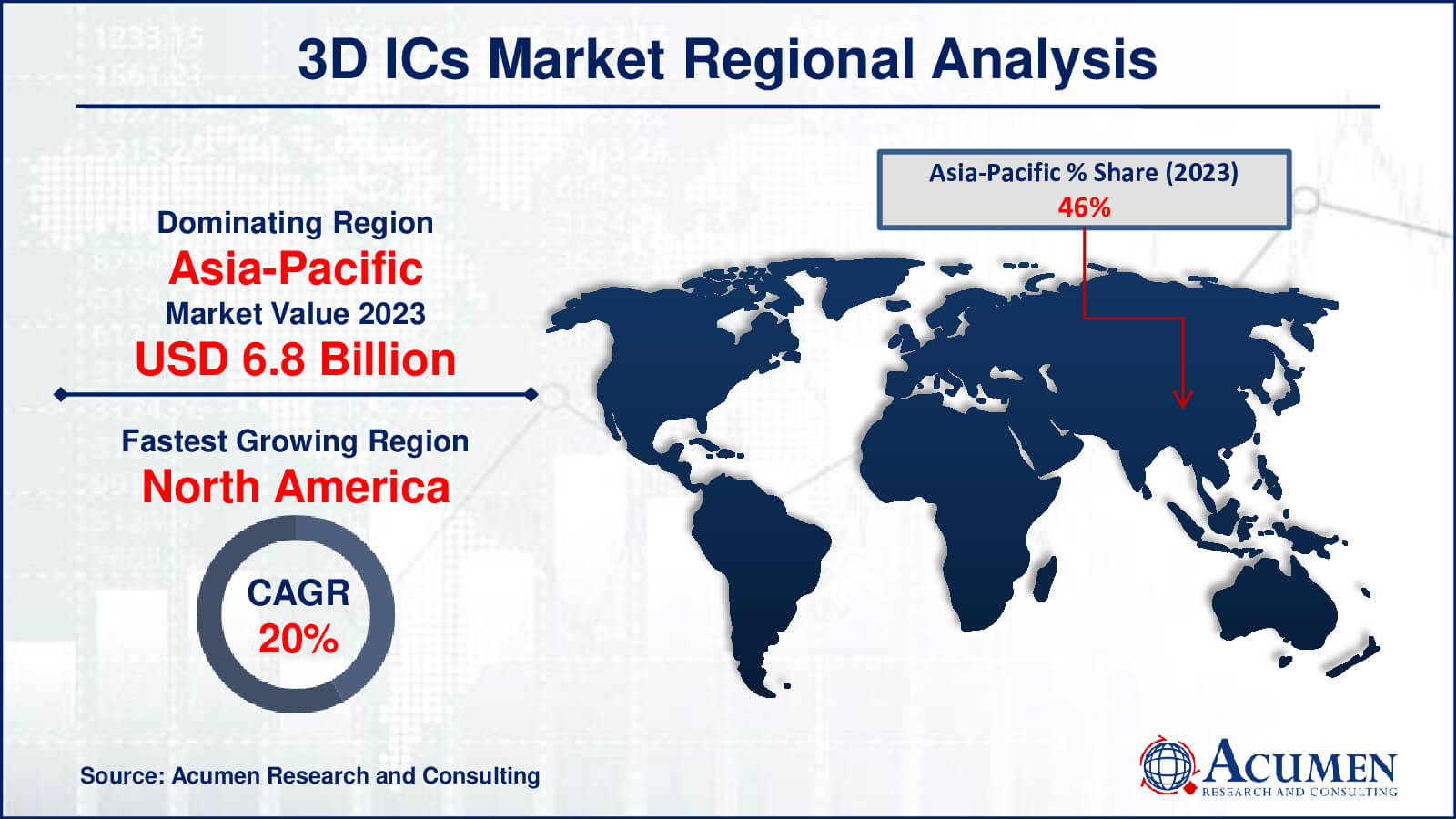

- Asia-Pacific 3D ICs market value occupied around USD 6.8 billion in 2023

- North America 3D ICs market growth will record a CAGR of more than 20% from 2024 to 2032

- Among type, the stacked 3D sub-segment generated more than USD 11.8 billion revenue in 2023

- Based on end-user, the consumer electronics sub-segment generated around 32% 3D ICs market share in 2023

- Increasing collaboration between semiconductor companies and tech firms is a popular 3D ICs market trend that fuels the industry demand

3D IC technology represents a cutting-edge advancement that significantly contributes to the design and development of lightweight and portable consumer electronics by minimizing the size of the components used. This reduction not only enhances the compactness of devices but also improves their efficiency, speed, durability, and memory capacity. Consequently, these benefits make 3D ICs increasingly popular across various industry sectors. The integration of 3D ICs in smart devices is driving a substantial surge in global demand, as industries seek to leverage these advantages for the next generation of technology. Moreover, the enhanced performance and reduced energy consumption provided by 3D ICs are pivotal in meeting the growing consumer expectations for high-performing, durable, and efficient smart devices, further solidifying their role in the future of electronics.

Global 3D ICs Market Dynamics

Market Drivers

- Growing demand for miniaturized and portable consumer electronics

- Enhanced performance and efficiency of electronic devices

- Increased adoption in automotive and aerospace industries

- Rising investment in semiconductor research and development

Market Restraints

- High cost of 3D IC manufacturing

- Complexity in design and integration

- Limited availability of skilled professionals

Market Opportunities

- Expansion into emerging markets

- Development of advanced manufacturing technologies

- Integration with artificial intelligence and IoT applications

3D ICs Market Report Coverage

| Market | 3D ICs Market |

| 3D ICs Market Size 2022 | USD 14.8 Billion |

| 3D ICs Market Forecast 2032 | USD 66.4 Billion |

| 3D ICs Market CAGR During 2023 - 2032 | 18.7% |

| 3D ICs Market Analysis Period | 2020 - 2032 |

| 3D ICs Market Base Year |

2022 |

| 3D ICs Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Type, By Application, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Besang Inc., Samsung Electronics Co. Ltd., ASE GROUP, 3M Company, STMicroelectronics N.V., United Microelectronics Corporation, IBM Corporation, Xilinx Inc., INTEL CORPORATION, Micron Technology, Inc., Tezzaron Semiconductor Conductor Corporation, Toshiba Corporation, and Cadence. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

3D ICs Market Insights

The increased need for high-performance and compact integrated circuits (ICs) in a wide range of devices, including desktop computers, tablets, mobile phones, automotive products, smart TVs, and heavy equipment, is expected to be a key driver of the 3D ICs market. These ICs provide substantial advantages by allowing devices to be smaller and more efficient while maintaining performance. Other factors driving the rapid rise of 3D ICs include their potential to deliver higher bandwidth and better overall performance, which has become critical in the production of energy-efficient devices such as 3D LEDs. These features make 3D ICs particularly desired for the most recent technological developments.

Moreover, increased R&D investments and strategic collaborations among industry players are likely to broaden the applications of 3D ICs. Companies are increasingly working together to tackle technological obstacles and develop innovative solutions, widening the reach of 3D IC integration across multiple sectors. The improved capabilities of 3D ICs also play an important part in satisfying the expectations of the consumer electronics sector, where products must give higher performance while remaining compact and energy-efficient. Despite the high development prospects, the viability of 3D IC technology and a lack of accompanying IT infrastructure have created some problems, particularly in thermal management and testing errors. These difficulties are projected to limit the growth throughout the 3D ICs industry forecast period, since they provide substantial challenges in the manufacturing and deployment processes.

Nonetheless, the growing demand for automated products and high-functioning devices will drive original equipment manufacturers (OEMs) to incorporate 3D ICs into their designs. This integration is expected to create new market opportunities, as the expanded capabilities of 3D ICs correlate closely with the changing needs of the technology landscape. As OEMs attempt to provide more sophisticated and efficient products, the 3D IC market is poised for significant development, fueled by innovation and strategic industry partnerships.

3D ICs Market Segmentation

The worldwide market for 3D IC market is split based on component, type, application, end user, and geography.

3D IC Market By Component

- Through-Silicon Via (TSV)

- Through Glass Via (TGV)

- Silicon Interposer

According to 3D ICs industry analysis, the through-silicon via (TSV) sector is predicted to be the most significant in the market. TSV technology enables vertical electrical connections through a silicon wafer, considerably improving performance and shrinking the size of electronic devices. This segment's supremacy stems from its broad use in high-performance applications such as memory devices, sophisticated CPUs, and logic chips. TSVs provide superior electrical properties, such as lower latency and power consumption, which are required to satisfy the needs of modern electronic equipment. The growing demand for efficient, high-speed data transfer in consumer electronics, automotive, and telecommunications industries drives the TSV segment's growth, making it the largest and most influential component in the 3D integrated circuit market.

3D IC Market By Type

- Stacked 3D

- Monolithic 3D

The stacked 3D sector dominates the 3D IC market due to its improved integration capabilities, which improve performance while reducing power consumption. Stacked 3D integrated circuits provide higher density and bandwidth by vertically stacking many layers of silicon wafers or dies, making them excellent for high-performance computers, data centers, and advanced mobile devices. This architecture reduces link lengths, increasing speed and lowering latency. Furthermore, the developed production methods and existing infrastructure for stacked 3D ICs help to explain their market dominance. Their ability to combine several types of devices, such as memory and logic, in a single package accelerates their acceptance across a wide range of applications, cementing their leadership in the 3D ICs industry.

3D IC Market By Application

- Logic

- Imaging & optoelectronics

- Memory

- MEMS/Sensors

- LED

- Others

The memory segment is currently driving the 3D ICs market, owing to rising demand for high-capacity, high-performance storage solutions. 3D ICs allow memory cells to be stacked vertically, considerably improving storage density while maintaining the same size. This is critical for applications that require a lot of data storage, such as smartphones, tablets, and data centers. The ability of 3D memory ICs to deliver quicker data access speeds and lower power consumption than typical 2D memory solutions makes them very appealing. Furthermore, the growth in artificial intelligence, machine learning, and big data analytics applications needs enhanced memory solutions, which contributes to the memory segment's dominance in the 3D integrated circuit market.

3D IC Market By End User

- Consumer Electronics

- Telecommunication

- Automotive

- Military & Aerospace

- Medical Devices

- Industrial

- Others

The consumer electronics segment is leading throughout the 3D ICs market forecast period due to the increasing demand for compact, high-performance devices like smartphones, tablets, and wearables. 3D IC technology enables significant improvements in device performance, power efficiency, and form factor by allowing more functionality to be packed into smaller spaces. This is crucial for consumer electronics, where sleek designs and extended battery life are key competitive factors. Additionally, the rapid pace of innovation in this sector, driven by the need for enhanced multimedia capabilities, high-speed processing, and advanced features like augmented reality and AI, fuels the adoption of 3D ICs. The high production volumes and constant technological advancements in consumer electronics further cement its leading position in the 3D ICs market.

3D ICs Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

3D ICs Market Regional Analysis

In terms of 3D ICs market analysis, with a strong semiconductor industry and significant electronics manufacturing centers, APAC dominates the worldwide industry. Countries such as China, Japan, South Korea, and Taiwan lead the way in semiconductor manufacture and innovation. The region benefits from a huge consumer electronics industry, government measures to assist semiconductor research and development, and a trained workforce. Furthermore, the proliferation of smartphones, tablets, and other consumer electronic gadgets in rising economies like as India has a substantial impact on the growth of the APAC 3D IC market.

North America emerges as the fastest-growing region in the 3D ICs market, owing to technological developments, strong R&D activities, and rising need for high-performance computing and data processing solutions. Leading semiconductor corporations, research organizations, and technology behemoths have made significant investments in 3D IC technology. The adoption of advanced driver assistance systems (ADAS) and self-driving vehicles in the automotive sector, as well as the rapid implementation of 5G technology in telecommunications, all contribute to increased demand for 3D integrated circuits. Furthermore, initiatives aimed at increasing national competitiveness in semiconductor manufacturing and supporting innovation in emerging technologies are driving the growth of the 3D ICs market in North America.

3D ICs Market Players

Some of the top 3D ICs companies offered in our report includes Besang Inc., Samsung Electronics Co. Ltd., ASE GROUP, 3M Company, STMicroelectronics N.V., United Microelectronics Corporation, IBM Corporation, Xilinx Inc., INTEL CORPORATION, Micron Technology, Inc., Tezzaron Semiconductor Conductor Corporation, Toshiba Corporation, and Cadence.

Frequently Asked Questions

How big is the 3D ICs market?

The 3D ICs market size was valued at USD 14.8 billion in 2023.

What is the CAGR of the global 3D ICs market from 2024 to 2032?

The CAGR of 3D ICs is 18.7% during the analysis period of 2024 to 2032.

Which are the key players in the 3D ICs market?

The key players operating in the global market are including Besang Inc., Samsung Electronics Co. Ltd., ASE GROUP, 3M Company, STMicroelectronics N.V., United Microelectronics Corporation, IBM Corporation, Xilinx Inc., INTEL CORPORATION, Micron Technology, Inc., Tezzaron Semiconductor Conductor Corporation, Toshiba Corporation, and Cadence.

Which region dominated the global 3D ICs market share?

Asia-Pacific held the dominating position in 3D ICs industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of 3D ICs during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global 3D ICs industry?

The current trends and dynamics in the 3D ICs industry include growing demand for miniaturized and portable consumer electronics, enhanced performance and efficiency of electronic devices, increased adoption in automotive and aerospace industries, and rising investment in semiconductor research and development.

Which type held the maximum share in 2023?

The stacked 3D type held the maximum share of the 3D ICs industry.