Zero Turn Mower Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Zero Turn Mower Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

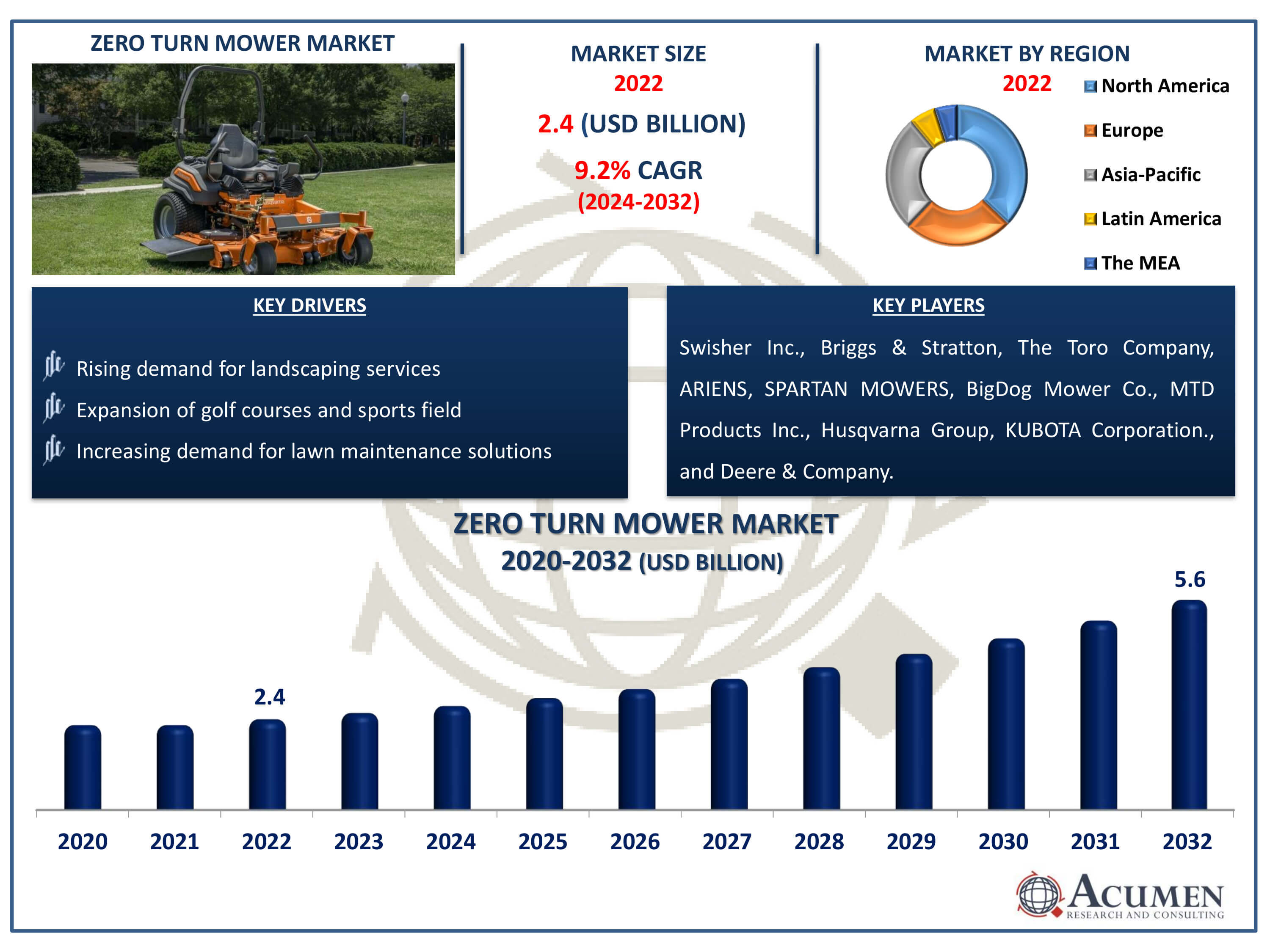

The Zero Turn Mower Market Size accounted for USD 2.4 Billion in 2022 and is estimated to achieve a market size of USD 5.6 Billion by 2032 growing at a CAGR of 9.2% from 2024 to 2032.

Zero Turn Mower Market Highlights

- Global zero turn mower market revenue is poised to garner USD 5.6 billion by 2032 with a CAGR of 9.2% from 2023 to 2032

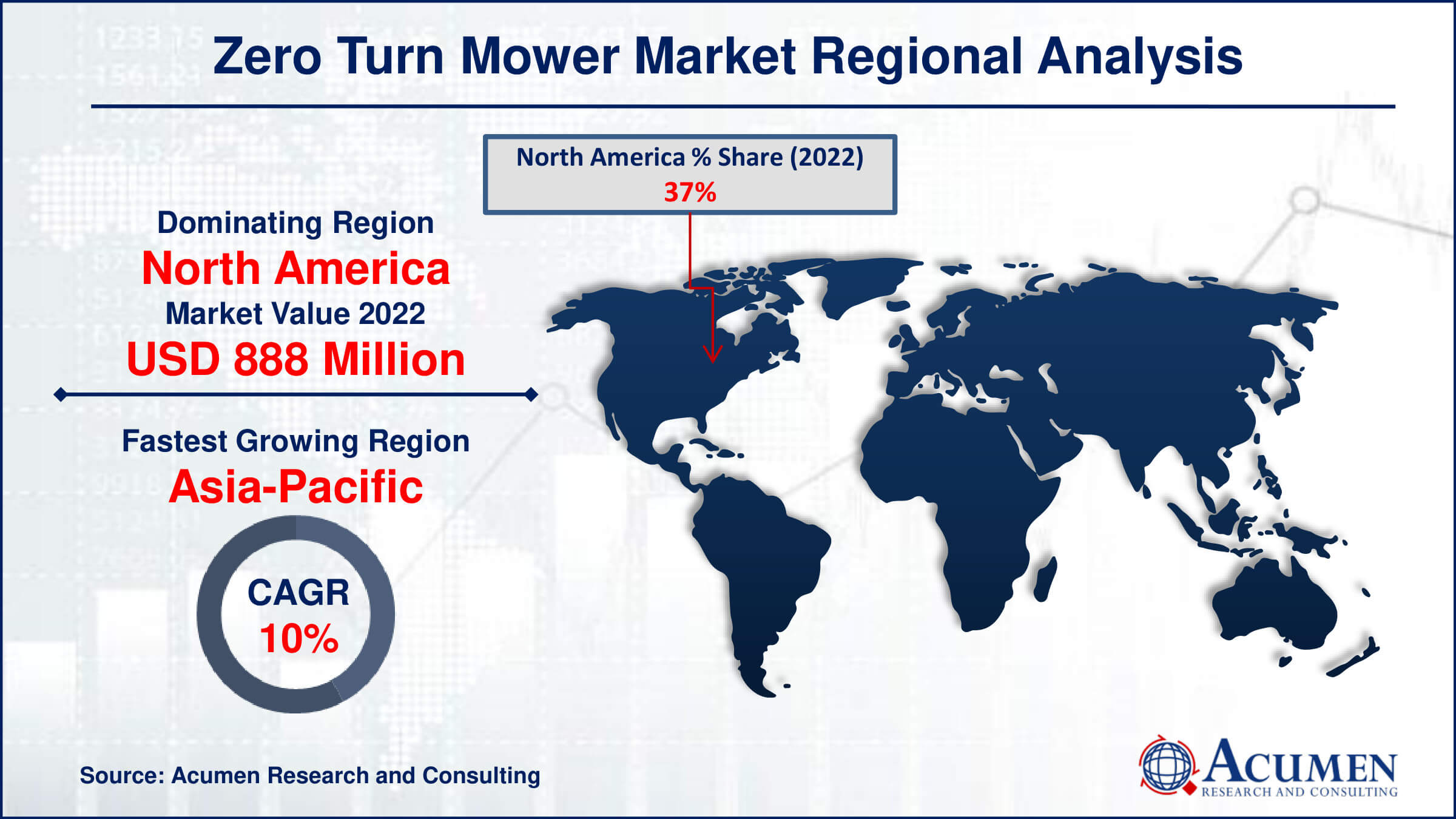

- North America zero turn mower market revenue occupied around USD 888 million in 2022

- Asia-Pacific zero turn mower market growth will record a CAGR of more than 10% from 2023 to 2032

- Among cutting width, more than 60 inches sub-segment generated 40% market share in 2022 due to enhanced flexibility

- Based on application, commercial sub-segment contributed 59% share in 2022 due to higher demand from professional landscapers, golf courses, and municipalities

- Increasing expansion into new market such as golf cources, sports field and commercial landscaping is a popular zero turn mower trend

A zero-turn mower is a specialized type of lawn mower that has a turning radius of effectively zero. This means it can turn 360 degrees in place, allowing for highly precise and efficient mowing, especially in tight spaces or around obstacles like trees and flowerbeds. Zero-turn mowers are commonly used in landscaping and lawn care for both residential and commercial properties due to their speed, mobility, and ability to provide a clean, professional-looking cut.

Global Zero Turn Mower Market Dynamics

Market Drivers

- Rising demand for landscaping services

- Expansion of golf courses and sports field

- Increasing demand for lawn maintenance solutions

Market Restraints

- Seasonal variations

- Concern about rollover and growing focus on air pollution

Market Opportunities

- Technological advancements in land mower equipment

- Integration of smart technologies

Zero Turn Mower Market Report Coverage

| Market | Zero Turn Mower Market |

| Zero Turn Mower Market Size 2022 | USD 2.4 Billion |

| Zero Turn Mower Market Forecast 2032 |

USD 5.6 Billion |

| Zero Turn Mower Market CAGR During 2024 - 2032 | 9.2% |

| Zero Turn Mower Market Analysis Period | 2020 - 2032 |

| Zero Turn Mower Market Base Year |

2022 |

| Zero Turn Mower Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Cutting Width, By Application, By Power Source, By Horsepower, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Swisher Inc., Briggs & Stratton, The Toro Company, ARIENS, SPARTAN MOWERS, BigDog Mower Co., MTD Products Inc., Husqvarna Group, KUBOTA Corporation., and Deere & Company. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Zero Turn Mower Market Insights

The zero-turn mower market has witnessed a remarkable surge in recent years, primarily fueled by the escalating demand for landscaping services. This growth can be attributed to several factors, including increased commercial and residential landscaping projects, a rising focus on lawn maintenance, and advancements in mower technology enhancing efficiency and precision. Additionally, the growing trend towards eco-friendly landscaping practices has spurred the adoption of zero-turn mowers. These mowers offer reduced emissions and fuel consumption compared to traditional models. As a result, manufacturers are experiencing heightened demand, prompting them to invest in innovations.

However, concerns about rollover and growing focus on air pollution restrain the growth of the zero-turn mower market. For instance, operating a gasoline lawn mower for an hour releases as much volatile organic compounds and nitrogen oxide as driving a new car for 45 miles, as stated by the U.S. Environmental Protection Agency (EPA). Garden equipment engines contribute to up to 5% of the country's air pollution. Gas-powered engines used in zero-turn mowers significantly contribute to air pollution due to their emission of harmful pollutants such as carbon monoxide, nitrogen oxides, and volatile organic compounds. These pollutants are released into the atmosphere during combustion, contributing to smoke formation and adverse health effects, particularly in densely populated areas. Transitioning to alternative power sources like electric or propane can help mitigate this pollution and reduce environmental impact.

Technological advancements in lawn mower equipment create an opportunity for the zero-turn mower market. For instance, in February 2023, John Deere unveiled its newest offering, the Z370R Electric ZTrak, a residential zero-turn mower. These innovative machines offer enhanced flexibility and efficiency, allowing users to navigate tight spaces. Features like improved cutting decks, increased horsepower, and designs are attracting both homeowners and professional landscapers. Additionally, advancements in fuel efficiency and emission reduction, as seen in electric models like the Z370R, align with growing environmental concerns. As a result, the zero-turn mower market is experiencing significant growth, driven by the demand for high-performance, eco-friendly landscaping equipment.

Zero Turn Mower Market Segmentation

The worldwide market for zero turn mower is split based on cutting width, application, power source, horsepower, and geography.

Zero Turn Mowers Market By Cutting Width

- Less Than 50 inches

- 50 to 60 inches

- More than 60 inches

According to zero turn mower industry analysis, more than 60 inches cutting width segment dominates the market. These large cutting widths cater to professionals and commercial users who require efficient and swift lawn maintenance over expansive areas. Their popularity stems from increased productivity and reduced mowing time, making them favored choices for landscaping businesses. This segment typically offers advanced features such as enhanced flexibility, powerful engines, and durable construction.

Zero Turn Mowers Market By Application

- Residential

- Commercial

Based on application segment, commercial sub-segment dominated the zero turn mover market in 2022. The significant share in this application is witnessed due to their higher demand from professional landscapers, golf courses, municipalities, and other commercial entities. These buyers often prioritize features like durability, performance, and efficiency over cost, leading to a preference for commercial-grade zero-turn mowers. These machines are built to withstand heavy usage and offer advanced features such as larger cutting decks, higher horsepower engines, and enhanced flexibility, making them ideal for demanding mowing tasks efficiently.

Zero Turn Mowers Market By Power Source

- Gas

- Diesel

- Electric

- Lithium-Ion

- Lead-Acid

According to the zero turn mower market forecast, based on power source, electric segment is expected to dominate the market throughout 2023 to 2032. Within this segment, the dominance of lead-acid batteries is anticipated. This preference for lead-acid batteries likely stems from their affordability, reliability, and widespread availability, making them a favored choice for powering electric zero turn mowers. As environmental concerns and technological advancements drive the shift towards electric power sources, lead-acid batteries are expected to maintain their stronghold in this expanding market.

Zero Turn Mowers Market By Horsepower

- Low (less than 10HP)

- Medium (10HP - 25HP)

- High (more than 25HP)

Based on zero-turn mower market forecast, high (more than 25 HP) horsepower is expected to dominate in the coming years. This trend underscores a growing preference among consumers for more powerful and efficient mowers to tackle larger lawn areas or tougher land. High horsepower models are likely to offer enhanced performance and productivity. Conversely, medium horsepower mowers, typically ranging between 10HP and 25HP, offer a balance between power and flexibility. They are suitable for medium-sized lawns.

Zero Turn Mower Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Zero Turn Mower Market Regional Analysis

In terms of zero-turn mower market regional analysis, North-America dominates the market. The increasing adoption of landscaping and gardening activities, coupled with the rising demand for efficient lawn care equipment, is driving this trend. Additionally, advancements in technology have led to the development of more powerful zero turn mowers, further fueling their popularity in the region. For instance, in May 2023, AriensCo, a leading producer of outdoor power gear, introduced the newest member of the Ariens lineup, the Ikon Onyx. Boasting cutting-edge attributes and functionalities, such as a 52-inch cutting deck, the Ikon Onyx guarantees effective and meticulous lawn maintenance. Moreover, the emphasis on time-saving and cost-efficient solutions for lawn maintenance has contributed to the surge in demand for zero turn mowers, making North America the fastest-growing region in this market segment.

Asia-Pacific is the fastest growing region in the zero-turn mower market. Several factors contribute to this dominance, including a burgeoning population, increasing disposable income levels, and a growing trend towards landscaping and gardening as recreational activities. One key driver of the zero-turn mower market in Asia-Pacific is the rising demand for efficient and time-saving lawn maintenance solutions. As urbanization continues to reshape the region's landscape, there is a heightened emphasis on maintaining green spaces, for the environmental sustainability. Moreover, technological advancements and innovations in zero-turn mower design have bolstered their appeal in the Asia-Pacific market. Manufacturers are continually introducing features such as improved fuel efficiency, and integrated smart technologies, catering to the diverse needs of customers across the region. For instance, Segway, a leader in personal transportation and robotics, is thrilled to declare the official launch of its eagerly awaited Navimow i Series robotic lawn mower on March 1, 2024.

Zero Turn Mower Market Players

Some of the top zero turn mower companies offered in our report include, Swisher Inc., Briggs & Stratton, The Toro Company, ARIENS, SPARTAN MOWERS, BigDog Mower Co., MTD Products Inc., Husqvarna Group, KUBOTA Corporation., and Deere & Company.

Frequently Asked Questions

How big is the zero turn mower market?

The zero turn mower market size was valued at USD 2.4 billion in 2022.

What is the CAGR of the global zero turn mower market from 2024 to 2032?

The CAGR of zero turn mower is 9.2% during the analysis period of 2024 to 2032.

Which are the key players in the zero turn mower market?

The key players operating in the global market are Swisher Inc., Briggs & Stratton, The Toro Company, ARIENS, SPARTAN MOWERS, BigDog Mower Co., MTD Products Inc., Husqvarna Group, KUBOTA Corporation., and Deere & Company.

Which region dominated the global zero turn mower market share?

North America held the dominating position in zero turn mower industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of zero turn mower during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global zero turn mower industry?

The current trends and dynamics in the zero turn mower market are raising demand for landscaping services, expansion of golf courses and sports field, and increasing demand for lawn maintenance solutions

Which cutting width held the maximum share in 2022?

More than 60 inches cutting width held the maximum share of the zero turn mower market.